27/09/2018

DEAR YIP MAGAZINE

My wife and I have been buying property over the years and are now looking to retire. I am 57 and will have a government PSS super pension at 60 of about $50,000 per annum.

My wife, Karen, is 55 and has approximately $100,000 in her super fund. We are trying to work out which properties to sell in order to generate some positive cash flow, while at the same time keeping some property for future gain.

Can you suggest a way forward based on our portfolio? We also want to sell our PPOR next year and buy another smaller house in Canberra for up to $850,000.

Regards,

Bob

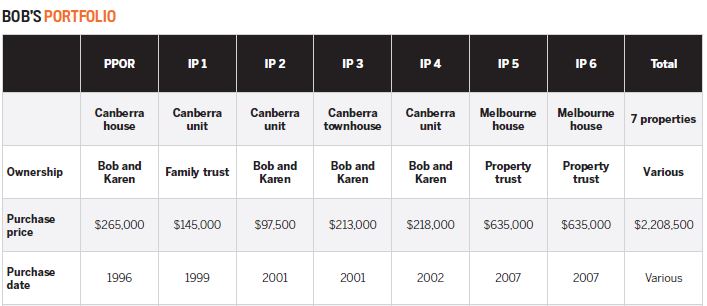

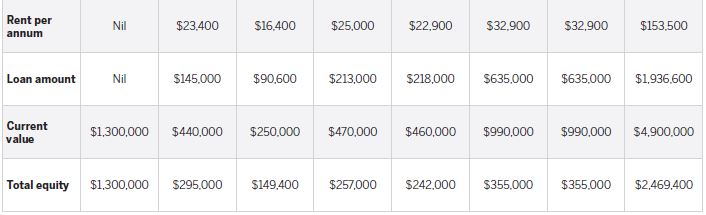

Decisions about how you organise your retirement involve many variables, and the trick is to cut through the number of ‘what if’ scenarios you are faced with. The following are my thoughts and the way I would approach retirement, and should not be construed as financial advice. In your case, let’s look at what you have:

1 Upon retiring you will receive a $50k pension. I assume Karen will draw 5% of her super every year, giving you a total of $55k income per annum for the foreseeable future.

2 We also know that you will receive a tax-free lump sum (approximately $375k) from downsizing your home.

"If you intend to have a more expensive lifestyle, then you need to have a more sophisticated plan"

3 Looking at your property portfolio [see overleaf], I will assume that it is cash flow neutral. In practice this is probably the case today, but when you retire your taxation will be lower and therefore your cash flow will worsen somewhat. You need to calculate what your portfolio cash flow will be once you retire. If it is cash flow negative, I would sell enough properties (and/or use the $375k downsizing proceeds) and lower your debt level to make your portfolio slightly cash flow positive before tax. In this way, you will not have to rely on taxation to make it work. If there are any tax benefits, these will be a bonus!

4 Given the above, you need to work out what your lifestyle is going to be when you retire. Are you the active type? What kind of hobbies do you have? Do you plan to travel extensively overseas? Will you buy a motorbike or take up skydiving? Or will you just look after your garden and read books? Depending on your plans, your budget can vary widely.

5 In other words, is $55k per year in annual income going to be enough? If the answer is yes, then you can keep your portfolio for now and, over time, dispose of one property at a time and indulge in some pleasurable activities (a cruise around the world perhaps, or renovating your home) with the proceeds of sales.

If you intend to have a more expensive lifestyle, then you will need to have a more sophisticated plan, as you’ll need to top up your $55k annual income.

6 Firstly, you need to decide how active you will be, and for how long, and then come up with a number in terms of the yearly income you would want. Also, as you grow older your lifestyle will reduce.

For example, if your hobby is to fly small planes, at what age will you stop flying? At some point, your budget will change from one that supports an active lifestyle to one that suits a more passive one, and you need to allow for this so you have more to spend when you are still active.

These are sometimes hard topics to face, but it pays to be realistic! To fund this plan you need to scale down your portfolio.

This is because the most effective way to access equity is to sell the asset. Overall, you have about $1.6m in equity across your portfolio, in addition to the $375k downsizing proceeds.

Once you have calculated how much you will need, you can work out the timing of your property portfolio disposal. You should seek advice from an accountant, as tax considerations will also drive the timing of selling your properties. Disposing of the portfolio over time will almost certainly be less taxing than selling everything at once. My other comments are:

• Whatever excess cash you have at any point in time can sit in the offset account of one of your remaining loans.

• You can also factor in a reverse mortgage on your home (after you have downsized) to release equity safely from an asset you will never sell.

In summary, you need to do a fair bit of brainstorming about what your life will look like after retirement, and then consult a good accountant and financial planner to set up an effective plan and timetable that will deliver your expectations. And please don’t tell me you want to leave something for the kids! Just enjoy your retirement. You worked hard for it!

is CEO of Multifocus Properties and Finance and

an experienced property investment specialist,

mortgage broker and author of Creating

Property Wealth in any Market