THE PLAYERS: BARBARA AND JOHN SMITH

THE PLAYERS: BARBARA AND JOHN SMITH

AGE: 40

OCCUPATION: Market analysts

INCOME: $120,000pa net combined

PORTFOLIO VALUE: $0

LOANS: $0

EQUITY: None

CASH SAVINGS: $200,000

CURRENT LIVING ARRANGEMENT:

Renting for $460 per week

GOALS

- To stop renting and buy their own home in

their desired neighbourhood, Concord West, within five years.

- To purchase investment properties that help them achieve their home ownership goal

- To channel their $30,000 plus in annual savings towards property investments, and ultimately grow their wealth

- To build an investment property portfolio and own at least three to five properties within the next five years

- To be able to afford a dream vacation every year

The game plan

Barbara and her husband are in a strong position to get started in the property market. With $200,000 in savings in the bank and an annual cash surplus of $34,000, they have the means and ability to begin investing almost immediately, which is an ideal place to be when starting out.

I am not sure of their personal debt situation, which plays an important part in their overall wealth creation strategy. When working with my mentoring clients, one of the first things we do is work on their financial foundations – that

is, reducing their bad debt, highlighting any gaps in their budgeting, and creating a plan to pay off their debts as quickly as possible.

Barbara doesn’t discuss her family’s debt position, so I am unsure what their credit card debt and other consumer debts look like.

If they have any of these non-tax-deductible ‘bad debts’ weighing them down, my immediate advice is to channel any surplus income each month into paying this off – or even to dip into their savings to eliminate this debt and get started as property investors with a clean slate.

From this position, Barbara will be able to invest immediately and we can begin devising an investment strategy to guide her very first property investment decision.

Initial assessment

Before developing a property and finance strategy, as an investor you have to assess and review your own ‘property investor profile’. My philosophy in life is that ‘knowledge is power’, and the more you can arm yourself with information and education, the smarter and more successful your financial decisions will be.

For this reason, I guide my clients towards self-assessing their own situation and needs, now and in the future, so they can make smart investing decisions that take them closer towards their goals.

Barbara’s property investor profile is based on a number of factors, including:

• age

• desired retirement age

• personal income

• personal assets, eg shares, property, savings, term deposits

• wealth creation objectives

• risk appetite

• debt position

• long-term goals

• short-term and long-term goals

Based on these factors and the information Barbara has provided, we would consider Barbara to be a conservative investor. With time on her side, she is not in a huge rush to create instant equity or achieve fast growth, which means she doesn’t need to take aggressive action or embrace big risks.

We would advise Barbara to educate herself on her chosen property locations as much as possible, so that she becomes an expert on the area and thus feels comfortable investing in these locations. This will give her the confidence to take on calculated investment risks over the next 10 years in order to achieve her property and wealth creation goals. Let’s take a look at David’s current situation:

Financial analysis

Barbara has a savings balance of

$200,000, which is a strong financial position to be in when beginning investing in property. She and her husband also earn more than they spend each month, demonstrating that they live within their means and can stick to a budget and financial plan. These are essential qualities of successful investors, so I’m confident that Barbara will move forward from the best possible starting point.

Finance strategy assessment

Barbara hasn’t discussed her risk profile or appetite for risk, but from the information available to me I’m going to assume she is in a ‘low risk’ category. The fact that she is 40 years old and has amassed a sizeable savings balance, and that she lives within her means, demonstrates that she is responsible and conservative with her money, so I will move forward with the assumption that she desires a conservative investment strategy.

As a matter of good money management, I always advise my clients to have a financial buffer in place to support their investments. This is essentially a small cash reserve of at least $10,000–$20,000, which can be used to help deal with property emergencies, whether it’s a longer-than-anticipated vacancy period, or unexpected repairs that come with an eye-watering repair bill.

For Barbara and her husband, I would recommend keeping at least 20% of their savings – or $40,000 – set aside in a mortgage offset account. These funds will act as their financial buffer to help them deal with emergencies and ensure they don’t feel overexposed to financial risk.

I’ve long said that, as property investors, the actual bricks and mortar we buy are far less important than our access to finance – because without finance the deal is dead in the water.

Consequently, to build a high-performing property portfolio not only requires strong property selection but also demands a well-designed and personalised loan strategy to ensure you have the ability to get finance when you need it.

For Barbara’s finance strategy, I am taking into account:

• her conservative risk profile

• her borrowing power

• the tax-effectiveness of her loan structures

• her long-term property goals

Based on the information provided, here is our preliminary assessment:

• Barbara’s borrowing capacity at an 80% loan-to-value ratio (LVR) is approximately $400,000–$500,000, depending on her personal debt situation. APRA is prompting banks and lenders to clamp down on LVRs to investors above 80%, so we will calculate all of Barbara’s loans going forward at this conservative threshold, except for her principal place of residence (PPOR), as this would not be an investment loan.

