David Smith is a 50-year-old sales manager living in suburban Adelaide. For the past 16 years he has been providing financial support for his growing children. Now that his children are all adults and making their own way financially, David is turning his focus to his own financial position, as he fears this won’t support his retiring anytime soon, and his superannuation will not last long in retirement.

David Smith is a 50-year-old sales manager living in suburban Adelaide. For the past 16 years he has been providing financial support for his growing children. Now that his children are all adults and making their own way financially, David is turning his focus to his own financial position, as he fears this won’t support his retiring anytime soon, and his superannuation will not last long in retirement.He needs to consider his best options for investment of the surplus funds he now has available to increase his chances of a financially secure retirement.

David is considering all options, and one of these options is investing in property. This game plan will explore his options for buying several investment properties to build up a portfolio of property that can deliver him capital growth returns as well as a passive rental income to replace his wage once he retires.

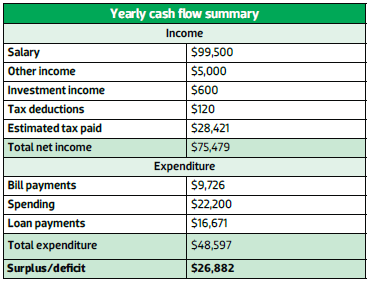

With 15 years of work remaining and an extra $1,500 per month in surplus income, this brings his overall surplus to $2,240 per month and ensures his borrowing power, which is one of the four critical elements for investing.

Provisioning future expenses

To develop a financial strategy for David, we need to look at his current and future financial commitments.

• We plan to provide each of David’s children with a wedding gift of $10,000 when they reach 30 years of age. He has already paid one of these amounts, but there are three kids left, so some of his surplus cash must be retained, or provisions made for these gifts in his personal borrowing.

• Furthermore, from a cash flow perspective, David has provisioned $1,000 for household upkeep and maintenance in 2015, and $2,500 in 2020.

• Fortunately, David has quite a new home. He is also willing to cash out his long-service leave, which he estimates will provide him with $25,000 at today’s dollar value, but this figure will be adjusted for when it is planned to occur in May 2017. Another positive is that he has a fully maintained company car, so he doesn’t need to factor in any car purchases until after retirement, and this will be funded out of the passive income his wealth base will produce.

• Finally, on the cash flow front, David currently provides for an annual holiday budget of $3,600 per year. Yet as he gets older he wants to increase this by an extra $2,000 a year so he can enjoy more holidays and leisure time while he is still young, fit and active. This extra money will be factored into his household budget numbers from the age of 60 (10 years from now).

Savings/equity position

Another critical element is a borrower’s savings/equity position. In David’s case this isn’t so straightforward.

David’s current home still has a mortgage with a loan-to-value ratio (LVR) of 66.25%. This does give him scope to act now, but David will need a good understanding of risks versus rewards, as well as the principles of sound money management, if he is to take on more debt in order to accumulate properties and then retire out the debt over time.

He will need to give this serious consideration if he is to build a property portfolio, which along with his super position will allow him to self-fund his retirement on an income of $60,000 per year.

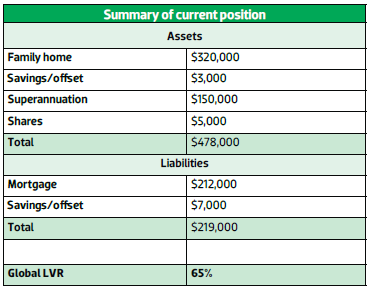

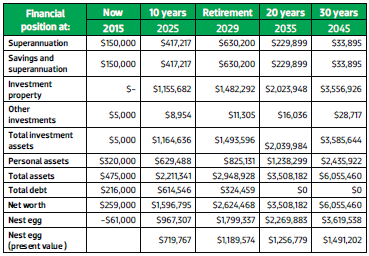

Let’s take a look at David’s current situation:

We can see from David’s numbers that apart from his family home he only has $150,000 in super, and having been committed to financially supporting his kids he hasn’t been able to put a lot away in savings until now. Even with 10 more years of contributions, that level of super isn’t going to see David reach his desired target. David is right: something needs to be done, and from a property point of view. And given that it’s a longer-term investment approach, it needs to happen soon...

The Game Plan:

The advice that a professional property investment advisor gives a prospective client should never be about trying to retrofit a particular property investment strategy of their choice to a client’s situation.

