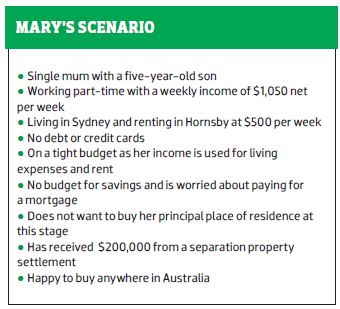

I have recently separated from my husband, and I have received part of the proceeds from the sale of our house. I have one child, Max (5), and I want to know what to do with this lump sum ($200,000) from the house. My weekly income is tight, so I don’t really have any money for a big mortgage on top of rent, food, and other expenses.

As far as my goal is concerned, I am open to possibilities. Ideally, I would like something income-producing in the short term (eg rent) but that might give me some capital gains further down the track. Ideally, I’d like to get the short-term cash flow coming in asap. I currently have no investment properties.

My weekly income is approx. $1,050 net, a combination of wages and other benefits. I have no debt. I am willing to invest anywhere in Australia. I am currently renting in Hornsby, NSW.

Step-by-step game plan

I’ll show Mary a game plan for getting started with different options. Mary can review and decide what options will suit her personal and financial circumstances best and help her achieve her goals with a low-risk strategy.

STEP 1. Figure out what Mary wants to get out of property investing

Before Mary can start thinking about property, she needs to do a bit of a selfanalysis to clarify her goals. Therefore she needs to take the following steps:

- Write down her short-term goals for the next one, three, five and 10 years. Mary may want more education, or more work hours, a new career, to travel, or to have a house to live in. Only Mary knows what will drive her towards achieving these goals.

- Make the goals more specific, with a timeframe. This will allow Mary to focus on exactly what she needs. For example, Mary may want only $100 a week extra now, but what income will she need from property in the future?

- Be clear about her goals and timeframes. This will give her more clarity on what path to take.

- Be clear about what level of risk she can tolerate. I would recommend a low-risk strategy.

- Does she want hands-on or hands-off investing? How much time does she want to put into a property, ie to research and find the property herself, or enlist a property buyer?

- Decide where she wants to invest.

- Decide what type of property to buy (house, townhouse, villa, apartment).

- Decide whether to buy a property outright with her $200,000 cash (buy cheaper entry-level property) ...

- Or decide whether to borrow money from the bank. (How much will the bank lend her?)

STEP 2. Get educated about the property market and take the following steps

- Learn the basics of investing by reading property magazines such as Your Investment Property and books with inspirational articles.

- Read about different investing strategies (eg buy and sell, buy and hold, renovate, develop, etc).

- Work out which strategy will suit her personal and financial circumstances best.

- Find out her borrowing capacity for current and future investing by speaking to a broker or bank. Knowing whether you qualify for a loan gives you a better starting point for setting goals.

- Learn about what makes a property cash flow positive so that her tight budget is not impacted.

- Learn about the purchase costs, holding and maintenance costs involved in investing in property.

- Be wary of doing too much research on the internet, paying for property courses, joining internet forums, joining property groups, and so on, as they may take a lot of time and money for little result, and can lead to confusion and procrastination.

- Balance website research with actual up-to-date, on-the-ground research reports.

- Find someone she can trust to guide her, with experience in the strategy she has chosen to follow.

STEP 3. Decide what investment option is best for her

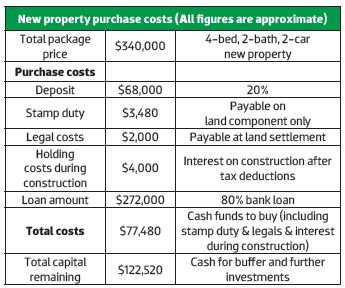

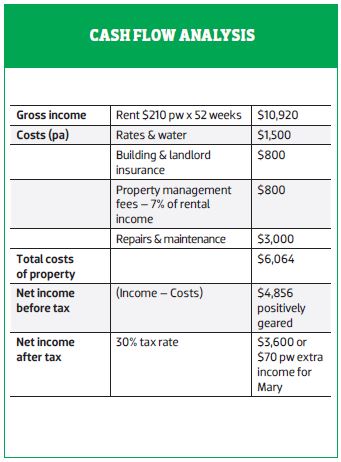

Option 1: Buy a property for extra income, using all cash of $200,000

1. Estimate the costs of buying

- Factor in an extra 5% of the purchase price for stamp duty, legal and other purchase costs.

