Earning passive income from property isn’t just a matter of buying a dwelling and sitting back while you pick up the rent payments each month. A great deal of effort goes into managing a rental, which includes everything from maintenance to communicating with tenants and marketing the property.

This can be challenging, especially if you have a portfolio of multiple properties, which is why many choose to enlist the aid of property managers.

Some investors are happy to accept the challenge, however. Self-managing a property can lead to better relationships with tenants and can improve your social skills. It also helps you become more involved in different aspects of property investment. In fact, many investors have found themselves going into professional property management.

In the long term, which is the more sustainable move? We break it down for you.

Why do it yourself?

A property manager is also one more expense on top of the many costs you take on when buying a property. You get what you pay for with many property managers, so if you try to save in this area you could wind up with an inefficient manager, which means you have to step in yourself, negating the point of hiring them.

Alternatively, you could get excellent service but have to pay through the nose for it. For an investor on a budget, particularly a new investor, this may not always be a viable option.

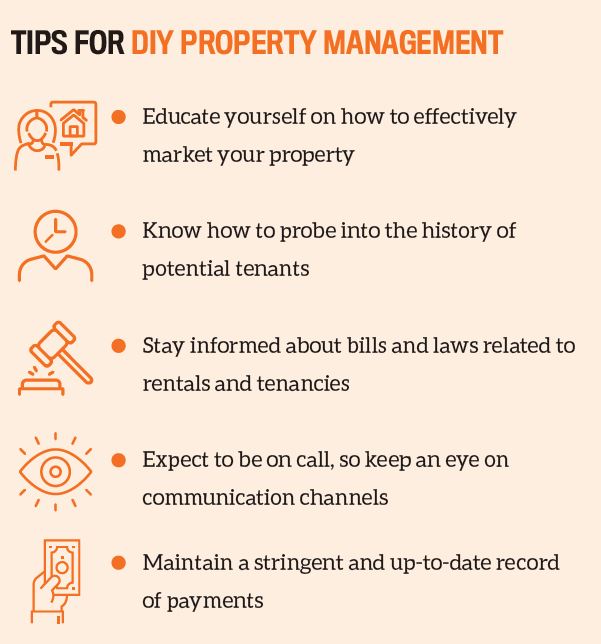

Managing your own property takes you through a wide spectrum of property investment processes. You learn to advertise rentals wisely via the right media; screen tenants; negotiate terms and rates; and set inspection schedules.

Nurturing relationships with tenants as both the owner and property manager can also inspire greater respect and camaraderie between both parties, and you could find it easier to hang on to good renters in the long term.

Along the way, you become a better communicator, improve your people skills, widen your network of industry contacts, and gain broader knowledge of the property market in general.

Indeed, a number of effective property managers today began their careers by managing their own properties before branching out to the properties of other investors once they became adept at the craft. Managing a property personally can be very challenging at the start, but once you find your footing you not only hold the fate of your portfolio in your own hands but could end up finding your personal calling.

Why hire a property manager?

Not every investor is up to the task of managing property, especially those with sizeable portfolios or investments across different states. It’s a process that can be costly in terms of money, time and effort, and for some the expenses involved in self-managing can far outweigh the benefits.

You could be coming home at the end of a long day to the terrible news that your tenant needs something repaired urgently – or to a report that a visitor’s pet did serious damage to the flooring; or worse, to find out that your tenant has gone AWOL and left you with a giant mess to clean up. It can be very hard to deal with any of these issues calmly, especially if you’re not in the mood.

“Most property portfolios are six-, sometimes seven-figure investments. You’d want an experienced professional to manage it instead of just leaving it to chance”

This is where hiring a property manager comes in very handy – you have someone who is equipped to handle problems like these, and you can kick back and relax for the most part.

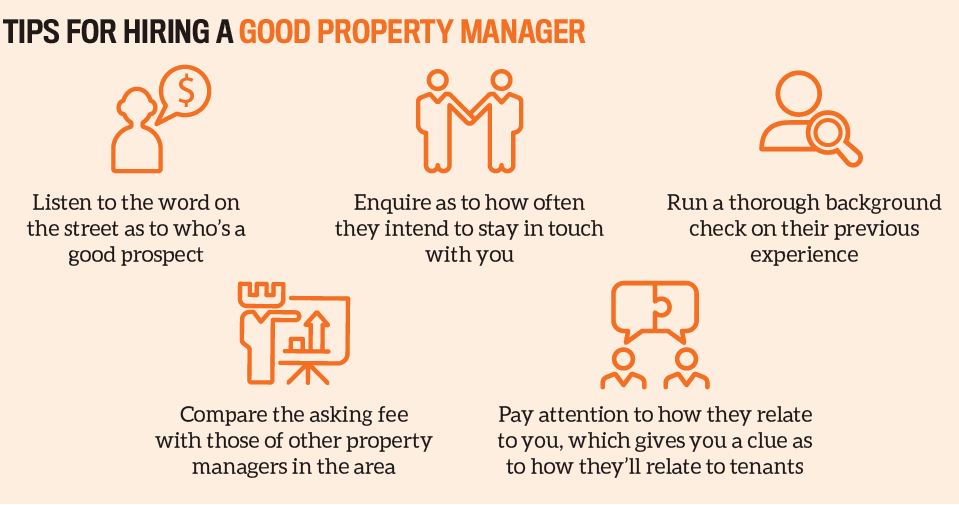

“Whether you own one property or multiple properties across multiple states, it just makes sense to engage with professionals. I want someone who has the systems, processes and policies in place to deal with whatever arises,” says Victor Dong, blogger on The Frugal Samurai.

“Most property portfolios are six-, sometimes seven-figure investments. You’d want an experienced professional to manage it instead of just leaving it to chance.”

While property managers do cost money, Dong points out that, ultimately, the cost is not that significant when the time and effort required to do it yourself is taken into account.

“In my portfolio, I’ve worked it out to be around $20 per week per property, which, after tax deductions and comparing the number of hours involved if I was to do this DIY, makes it a no-brainer.”

Dong highlights as another positive the fact that the property manager doesn’t own the property, since that means you have a calm, unbiased representative who will be less prone to reacting emotionally. The key to a good property manager–owner relationship is, he believes, adequate communication.

“If things are running smoothly, then you’d expect minimal contact with your property manager. But there are certain periods when strong communication is key,” he explains.

“For instance, if your property is being advertised for lease, you should be receiving updates post every open viewing as well as weekly feedback as to how the lease campaign is progressing. With any maintenance issues that arise, you’d expect to be notified of any urgent issues immediately, with non-essential issues summarised in an email, preferably with quotes.”

A good property manager can also do more than just manage your rental – they can be an excellent resource.

“The really good property managers will be an invaluable source of market information on setting the rent at lease renewals, knowing the types of properties tenants like and dislike, as well as rental market direction. You pay them, so use them!”

Ultimately, the choice between self-management and hiring a property manager comes down to the quality of the attention and effort you want to give your property. If you are able to commit to the process of looking after a rental, DIY management can be the way to go – you get things done right your way, and you beef up your life skill set along the way. If you want a more hassle-free investment experience that enables you to concentrate on acquisition, hiring a property manager could be the better call.