07/05/2012

As vacancy rates tighten in many of Queensland's key property markets, tenants are becoming increasingly desperate to secure a rental property. Read on to discover which Queensland markets are playing into the hands of landlords.

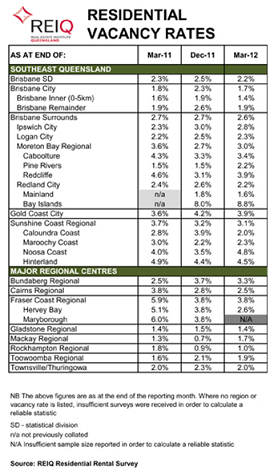

New figures from the Real Estate Institute of Queensland (REIQ) reveal that many of the state’s rental markets now have vacancy rates that are well below the 3% mark at which they are considered to be balanced between tenants and landlords – indicating that landlords have the upper hand across large swathes of the state.

Brisbane, for example, saw its vacancy rate drop from 2.5% to 2.2% during the first quarter of the year, with the smaller ‘Brisbane City’ zone seeing its vacancy figure drop from 2.3% to just 1.7%.

According to the REIQ, reports are coming in from agencies in the state capital that the supply of rental accommodation is remaining limited as tenants stay put, students are settled for the year, and potential first home buyers still opt for a wait-and-see approach. Meanwhile, investment properties are being snapped up by owner-occupiers, which is also contributing to a reduction in rental stock.

Away from the state capital, the Coloundra Coast region of the Sunshine Coast saw a huge vacancy rate drop over the quarter – plummeting from 3.9% to 2% – while Hervey Bay was another big loser, seeing its figure drop from 3.8% to 2.6%.

“Until very recently, we had many potential first home buyers and investors sitting on the sidelines while our market and economy recovered from the natural disasters last year, which has put pressure on our rental market,” REIQ CEO Anton Kardash.

“However, this pent-up demand is now starting to dissipate with the latest Australian Bureau of Statistics (ABS) data showing increasing numbers of investors and first-timers coming back into the market.”

According to the REIQ, ABS lending finance figures for February showed the number of Queensland investors was up significantly compared to the same period last year, while demand from first homebuyers and owner-occupiers was also starting to increase.

“This more robust level of investor demand is good news for our rental market given more investors means more investment stock for renters to choose from,” said Kardash.

Some markets fared better than others, with Mackay, for example, seeing its vacancy rate rise by 1% over the quarter – albeit to a tight 1.7%. This rise can be attributed to a number of leases expiring during the quarter, as well as a slowdown in the upper end of the rental market, said the REIQ. But overall, it claims that tenant demand in Mackay remains strong with some agencies reporting more than 10 applicants per listing.

Browse the where to buy section of our property investment forum for more discussion of the nation’s property investment hotspots.