• Barbara has indicated a minimum potential savings rate of just under $3,000 per month or $35,000 per annum. Taking a conservative approach (to allow for unexpected family expenses) we will set aside $5,000 of these savings to be deposited in the family savings account (to be converted to a mortgage offset account once property has been purchased).

• The remaining $30,000 annually can be used towards property purchasing endeavours, including property deposits, repairs and maintenance, and funding any potential negative gearing gaps.

These figures were used to determine the type and number of properties Barbara is likely to be able to acquire in the period we are planning for. We have also allowed for various strategies to improve cash flow throughout her property journey, including an increased salary income, and property improvements such as cosmetic renovations.

Using Real Wealth Australia’s research and taking a conservative line, we project that Barbara will be in position to comfortably purchase her PPOR and one investment property.

She will then be in a position to conservatively add another property to her portfolio every 24 months or so. This would see her portfolio grow to comprise seven to eight properties within 10 years.

The types of properties Barbara should target are those that fall within her budget and risk profile. This means we will avoid high-risk mining towns and regional resource locations, due to risk; we will also bypass inner-city investments due to the higher cost of entry, and off-the-plan CBD apartments due to many capital cities experiencing a glut of vacant apartments.

Instead, we will focus on building a balanced property portfolio that Barbara and her family can afford to maintain now and over the next 10 years, without impacting on her ongoing cash flow or her ability to service future loans and obtain further lending.

The property strategy

Given that Barbara has $200,000 in savings and sufficient cash flow to sustain a negatively geared investment, our first priority will be to secure a good-quality growth investment property.

It’s important for investors to do extreme due diligence when sourcing an investment property, which means researching every aspect of the market – from vacancy rates and tenancy demands, to local infrastructure projects, long-term capital growth rates and demographic trends and statistics. A wealth of information can be obtained from reputable sources such as the ABS, RP Data, Residex, and YourInvestmentPropertymag.com.au, among others.

However, in Barbara’s situation, we would recommend that she first purchases a PPOR. This will not only help her to reach her goal of home ownership, but it will also allow her to leverage her money in the smartest way possible to convert ‘bad debt’ into ‘good debt’. Best of all, the suburb Barbara wishes to live in, Concord West, is a strong growth suburb of Sydney. It has enjoyed strong historical growth of 68% over the last five years (around 10% annually), according to CoreLogic RP Data.

PROPERTY DETAILS

Location: Concord West

(or neighbouring suburb), Sydney

Purchase price: $650,000 at 90% LVR Lenders mortgage insurance (LMI): $13,000 (capitalised on the loan)

Stamp duty (NSW): $25,000

Other acquisition costs (inspections, conveyancing, etc.): $3,000

Deposit: $65,000

Total loan: $585,000 + $13,000 LMI = $598,000

Current loan interest rate: 4.5%

Mortgage repayments (interest only for five years): $515 per week

Body corporate fees: $1,500 per year

or $30 per week

Council rates and other ownership expenses: $3,000 per year or $60 per week

Total new weekly expenses: $605

Previous rental expenses: $460 per week Difference between rent and mortgage: $145 per week or $7,500 annually

TOTAL CASH OUTLAY: $81,000

Under this strategy, Barbara would purchase her own home as her first priority, at a cost of $81,000, leaving roughly $120,000 in her savings account.

Barbara should create an offset account and place all of her savings into this account, to offset her mortgage repayments. This will save her more than $5,000 per year in interest payments until she purchases her first investment property.

Because of the additional costs of home ownership when compared with renting, Barbara will need to spend an

extra $7,500 annually on her mortgage and other expenses. However, until she purchases any investment properties, the $5,000 in saved interest payments will help to balance this out. Fortunately, Barbara has the capacity to save $35,000 annually, so she can easily manage these extra expenses.

Just as importantly, when she does invest in her first property, the funds she withdraws from her offset account to facilitate the purchase will then become tax deductible. This is because she is effectively redrawing funds from her PPOR mortgage for investment purposes, so the interest payments on those redrawn funds are allowable as a tax deduction by the ATO.

In fact, I would also suggest that she splits her loan to ensure she can clearly demonstrate that the funds were used for investment purposes, making it easier to keep track of when lodging tax returns.

Top tip!

It’s best to treat property investing as a business and keep all monies and expenses separate from any personal expenses. This will make it easier for you at tax time when lodging your tax return, and for the ATO when it does its audit.

This is a smart and effective strategy that investors can embrace, in order to use their PPOR as a vehicle for savings and also to pay down their bad debt.