Rather, the advisor should offer open and independent property assessments, investment strategies and overall advice aligned to each client’s individual financial and personal goals. And in doing so they must look seriously at their client’s current cash flow, plus future cash flow needs, risk profile and overall comfort in taking on debt.

The 'Do Nothing' Scenario:

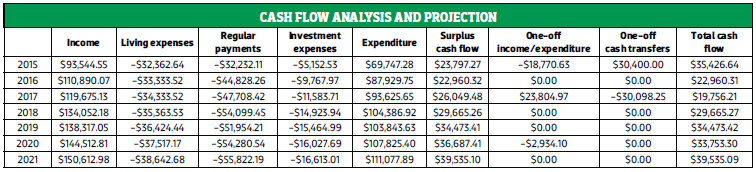

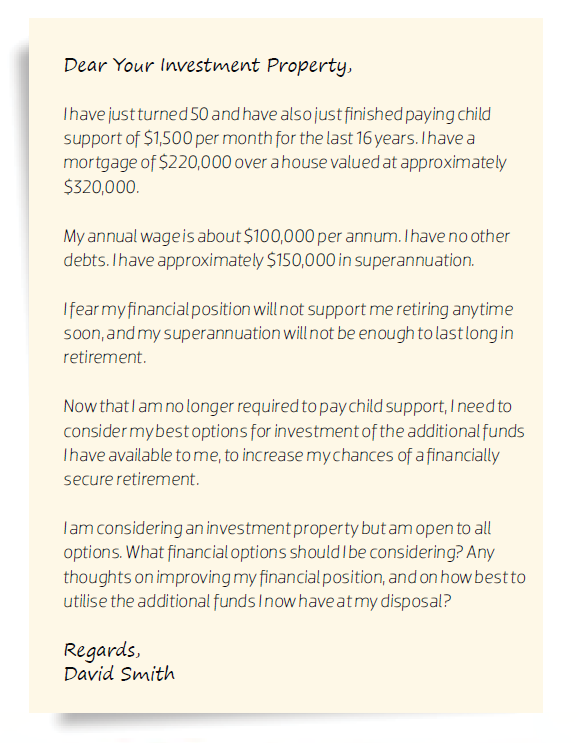

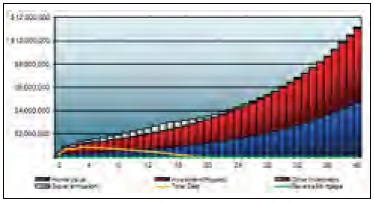

The wealth and income projection chart at right looks at David’s current situation and into the future.

This is what we call the ‘Do nothing’ scenario – meaning that if David doesn’t put any of his current surplus cash flow to work and just spends it on discretionary items and meets his current debt obligations at minimum repayment levels, his dream of having a passive income of $60,000 a year (self-funded) when he retires at age 65 is not possible at all.

If he pays himself $60,000 in retirement, as the model shows, his super will be exhausted very quickly, and then the model is looking to find this amount so it’s defaulting to a reverse mortgage position, but again this isn’t a possibility because it shows the forecast projections are not working at all.

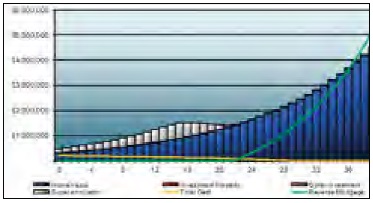

The yearly numbers shown in the ‘Cash flow analysis and projection’ table below, which have helped generate the wealth and income projection graph, really hit home. They show David that unless he acts now and puts his surplus cash flow to use, instead of putting it towards current discretionary spending, his dream of a self-funded retirement will effectively be over, resulting in a potential case of a pension-funded retirement of significantly less income or, worse still, having to work for the rest of his life.

Making Sense of the numbers

To help understand the numbers, let’s work through each column to illustrate cash flow and stress-test our ability to borrow and to service current and planned future borrowing.

Income

This is the after-tax income David receives (assumed to increase by 3% per annum until his planned retirement at age 65). For those with a keen eye for detail, you will see there is still a small amount of income coming in from 2037, and this is being generated from the $5,000 share portfolio income distribution.

Living expenses

This is the total bills and spending allowed for on a yearly basis (assumed to increase each year by 3%).

Regular payments

This is the total of the annual loan repayments David is making on his current mortgage and personal loan.

