"Dear Your Investment Property,

I have been a subscriber to 'Your Investment Property' since 2009 and have learnt so much from it.

Thank you and please keep up the good work.

I would like to ask some questions regarding my investment strategy and future path.

My name is Rockney Wong. I’m 31 years old and currently working full-time as a mechanical engineer in Brisbane. I purchased my first property in 2009 in Melbourne as a PPOR when I was working there. Since then I have accumulated more properties and have built up a small portfolio as listed below:

- 3-bed house – Mulgrave, Vic (2009)

- 2-bed house – Fitzgibbon, Qld (2011)

- 3-bed house – Kuraby, Qld (2013)

- 2-bed house – The Range, Qld (2014)

- 3 x 1-bed units – East Toowoomba, Qld (2015)

- 1-bed unit – Hamilton, Qld (under construction – to be completed in 2016)

I feel somewhat at a crossroads at the moment. While I understand the importance of cash flow, and that I can continue to finance and purchase a few more properties if desired, I don't know how to move to the next step towards my goal of becoming a property developer and investor.

I’m wondering if you, or your panel of experts, can help or at least point me in the right direction.

Regards,

Rockney Wong"

.JPG)

To help the team at Your Investment Property with this task, we enlisted the help of our expert, Matthew Hughes, senior property strategist at Momentum Wealth, to come up with a practical and actionable plan.

The game plan

Rockney finds himself in a similar situation to a large number of investors – he has achieved a reasonable amount of success to date; however, he has hit a crossroads and is unsure of what to do next in order to continue his growth while

protecting what he has built.

Rockney has some clear retirement goals and has acknowledged he has a “reasonable” knowledge of property investing but could certainly “learn more”. He also has a plan in mind, though it’s not documented or comprehensive enough to give him full confidence in his direction.

Rockney is currently 31 years old and would like to retire before the age of 50 with more than $2m in net investment equity. He has already acquired a portfolio of seven properties, although at first glance we find that some of the assets he has acquired are not ideal, based on his desired outcomes. Others, like the triplex with development potential purchased in East Toowoomba, are certainly aligned with his goals.

Rockney has a good income and low living expenses; however, he has very little usable equity, with the portfolio very close to an overall LVR of 90%. Keen to continue his growth, Rockney has engaged an expert team to review his current holdings and finance structure to identify the optimal path moving forward.

Initial assessment

Matthew and the team of acquisition and finance specialists at Momentum Wealth conducted a thorough review of Rockney’s history and current situation, as well as gaining a detailed understanding of his future lifestyle and financial goals.

Before developing a property and finance strategy, the team had to assess Rockney’s property investor profile. This profile is based on a number of factors, including his:

- Current age

- Desired retirement age

- Personal income

- Wealth objectives through property

- Willingness to take on debt

- Long-term goals, such as how many properties he would like to acquire

- Preferred investment strategy, such as the types of properties he wants to acquire (cash flow versus growth)

Based on these factors, Rockney is considered to be a moderately aggressive investor who understands the need to

take on calculated, yet diminishing, investment risk over the next five to 10 years in order to achieve his goals.

Portfolio assessment

One of the first things our team noticed was that Rockney has been targeting properties that produce sound rental returns

(most are neutrally geared, or close to it). But sometimes neutral or positive cash flow properties come at the expense of capital growth – as is the case with two of Rockney’s properties detailed below.

Recommended action

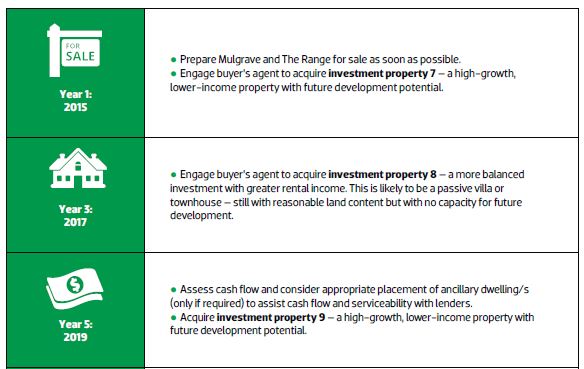

Based on Rockney’s goals and our expectation of lower-than-market future growth, our team’s recommendation is to prepare both of the above properties for sale as soon as possible. The sale of these two assets will allow us to reposition the proceeds into a higher-performing ‘growth’ property immediately – likely something with future development potential.

Rockney’s tax accountant should be engaged immediately to ensure that the timing of the sales and all potential tax implications are considered. Combined sales proceeds are expected to be $71,520, plus Rockey’s $50,000 current savings, giving him a total of $121,520 on hand (before any capital gains tax).

Finance strategy assessment

To build a large, high-performing property portfolio requires astute property selection. It also requires a well-designed loan strategy to ensure you have the ability to get the right finance when you need to make your next purchase.

If you’re unable to access finance when you need to, you won’t be able to buy any property, which could set you back and potentially cost you hundreds of thousands in lost capital growth.

Rarely is one lender likely to be the best solution for you to build a large portfolio. Lending policies change, and with a diverse range of loan structures available, using the same lender for multiple property purchases may actually inhibit your ability to achieve your goals. Your credit advisor or mortgage broker should provide you with a loan strategy document detailing your present circumstances and a recommended loan strategy. This loan strategy is reviewed before you are ready to make your next purchase.

In Rockney’s case, he has a gross income of just over $97,000 per annum. His living expenses are approximately $14,000 per annum – very low and unlikely to change in the foreseeable future, given he is still living in his family home.

