In Part Three of our beginner’s guide to investing, we show you how to create a comprehensive buying plan to help you build a solid portfolio that you can retire on sooner and richer. Your Investment Property reports

It is easy to think that once you have decided on an investment strategy and got your finances sorted, you have moved into the home strait. After all, the remaining step is simply to go out and buy a property, right? Wrong!

While the buying stage is one that many investors look forward to with great excitement, it is in fact full of minefileds that require skill and acumen to navigate successfully.

STEP 1 Creating your own buying brief

Before you enter into any investment, not just property, it is important to understand what your end goal is before making any commitments. Your first step towards reaching an understanding of these goals should be to compile a buying brief.

The ideal buying brief should take into consideration your goals, constraints and risk profile, so that when you begin your market research you are headed in the right direction in terms of property choice and return on your investment, as opposed to having other factors like emotion and visual appeal cloud your investment choice.

Empower Wealth CEO Ben Kingsley says that, to do this, you need to identify your personal goals and needs – in the short (five yars), medium (15-20 years) and long (25-plus years) term - alongside your chosen investment strategy. For example, you might want improved cash flow, early retirement or a comfortable retirement down the line.

This means you need to carefully analyse and take into account your household cash flow to ensure you have the financial ability to sustain your investments.

- The income coming into the household

- The household’s cost of living

- Any surplus income

- Any possible future income changes, like starting a family or having to live on one income

“It is all about determining your ability to hold the asset for the medium to long term, which is critical for capital growth,” Kingsley says.

All these elements also need to be considered in order to:

1. Establish a realistic price point – which, in turn, impacts on whether you can purchase one property or more and on what type of property you can buy

2. Identify whether you need to focus on capital growth and equity creation or rental returns and cash flow Kingsley says that if you have a strong income surplus you may want to consider well-positioned properties for good capital growth. Such properties will create equity more quickly and enable you to buy more properties sooner.

However, if you’re low on cash, going for higher rental yields could be a better option. Properties that generate good rental returns improve investor cash flow, which in turn makes it easier to hold on to your investment property over the long term.

Determine your ideal buying brief/wish list

The more you concentrate on properties that have general market appeal and at the same time have scarcity value, the higher your chances of capital growth due to this high-demand, low-supply equation.

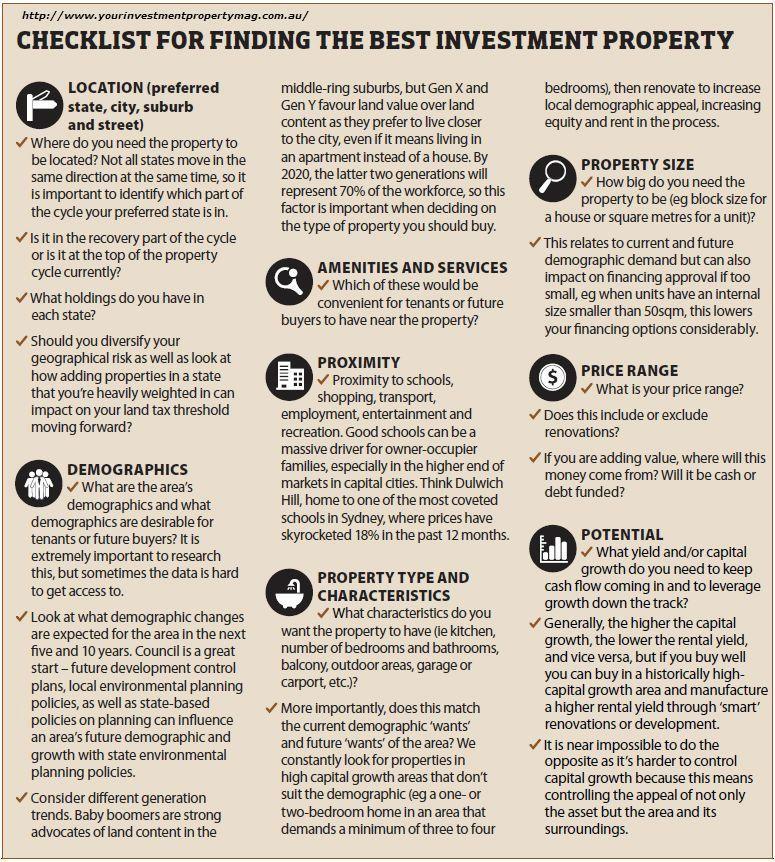

In creating your wish list, you should consider what features a prospective tenant or future buyer would see valuable in a property (see Checklist below).

Please click on the image to enlarge

- Can I service the level of debt required?

