4/5/2014

Step 1: Draw up a trust deed

Have questions about investing through Super? Click here to talk to one of our experts.

- Make personal loans to fund members or their relatives

- Use the fund for business finance

- Access funds until you are 55

- Buy residential property from a fund member

- Allow a member or relative to live in property owned by the fund

SMSF green lights

- The money is borrowed to buy an accepted asset

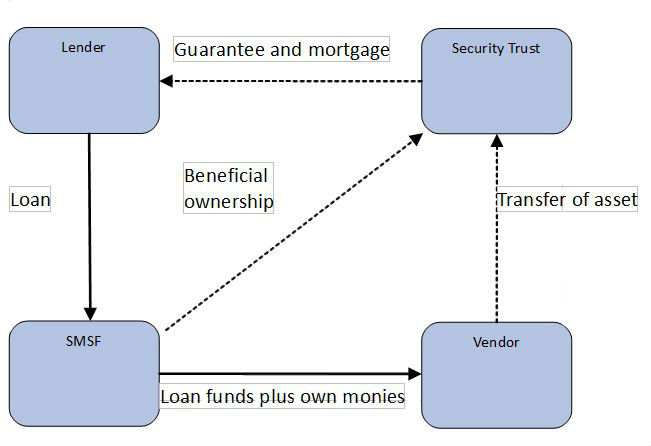

- The asset is held on trust so the fund acquires a beneficial interest in it

- The SMSF has a right to acquire legal ownership of the asset by making payments after acquiring the beneficial interest

- There is limited recourse (the rights of the lender against the SMSF for default on the sum of the borrowing and related charges are limited to the asset)

- Ensure the fund complies with superannuation laws

- Report on member entitlements

- Prepare annual accounts and reports

- Lodge tax returns

- In the event of bankruptcy or litigation, your benefits in a SMSF are protected, even if you withdraw some of this to live on

- There’s less tax on rental income

- Capital repayments on loans can be sped up by increasing the amount of contributions going into the fund

- Property you already own can be transferred into the fund to unlock cash to invest in other assets