10/01/2019

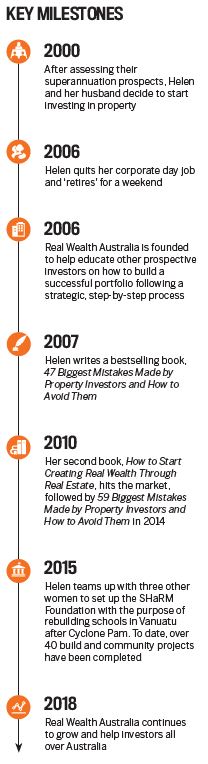

Real wealth Australia has been helping to educate prospective investors for more than a decade on how they can make smarter property purchasing decisions. Your Investment Property spoke to founder Helen Collier-Kogtevs to get her advice on how investors can equip themselves for their property investment journey.

YIP: What do you think separates Real Wealth from other educators?

Helen Collier-Kogtevs: Our first big difference is that we do not offer real estate. I’m all about education – and only education. Lots of other companies in the industry say the same thing, but after spending a bit of time with them you find out they actually do sell real estate in a roundabout sort of way. It’s something I’ve experienced myself. When I was learning to be an investor and being mentored, some of them tried to sell me real estate, which I didn’t appreciate. And so I vowed I would never do that.

The second big difference is that we offer genuine one-on-one mentoring. It’s not one-on-the-masses mentoring via webinars or classroom – this is mentoring that’s hand-holding, personalised and tailored to the individual, which is what I wanted when I was a student. When I was looking to become a mentor, I literally sat down and created programs in a step-by-step format that anyone could follow; I didn’t want to make it complicated. I wanted to take something that was quite complex and create a systemised approach that I could teach anyone, from adults to children.

One of Helen Collier-Kogtevs’ key principles of investing is the importance of learning how to distinguish between choosing a potential investment property and buying a home of your own – something many beginner investors struggle with. Too often, prospective investors succumb to the desire to buy a property that they would like to live in, rather than considering the wider implications.

“If you want to buy a house, that’s easy. Anyone can buy a house,” she says.

“But building a portfolio is complex, and it requires strategic thinking. It’s not as simple as just investing in a development or off-the-plan deal – you need to systematically piece things together to see if they meet your planned outcomes.”

Collier-Kogtevs stresses that further analysis is required – investors need to look towards the end result. Considering longterm income goals, planned retirement age and lifestyle choices is key to determining which property becomes the ‘better’ investment choice – and this may differ entirely from an investor’s personal feelings about the aesthetics of the property.

“Many new investors don’t understand that you can actually utilise research data and forecasting techniques to see what your property’s probable future is going to look like,” Collier-Kogtevs says. “That way, you can make an informed decision before going out and signing a contract.”

YIP: What are some of the common mistakes you see potential investors making?

HCK: There are lots. I wrote a book about it – 59 Biggest Mistakes Made by Property Investors and How to Avoid Them! But I’d say for newbie investors in the market the biggest pitfall is the ‘follow the herd’ mentality. Prospective investors could find themselves going along to seminars with a charismatic host who makes outlandish claims like “the moon is the next hotspot” or “the moon is where you should be buying this type of property”. Then they throw in lots of facts and figures to convince you. The fact is that a lot of people fail to do enough research and due diligence on whether those options are actually right for them. A blanket, one-size-fits-all approach doesn’t work. We’re all individual, and we all have different circumstances and different investing goals.

Sometimes we find that people who join Real Wealth Australia already have some investments – often because they’ve attended the sort of seminar I’ve just described – and they’ve hit a wall. It’s up to me to help them fix it, which I’m happy to do, but it’s unfortunate that they fell victim to people who were trying to sell them something that didn’t fit their needs at all.

“A blanket, one-size-fitsall approach doesn’t work. We’re all individual, and we all have different circumstances and different investing goals”

“A blanket, one-size-fitsall approach doesn’t work. We’re all individual, and we all have different circumstances and different investing goals”

YIP: What do you think investors need to know before going ahead with purchasing property?

HCK: Potential investors will need to start thinking about where and how they spend their money, because they need to be accountable now. These days when they apply for a loan, banks want to know everything. At least in part due to the royal commission into banking and financial services, banks are starting to reel in a bit too tight on prospective borrowers too. For investors looking to apply for loans, working with a good broker in this situation can be really valuable; they can run through your bank statements with you and take some other steps to make sure you have the best possible chance of getting your loans approved.

YIP: Big picture, where do you think the Australian property market is going over the next few years?

HCK: Well, I don’t have a crystal ball, but it’s already cooled off, and I think that will continue over the next two to three years, possibly up to five. On the financial front, I think people are overreacting to the negative media, so they are a little bit nervous. However, I think when they realise that it’s all OK and the market’s settled down again, there will be another run.

“Potential investors will need to start thinking about where and how they spend their money, because they need to be accountable now”

To find out how Real Wealth Australia can help you grow your property portfolio, visit realwealthaustralia.com