Property prices are still rising in many places in Australia, but underneath this hyperactivity is a slowing economy that could soon manifest itself to the property market. So what will you do when the downturn occurs? Sam Saggers explains.

After enjoying healthy economic growth during the past couple of decades, Australia is now experiencing a slowdown. This is evidenced by below-par economic growth and rising unemployment that started over a year ago.

This slowdown in economic activity has prompted the RBA to slash the interest rate to a new low of 2.25%, and there are predictions of further rate cuts in the near future. While this is welcome news to property investors as it means cheaper interest rate payments, it is in fact a worrying sign that the economy is getting weaker.

But although you may not be able to entirely protect your property portfolio from a downturn, understanding how one could affect you will help you minimise its impact. This may also lead you to opportunity in adverse times.

Holding on to your nerve

People often lose faith in the property market when they have a property that is losing value because the market is soft. What they fail to understand is that losses only occur if you need to sell during a downturn.

On the surface, selling could be considered a fair and reasonable decision. However, selling when prices are soft will do nothing but ensure your losses.

At times of instability everybody is thinking the same way; they’re nervous and contemplating selling, which usually leads to a race to the bottom.

It’s important to remember that, in time, all markets in Australia have proven to finish one cycle and move on to the next at a higher rate. So if time is on your side, holding can prove very sensible.

So ask yourself: is selling a smart move or am I better off going for the long haul?

Let’s examine a real-life scenario – my own

Young and naive, I bought my first property. I was so happy. I truly thought it was as simple as buying a property and watching it go up in value in a few short years.

Looking back, I had money and wanted real estate, but I was clueless, which resulted in me buying a dud. I obtained the property after the growth cycle had hits its ceiling, and I failed to negotiate well. I got caught up in my own emotions. I fell in love with the property and just had to have it. As a result, I bought in a minor downturn.

The property didn’t go up in value right away. I really began to hate the property. I sold in a slowdown, fearing the worst, and took a $30,000 loss. I was disgruntled and devastated.

Thankfully, I went on to find my way in other deals and was able to get back on track, fast. Fifteen years since I bought that first property, it’s now worth double what I paid for it. My fear drove me to sell in a downturn rather than wait for better times and get a normal result as the market ebbed and flowed.

Mindset meltdowns are often based on fears of normal problems rather than abnormal issues. A downturn is a normal issue. The reality is we have had many downturns when looking back over the property cycles.

Developing a strong mindset

During a life of property investing, it’s fair to say you will run into a downturn at some point. Here are some ideas for how to have the right mindset, and my master plan for dealing with a downturn.

1. Beware of your mental state

Always control your mental state. Don’t let irrational thoughts enter your mind. Be calm and give yourself time to solve the issues at hand.

2. Develop awareness of the real problem

Be aware of the rationale of the problem. Learn to put it in context – marry it against the many other possible market forces. It will be a great learning curve.

3. Develop gratitude

Be glad that you have the opportunity to work through the challenge. It will make you a better and more successful investor.

Managing the downside

Your ability to ride the downturn depends on how you manage the risk. Here are some factors to consider when assessing risk:

Are you buying in a desirable area? Does that street carry risk? An example of risk in terms of location would be buying near a waste management centre or a high Housing Commission area.

Land

Is there much planned in the area? Is there a risk of overdevelopment? How will this impact your property?

Environment

Is there a risk of environmental impact? An example would be a bushfire-prone area, or property in a known flood zone.

Improvements

Is the property overcapitalised, or is it in keeping with the area? In this case it may be the best house in the worst street, which in a downturn will suffer heavy losses.

Values or reduced value

Is the property you’re buying today selling at a rock-bottom price? Or will the market fall further, meaning the property could actually be worthless soon?

Local economy impact

Is the area going to be impacted adversely, or could an external force be capable of devaluing the market? An example would be a one-mining-company mining town. The town could suffer huge losses in property values if the mine was shut down.

Maximising the resale potential

During a downturn, solid properties that appeal to both renters and homebuyers will rent and sell faster than the alternative. Therefore, it’s important that you stick with properties that appeal to both demographics to ride out the downturn.

Here are the basics of what people want:

- Location

- Absence of noise

- Security

- Sizeable bedrooms

- Temperature and lighting

- Cleanliness

- Everything works

Understanding property cycles

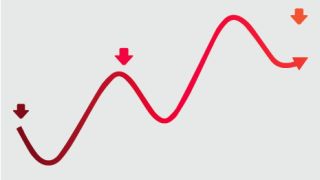

In an ideal world, you’d want property prices to just keep rising, but in reality, during a property cycle, which on average is 13 years, you will experience a series of swings.

