08/10/2013

You’ve read the success stories about super funds paving the way to super profits through property investment, but how can you make your fund work for you? Your Investment Property walks you through the process, from setting up a self-managed fund to powering through the paperwork and ultimately purchasing a property.

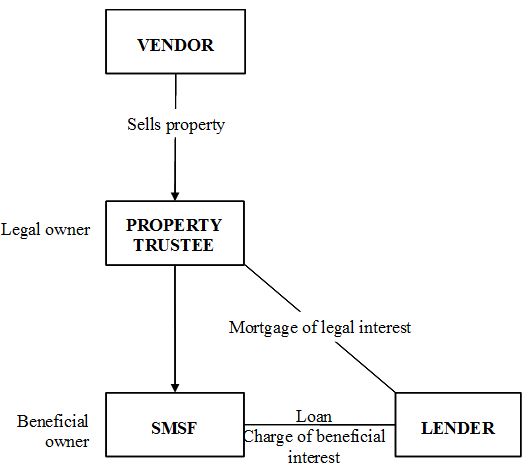

Image Source: SMSF Lending

Features of an SMSF loan

Enables an individual to purchase residential or commercial property using their super fund for the deposit and transfers

- Complies with government legislation: SIS Act – Section 67 (4A)

- Funds the acquisition of eligible, income-producing real property

- Has limited recourse; the SMSF is the ‘beneficial owner’ until the loan is paid out

- Loan-to-value ratio (LVR) typically up to 70% for residential and 65% for commercial property

- Loan term up to 30 years for residential property, up to 20 years for commercial property

- Ensure the SMSF complies with the ‘sole purpose’ test

- Regularly review your investment strategy

- Ensure your strategy takes into account members’ retirement goals

- Consider the risks involved in investments

- Allow enough cash to pay all SMSF bills

- Remember to pay SMSF benefits

- Consider diversifying your SMSF’s investments

- Pay expenses from an SMSF-dedicated bank account

- Ensure the fund’s ownership of investments is assured

- Keep SMSF money and other money separate

- Don’t have the assets of your SMSF in another entity’s name

- Don’t use SMSF assets for personal use

- Ensure the fund’s sole purpose is to pay retirement benefits to members

- Accept contributions and pay benefits (pension and lump sum) according to super and tax laws

- Make informed investment decisions

- Comply with restrictions

- Ensure an approved auditor is appointed for each income year

- Complete administrative tasks, eg lodge annual returns

- Review and update the fund’s trust deed and investment strategy

| Questions | Answers |

| Can I have an interest-only loan? |

Yes – for a period of up to 15 years, depending on the loan and lender.

|

| Can I fix the rate? | Yes – rates can be fixed for one year up to the full term, depending on the loan and lender. |

| Can I redraw on the loan? | No. |

| What is the loan size? | Minimum $100,000 and no set maximum, this is subject to lender approval of the property and SMSF borrowing capacity. |

| What costs should I consider? | You’ll need to establish a SMSF and trustee as well as a bare/security trust and trustee, plus pay all normal costs associated with buying property and taking out a loan, plus a lender’s legal review fee. |

| What sort of property can I buy? | Any residential investment property and any income-producing commercial property, including rural properties. |

| Can I refinance an existing property? | No, however ‘business real property’ that is held outside your SMSF or owned by a related party can be purchased by your SMSF using a SMSF loan. |

| What about outgoings and other property costs? |

Management fees, maintenance, rates and other costs associated with property ownership are the responsibility of the SMSF. All rent received belongs to the SMSF.

|

| What about negative gearing? | The property can be negatively geared inside the SMSF. Normal superannuation contributions into your SMSF can be used to offset any shortfall between rent received and loan payments and outgoings. Any voluntary contributions you make may receive preferential tax treatment, consult your adviser. |

Source: SMSF Loans

Have questions about investing through Super? Click here to talk to one of our experts.

"SMSF loans vary from regular loans in a number of ways and are generally more restrictive. They require higher deposits, have lower LVRs and prohibit redraw" Find out how much you can borrow using our SMSF calculator.

The sale contract is entered into with the property trustee holding legal title and the SMSF holding beneficial title.

Many changes regarding SMSF investment have recently been proposed. Consult the ATO website and qualified professionals to ensure you’re up to date on the latest legislation.

- The money is borrowed to buy an accepted asset

- The asset is held on trust so the fund acquires a beneficial interest in it

- The SMSF has a right to acquire legal ownership of the asset by making payments after acquiring the beneficial interest

- There is limited recourse; the rights of the lender against the SMSF for default on the sum of the borrowing and related charges are limited to the asset

A growing number of Australians are enjoying the benefits that come from purchasing an investment property through a super fund. It not only sets up a promising path towards retirement, but also brings an entourage of tax benefits.

- The original asset being acquired under the arrangement must be a single asset or a collection of identical assets that have the same market value

- The asset held in trust under the borrowing arrangement can only be replaced by another asset in very limited circumstances that will be listed in the SIS Act or its regulations

- Super trustees can’t borrow to improve real property

- Other fund assets can’t be exposed, directly or indirectly, to a default on the borrowing

- The asset being acquired under the arrangement can’t be subjected to a charge other than in relation to the super trustee’s borrowing or the super trustee’s rights in relation to the asset. For example, the asset can’t be used as security for another borrowing

Craig Morgan, managing director of I-Financial Group, which operates SMSF Loans, explains that a number of changes relating to SMSF investment have been proposed since mid-March 2010. Consult the ATO website and qualified professionals to ensure you’re up to date on the latest legislation amendments before investing through your fund.

Step 1. Consider your options

Before deciding if a SMSF property purchase is right for you, you should consult qualified professionals and review your current situation.

- Consider your options and seek professional advice.

- Ensure you have sufficient assets, time and skills to manage your own fund.

- Follow the super and tax laws and understand the risks.

- Tailor your trust deed and investment strategy to suit the members of your fund.

- Be sure you can meet your record keeping and reporting obligations.

- Make sure you understand your annual auditing obligations.

Step 2. Set up the SMS

The ATO website offers a wealth of information about self-managed super. Consult www.ato.gov.au/superfunds/ to learn more about the rules, requirements and processes involved.

Register the SMSF with the ATO

Once your fund is legally established and all trustees have signed a trustee declaration, you need to register your fund with the ATO. You will also need to obtain an Australian Business Number (ABN) and Tax File Number (TFN) for the fund. You need to register the fund for GST if its annual turnover is greater than $75,000.

Once you’ve established your fund, you’re legally required to:

- lodge an SMSF annual return

- pay the supervisory levy, and

- have an audit report prepared

Open a dedicated bank account

Establish a separate bank account dedicated to your SMSF. This will keep your super fund assets well away from your personal assets and will help simplify account-keeping and administration.

Step 7. Gain formal loanAn SMSF loan simply enables individuals to purchase eligible, income-producing residential property using their SMSF for the deposit and transfers.