The key thing for an investor to remember, at the very beginning at least, is that it’s not as important to know exactly how you are going to achieve your financial goal as it is to have faith that you will achieve it, and to expect success.

Over the past 20 years I have spoken to many hundreds of investors, and the most successful are often not the ones who started with the most but those who were the most determined.

Success is really more about your resourcefulness and your intentions than your resources.

Now that you’re in the right headspace, here are some strategies and ideas you can use to grow your portfolio with the aim of producing an annual income from the rent roll.

Use the magic of leverage

Leverage is the key to creating wealth. The more leverage you have, the more wealth you can create. It’s as simple as that.

Property is such a great wealth creation asset class because it gives you much more leverage than other asset classes. If you have a 10% deposit, you can borrow the other 90%. You can even borrow the 10% deposit plus buying costs if you have equity in existing property.

Your borrowing capacity, combined with your willingness to take on good debt, will be key to achieving your fi nancial goals. And if you purchase a property that is self-funding from day one, all of the equity growth is yours, without any of the holding costs.

So, what’s the catch?

Rather than a catch, let’s call it an obstacle to overcome. The reality is that if you are highly leveraged you are inevitably taking on signifi cant debt. During the acquisition stage of your strategy this is exactly as it should be. After negative gearing benefits are factored in, your portfolio is hopefully paying for itself, so it is not a burden on a day-to-day basis. And your properties are gradually increasing in value over time, as are the rents. All is looking good.

After a few years you may have acquired six or seven properties, and all your friends think you are a millionaire. However, the investor who owns this portfolio may think a little differently.

Why? Because they know that, although they receive a substantial rental income, they also have substantial expenses. Mortgages, council rates, body corporate fees, property management fees, insurances, maintenance, potential land tax liabilities, the list goes on.

Often, when all these expenses are accounted for, the net weekly cash flow, while positive, will not replace even a modest income. They struggle to understand how they will ever make good money out of their outwardly impressive property portfolio.

A typical investor scenario

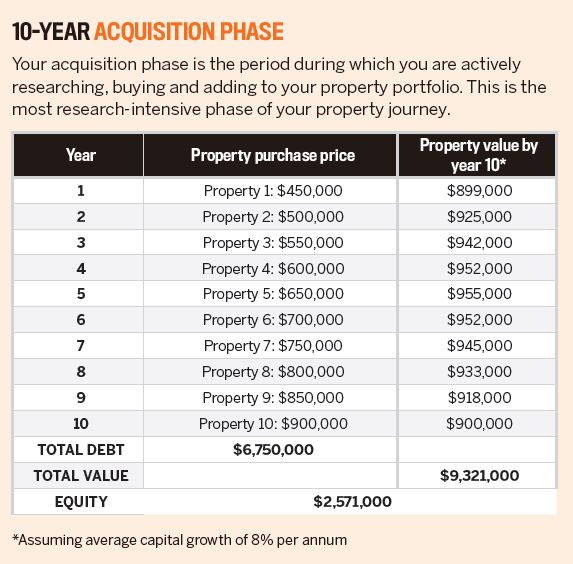

Let’s say a property investor acquired one property a year for 10 years. Their first property cost around $450,000; their last cost $900,000 (see ‘10-year acquisition phase’ table overleaf). Over the 10-year acquisition phase, they spent around $6.75m on property, which is worth over $9.3m.

If you have one property in Sydney and one in Brisbane, the chances are that at any one time at least one of them is in an upward growth cycle

This investor now owns 10 properties in a portfolio worth over $9m. As the investor borrowed 100% with each acquisition and has only made interest-only payments, their mortgage balance is sitting at just under $7m, giving them an increase in net wealth of approximately $2.5m. Remember, we are assuming that the portfolio has been self-funding from day one.

So this investor has manufactured wealth of $2.5m in 10 years, without using any of their own money. Pretty impressive. It certainly beats superannuation.

But hang on. Surely passive income is all about positive rental income, not equity? And therein lies the challenge.

This $9m portfolio, once all expenses have been deducted from the income, may show a positive cash flow of only $25,000 to $35,000 per year, if that. That is not even a modest passive income, particularly when viewed against the size of the asset base.

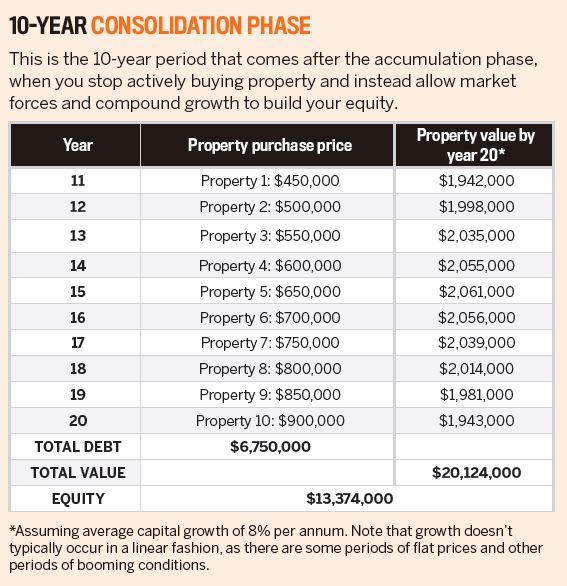

Properties tend to become more cash flow positive over time, so they could just hang on for years and years until the cash flow improves to the point where it can provide a reasonable income (see ‘10-year consolidation phase’ table at left). However, most investors would not be prepared to wait that long, so is there another way to speed things up?