- Mary needs $10,000 for costs from her $200,000 to buy a property.

- A property priced at about $190,000 would give a greater than 5.4% rental yield.

- This could achieve approximately $200 a week rental income for Mary.

- Finding a suitable low-value investment property in an area with good rental yields would be the next challenge.

- To meet Mary’s purchase price guidelines of $190,000, we give a property example below in an affordable regional area of NSW. Parkes in the Central West of NSW has affordable property with good rental yields of 5% plus, and has good demand for rentals as shown by the low vacancy rate, which is less than 1%.

2. Estimate the cash flow

When estimating the cash flow, Mary needs to take the following into account:

- Purchasing a property with cash does not exempt an investor from holding costs.

- Property management fees will amount to approximately 7% of the rent.

- Rates and water bills, landlord and building insurance, and repair and maintenance costs need to be factored in, as tradesmen’s costs are expensive.

Verdict

The $70 per week may be enough extra income to make a difference for Mary. However, even with capital gains on the property in the next few years, Mary could face costly repairs and upgrade requests from tenants, which could cost her money.

With a tight weekly budget and no ‘buffer’ of money left for these and other contingencies – for example, periods of no rent or unexpected repairs – Mary may be unwise to use her $200,000 for a single purchase in this way. She leaves herself exposed, with no back-up buffer of money, and may feel that the risk is not worth it.

Option 2: Borrow to invest

Before she can decide which specific strategy is best for her, Mary first has to establish how much she can afford to borrow.

Mary is currently living on a very tight budget, with 50% of her income taken up by rent, and living expenses taking the other 50%.

Borrowing money may be a desirable option, but what do banks look for when lending money?

- Reliable income with a good employment history

- Low debt levels

- Good savings record

- Serviceability to pay a loan (not spending all you earn on living expenses)

- Security property (could be the property you are buying)

- Deposit (could be cash in bank or equity from another property)

Mary has no debt, which is to her credit, and she has money for a deposit; however, she is spending all her earnings on rent and living. The bank looks for a demonstrated savings record, so to be in a stronger borrowing position Mary may need to increase her part-time income.

Mary may also need to speak to an independent mortgage broker to get a better understanding of her borrowing capacity.

Once she’s approved for a loan, Mary can then use the borrowed money to buy her first investment property.

- Mary uses some of her $200,000 to buy a property, and borrows the rest from the bank.

- The rent and the tax benefits will pay for the property along the way, and it can give Mary cash flow for income, as well as capital growth, if she buys a well-researched and well-located property in a growth area with good rental yields and good tenant demand.

- With cash left over Mary could plan to build a portfolio of properties over the next few years.

- As each property increases in value, she can leverage from the capital gains into another property as her borrowing capacity allows.

Option 3: Buy and renovate to get increased rent and potentia capital gain

Buying a property and then ‘doing it up’ to either get a higher rent or on-sell or revalue for the capital gain is a popular ‘getting started’ strategy. You manufacture capital gain by doing some work on the property.

- Mary has to consider whether she has the time as a single mum to devote to a renovation project.

- Mary may not have the practical skills to do a renovation herself and may need to ask for help from friends or pay for expensive tradesmen. With a tight budget this may be beyond her financial means.

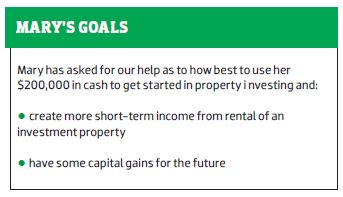

- This may restrict Mary to buying close to home in Sydney, where property prices for potential renovation properties may be out of her reach. For example, one-bedroom units in Hornsby cost around $450,000. Mary may need to borrow approximately $360,000, so affordability and borrowing capacity could be the issue if using this strategy.

