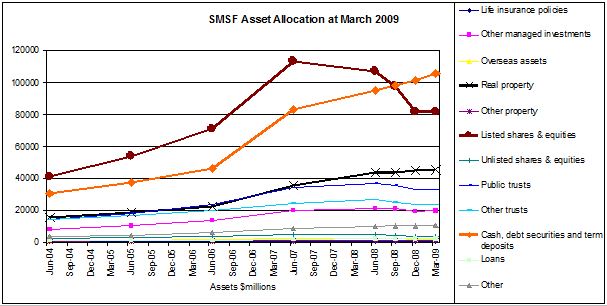

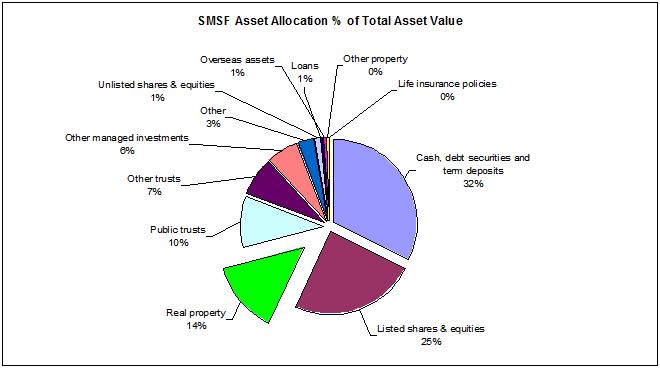

Most people are surprised to hear that SMSFs account for some $328 billion or 31.8% of total superannuation assets. With a massive 32% investment in cash or $105 billion across all SMSFs, there is ongoing discussion as to whether these funds are fully invested, and how many are simply sitting wholly in cash rather than growth assets. Of the total $328 billion in SMSF assets, only $45.2 billion or 14% is held in direct property, and just $81.6 billion or 25% in listed shares and equities. Over time this allocation to shares has been falling as the allocation to cash has increased, while direct property has only seen modest growth.

SMSF Asset Allocation over Time

SMSF Asset Allocation, mid-2009

1. SMSF must have an investment strategy

No SMSF can exist to create wealth without an investment strategy. An investment strategy is a set of rules or guidelines as to how a trustee intends to invest funds and contributions on behalf of members to achieve their objectives.

Have questions about investing through Super? Click here to talk to one of our experts.

5. SMSF can develop property

“Generally speaking a superannuation fund cannot develop property,” says Hasib. “However, should a potential development represent a small portion of the fund’s total value and is in-line with the investment strategy, incorporating all the other assets in the fund, it may be successfully argued that it is appropriate.”

As with all investments in a complying SMSF, because contributions and investments in the fund are preserved until retirement, they enjoy the beneficial superannuation tax regime.

“Just like negative gearing in an individual’s name, the SMSF would benefit from the same tax benefits, that is, tax deduction for the negative component of the interest, and depreciation,” says Hasib. “However the biggest benefit is CGT. Should the fund hold the asset longer than one year and then decide to sell it then CGT drops from 15% of the gain down to 10%, and if sold in pension phase (generally over 55 years of age) CGT is 0%.”

The beneficial superannuation tax environment means that income and capital gains earned from a property held in a SMSF provide greater reinvestment value, being the difference between a member’s individual tax rate on income and capital gains, less the tax rate they pay within the superannuation environment.

10. SMSF must satisfy the law

“It is crucial to seek professional advice,” says Hasib. “The SIS regulation is complex and requires careful consideration before implementation. One also needs to take into consideration the appropriateness of starting a SMSF and weigh up the costs relative to the potential gain.”

It is mandatory that trustees, or would-be trustees, understand the law and spirit of the governing superannuation legislation (SIS). However as trustees of a superannuation fund they must also understand their obligations under the: Corporations Act; and the relevant taxation laws.

For trustees of SMSFs there are no excuses for not complying with the law, and the rules outlined in the trust deed and the investment strategy. Trustee obligations to the members of their funds are regulated by ASIC and the ATO. Penalties for not following these rules can include: your SMSF becoming non-compliant and losing its preferred tax status; the trustee(s) becoming disqualified to act as trustees; prosecution under law; and a range of significant penalties including imprisonment for criminal breaches of the law.

Trustees should keep informed of their duties and where confused: consult the ATO website www.ato.gov.au; or obtain an explanation from an accountant, financial adviser or a lawyer.

Have questions about investing through Super? Click here to talk to one of our experts.