- Do I have the cash flow to maintain and hold a property over the medium to long term?

- Is my focus on equity creation or improved cash flow?

- What is my exit strategy or end game?

Putting theory into action

When tailoring your wish list to your investment needs, you may find that your preferences become your constraints in some ways. Your budget may not allow you to tick off all of the requests on your wish list, and you may need to make compromises in order to stick to your target purchase price.

For example, it may not be achievable to buy a beach-front house with all of the features on your wish list and a $400,000 budget. This is when you may need to look at other areas, say interstate, or at other asset types (eg a unit rather than house and land), to gain what you require.

- You should target markets that are showing good capital growth and are on the way up in their cycle.

- Within such a market, isolate properties where value can be added quickly via renovation or development.

- Buy a property on a large block, subdivide it and build on it. The end result equals two properties in a sought-after area.

“Whatever you purchase, it has to go up in value,” Trilogy Investment Property Funding CEO Ed Nixon says. “It needs to be in a high-growth area – not somewhere in the middle of nowhere, where it might be getting decent yields but just doesn’t grow in value.”

Results Mentoring coach Brendan Kelly agrees, and emphasises that each different strategic approach will also impact on your brief and buying criteria. For example, if you want to get the best value out of a buy-and-renovate approach, you should focus on older houses, whereas if you want to subdivide you need to focus on land block size.

After putting together a buying brief, the next step is to devise some comprehensive buying criteria.

This helps you to:

- establish the suburb and property price points that are workable for you

- identify the features of a suburb that make its market best suited to your needs, for example lifestyle options attractive to young professionals and which will drive up value, leading to capital growth

- clarify the type of property and the property features necessary to meet their requirements, eg older three-bedroom house with a garden, suitable for value-adding renovation and for renting to families

- identify specific suburb markets that have the desired area features and the right types of properties “You need to know a suburb’s market well and what prices in that suburb are like. This is so you can loosely forecast a wave of growth, and so – if selling – that you can then figure out when the right time to sell is. rely solely on median prices to identify a good buy. Detailed analysis is critical.”

STEP 2 Conducting your research

The second part of the buying process involves conducting appropriate market research on the types of properties you listed in your buying brief (wish list). You should identify all available and appropriate properties in your target location and compare them by sold price (not asking price, as this is just real estate agent opinion), features, sales history and rental yield.

You can access sales records using the online property research websites of Residex, RP Data, Australia Property Monitors (APM), Real Estate Investar and DSRScore.com.au.

RP Data and APM are good for researching at asset level and Residex is good for capital growth predictions, while Real Estate Investar and DSRScore.com.au provide supply and demand indicators such as vacancy rates, stock on market as well as other tools to narrow down your search.

When browsing these online research centres, assess each of the available and appropriate properties you have found in your target location for their capital growth over the last 12 months, five years and 10 years (possibly even 20 years for a better long-term performance record). Or, if it is rental yield you are focused on, then you should look at the rental returns of the properties (also included on these websites).

Remember, it is performance you are looking for here. So you may need to compromise on a few elements on your wish list to you may need to compromise on a few elements on your wish list to find that high yielding/growth investment you are after.

After conducting this initial research, add all of the properties you’ve found to an extended list. Then use this list to develop a shortlist of properties within your price range that have high potential and warrant a physical inspection. There are varied rules of thumb out there among buyers’ agents and advisors that say you should inspect between 50 and 100 properties before purchasing, in order to get a good feel for

the price range and buyer activity in any one market.

This 100-property minimum will help you derive what is a good-value investment for your criteria. It may seem like a lot of properties, but it really isn’t. In any given weekend you will view around 10 properties. So, two and a half months of market research and open inspections really isn’t that much time to dedicate to such a big purchase.

This period is essential for you to gain a good understanding of the value of the property features detailed in your buying brief. It will also ensure that you are able to spot good value and determine what you should be willing to pay for a property. More importantly, not only will you start to understand local pricing, but you will also start to understand the supply and demand mechanics of that area at that point in time, and generally the best time to buy is when demand is low and supply is high, as opposed to the other way round.

Supply and demand factors

When researching a suburb, Kingsley recommends that you take into account both the supply side and the demand side of the equation. This will give your analysis of the market more accuracy.

The purpose of this step is to help you create a shortlist of properties to do your final round of due diligence on.

