Some novice investors swallow the developer’s narcotic lure and buy into a new project. Other investors won’t touch the shiny stuff.

Where do we draw the line between 'new' and 'old'?

Picture a well gentrified market close to the city CBD with many heritage properties more than 100 years old.

In this market any property less than 20 years old would be considered 'new'.

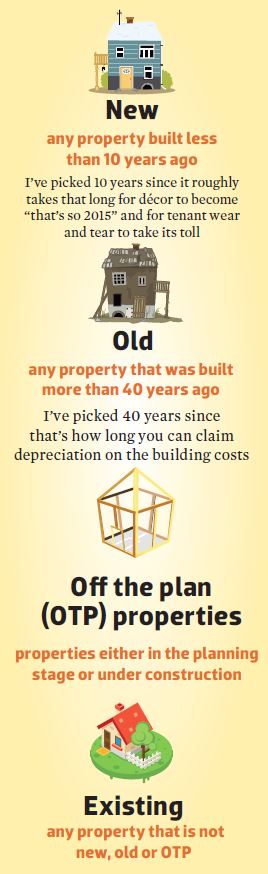

For the purposes of this article I’m going to use the following definitions:

Risk vs reward

All investing comes down to risk and reward. So, any strategic analysis will come down to an examination of each property age bracket in terms of those two qualities – boring but important.

The investor dream of buying OTP is capital growth during the construction period before they have a large mortgage. The idea is to buy using a deposit bond early in the project to maximise time for growth and minimise 'hurt' money contributed.

If the construction period was long enough, the market hot enough and if the investor used a deposit bond, they may have enough equity to cover their 'hurt' money:

Take, for example, an OTP property with a contract price of $500,000. With an 80% loan to value ratio (LVR), a buyer will need a deposit of $100,000. On top of this there will be stamp duty and legal fees of about another $25,000. The total funds coming from the investor will be around $125,000.

If the project build is two years and there is 10% capital growth during each year, then the new value of the property will be over $600,000. An 80% LVR on $600k is $480k. Remember, the contract price is still $500k. So, the investor will only need to contribute

$45,000 instead of $125,000. $80k of the deposit has been taken care of by the lender.

This kind of opportunity is not possible when buying new, existing or old properties.

But if the market takes a dive during construction, an OTP property will end up being a nightmare. Imagine the property dropping from $500k to $400k. Now the bank will only lend 80% of $400k which is $320k. So the remaining $180k will need to come from the investor. Add stamp duty and legal fees and the contribution is $225,000 – now that’s real hurt money.

Growth after construction Supply is the enemy of capital growth. Supply comes from new developments. So effectively when you buy OTP properties, you’re buying into a project that hurts capital growth potential for the suburb.

When a project completes, there is a sudden glut in supply which dampens the growth rate. Time needs to pass for that extra supply to be absorbed before growth rates will return to normal – that’s assuming demand is constant.

New properties may suffer from the same fate if not enough time has passed to absorb the impact of their entry into the market.

Existing and old properties should not have this problem. However, if new estates and unit complexes open up nearby, almost all properties will experience some price growth challenge regardless of age bracket.

Repairs & maintenance

A building inspector can’t crawl all over an OTP property looking for issues. So, you won’t know if you’re buying a property with a problem – you’ll only know once the problem has been built and now you own it.

You’d think that newer properties come with fewer headaches in terms of repairs and maintenance. However, this is largely dependent on the quality of the build.

Challenges over warranty and disputes with the builder happen more frequently than assuming investors realise.

If the price of a new build seems a little too good to be true, perhaps some quality has been forfeited for affordability.

However, an existing property will have most of the kinks ironed out already. New properties may still have some issues to settle.

On the other hand, an old property will likely generate some major expenses every now and then. Things like electrical rewiring, foundation or roofing issues could really kick your bank balance in the guts.

Renovation potential

An OTP or new property will have practically no renovation potential. Wear and tear from a typical tenant’s use of a property will bring it into a state of renovation potential eventually. But it might take 10 years.

Note that existing, and even old properties, may not have renovation potential if the current owner beat you to it.

Premium pricing

OTP properties may come with a hefty price tag well in excess of intrinsic value. Sometimes this comes down to high fees developers have to pay to local authorities. But more often it is developers preying on uneducated buyers to maximise profit.

New properties have a greater impact on the sentiment of emotional buyers. An extra $1,000 spent on sparkle may allow the developer to add an extra $10,000 to the price tag.

If investors plan to buy into an OTP project early to make the most of capital growth prior to settlement, they won’t have prior sales in the same project to compare with. But even if they did, they don’t know if those sales were by objective investors or emotional owner-occupiers.

This all means that buying an OTP property exposes the investor to the risk of paying too much. A new property might present a similar risk. But existing and old properties are more likely to have recent similar sales to compare with and have a larger pool of rational buyers.

Vacancy

The vast majority of tenants don’t rent off the plan. They want to walk inside a real property and picture where their furniture will go. This means you’re unlikely to have tenants move in the first Friday night after settlement.