It’s common to see around three highs and two low periods of economics during this time. In essence, the market acts like a snake that slithers.

A cycle does not do a consistent loop or circle like a property clock. Though property clocks are a good visual way of explaining a point in time, a rolling index is far more accurate and will show more highs and lows than a circular clock face. See example index below:

What you will need to know is that there are three market trends as the market slithers along.

Bottom of the market

The market is near the bottom of its low. This can stagnate for some time. As a property investor it can be a long wait period for recovery to come. It can be a great time to buy, but patience is a virtue.

The counter cycle

This is when there is weakness in the market. Yields are low, but great locations are available. This could be a period of trough in the market cycle, in which economic sales activity is slow. This often means there is the ability to buy at a discount or even to just get into a great neighbourhood that you couldn’t previously afford.

Provided care is taken to identify micro activity, this is a great way to buy in the best suburbs, but for those thinking of selling at a loss, don’t do it! It won’t be long before a rise will come. It may be a few years, but if the property is measured against the entire cycle, your property should go up normally as the cycle changes.

Rising market

This is where most capital gains occur; sales volumes are extremely high and days on the market are low.

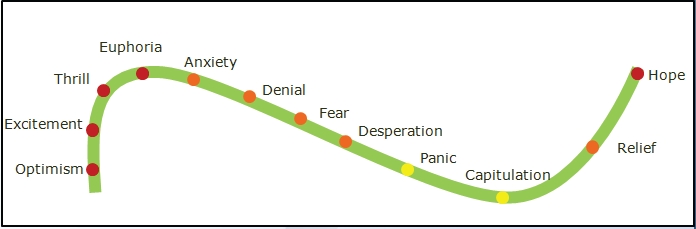

Understanding investor psychology

So why do people get so jumpy in a downturn? Understand that emotions play a huge part in the marketplace. The illustration below shows the psychology of the market, from Optimism to Capitulation to Relief and Hope. The market is a mixed bag of ups and downs.

If you truly start to understand the market and the psychology of it, you will know that after a period of turbulence or capitulation (Downturned Market) comes a period of relief (Recovery Market). Investors hate their properties in a downturn, but relief may not be too far away. I advise you let time in the market do its thing.

Dealing with market swings

An important factor in a market’s decline is the banks’ attitudes towards the area.

During good times, banks will adopt a high lending policy, often lending 90% or more in the area, subject to mortgage insurance.

When a market softens, lending is the first thing to change. For example, you may now have a property in an area where lending has dropped to 80–70%. This means that potential buyers will now need to have a sizeable deposit to buy your property. Most buyers don’t have such deposits. The downside is that it effectively freezes your property from a larger market audience.

When a market declines, recycling equity can be problematic, so it’s best that you are not cross-securitised if you have multiple properties. You don’t want one bank to control all your loans, redraws and money.

How cross-securitising works in real life

Let’s say you have a property in a small town, and it has dropped in value by $50,000 as the market has declined. Fortunately, you have another property in a fast-moving growth market that’s gone up by $50,000. If both properties are with the same lender or funder, your net position is $0 equity.

Now let’s assume they were with different funders or banks. You would be able to use the $50,000 equity gain on your better-performing property, while ignoring your paper loss on your non-performing property and waiting for that property to recover. It means you are not stuck.

At the end of the day, the only assets you can manage are cash or redraw in your equity. Not crossing your loans is so important when assessing future risk.

Don’t use just one bank if you want to sell your portfolio one day. The solution is to use a wide array of banks and funders.

Another approach to managing risk is to have a buffer of reserve money. I like people to keep a good chunk of cash liquid to pay for any unexpected bumps along the way. And there are always bumps. Remember: banks will look at your risk profile by considering the following:

- Age

- Proof of savings

- Stability of employment

- Other securities

- Net worth

- Employed or self-employed

- Rental income

Conclusion

Being an investor of any kind carries risk. I like to think that property is lower-risk; however, there has been a huge degree of economic property bliss of late. Investors need to have better fiscal consideration and use vigilant planning and forecasting to anticipate the challenges ahead. You need to plan not only to endure a downturn, but also to triumph.

Sam Saggers is an active property investor and the CEO of Positive Real Estate Group.