- Mary would need to borrow from the bank and be able to absorb the holding costs of the mortgage while completing the renovation, which would impact on her tight budget.

- Buying and selling property is costly; there are entry fees such as stamp duty and legal costs to consider. The exit fees such as agent’s commissions and capital gains tax can be hefty.

The example renovation project in the table below shows that Mary could come out at a loss, even if she had the borrowing capacity to buy and the funds to do a renovation.

Verdict

Based on these assumptions and figures, that’s a lot of work for very little reward. If Mary sells, she will no longer have an income-producing asset and will need to start again and could be down $4,000. Any equity gained will have been used up in costs.

While this strategy has good appeal, there are reasons it may not suit Mary at this stage of getting started in property. It may suit Mary when she has more experience and is in a better financial position, with more time for hands-on investment.

Option 4: Buy a house and add a granny flat

Building a granny flat is another strategy, with the great potential reward of two incomes from one property. However, while the prospect of great cash flow and an increase in income may appeal to Mary, it is not as easy a strategy as at first glance.

- Mary would have to consider borrowing money to buy in the right area where granny flats are in demand.

- The purchase price of the house would need to be within Mary’s borrowing capacity.

- If Mary secures a property in an affordable area suitable for adding a granny flat, it may take time before she can borrow again to build a granny flat (costs from $80,000 to $120,000).

Verdict

If Mary is looking anywhere in Sydney for a suitable property to buy, it may be unaffordable for her in the current hot market.

Mary could end up in a catch-22 situation: it’s unaffordable to hold the property without the granny flat, and unaffordable to borrow more to build the granny flat to have the extra rental income.

Using this strategy in affordable regional areas of NSW or Queensland may not meet with the same success, as the demographics are different in regional cities and towns and granny flats may not have appeal or be in demand.

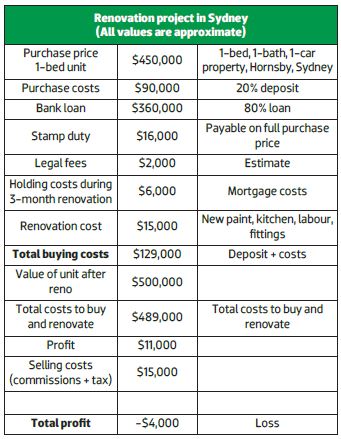

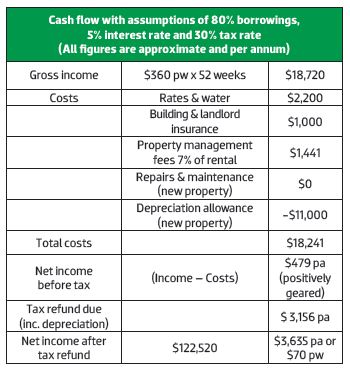

Option 5: Buy a new property with borrowing capacity of $300,000

- We will assume, based on the information available to us, that Mary has a borrowing capacity of $300,000 now, or will do at some time in the future. Mary, of course, will need to verify and clarify everything with her broker.

- With $300,000 borrowing capacity and $200,000 cash, Mary can fund a 20% deposit and costs of purchase, and have a large cash buffer left for contingencies, which will make her investment as low-risk as possible, allowing her to sleep at night.

- Mary needs to find a property that is affordable and will deliver capital gains over time and not cost her any money, but rather make money and be cash flow positive.

- Mary could buy a brand-new four-bedroom, twobathroom, double-garage house and land package in Ipswich, an outer area of Brisbane, for under $350,000.

- Ipswich is a population growth area of Brisbane that is currently reaping the benefits of huge infrastructure spending on motorways, roads, rail, schools, hospitals, shopping centres, to name a few. Registered land is in short supply, and the area has all the drivers for capital gains to occur over the next few years.