Based on the information provided, our preliminary assessment suggests that Rockney’s borrowing capacity at a 90% loan-to-value ratio (LVR) is approximately $550,000. This has been assessed on the assumed purchase of a high-growth, lower-income asset (4% gross yield has been used in our calculations, and a 7% interest rate has been assumed for all projections).

Rockney has indicated a minimum potential savings rate of $3,000 per month or $36,000 per annum. This figure was used to determine the type and number of properties he is likely to be able to acquire in the period we are planning for. We have also allowed for the potential employment of a number of different cash flow improving strategies throughout Rockney’s acquisition path (ancillary dwellings and cosmetic renovations, among others).

Using Momentum Wealth proprietary analysis tools and various reasonable assumptions, we project that Rockney will be in a position to purchase, initially, post-sale of the aforementioned properties, and again at Years 3, 5, 7, 9 and 10. This would see his portfolio grow to comprise 12 total investment properties in 10 years’ time.

The types of properties we should target will depend on Rockney’s ongoing cash flow and ability to service future loans and obtain further lending.

Based on an initial purchase of an older property on a larger parcel of land in an area with future development potential in Perth, WA, the numbers are as follows:

Given Rockney has in excess of $120,000 at this stage, he is able to proceed with the purchase as outlined above, while also meeting our minimum cash buffer recommendation of $27,830 (assessed based on Rockney’s net personal income, the rental income from his portfolio, and his risk profile).

Only lenders that accept 90% LVR plus full lenders mortgage insurance (LMI) should be considered for this next purchase. We wouldn’t look to refinance any of Rockney’s existing portfolio at this stage, as none are cross securitised and he would be subject to additional LMI charges with no clear benefit. Once we see some additional growth in some of his properties, we may look to refinance some or all in order to diversify and build further relationships across a number of different lenders.

The property strategy

Rockney has achieved a reasonable amount of success in a short period, and our proposed changes have put him on a path to overachieving his financial goals, even based on modest projected growth rates.

Any further acquisitions will need to be more focused on capital growth, with strong consideration given to balancing Rockney’s cash flow and managing his risk. Although his next purchase would be at a 90% LVR, we would recommend future purchases be capped at 80%.

While Rockney is keen to become a developer at some stage soon, we have delayed this option in favour of the acquisition of more land in the next 10 years.

Affordable development opportunities that are relatively close to capital cities are in finite supply, so Rockney’s goal should be to obtain as many of these assets as possible in the short-to-medium term.

His development ambitions can be satisfied beyond his projected 10-year acquisition plan detailed above. By this time, the properties he holds and the land he intends to develop should have gone up in value, considerably improving his development margins.

Consideration will be given at the appropriate time as to whether Rockney should develop and sell all dwellings for profit, or retain some for ongoing passive income. A current market comparison for that time will have to be conducted to compare these options with other opportunities he will have available to him.

The key to Rockney’s plan is to acquire high-performing growth properties in the early stages (some of which suit the development profile we are seeking) in order to ensure that we have multiple, sound options to choose from in the later stages.

Managing risks

While property traditionally generates a solid and relatively consistent and stable income stream, there will be periods when there are vacancies. Furthermore, there may be times when repairs or maintenance are required in order to ensure a property remains attractive to tenants.

It is also essential to maintain a property in line with legal standards. Rockney should set aside a sum of money specifically for property contingencies. Depending on the age and condition of a property, the current rental market status, and the term left on the lease, this amount should be equivalent to anywhere from two to four months of the expected rent for residential properties (more for commercial properties if any are acquired).

Having this cash buffer will enable Rockney to keep his property well maintained and deal with any unexpected maintenance issues or vacancies. While we have advised a current figure above, this figure must increase commensurately with the size of his portfolio over time. Other considerations should also include:

a) Income protection, life and other related insurances

When building a property portfolio, one of your most important assets is the ability to earn an income. Without an income, you may not be able to pay for the ongoing upkeep of your property investments. Similarly, if you were to pass away, you would need to consider how your family would be able to continue holding the investment properties. Rockney needs to make sure he has insurance to sufficiently cover repayment of his mortgages if the worst case should happen.

b) Tax structuring

As a portfolio grows, land tax may become an issue to consider when investing. We recommend Rockney speaks to his accountant before any property purchases are made. Then once he has purchased a property, we need to make sure he maximises the tax benefits he is entitled to. Rockney’s property management team should arrange depreciation reports for his properties to ensure that his accountant has the information they need to claim the most in depreciation benefits.

If your properties are negatively geared, you should consider whether you want to receive negative gearing benefits at the end of the tax year or whether you would prefer to receive a tax payment reduction during the year. If Rockney would prefer to pay less tax during the year rather than receiving a refund at year end, his accountant can arrange for a PAYG variation.

c) Estate planning

While we never like to talk about it, it’s important to plan for your family in the event that you pass away early. Estate planning involves the preparation of a will and choosing executors, powers of attorney (while still living) and other factors that may be relevant to your circumstances should you pass away.

d) Portfolio reviews

Property investing is not a ‘set and forget’ wealthbuilding strategy. It’s important to regularly review your current portfolio to ensure your properties are still the right assets for your circumstances and to assess when you’re ready to make the next acquisition.

Disclaimer

The advice contained in this article is for general information only and should not be taken as financial advice. Please make sure to speak to a qualified professional person before making any investment decision.

The expert: Matthew Hughes

Matthew Hughes is a senior property strategist at Momentum Wealth. He bought his first property at the age of 19 and has more than 16 years’ experience in a consulting and managerial capacity. He holds a Certificate IV in property services (real estate) and a diploma in finance and mortgage broking management.

(2).JPG)

.JPG)

.JPG)

.JPG)

(1).JPG)

.JPG)

.JPG)

.JPG)