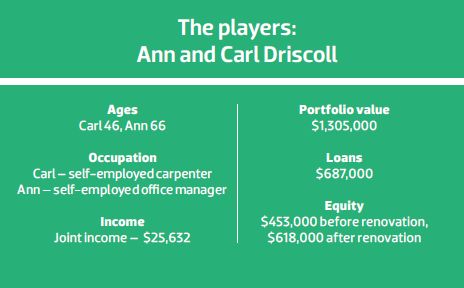

Ann Driscoll and her husband, Carl, are looking to renovate their way to an early retirement. But with their modest combined income of just $25,632, how are they going to make it happen? Brendan Kelly examines their situation and puts together a property investment game plan.

Like many aspiring property investors, all that Ann Driscoll and husband Carl want is to retire comfortably and pursue what they love. In their case, it’s to be able to prospect for gold full-time.

“Carl always finds the gold so we can add to our income by selling some of it,” says Ann.

To this end, they’ve decided renovation would be the best way for them to generate the income they need to retire in comfort. With a relatively modest goal of retiring on $30,000 a year without any debt, they may be closer to it than they think. Already, the couple have amassed seven cash flow positive properties and built equity worth $453,000. They’re currently renovating one of their properties and planning another one as soon as the first project is completed. The couple expect the added value will boost their equity position to $618,000 after renovations.

However, they have some challenges: Ann and Carl are both self-employed and earning a combined income of just $25,632, which severely restricts their borrowing capacity. They also have some properties in areas that are not performing well.

So how can they successfully renovate their way to retirement? Enter our resident property investment coach Brendan Kelly.

» To be able to do renovations full-time without using their wages

» To generate enough income from properties to enable them to prospect for gold full-time

» To retire on $30k pa income debt-free

» To own a property on the coast debt-free

Brendan’s assessment

It takes more skill and knowledge than being a masterful renovator to make renovating a successful and viable full-time business. This is something that Ann is becoming acutely aware of.

Ann and her husband, Carl, a skilled renovator and gold prospector, are living a conservative lifestyle in North Queensland and are at a point in life where they are really looking at winding down. Right now, Ann is attempting to figure out exactly how to make that happen.

Their original goal was to move back to the coast, but as they have carved out a fairly comfortable lifestyle where they live now, the idea has evolved to a future lifestyle that could accommodate both – and why not?

The issue, of course, becomes one of managing finances to afford that lifestyle.

Planning for retirement

There are series of questions that Ann and Carl have to ask themselves in order to get a better idea of the size of the task at hand. These include:

- How much cash and income do I need to live the life I want?

- What’s the target date that I’m aiming to do this by?

- How much cash and income do I have at the moment?

- How big is the financial gap I need to fill?

- How much time have I got to fill this gap?

- And what do I need to do differently to achieve this?

The couple are comfortably living a conservative lifestyle so their retirement demands are not high. In fact, Ann said they’d be comfortable with a passive income in the order of $30,000 (supporting no debt) per annum. This is after they have purchased the property on the coast.

When considering a retirement income of $30,000 as an achievement, many middle managers and white-collar ‘yuppies’ interviewed on city streets might scoff. However, there are a couple of very smart points to remember:

1. A conservative approach to lifestyle means a lower asset base for financial freedom.

Seeking a passive income of $100,000 is a fantastic goal to have, but at an average return of 8%, an investor would need $1.25m created with ingenuity and, more often than not, after-tax dollars.

Seeking a starting passive income of $30,000 means building an asset base of just $375,000. Much easier to achieve!

2. And sooner!

With a lower target for financial freedom, saying goodbye to the boss can happen in a far shorter period of time. Imagine the freedom of not needing to work ever again at the age of 45 instead of 65?

The Game Plan

Let’s say the couple buy a one-bedroom apartment worth around $150,000, or a small, cheap two-bedroom property some kilometres from the beach for the same price.

Based on what they aspire to in retirement, let’s calculate how much they will need in terms of assets to be able to retire comfortably.

Assuming that Ann can achieve an average of an 8% net return on her investments, let’s calculate her asset needs:

Add to this the $150,000 plus settlement costs of $8,000 for the coastal home and we can see that Ann and Carl need a total of $533,000.

The $30,000 income would be generated from debt-free, high-yielding properties in areas where vacancies are low. This could be from investing capital in their existing properties to pay down debt, or selling up the entire portfolio and starting again – perhaps with commercial properties this time?

Of course, if selling up was the idea, then buying and selling costs would need to be included into the projected model. This may mean a balance of more than $375,000 might be needed to get a similar result.

The remaining $150,000 covers the cost of the second home on the coast. While it is not factored into these calculations, the dwelling could also be rented to increase cash flow for the couple.

Target date

Having clarified their financial need, the issue now becomes one of timeframe. For Ann, having this tomorrow would be ideal; however, it may be a few years yet. The way to determine how far off retirement might be is to review their current financial position relative to their goal.

Current cash and income

Some time ago, Ann and Carl elected to live a more frugal existence and moved to rural North Queensland. Despite the fact that their combined earned income in the last 12 months was just $25,000, they have recently amassed a property portfolio of seven cash flow positive properties.

Portfolio property market conditions

A quick review of the supply and demand statistics for suburbs that Ann and Carl have invested in reveals some disconcerting news.

• Hughenden is currently in a ‘buyer's market’, meaning properties take a long time to sell, and while on the market, values are likely to fall a little. The cash flow of the properties in these suburbs is pretty good, so if they can continue to occupy them with paying tenants, they should be OK.

• Lethebrook has not had sufficient buying or selling activity to make a call on the nature of this market.