Investment expenses

These are the holding costs associated with any investments (currently there are no investment expenses because no properties are held).

Expenditure

This is the sum of the expenses columns.

Surplus cash flow

This is the sum of income less expenditure.

One-off income/expenditure

This is the sum of one-off items and their impacts on cash flow over the year in which those items occurred. Examples are the three wedding gifts of $10,000 (in today’s dollars) and how they will impact on David’s overall cash position when these payments are made in 2024, 2026 and 2027 respectively.

One-off cash transfers

This is the sum of monies received in any one year for any equity release events to assist with the overall cash flow position, less property acquisition costs.

Total cash flow

This is the sum of the cash flow surplus or deficit forecast each year based on the financial and cash flow information provided by David.

Key points

• David’s success in implementing this game plan is going to be a story of cash flow and liquidity management, given his age and current financial position.

• If David is going to take on more debt during the accumulation phase of this plan, we need to focus on his spending and income to ensure he doesn’t get into any financial difficulty that results in having to sell a property too early and missing out on the long-term investment return benefits.

Analysing David's cash flow

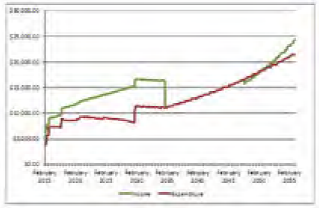

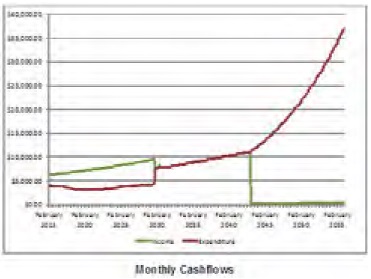

Let’s take a look at David’s monthly cash flow chart:

• There is ample surplus cash flow, as demonstrated by the gap between income and expenditure, allowing us the potential to borrow money to invest and to ultimately, over time, build David a property portfolio.

• Following on from our stress-testing of David’s cash flow, we are now in a position to release the equity in his current property to an LVR of 90%, which will release

$76,000 as our liquidity planning takes shape.

• This will attract a lenders mortgage insurance (LMI) premium, which has been factored into our cash flow assessments ($4,400) and will be capitalised onto the investment lending. This equity is going to serve two purposes: firstly, as a reserve cash buffer, and secondly, it’s going to be used as the deposit for a couple of property investment acquisitions I am recommending.

Once again, this is why cash flow management is the foundation of any smart property investment strategy and overall plan, because in almost every case the investor takes on debt to invest in property in order to control a larger asset base over a shorter period of time and get the returns on those assets sooner rather than later.

Property Strategy

In terms of investment property strategies, I am mindful of David’s need to see these properties start to deliver passive income at a reasonable level in what we would consider a shorter-term property investment timeframe.

In addition to this, I am conscious of David’s risk profile in terms of the types of properties that may suit him. In our meetings we spoke of some property strategies that could deliver great capital gain returns but would require significant cash flow support in their early investment years, and others like what we are presenting here, in which our focus is to try to secure higher-yielding assets that turn positively geared sooner. This was a strategy David liked.

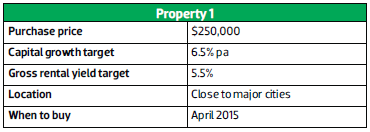

I am recommending that David buys two $250,000 investment properties in relatively quick succession, one in April this year, and our return targets are capital growth of 6.5% and rental yield of 5.5%.

Property 1 is in a major city location as it is an established unit/apartment in an up-and-coming area close to the city and with solid commuter and lifestyle elements.

YEAR 1: 2015

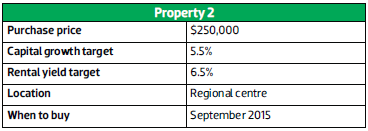

The second property would be purchased in September, and the forecast returns from this asset are capital growth of 5.5% and rental yield of 6.5%. This is a regional city with good broad economic prospects, tight vacancy rates and limited supply, but the town must also possess strong lifestyle elements that are attractive for continued population growth and job opportunities.

After these two acquisitions I’d like David to just get comfortable with holding a couple of properties and keeping a keen eye on cash flow and his financial budget.

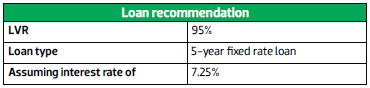

I have recommended 95% LVR purchases (no capitalisation on the LMI, due to the majority of lenders placing these restrictions on investment lending).

