Natalie and her husband Gerry first started property investing back in 2007, when living in New Zealand. “The GFC hit hard and we were able to purchase a ‘dog’ of a property in a highly desirable street in Auckland – that project started off our love for renovating,” Natalie says,

“We also renovated an apartment that we made $190,000 out of, but it wasn’t the apartment that gave us the bug to continue. It was the grand old homes that had us hooked!”This is what led them to purchase an over-sized Queenslander in the leafy suburb of Ascot, Brisbane, a few years back. In between running her own styling business and writing for her blog, Society of Now, Natalie and Gerry embarked on a large-scale renovation of the dilapidated home, which ultimately saw them pocket a handsome six-figure profit.

“Around 40% of the street was units, and the old Queenslanders across the road were in disrepair as well. We always knew this would be a negative for buyers”

“Around 40% of the street was units, and the old Queenslanders across the road were in disrepair as well. We always knew this would be a negative for buyers”

Worst house in an ordinary street

Most people know the old adage that you should always aim to buy the worst house in the best street. The philosophy behind this is that you can always change a property, but you can’t change its location.

In Natalie and Gerry’s case, they didn’t quite follow this formula. “It was located in Ascot, a desirable riverside suburb. However, what we were always wary of was that whilst the house was in an affluent

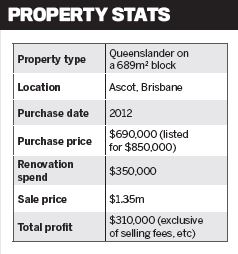

“Around 40% of the street was made up of units, and the old Queenslanders across the road were in disrepair as well. We always knew this would be a negative for buyers when it came time to sell, and we were fully aware that it would affect the end sale price.” The property – a 1920s grand Queenslander with a double-gabled roof on a 689sqm block – was initially listed on the market for $850,000. After getting no bites, it was reduced to $750,000, before Natalie and Gerry finally negotiated it down to the sale price of $690,000, which they paid for in April 2012.

Originally, we were concerned about over-capitalising, so we planned on a small spruce up. We were going to upgrade the bathroom and add a new kitchen with a back deck. This very short-lived idea had a reno budget of around $100k,” Natalie says. “But this small upgrade didn’t sit right with us and we realised it was never going to return a good price come auction day.”

From this, they came up with a reno budget of $350,000.“We knew the renovation had to look spectacular, but without over-capitalising,” Natalie adds. “Ultimately, we came in right on budget and ended up getting a lot of bang for our buck.”

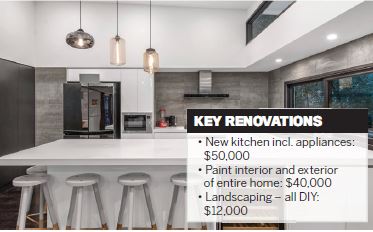

From depressing to dazzling

Tackling a renovation of this size was no simple task. The majority of the home’s original features remained, but they were very aged. And in terms of flow, there was no connection between the home and the private leafy backyard and pool.

“And both the kitchen and bathroom were frankly quite depressing!” Natalie says.So, with so many different aspects of the renovation to consider, they decided to engage an architect, Robert Biscoe of Biscoe Wilson, who worked with their brief and “contributed many of the amazing design elements in the modern pod,” says Natalie.

“We also engaged Sam Wormwell from Fiddlers Green Construction, to carry out the work on a full contract. He then engaged most of the trades, apart from a few of our own preferred trades who we managed together.”

Natalie was on-site “almost every day” to answer any questions and ensure the renovating was on track towards achieving the end result that they wanted. “We only did a small amount of the work ourselves – mainly in the restoration of the old house and all the landscaping – and we created a private garden oasis to complement the pool area. We’re both working full-time and will only DIY what we know we can do well.”

Following the renovation, the rent appraisals came in at between $1,200 and $1,500 per week, although Natalie and Gerry chose to live in it themselves while they planned their next project.

In June 2016, they listed the house for sale and achieved a selling price of $1.35m within just two months.

“Whilst there really were no surprises for us, we did realise the impact that high-density housing would have on the house prices in our street. This was reflected in the purchase price and inevitably in the sale price,” Natalie says.

“We both work full-time and will only DIY what we know we can do well”

“There was only one thing we wished we had – and that was a spare $50,000 to build a two-car garage, which was a bit of a downfall when it went to market. But, we still achieved a price we were happy with and the new owners have engaged our same architect to add a garage and covered carport.”

The couple are currently mid-way through renovating their second investment project in Brisbane – this time, another Queenslander in the sought-after suburb of Paddington. “The plans for this are much bigger; we will be raising the house, and then building under and out!” Natalie says.

“I love renovating; I’m always happy when there’s a good profit, of course, but the most successful and most satisfying part for me is in creating a stylish space, that not only looks amazing but feels warm and homely to live in. “My goal is to create tranquil living spaces for modern living.”