• Ingham and Home Hill are currently ‘stressed’ markets, meaning properties will take quite a long time to sell, and while on the market, values will fall.

• Charters Towers is currently ‘very stressed’, meaning properties will take a very long time to sell, and while on the market, values may fall significantly.

Suggested strategies

For many of her properties, it might be wise to see if the existing tenants will sign a two-year lease agreement in exchange for no increases in rent.

Given prices are likely to fall further, rents are likely to come down too. While offering a fixed rent for two years sounds counterproductive, it will sound enticing for the tenant today and encourage the signing of a two-year lease agreement ensuring occupancy.

When rents fall, this fixed price will look good compared to other properties, improve the gross yield and make the property more attractive to other investors looking to buy into the area when the market warms up again. However, such an action ties up working capital.

Borrowing capacity

An earned income of $25,000 does not allow significant borrowing – let’s say about $48,000. Without this leverage, making money through property gets a little trickier – not impossible, but trickier.

One idea is to ‘partner up’ to increase the funding capacity. Carl has some great renovation experience and skills and would be someone many investors would be glad to have on their team; however, Ann and Carl are conservative and self-reliant and therefore are not comfortable with partnering up with other people to pool funds, skills and time.

The benefit is that there’ll be no complications among friends. The consequence is that the funds they have today, and what they are able to earn tomorrow, are all the funds they are going to have, in order to build what remains of their retirement plans.

The Gap

Financial position

Net asset/equity: $453,000

Target asset value: $533,000

Shortfall: $80,000

This summary shows us that Ann and Carl have a net asset base of $453,000. This is a fantastic achievement in such a short period of time, given their conservative income. But as they need something in the order of $533,000, this represents a shortfall of approximately $80,000.

Using only what they have now, and the minimum borrowing available from their income, Ann and Carl need to think more creatively than the traditional buy-and-hold investing, and sooner rather than later. Fortunately, they have a flair and passion for renovation.

As neither of them are burdened by the traditional 9 to 5 restrictions, they are free to pursue this more active approach to building capital from their investing strategy.

What to do now

While close, achieving their goal ‘tomorrow’ might be pushing the boundaries a little as there are a few issues to be worked through before their ultimate lifestyle can be enjoyed.

If Ann and Carl are to progress with their investing, they will need to free up some capital to go again. The choice is to draw down on the equity they have available in their portfolio, or sell some property. With approximately $48,000 in additional borrowing capacity, the option to draw down will not necessarily allow them to achieve what they want when they want it.

On the other hand, selling Properties 3 and 5 will free up something like $200,000. Add to this the increased borrowing capacity ($48,000 + $134,000 (Property 3) + $130,000 (Property 5)), which amounts to potentially $300,000, and their options become much greater!

That said, let’s take the more cautious approach of borrowing only $100,000 after selling Properties 3 and 5, and see what impact it might have on their ability to achieve the retirement they want, plus more.

Based on the above numbers, having accounted for all costs to see the projects through, such a renovation will offer Ann and Carl approximately $27,000 profit as fast as they are able to find, buy, settle, reno, sell and settle. With time and effort this could occur within five months. Then within just 15 months they could have the additional $80,000 they need to retire with the lifestyle they now seek, using only their own money, skill and time.

Then what?

And this is a fundamental question. Once retired, how do you fill your day?

“We would be more than happy to forgo the cottage on the coast as long as we could purchase a reno, live in it and take our time to renovate so we can enjoy the area without the constraints of lack of money and work commitments. Food, roof and travel are enough for us,” says Ann.

It appears that Ann and Carl are not only willing, but looking forward to their retirement and to renovating properties as they travel around the country – so much so that Ann is willing to give up their home by the coast. Going back to Ann’s original question, it may not be appropriate to hang up the hammer so soon.

If we then divert the $200,000 (from the sale of Properties 3 and 5 once allocated to the coastal cottage) back into ‘slower’ renovation live-in projects, Ann and Carl could be living on a passive income of $30,000, travelling and renovating their way across Australia – living the dream!

In order to get a clearer picture of the business of renovating their way across the country, it’s important to model with realistic numbers exactly how this could work before taking any action to implement the idea. The following illustrates how it might work.

Assumptions

• Carl and Ann could plan and execute a series of eight-month renos.

• They are happy to maintain their lifestyle on a minimum income of $30,000 from their investing, and supplement it with their earned renovation income.

• The remaining profit gets reinvested into other properties and continues to generate capital.

Following this plan would continue to increase their income for lifestyle, plus continue to build their net asset position over time. On an easy road of one cosmetic renovation per year, within five easy years, Ann and Carl could double their lifestyle income and add more than $200,000 to their equity position on a path that will continue to support and build their passive income potential, for it really is time to hang up the hammer for good!

Despite Ann perhaps feeling a little stuck right now, there are ways beyond her current position into a more lucrative outcome while doing what she and Carl both enjoy so much – renovating.

Thinking differently about the portfolio they currently have, being open to possibly selling some of their properties to release capital, and taking this capital to work on properties close to home but in areas more likely to grow … Such an approach has the capacity to deliver the lifestyle Ann so desires for herself and Carl.

Keep going, Ann!

.jpg)

Brendan Kelly

Along with Simon Buckingham, Kelly is the co-author of a number of property investment books, including The Real Deal: Property Invest Your Way to Financial Freedom. He was the first property coach to join the RESULTS Mentoring (resultsmentoring. com) program, which provides educational resources and mentoring assistance to those seeking to invest in property. To date, Kelly has coached over 600 investors.

Disclaimer:

The advice contained in this article is for general information only and should not be taken as financial advice. Please make sure to speak to a qualified professional person before making any investment decision.

.jpg)

.jpg)