Metropole has been working with clients to help secure their financial future for over two decades. With Australians arguably more interested in investing than ever before, it’s crucial to be equipped with the right tools to not only build wealth but retain it. Your Investment Property sat down with director of Metropole Wealth Advisory Ken Raiss to discuss how investors can manage their wealth, both for themselves and for future generations.

YIP: How does Metropole work with clients to assess and create their financial goals?

Ken Raiss: Attaining wealth doesn’t just happen – it’s the result of a well-executed plan. However, we appreciate that not everyone necessarily has the time or inclination to equip themselves with the relevant knowledge to maximise their finances. That’s where a specialised team – like Metropole Wealth Advisory – can step in.

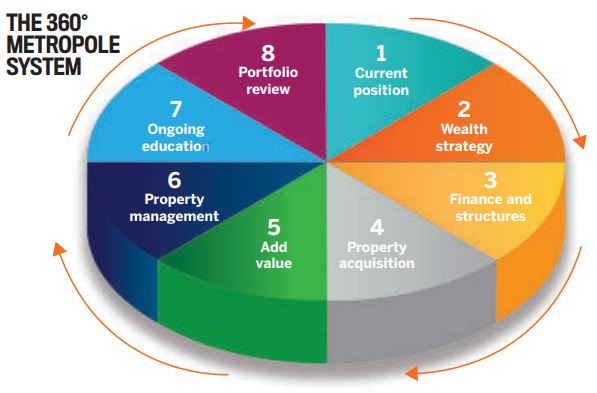

We start by discussing with our clients what they’re trying to achieve financially. Rather than focus purely on property, we take a holistic view and cover areas such as tax, asset protection, strategic finance structuring and risk mitigation. Once we’ve got a firm grasp of their plans, we then hold their hand through an implementation program – an eight-step process that we call the 360° Metropole System (see illustration below). This is a cycle that builds upon itself; when the eight steps have been worked through and completed, it presents an opportunity to begin again as is relevant for the individual.

“A lot of people try to save their way to financial independence, but that’s akin to beating your head against a brick wall”

KR:

One of the key advantages of property in comparison to other asset classes is that it can be borrowed against and leveraged. Of course, not all properties are created equal. At Metropole we believe less than 5% of the properties currently on the market are investment grade, and we use a strict approach to correct asset selection.

“One of the key advantages of property in comparison to other asset classes is that it can be borrowed against and leveraged”

YIP: What are some of the biggest risks investors can encounter when venturing into property? How can this be effectively managed?

KR:

We ensure our clients have robust finance strategies to buy themselves time – as well as properties – by having a financial ‘rainy day’ buffer to see them through the ups and downs of the property cycle.

We set up the correct ownership structures – ones that maximise tax effectiveness, protect assets and facilitate passing on a legacy. This is often through trust structures, but not all trusts are the same. Sophisticated investors use trusts with special clauses that give more protection and greater flexibility.

And we ensure our clients cover their risks with adequate insurance, both life and income protection, as many don’t realise one of their biggest assets is their future income-earning capacity.

Another important tool is having a proper will in place. When preparing a will, people tend to focus on who gets what, not how they will actually get it. But having a properly constructed will helps ensure wealth stays within the family, and builds in protections against situations like failed relationships or other breakdowns.

Of course, one of the biggest risks is not getting into property investment to protect your financial future.

ABOUT THE EXPERT

To find out how Metropole Wealth Advisory

can help you grow, preserve and distribute your wealth,

call Ken and the team on Ph: 1300 METROPOLE

or visit www.metropolewealthadvisory.com.au