STEP 3 Inspecting and selecting

Personally inspect the 100 or so properties you have selected from your market research and compile a report on the following:

- The initial feel of the property and aesthetics

- The floor plan

- Features and characteristics

- Its potential rent/yield (based on local comparables obtained)

- Any possibility to add value, and areas that will require repairs (try to take photos), and if so quotes on how much they will cost (the more ‘fixed price’ quotes the better)

- Its location within the street

- Its outlook and orientation (note whether there is any possibility of being built out)

- Neighbourhood profi le (approximate ratio of tenanted versus owner-occupied properties)

- Proximity to local amenities, schools and transport, area/suburb profile and its demographics

STEP 4 Conducting due diligence

Due diligence is a crucial aspect of the buying process, yet it is common for buyers (even the most experienced ones) to get so excited about finding the right property that they bypass this step and move straight on to negotiating the sale, or perform this step poorly. If done incorrectly, this can become a rather costly step.

This is a huge mistake because it is the stage at which you as the buyer can find out the most about the property you intend to purchase.

During the due diligence stage, buyers should be sure to:

1. Get an expert such as a lawyer, solicitor or conveyancer to review the contract before signing. This review will expose the exact terms and conditions that make up the contract of sale between you, as the possible buyer, and the vendor.

2. Review this with your legal representative and have them suggest any areas you might want to amend in favour of you as the buyer. For instance, you may want to request that the deposit be lowered from 10% to 5%, or that a five-day cooling-off period be included within the contract.

The conditions you seek and how they are accepted will vary from state to state and property to property. It is also important to not go too far in negotiation either.

For example, if you find the property of the century and it is important to secure it, and you’re trying to get a 5% deposit accepted when you have more than 10% deposit to cover it, will this risk the deal being not accepted? This is where you need to use common-sense judgement, ie is it worth risking ie is it worth risking putting the vendor or real estate agent offside? In a hotter market 10% will be asked for; conversely, in a slow market or for a property with little demand, 5% deposit may be accepted.

STEP 5 Negotiating

Before you settle and during the cooling-off period, make sure you organise a building and pest inspection (for a house) or a strata report (for a unit).

These reports will reveal any past or potential future costly problems with the building and surrounds, including an estimate of how much it might cost to fix any problems that are discovered.

Any negatives that come from your due diligence should then be weighed into your decision to either start negotiating on a purchase price for the property or walk away from the deal. You may also be able to negotiate a reduction in your purchase price to cover any discovered issues.

If you conduct a strata report and are unsure from its findings, it may be prudent to also conduct a building and pest report on the building to see if anything major is evident – $500 spent now could save potentially thousands of dollars down the track in special levies. Be wary of future works in unit blocks as these could result in a higher levy down the line.

It is important to know that the due diligence and negotiation stages go hand in hand in many ways. These processes may happen simultaneously, especially if there is a race to the finish line for the property.

The art of negotiation

One of the most important parts of the negotiation process is preparing for the actual negotiation; that is, obtaining the true market value of the property.

Remember that the listing price doesn’t mean anything during the negotiation process. To avoid overpaying and facing costly expenses, have an independent valuation of the property done before the negotiation period begins. This may cost you between $200 and $350 but it will be money well spent if you can negotiate an extra $10,000 off the sale price of the property.

Alternatively, you can research properties that have sold within a 1km radius of your property over the last three to 12 months. This will give you an idea of how much the property is likely to sell for, although competition may inflate the price.

Developing your negotiation strategy

Going into the negotiation stage, you have to remember to take your emotions right out of the game. You’ve all heard this a thousand times before but the phrase isn’t getting any less relevant.

Go into the process knowing your target price and contractual terms (such as your preferred deposit amount and settlement timeframe) and stick to them. However, keep these initial terms reasonable because the more conditions you attach to the contract, the more constraints there are for the vendor. You don’t want the vendor to become rigid with the final sale price of the property or offer it to another buyer.

If the vendor seems protective of their terms, turn the tables on them by using your due diligence. Draw upon whatever information you were able to gain as to their reasons for selling. Think about whether the agent mentioned if the vendors needed to settle the property quickly, or whether they were flexible about a longer settlement period. If the vendor requires a shorter settlement, you might be able to negotiate a few thousand dollars more off the sale price.

At the negotiation table

If you’re uncomfortable with negotiation or haven’t done it before, it might be useful to hire a professional buyer’s agent for this part of the buying process.

If you’re serious about negotiating quickly on a property, have the contract fully filled out (post due diligence with your solicitor) and your deposit cheque ready as the negotiation is drawing to a conclusion, and use these as your tools to show you are serious. Saying you’re serious is totally different to showing you’re serious! Showing you’re serious has got some clients property at $20–30k less than other offers, as the selling price is not always the vendor’s main reason for selling; sometimes it can be time and urgency they require.

