According to the Treasury Department, the Superannuation (Objective) Bill 2016 sets out a clear objective for superannuation “to provide income in retirement to substitute or supplement the age pension”.

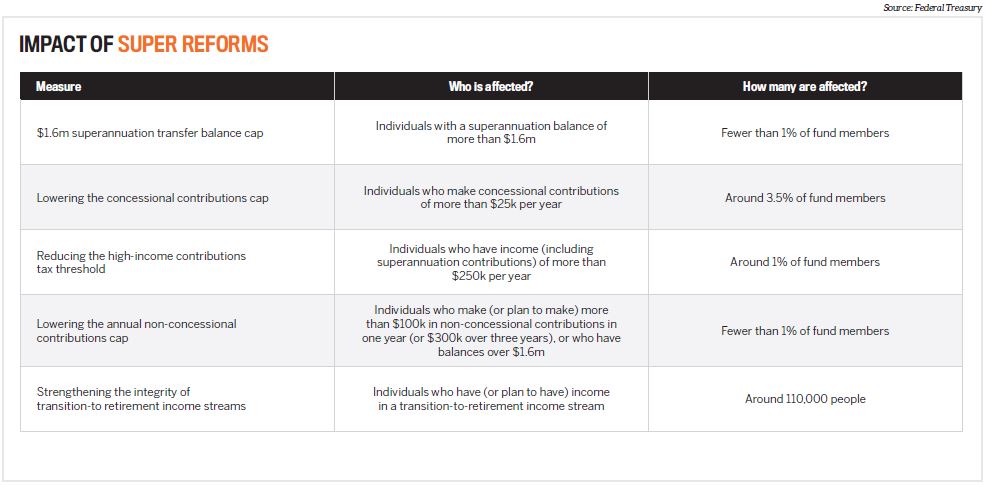

Some of the measures introduced reduce previous concessions for super account holders with high balances, while others are designed to assist low-income earners, the partially self-employed and retirees.

Here are the changes in summary:

- New cap

From 1 July 2017, the caps for transfer balances and preand post-tax contributions have changed. According to the Treasury, the changes mean there will be a $1.6m transfer balance cap on the total amount of accumulated superannuation that an individual can transfer into the tax-free retirement phase.

Subsequent earnings on balances in the retirement phase will not be capped or restricted.

Savings beyond this can remain in an accumulation account (where earnings are taxed at 15%), or outside the superannuation system.

Transitional arrangements apply. People already retired with balances below $1.7m on 30 June 2017 will have six months from 1 July 2017 – which isn’t long now – to bring their retirement phase balances to under $1.6m.

"SMSFs with residential property have increased to 22% from 19% over the past year"

- New thresholds

The threshold at which highincome earners pay additional contributions tax (Division 293 of the Income Tax Assessment Act 1997) has been lowered from $300,000 to $250,000. The annual cap on concessional (before-tax) superannuation contributions will be lowered to $25,000 (currently $30,000 for those aged under 49 at the end of the previous financial year, and $35,000 otherwise).

The government will lower the annual non-concessional contributions cap to $100,000 and will introduce a new constraint such that individuals with a balance of $1.6m or more will no longer be eligible to make nonconcessional contributions.

As is currently the case, individuals under 65 will be eligible to bring forward up to three years of nonconcessional contributions.

Investing in property via an SMSF remains an attractive proposition for many Australians. Not only does it allow more people to buy investment properties to help improve their financial futures but it also still provides significant tax advantages, particularly around capital gains tax. This is especially true once the SMSF account holders have reached pension stage.

If so, to learn about the benefits of a Self-Managed Super Fund. click here

Interestingly, the second annual Property Investment Professionals of Australia Property Investor Sentiment Survey, which gathered insights from over 1,000 property investors in late 2017, showed that around 14% of survey respondents had invested in property via an SMSF.

It also revealed that more than 70% of respondents believed now is a good time to invest in property – a very similar result compared to the year before. About 60% of respondents were looking to buy property in the next six to 12 months.

The survey results confirmed that investors remained focused on the long-term benefits of property investment, which is a mindset that SMSF investors should have as well.

Misconceptions about SMSFs and property investing

While the full impact of the $1.6m super ceiling may still not be widely understood, it is perhaps causing the most concern among SMSF account holders.

It’s important to understand that there is no limit to how much money people can have in their super accounts, but the excess above $1.6m per SMSF member needs to stay in the accumulation phase, which does attract a 15% tax rate.

"It’s important to understand there is no limit to how much money people can have in their super accounts"

Demand for property from SMSFs continues to be strong, with research showing that as many as two in five SMSFs hold residential or commercial property.

In fact, those SMSFs with residential property have increased to 22% from 19% over the past year, while direct commercial has risen to 20% from 18%, according to research by the Financial Services Council and UBS Asset Management.

If so, click here to learn about the benefits of a Self-Managed Super Fund.

While changing super rules can unsettle investors, well-selected property remains an attractive investment class for the long term. Despite unease among some SMSF investors, talk of property price bubbles and tightening investor lending policies, Australian property investors remain bullish about the long-term merits of residential real estate.

According to some corners of the market, a raft of commercial properties are coming up for sale as a result of panicked SMSF investors fearing the new super rules will increase their potential liabilities.

But they don’t have to sell: assets exceeding the $1.6m individual ceiling will need to be spread across two holding accounts – the pension account and the accumulation account. The accounts are often routine in an SMSF, when there are various members and some are already retired and drawing a pension.

For example, if a fund has property worth $2m, the SMSF members would need to transfer $400,000 back into accumulation. The actuary would then issue a new pension certificate to state that 80% of the fund earnings would be exempt. Hence there is no change of ownership.

The transitional arrangements allow for the member to reset the cost base in this process to the value as at 30 June 2017. Tax will then be payable on growth on the 20% of the asset that is in accumulation.

Compared with the top tax rate of 45% for those earning $180,000 in income, a rate of 15% in an accumulation account is still very attractive. CGT also remains at 10% for SMSF assets, where the asset is held for more than one year.

It’s important that SMSF investors who are considering selling their properties take into account the transaction costs and time involved in doing so – the numbers are unlikely to add up to a win.

With all property investment inside and outside of an SMSF, one of the keys to success is time in the market so that the power of compounding can work its magic. Therefore SMSF investors need to stay calm and look to the long term, rather than react to the relatively short-term impact of these changes.

is the director of Empower

Wealth and the former chair

of the Property Investment

Professionals of Australia.

(PIPA)