I’m also suggesting five-year fixed rate loans, and in our modelling I’ve forecast these at a 5.5% interest rate, which is above current pricing levels, but it’s important to be conservative as this borrowing is being planned for the long term.

For the record, our property investment forecast models, such as this one for David, have long-term interest rates of 7.25% factored in, unless stated as fi

xed rates, as in this plan, which after the five-year period will revert to variable at 7.25% for the remainder of the loan term.

YEAR 3: 2017

I am recommending that David makes his final purchase in September 2017, of a $200,000 property with targeted investment returns of 5% capital growth and 7% rental yield.

This is very much a cash flow strategy, as we are getting closer to the retirement target date. It will more than likely be a regional city purchase, given the higher yield we are looking to chase down and the slower rate of capital growth in line with lower wage growth usually experienced in most regional (non-mining) towns.

In stress-testing cash flow and this overall property portfolio game plan, let’s take a look at the cash flow charts again, with these three properties now included in David’s retirement plan.

Monthly cash flow

Monthly surplus cash flow remains sound, even with the increased debt-servicing commitments.

In the above chart, you can see the three steps up in expenditure (red line) and also in income (green line), so even though we now have three investment properties within our portfolio, we are managing our cash flow well, because instead of that money being assumed to have been spent on discretionary items and living for the now, David’s monthly cash flow surplus has been used for a far better purpose in helping him build a passive income for retirement.

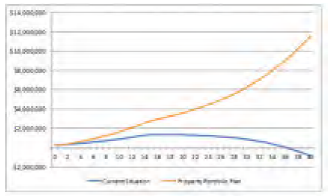

What does this plan do to David’s overall wealth and income projection picture?

As we can see during the acquisition phase, David’s debt position grows up until the third investment property purchase, but after that point we move into the debt elimination phase and are able to retire the debt out to live off the passive income from our property and other investments.

In further stress-testing the annual numbers, we see a significantly improved financial picture.

During the period from 2035 to 2046 David will be able to access his full super, meaning he will be able to pay down debt and also have $60,000 in passive income during this time, until the super is exhausted. Then the properties take over in providing this ongoing passive income for David to enjoy in his retirement years.

What the future looks like

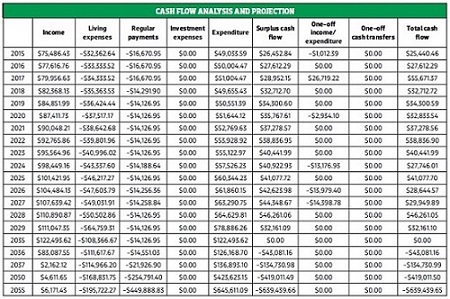

Now let’s take look at the projected asset values and overall financial position.

The chart below compares the two different stories of the current ‘Do nothing’ situation and the property portfolio plan, when factoring in the forecasts and projections outlined in the property investment recommendations.

To further illustrate the benefits of time and long-term investing on David’s wealth position, the following table summarises this position nicely, based on the forecasts and assumptions used in our property investment modelling.

It makes for pleasant reading and, most importantly, is a tailored plan based on David’s cash flow and financial situation.

Playing On

Naturally, for a plan like this to materialise, David will have to keep a watchful eye on spending and continue to practise sensible money management, but the retirement payday will be well and truly worth it, with no need to sell down any of the properties acquired, and with the combined portfolio generating the passive income he is hoping for.

DAVID’S 10-STEP PLAN

1. Ensure his income and expenditure are reflective of his actual lifestyle

2. Reconfirm that current monthly cash flow surpluses are correct

3. Ensure all future planned increases in expenditure and one-off expenditure items are factored into his cash flow situation both today and into the future.

4. Decide whether he is happy to have his long-service leave paid out, and these fund will then be available for investment purposes.

5. If property is going to be his preferred investment vehicle, then have assessments of his borrowing power undertaken.

6. Release equity in his current property for deposits on planned purchases.

7. Obtain pre-approvals from lender for the first two investment purchases

8. Seek advice from a Qualified Property Investment Advisor on the areas/locations to invest in.

9. Seek the services of a licensed buyer's agent to help select and negotiate the investment property purchases to meet the target investment returns required for this plan. (Don't leave it to luck or guesswork.)

10. Maintain and monitor household cash flow to ensure plan will materialise.