STEP 6 Securing the property

Once you have had your offer accepted, it is important to exchange contracts and set a time limit for return of the contracts (usually by close of business that day). This will put the pressure of loss back on the vendor and their agent.

Once you by the bank, the exchange has occurred and you have a settlement date set in stone, book in with the selling agent for a time to conduct a pre-settlement inspection. This inspection will give you the opportunity to make sure you’re getting the same property and the internals that were part of the sale you signed the contract for.

This may sound funny, but sometimes fittings and fixtures – part of what you bought legally – are removed by the owner after the exchange of contracts and before you settle on the property. So make sure you have taken photos of the property before you exchange contracts, and compare these with the condition of the property at the pre-settlement inspection and with your sale contract and inventory agreed.

The only thing left now is to wait for settlement day and get your keys.

Seeking advice and assistance

If you’re feeling overwhelmed at this point, take heart. It’s normal, and you're not alone. If you're not too confident about your ability to do all of this on your own or you simply want to minimise things that could go wrong, there is another way: enlist a reputable and stringently vetted buyer’s agent or an advisor.

It is well worth having a good advisor, agrees Intuitive Finance managing director Andrew Mirams. He believes that beginner investors can significantly reduce their risks by seeking reputable professional advice and trusting it, but he says people are often decidedly wary of getting professional advice. “It might cost a bit for a professional, but it will ensure you get your purchasing decisions right, initially and further down the track. If you try to do it by yourself you are likely to end up paying more in the long run,” he says.

Beginner investors can also learn many of the skill sets and data sources that buyers’ agents use over the course of several property acquisitions. This will make it easier for you to do it yourself in the future and avoid buyers’ agents’ fees in the process.

Buyers’ agents: the lowdown

If you’re thinking of using a buyer’s agent, there are a few things you need to be aware of. While there are many advantages of enlisting one, there are also some downsides. The key is to carefully vet whoever you’re hiring to make sure you’re getting the best and right advice.

THE PROS

Propertybuyer.com CEO Rich Harvey says that, along with helping with investment strategy and selection criteria design, a good buyer’s agent can:

- Save you time: They know where to look and can shortlist a more extensive range of suitable properties efficiently.

- Save you cash: They know how much to pay and can provide the latest market knowledge and research.

- Seal the deal: They are well versed in negotiating on your behalf.

"But not only does an agent add value in terms of individual property selection; they also help to educate you about the process along the way, in order to help set you on course for future investment."

THE CONS

Unfortunately, there are some unscrupulous agents in operation, Results Mentoring coach Brendan Kelly say. Such agents prey on the naivety and vulnerability of beginner and/or time-poor investors.

Kelly says there are two main areas investors should be careful of when working with an agent:

- Vested interests: Some agents tout deals that involve commission or even kickbacks from a developer or seller. This means they are not giving investors independet, unbiased advice. It can also result in hidden costs for the investor.

- Information provided: Some agents give investors information that doesn't manipulate the numbers and costs involved. This allows them to depict attractive deals offering great profit and rental returns that may not be an accurate depiction of the reality.

THE COSTS

Harvey says an agent's full-service fee is typically around 2% of the purchase price, plus GST. However, some agents will negotiate a set or fixed fee in advance. Many agents that Your Investment Property contacted charge a fee of $9,900 and above. Some agents offer "negotiation only" and auction-bidding services.

How to get the most from an agent

Harvey says collaboration, a willingness to listen, and an open mind (on the part of the investor) are key to a successful partnership with an agent.

Kelly recommends that you should know your numbers and have done your due diligence, and you should request full disclosure.

"This will help you better understand whether or not the deals being suggested to you are in your best interest," he says.

If you pay attention to the work of your agent, you can learn a lot about property investment and the strategies, techniques and research it involves.

If the company can’t answer your questions and provide evidence to back up their answers, you should not proceed with them as they are unlikely to be experts in the area. Finally, the answers to the four questions given here (see box) will assist you in understanding whether the company you are engaging is working for you, and whether their recommendations are based on intimate local market knowledge or knowledge gained online or from interstate.

If you are looking for a property advisor or a buyer’s agent/advocate to purchase a property for you, there are four very important questions you should be asking:

1. Does the company have an office in the state/area they are recommending?

2. Is the agent’s company licensed in the state they are recommending that you purchase property in? (Request evidence of this.)

3. What is their fee and is this paid by you as the client?

4. Does the agent have any properties available at the moment or will they search for a property that is specific to your needs?

This feature is an excerpt from Your Investment Property's August Issue. To read the complete feature, you may purchase the issue or sign up for a subscription.