With so many differnet lenders and loans to choose from, finding the right loan and finance structure can be confusing and overwhelming. I was certainly amazed when I went from working for a 'big four' bank to running my own mortgage borking business and discovered how many different features were available on loan products, and that different lenders interpreted and offered these features in different ways.

Most people rush into the decision on which lender and loan to choose in order to meet the settlement deadlines or get the cheapest rate, but it is certainly worth spending a little a bit of extra time up front to get the right advice and choose loan products and a debt structure that will ultimately help you achieve your goals sooner.

Before you choose the right loan with the right fefatures, I recommend you ask yourself the following questions:

- What is the purpose of the loan? More specifically, is it personal debt (eg a home loan, which is not tax deductable) or investment debt (eg loan to purchase an investment property, which may be tax deductible)?

- Will the purpose of the loan change in the future (eg are you buying a home that you intend to convert to an investment property in the future, or vice versa)?

- Will you have the capacity to save money over and above your loan repayments and living expenses? Approximately how much can you save on a monthly basis?

- How soon do you want to purchase your next property (either a home or an investment)

- Do you have any events approaching in your life that you are planing to fund out of savings or personal cash flow, eg. holidays or purchase?

The answer to these questions will ultimately help you determine the loan features that are important to you and that will ensure the loan you choose gives you the ultimate combination of cost, flexibility and tax effectiveness.

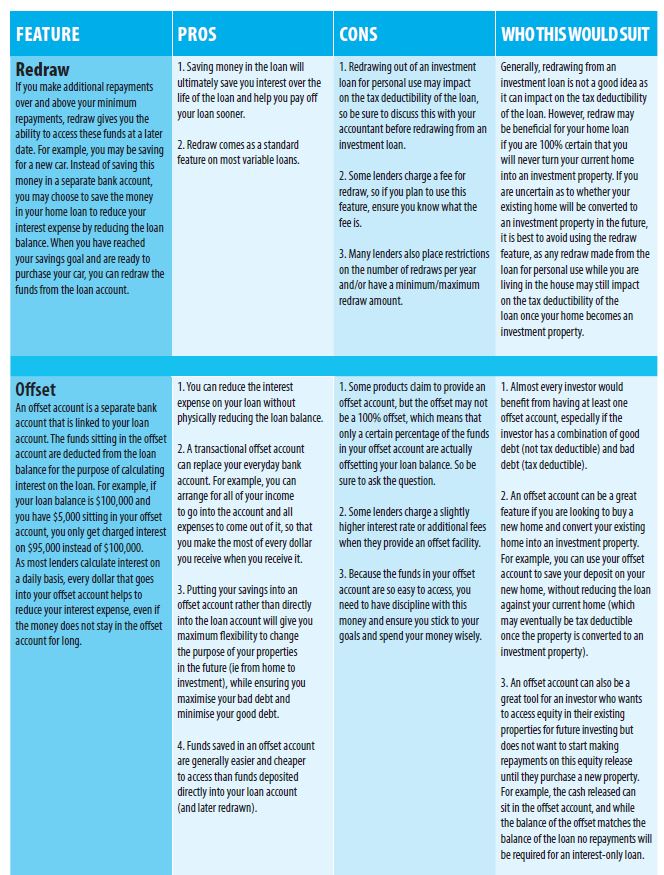

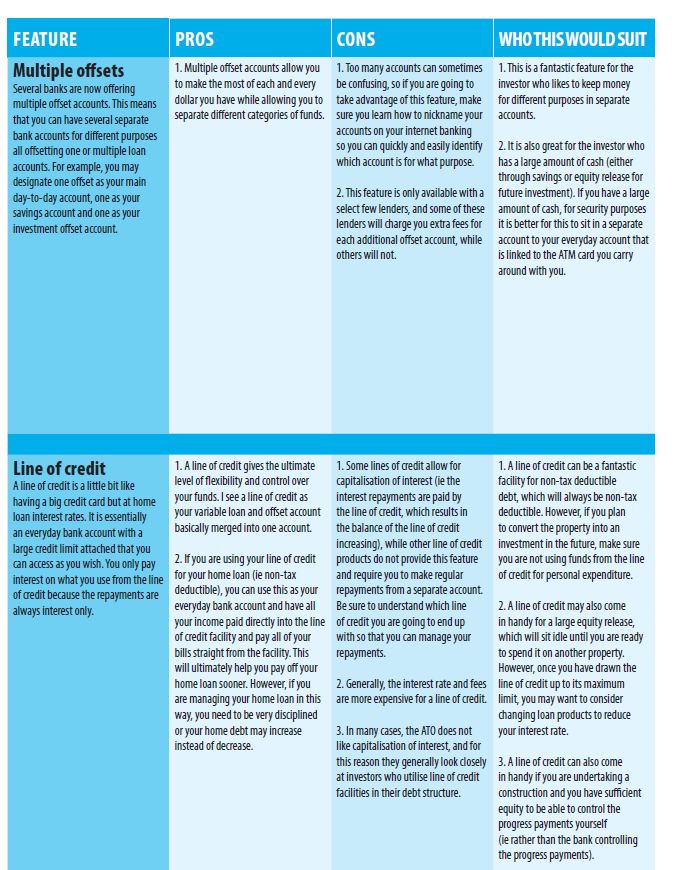

A few of the popular features/loan types for investors include:

- Redraw

- Offeset accounts

- Line of credit

Click on the images above to enlarge

Other features to consider

Along with the features detailed above, there are many others you may consider valuable in a loan product, including:

- Umbrella limits – where you have an umbrella debt limit approved and can split this limit however you like

- Ability to make extra repayments – where you are able to reduce the balance of the loan faster without penalty

- Honeymoon rates – where the interest rate is lower in the first few years of the loan and then reverts to a more expensive rate

- Portable loans – where you can keep the loan but change the security property

- Repayment holiday – where you can put a hold on your repayments for a period of time

Regardless of what you are looking for in a loan, the good news is that we are currently in a lending environment where there is a huge amount of competition and ultimately the investor/borrower is the winner. With all of the different lender and loan options available, it is so important to get the right advice before you choose a loan product. Spend your time researching a mortgage broker who is an investor and understands property investing, and also has a great reputation and great client feedback.

Finding the right mortgage broking partner will not only save you a huge amount of time but will also help you save money and proactively achieve your future goals. The right mortgage broker will go through your short-term and long-term priorities to identify the features that will help you achieve your goals, and ensure you are only paying for the features you need. The right mortgage broker will also have strong bargaining power with the banks and will be able to get you a far better deal than you can get from the banks directly.

Ultimately, if you are an investor with several properties (or in the process of working towards this) your finance structure is likely to require a combination of the above-mentioned features and loan types, and the key is to find the perfect balance between cost, flexibility, control and tax effectiveness for your personal circumstances.

Marissa Schulze is an active investor and a mortgage broker at Rise High Financial Solutions

This article was published in the July 2014 edition of Your Investment Property magazine. You can subscribe to the magazine here.