Here’s how it goes:

• Potential tenants will browse your completed property possibly as soon as the first Saturday after project completion (or maybe the next if there was a BBQ already planned for this weekend)

• They’ll browse other similar properties, possibly in the same project

• They’ll think about which properties they like and will eventually submit at least one application

• The property manager may wait to receive a set of applications from multiple candidates before contacting you to go through them and pick one

• Then the property manager contacts the

successful candidate

• That candidate may have received another offer and might take more time deciding

• Eventually the tenant signs the lease with an agreed starting date that might not be 'right now' but often starting the next weekend, or maybe even the one after that (soccer this time)

• Then the tenant moves in any time after lease commencement

That can all take quite some time. But it gets worse.

From your first month’s rent the property manager will charge you a week or two as a letting fee. This is to cover their costs in advertising the property for rent and finding and vetting tenants.

New and old properties, as opposed to OTP, may already have a tenant in them. It might be possible to keep an existing tenant at the time of purchase if buying from a landlord instead of an owner-occupier.

Newer properties are preferred by tenants compared to older ones. Some would therefore argue that vacancy rates will be lower with newer properties. However, in a strong, expensive market, a cheaper older property may be just what a tenant wants rather than pay top dollar for something brand spanking new. It comes down to supply of rentable properties and demand from tenants for what you’re buying.

But if vacancy rates climb into ugly atmosphere, a new property is more likely to attract a tenant than an old one. Ironically, ugly vacancy rates are caused by too much OTP property hitting the market.

Yield

The yield for new properties is unlikely to exceed that

for old properties. New properties come at a premium, remember, so the renters at this level are not likely to match the majority. With limited demand for new property, rents might be capped, too.

But if there are a lot of grumpy tenants, frustrated with the condition of their dated abode, waiting for something new to become available, then the yield for such properties may be higher. Again it all comes down to supply and demand.

As a general rule, new property yields will be lower than old property yields.

Depreciation

As properties age, there is less depreciation left to claim. OTP properties therefore have the maximum depreciation benefits available. And newer properties come with more depreciation benefits than existing properties. Old properties have the lowest depreciation potential.

Older properties (i.e. older than 40 years) have already had all of their building cost claimed. However, they may have been refitted with new fixtures which can be depreciated such as stoves, A/C, carpet, etc.

Depreciation may suit investors with high taxable income. However, the first or second properties in a high tax-payer’s portfolio are usually enough to bring them back down to earth.

But investors can’t rely on depreciation. It is a deduction claimed for an expense not incurred. Eventually that expense will arrive. So, the tax break needs to be preserved for that future.

Investors can get into trouble by not putting money

aside for future replacement costs of depreciable items. Depreciation is not really the huge drawcard many proponents of new property claim it to be. Whatever you’re claiming and saving now needs to be put away for a miserable day in the future when your property manager calls to say, “You need to replace the carpet”.

Financing

OTP properties are riskier to finance because most conditional approvals from lenders are valid for only three months. Three months can easily pass by, even for a project the builder says will be complete “any day now”.

At the time of writing there are projects completing for buyers who assumed they would have a 90% loan to value ratio at the time they paid the deposit. But since then APRA has changed the lending landscape. Some of those buyers may not have a 20% deposit saved, uh-oh.

There is not this extra risk financing property in the other age brackets. Finance terms don’t differ according to age bracket. However, some lenders in the past may have raised an eyebrow when a heritage listed property appeared on their monitor.

Sunset clauses for OTP

A sunset clause allows parties to walk away from a deal if it is not going to be completed in the agreed timeframe. Recently Sydney developers have deliberately delayed completion of projects to replace existing buyers who committed ahead of the boom with new buyers prepared to pay more in the boom.

This highlights yet another risk of buying OTP.

There has been regulatory change to sunset clauses in NSW to prevent developers from getting away with this again. But it will be difficult for buyers to prove and easy for developers to delay for short periods if needed.

Negative gearing

At the time of writing there is a proposal by the federal opposition to scrap negative gearing for all future property investment purchases except for new properties. The idea being spruiked is to improve tax received and reduce the price of property, especially for first home buyers.

The idea in my opinion is just a grab for votes. It should fail in achieving both objectives. And I’m pretty sure they already know that.

If implemented overnight, there would be a reshuffling by property investors, developers, tenants and first home buyers to take advantage of the new laws. No doubt there will be some overnight winners and losers. But in the end the law of supply and demand will have its way.

The change would make OTP properties more appealing to investors (and therefore even harder for first home buyers to get into). Depending on the definition of 'new', it might also make new properties more popular, not just OTP.

But eventually, this change will look like a small ripple in an ocean of real estate history. The law of supply and demand will not be altered. And the tax change won’t stop people from needing a roof over their head at night.

To address demand the government needs to make Australia less attractive. Destroying the economy, starting a civil war, introducing pests, eliminating education, removing the health system, these things will go a long way to reducing demand.

On the other side of the equation there is supply. To address supply, the government should allow shanty towns to spring up overnight with poor infrastructure and low quality builds.

In other words, the government needs to take a leaf out of the book of nations around the world where prices are cheap and from where people desperately immigrate to Australia. Australia is a great place to live, don’t muck with it.

Summary

If your target property is old, you really need to focus on the building inspection. Call the inspector the day after their visit and go through every topic with them.

In general, old properties are a better choice than new. And OTP properties present some unique risks.

If you are going to buy new, make sure it is in a small project, pay top dollar for a quality build, and ideally buy in a suburb where this is the last possible new project.