TRANSFORMING A property to achieve a higher rental return is well worth the effort. Even simple changes can net $10 to $20 a week more, while adding an extra dwelling could bump up your weekly earnings by hundreds of dollars.

What can you expect from a higher rental return? Here are a few ways it will benefit your portfolio:

• A boost to your cash flow helps banks look more favourably on your loan requests.

• A property that’s likely to be a comfortable home keeps tenants happy and they stay longer.

• Value-adding improvements will increase your available equity and capital growth.

There are a few rules of thumb, however - namely, always make sure the changes will positively impact on your property’s value, and that the numbers will work out.

Every property is unique, so choosing an appropriate rental-boosting strategy is essential. Firstly, you need to do your research and tailor any changes to the local market. That way, you can make sure your money is spent wisely and you avoid overcapitalising.

And remember, the property is likely to be vacant while the changes take place, so factor the lack of income into your feasibility check before you make concrete plans.

• SUPERCHARGE STRATEGY #1: AESTHETIC REJUVENATION

THE BEST part of aesthetic alterations is the cost-effectiveness. By modernising and rejuvenating the simple things – such as with new hardware, a lick of paint

on sorry-looking bathroom tiles, and some attractive landscaping – you can easily bump up the rent in a very short timeframe, with minimal risk.

A new coat of paint delivers quick bang for your buck, while a stylish front door adds a modern touch to a property’s curb appeal. Or you could go a little further and install new kitchen cupboard doors or a new shower and bathroom vanity.

These simple changes can pack a punch, but it’s not just the living standard and asking rent that are improved. There are also plenty of other benefits to come from the resulting tax incentives.

Case in point: did you know you could claim depreciation on any works that you do on a property – and not only that but you can claim items you’re removing from the property as well?

Tyron Hyde, director of property depreciation experts Washington Brown, stresses the importance of hiring an accredited quantity surveyor before beginning any renovation work. They can accurately calculate the cost of the property’s existing assets, such as the bricks, concrete and roofing, and optimise your renovation expenses.

Otherwise, you risk missing out on possible deductions, including those you can claim under the ‘scrapping’ schedule.

“Scrapping is claiming a deduction for plant and equipment items, like ovens and dishwashers, and capital works deductions such as tiles, bricks and vanity units, when you throw them away or demolish them,” Hyde explains.

“If these items still have a residual value attached to them in the eyes of the Australian Tax Office, this value can be claimed as a deduction in full, in the financial year it was removed. The proviso is that the items must have been used to generate income for the owner prior to it being removed.”

The operation of tracking expenses and calculating depreciation deductions benefits from having a quantity surveyor on your team to review the property prior to the renovations starting so they can adequately assess the value of the renovated items.

“We’ll ask for the costs and details associated with the renovations once complete as well,” Hyde says.

The end result, he explains, is a comprehensive depreciation report detailing the maximum available tax deductions.

“For a $20,000 bathroom and kitchen renovation, you might be looking at a $5,000 depreciation deduction over the next five years,” Hyde adds.

8 EASY AND EFFECTIVE IMPROVEMENTS

8 EASY AND EFFECTIVE IMPROVEMENTS

• Paint internal and external walls

• Update hardware (door handles/taps, etc)

• Modernise light fittings

• Replace blinds/shutters

• Regrout bathrooms and kitchens

• Paint outdated kitchen and bathroom tiles

• Install a new front door

(painted a quirky colour for interest!)

• Do some simple landscaping

TOP 4 OVERLOOKED DEPRECIABLE ITEMS

1. Scrapping or residual value of items being thrown away

2. The common property items in strata units, like the lift, fire services and ventilation

3. Design and council costs associated with a renovation or new build

4. Fences, paths and even swimming pools, which can be claimed if built after 1992

Property designer and stylist Jo Powell says splitting a bedroom into two is unlikely to need approval, but some renovations will. For example:

• The addition of spaces outside of the existing footprint of a property, such as garages and carports

• Certain types of patio roofs

• New bathroom additions

• Most extensions

• Adding or removing some types of walls, particularly load-bearing ones

• Any changes to a heritage or asbestos home

It’s always a good idea to check your plans with the local council, no matter how small the change.

“Make the appropriate enquiries with your local bodies, as not obtaining the appropriate permits can seriously impact the resale value of your property,” Powell advises.

• SUPERCHARGE STRATEGY #2:

Adding extra rooms or changing the layout of a home is a trickier renovation strategy, but it can make a big impact on the property’s weekly earnings.

The addition of big-ticket items that are in line with the market can greatly improve the property’s desirability – for example, in a suburb where families are looking for four-bedroom dwellings, adding an extra room to your three-bedroom home opens it up to the family market and simultaneously commands a higher rental return.

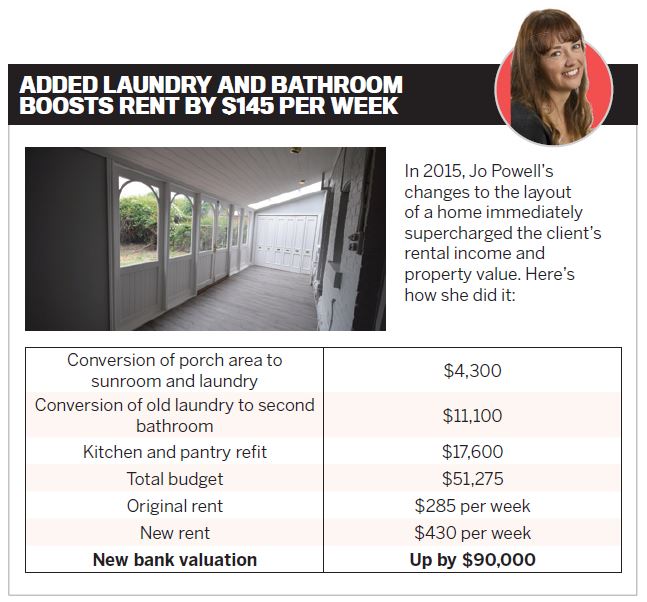

Jo Powell, owner of 3 Peas Property Styling, has helped investors create new homes out of old properties by transforming available space into desirable features for tenants.

“Today’s tenants are more discerning, and they’re willing to pay extra for conveniences that might once have been considered luxuries,” she says.

“Separate living areas and bathrooms enable multiple tenants to have their own space within one property. Tenants will pay extra for this convenience.”

The top additions and changes to maximise liveability include:

• increasing the number of bedrooms or bathrooms

• adding living areas

• adding structures to provide off-street parking, such as a carport or garage

• constructing a deck, verandah or patio to expand the floor size

If two-bathroom properties are hot, can you convert the walk-in wardrobe to create an en suite? If off-street parking is in high demand, is there room for a carport? Speak to local real estate agents for a gauge of tenant demands.

Next, measure out the property to see if it has the potential to be altered. You may need to ask a professional builder or property renovator for help. Powell advises property owners to always check permit and approval requirements with the local council, especially because regulations do vary between cities and suburbs.

Most important is the final calculation: the feasibility test.

“Ask yourself, do the changes or additions make financial sense – as in, will the return in terms of increased rental revenue be high enough to justify the amount invested?” Powell says.

She adds that it’s important to have contingency funds in place too. “You don’t want any surprises that can reduce your return on investment.”

As well as an immediate uplift in rent, there are plenty of other benefits to improving a property’s liveability.

These include a higher calibre of tenant who would be attracted to the property, and a reduced vacancy period at the end of a lease, Powell says.

“There’s also the prospect of retaining good tenants for longer periods.”

And of course there’s the big boost in capital value that the property will get from being upgraded to the next echelon of buyer desirability.