Let’s say, for instance, that Barbara withdraws $50,000 from her offset account to purchase an investment property. If that $50,000 was offsetting a mortgage at 4.5% ($2,250 annually), that repayment of $2,250 would then be legally tax deductible. Splitting the loan at this point helps to keep track of what is tax deductible and what is non-deductible at tax time.

For this reason, all of Barbara’s spare savings and her property buffer account should be placed into her mortgage offset account, with the funds available to be redrawn for the deposit on her next investment property. Note that, as with all matters of tax, you should consult your accountant for personalised advice.

First investment property purchase

Once Barbara’s PPOR purchase is out of the way, she can begin looking for her first investment purchase. From our preliminary research, we would suggest that a suburb such as Kedron, 8km from Brisbane’s CBD, could be a smart place for Barbara to search for her first investment property.

The median sale price of a two-bedroom unit in Kedron increased from $233,000 in 2006 to $450,000 in 2015. These growth rates are promising, and current price points fall within her purchasing price range.

Apartment prices have increased 6% over the last 12 months alone, according to data supplied by RealEstate.com.au, and rental demand is strong, with tenants paying between $300 and $400 per week, depending on the quality of the property.

The suburb has a large proportion of tenants – census figures show that 37.6% of people in the suburb rent – and more than one-third of the suburb is comprised of units, apartments and townhouses.

These are positive signs from an investment perspective, but they also make it necessary for landlords to ensure their property has some ‘wow’ factor compared to competing properties. This could include a new kitchen, a gorgeous view, renovated features or an extra bathroom.

For Barbara, we would suggest she purchases a two-bedroom apartment or townhouse in a small complex (less than 12 apartments), with scope to add value through light cosmetic renovations. Let’s assume she finds a property that suits the above requirements on the market for $359,000, and she successfully negotiates the price down to $340,000.

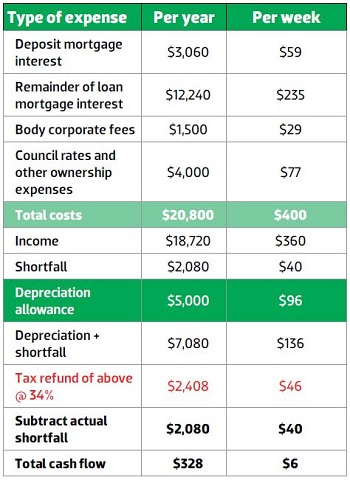

CASH FLOW ANALYSIS

Location: Kedron, Brisbane

Purchase price: $340,000 at 80% LVR

LMI: Not applicable as loan is above 80%

Stamp duty (Qld): $10,325

Other acquisition costs

(inspections, conveyancing, etc.): $3,000 Deposit: $68,000

Total loan: $272,000

Current loan interest rate: 4.5%

Interest-only repayments on deposit: $59 per week Interest-only repayments: $235 per week

Rental income: $360 per week

Depreciation allowance: $5,000 per year (approx.) Body corporate fees: $1,500 per year

Council rates and other ownership expenses:

$4,000 per year

TOTAL CASH OUTLAY: $81,325

Based on these figures, when tax and depreciation is accounted for and all expenses (including council rates and property management fees) are taken into consideration, the property should be virtually neutrally geared. Once Barbara accounts for routine repairs and maintenance, it will more than likely be negatively geared by around $50 per week.

Once this property settles, the next step for Barbara and her husband is to review their position and decide upon their next investment.

When deciding on any further property acquisitions, consideration will have to be given to balancing cash flow and managing risk. We would recommend further properties be purchased at 80% LVR in an effort to minimise risk. Further investments could be as follows (depending on Barbara’s independent research to quantify the suitability of each location and growth potential):

Year 1: 2015

● Purchase PPOR in Concord West.

● Spend $80,000 of $200,000 savings.

● Place remaining $120,000 into mortgage offset account.

Year 2: 2016

● Review growth in Concord property; based on projections, Concord West

should be up 10% to $715,000.

● New equity = $65,000.

● Purchase first investment property (and property asset number 2) in Kedron. Use $80,000 from offset account to fund this purchase..

● Add annual savings of $35,000 (including $5k personal emergency fund)

to mortgage offset account.

● Total offset balance = $75,000.

Year 3: 2017

● Review growth in portfolio. Based on projections, Concord West should be up 10% and Kedron 5%. New equity = around $90,000. Total equity = $155,000.

● No property purchase this year.

● Add annual savings of $35,000 to mortgage offset account.

● Total offset balance = $110,000.

Year 4: 2018

● Review growth in portfolio. Based on projections, Concord West should be up 10% and Kedron 5%. Total equity = $250,000.

● Review growth in portfolio and leverage equity to purchase property asset number 3.

This should be a high cash flow property to balance Barbara's portfolio.

● Add annual savings of $35,000 to mortgage offset account.

● Budget to spend around $300,000, using $75,000 from equity to fund purchase.