● New properties attract better tenants willing to pay better rents, with strong demand from young families.

● New estates are not always in untested areas; they are near major growth corridors and in established suburbs where prices are increasing due to demand.

● You could save on stamp duty on purchase price.

● Full house and land turnkey investment packages mean the property is ready for a tenant to move in after completion, with driveway, fencing, landscaping, clothesline, letterbox, TV aerial, window coverings, carpets and air conditioning all included.

● As I have purchased this type of property, I can testify to it being as hands-off, low-risk and stress-free as possible, even though it involves buying interstate.

Verdict

This strategy for buying a new property allows Mary to receive two incomes, one from the rent of $479 per annum positively geared, and the other income from the taxman of $3,156 per annum. This gives her a profit of $3,635 per annum or $70 per week. This is the same result as for the cheaper property in Parkes, bought with Mary’s $200,000.

● She has $122,520 left of her cash for more investing deposits.

● The property is in a predicted area for capital gains at the rising time in the property cycle.

● As her borrowing capacity increases, Mary can leverage into more property.

● Mary has a buffer for contingencies and can sleep at night.

● This is a hands-off investment that gives her cash flow as well as potential for capital gains.

● As this is a new property, she can more accurately predict her cash flow, with no worries over repairs and maintenance for many years.

● Significant savings on stamp duty give Mary a head start in value for her first property purchase.

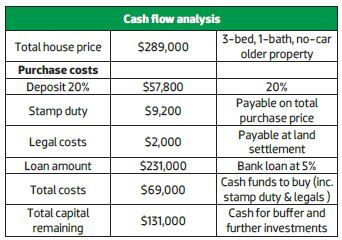

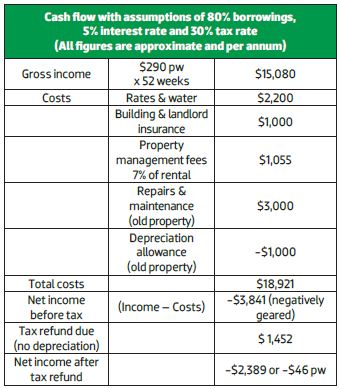

Option 6: Buy an OLDER PROPERTY in same area because it is cheaper to buy

This property is a three-bedroom home with one bathroom and no garage in the same area of Brisbane, near Ipswich. The purchase price is $289,000 with an estimated $290 per week rent (5.2% yield).

Verdict

This property, which is in the same growth area near Ipswich as the new property, delivers a negative outcome both before and after tax benefits.

- This property will cost Mary money.

- Mary may be able to afford to buy it, but on her tight budget she cannot afford to hold it.

- Older properties may seem better as they are cheaper, but newer properties represent better value and better cash flow.

- There are minimal depreciation benefits on the older property, which reduce the tax benefits for Mary.

- There is no second income from the taxman, and the cash flow is negative.

Long-term goal to build a property portfolio to replace income

Mary may conclude that buying property for short-term extra income is not as easy as it looks. There are costs and risks involved, unless you start from a solid financial platform. Rushing to buy a cheap first investment may have too many uncertainties for Mary and cost money to hold, instead of making money for her.

As a beginner investor who is also a single mum, Mary needs to keep her start into property investing as low-risk as possible. Some of the options presented are higher-risk and more hands-on, and some are lower-risk and more hands-off, allowing Mary to focus on her family and lifestyle.

I recommend she looks at property as a way to achieve her long-term goals of future financial security rather than quick extra income. Property is not a get-rich-quick scheme, or a way to get extra income quickly – it is more a way to create financial security for the future.

If Mary focuses on getting into a good financial position to borrow and buy her first investment property, then she will gain so much from that experience, and as she grows her portfolio she will be closer to her goal of replacing her income. An investor with $1m of net property assets could have a passive income of $50,000 a year at a 5% return rate. This is not unachievable for a typical investor over a period of time.

I wish Mary all the best for the future and hope that this game plan has given her some insight into the different strategies to get started in property investing.