Think ‘big picture’

It is important to acknowledge that there is more than one way to derive an income from your property assets. At the beginning of your property journey, you may not know exactly how you will end up earning an income from your investments. In fact, in the early days it is not even that important. All you need to know is that the larger your asset base, the greater your future passive income will be.

So, rather than waste time going into minute detail as to how you will use your assets in retirement, just focus on growing your asset base as large as possible in the least amount of time that you can.

In order to minimise risk it is important to have geographical spread, be acutely aware of property cycles, and balance your cash flows. All this needs to happen within the context of your risk profile. The longer you invest and the more experience you acquire, the more likely you are to appreciate the various options open to you and to be able to pick the one that is right for you when the time comes.

During the acquisition stage, your aim is to have a national perspective; to identify the known growth drivers in any given market; and to purchase in undervalued areas that have significant growth potential ahead.

Growth is not linear. Most doubling cycles comprise a growth phase of maybe three or so years, with the remaining years of the cycle being much more subdued. So you buy before the growth curve takes off, ride the wave, and have your properties revalued at the peak of the market. You then release this equity and reinvest in the next property market that is about to take off.

When choosing areas to invest in, it is always prudent to review them in the context of your risk profile. If you consider yourself a low-risk investor, you need to focus on the largest population bases with the most diverse economies.

Growth is not linear … So you buy before the growth curve takes off, ride the wave, and have your properties revalued at the peak

That means your core assets should be in Sydney, Melbourne and Brisbane. There are sometimes great opportunities in large regional centres like Geelong and the Sunshine Coast, but make sure you build up at least some exposure to each of the east coast capital cities. This could include your own home; it doesn’t necessarily have to be an investment property.

A few years ago, I was strongly recommending Sydney. Great new two-bedroom apartments could be purchased in the Parramatta area for around $350,000–$375,000. Hindsight tells us that this would have been a no-brainer. In the past few years these properties have doubled in value.

However, I don’t like to think about all the investors who potentially could have bought but did not have the vision. They missed out because they were not able to identify the known drivers of growth and predict what was going to happen to the Sydney market. Or, more to the point, they were not open to taking a leap of faith and allowing themselves to be guided by a property expert.

All of those investors who took my recommendation have been able to release large amounts of equity and continue to grow their portfolios. Interestingly, Sydney and Brisbane tend to be countercyclical. Sydney takes off first, and Brisbane follows sooner or later. This historic correlation can be tracked over the past few decades and is quite consistent.

If you have one property in Sydney and one in Brisbane, the chances are that at any one time at least one of them will be in an upward growth cycle. That is why many of my investors who have made good money in Sydney have released that equity and are putting it into the Brisbane market.

The need to think differently

To summarise, during the acquisition stage we rely on accessing manufactured equity to reinvest and build our portfolio.

But when we have reached the stage of going from acquisition to consolidation (ie when we stop buying), our properties will still continue to go up in value and we will still be creating substantial equity on a yearly basis, right? Absolutely.

In the previous scenario, let’s say our $9.3m portfolio was increasing in capital growth at a modest average annual rate of 5%. So, in the first year our net wealth increased by around $450,000.

If we are endeavouring to replace an earned income of, say, $150,000, we only have to access approximately one third of our total increase in net wealth for that given year in order to achieve this.

We obviously need borrowing capacity with the banks for this to happen, but if your starting loan-to-value ratio (LVR) is around 50%, which it should be after five or so years of consolidation (which is around 15 years after you bought your first property), this shouldn’t be a problem.

In order to minimise risk it is important to have geographical spread, be acutely aware of property cycles, and balance your cash flows

Every year, you are only accessing around one third of your total growth to live on, so every year your net wealth is still increasing and your LVR is dropping. This is a very elegant solution to a very real challenge!

The alternative

The only real alternative to the above is to sell down your appreciating, self-funding assets. For example, you sell five of your properties and use the funds, after costs, to pay off the remaining four outright. Then you live off the rental income from these assets, which no longer have a mortgage attached.

This will reduce your asset size by more than half, considerably diminishing your capacity to create more wealth in the future.

It will also mean that you will probably have to pay tax on a portion of your income. And let’s face it – your unencumbered assets will still attract expenses, even when they are mortgage-free.

In summary, if you invest in a number of well-located, well researched assets over a number of years, you are going to be much better off than if you do nothing. It is quite possible to replace earned income with passive income over a period of time if you are focused, strategic, and flexible in your approach.

Whether you decide to keep your asset base intact and live off equity drawdowns, or sell off a few to retire your debt, is up to your personal choice and individual circumstances. When the time comes, you will know what to do.

Ian Hosking Richards is an experienced property investor with a portfolio of over 50 properties.

He is the founder and director of Rocket Property Group.