● Add annual savings of $35,000 to mortgage offset account.

● Total offset balance = $180,000.

Year 5: 2019

● Review growth in growing portfolio and leverage equity to purchase property asset number 4. This should be a high-growth, lower-income property that is neutral or lightly negatively geared.

● Budget to spend around $400,000, using $100,000 from equity to fund purchase.

● Add annual savings of $35,000 to mortgage offset account.

● Total offset balance = $180,000.

Year 6: 2020

● Review growth in portfolio and leverage equity to purchase property asset number 5. This should be a high cash flow property to balance her portfolio.

● Budget to spend around $450,000, using $120,000 from equity to fund purchase.

● Add annual savings of $35,000 to mortgage offset account.

● Positive and negative cash flows continue to balance each other out.

● Total offset balance = $205,000.

Year 7: 2021

● Review growth in portfolio and look for opportunities to add value via small cosmetic renovations, improvements and new amenities. Fund via equity.

● No property purchase this year.

● Add annual savings of $35,000 to mortgage offset account.

● Positive and negative cash flows continue to balance each other out.

● Total offset balance = $240,000.

Year 8: 2022

● Review growth in portfolio and leverage equity to purchase property asset number 6. This should be a high-growth, lower-income property that is neutral or lightly negatively geared.

● Budget to spend around $500,000, using $130,000 from equity to fund purchase.

● Add annual savings of $35,000 to mortgage offset account.

● Positive and negative cash flows continue to balance each other out.

● Total offset balance = $275,000.

Year 9: 2023

● Review growth in portfolio and leverage equity to purchase property asset number 7. This should be a high cash flow property to balance Barbara's portfolio.

● Budget to spend around $500,000, using $130,000 from equity to fund purchase.

● Add annual savings of $35,000 to mortgage offset account.

● Positive and negative cash flows continue to balance each other out.

● Total offset balance = $310,000.

Year 10: 2024

● Review growth in portfolio and look for opportunities to add value via small cosmetic renovations, improvements and new amenities. Fund via equity.

● No property purchase this year.

● Add annual savings of $35,000 to mortgage offset account.

● Positive and negative cash flows continue to balance each other out.

● Total offset balance = $345,000.

Year 11 and beyond 2025+:

● At this stage, Barbara will have a balanced, diverse portfolio of seven properties, including:

● a PPOR in her desired living location. This home now has a very small monthly mortgage, with $345,000 in offset

● three high cash flow properties

● three high-growth properties

● several older properties with renovation potential

● She can now review her entire portfolio and make plans to add value to existing assets, sell down some of the assets, or continue adding properties to the portfolio over the coming five years.

● Five years later, at age 55, Barbara can decide to develop and/or extensively renovate suitable properties within her portfolio to drive extra value and greater profits.

● She can make a plan for retirement to ensure maximum capital is released for future use, prior to exiting the workforce.

The key to success with Barbara’s game plan is ensuring that she acquires high-performing growth properties and positive cash flow assets, to make sure she has a balanced portfolio and several exit strategies to choose from as her portfolio grows and her wealth expands.

All of the calculations for property purchases have been made assuming an 80% LVR and 20% deposit, in line with her conservative strategy and currently lending policies. Should the rules change, allowing her to borrow up to 90% LVR, she might want to consider this to accelerate her investing goals.

Managing risks

Property investing is considered one of the safest and

most proven methods for growing wealth; however, there are inherent risks when using this strategy to get ahead financially. You can minimise these risks by:

Obtaining landlord insurance policies

These are essential to give you, as a landlord, peace of mind, because your investments are protected against risks such as a tenant damaging the property or taking off in the middle of the night following weeks of unpaid rent.

Working with experienced property managers

This is one of the simplest and most effective ways to leverage your investment, as the wrong property manager can quite literally cost you thousands in extended vacancies and mishandled repairs. Interview at least three property managers before deciding on the expert you’d like to add to your team.

Maintain your investment properties to a high standard

Your property doesn’t need to be fit for a queen, but it does need to be clean, tidy, modern and safe. As part of Barbara’s financial strategy, we have allowed a buffer of 25% of her $34,000 in annual savings (around $8,500), funds that were not counted towards her regular savings so they could instead go towards covering rental vacancies and property expenses. Where available and appropriate, these funds should be reinvested into maintenance, repairs and light renovations.

Protect your income

Without an income, you may not be able to keep up with your property investment responsibilities, so make sure you have adequate income protection insurance (and a life insurance policy) to sufficiently cover your myriad mortgage repayments.

Talk to your accountant

Tax structuring doesn’t sound sexy, but it can save you a bucket in overpaid taxes and unexpected deductions. Speak to your accountant at the beginning of your property journey to ensure you structure your assets the right way from the beginning.