03/12/2018

When you’re in your 30s, you’re at the age of the three m’s: marriage, mortgage and munchkins. While it’s an exciting time, it’s also a very busy and frantic life stage, which can make the prospect of investing in property seem like just another thing you need to add to your ever-growing to-do list.

As you progress from your 30s into your 40s, some of life’s biggest challenges can rear up: raising kids, changing careers, relationship separation, divorce, adult children moving away, and even illness or death of family members.

Having an investment property can help provide access to additional funds when they’re needed most; however, it’s important to get the ‘where’ part of the equation right.

“I often speak to people in this age group after they have fallen for the latest shiny marketing, whether it’s a mining town investment, investing in the US, an off-the-plan inner-city apartment, an NRAS purchase, or the like,” property educator and mortgage broker Jane Slack-Smith says.

“The good news is that most pick themselves up and realise that next time they need to do it better. This age group have the borrowing capacity, and if they use investorsavvy buying techniques their homes should also have equity, so they can buy where they want.”

“If they use investor-savvy buying techniques their homes should also have equity, so they can buy where they want”

The biggest mistake they tend to make is buying where they ‘know’, ie just around the corner.

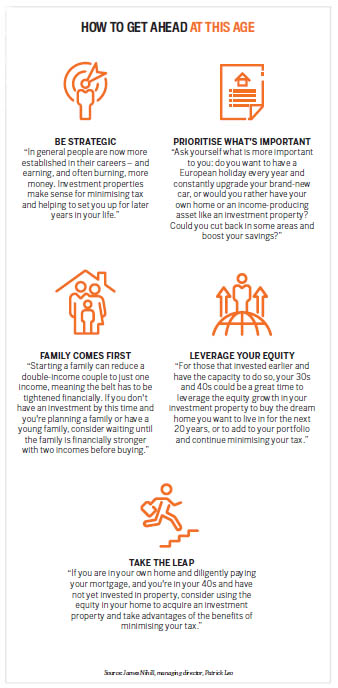

“This demographic needs to look beyond their local patch and be agnostic geographically, by looking at the locations that will get them the best return – and this might just be out of state. It is not too late for this age group to invest; they just need to start with a clear goal and time frame to achieve the goal, and a planned strategy to get there,” Slack-Smith says.

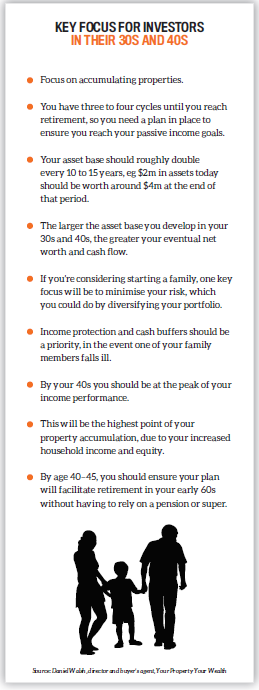

To do this, you need to set clear, achievable investment goals that are low-risk, and have a retirement plan that complements your property investment.

The magic question

For most people in their 30s and 40s, this is a busy time when they may be thinking about settling down and buying a home. As a result, their first big investment is often more happenstance than strategy.

This can set your investing career off on the wrong foot, says Drew Evans, director at Caifu Property, who suggests that with every property you buy, you should start by asking the question: will this investment increase or decrease my capacity to borrow?

“If you buy anything that locks in your deposit funds or doesn’t increase your cash flow, it’s getting you trapped, while every deal that generates equity and increases your cash flow is freeing you,” Evans says.

“This is exactly what we mean when we tell our clients to buy properties that set you up, they don’t set you back. For instance, if your borrowing capacity or buying power are going to go backwards because of a deal, then it’s setting you back – which means you’re on your way to getting stuck, and you need to be looking at different investments.”

In your late 30s through to early 40s, many people are reaching their peak earning capacity, and as a result their peak borrowing capacity as well. To use this in the most efficient way possible and generate maximum equity, you need to carefully structure your portfolio, which is where strategic and personalised property advice is key.

“In this phase you have the money to generate equity through small developments, where you get to take control of the outcome. But a false step now into a slow, underperforming property could blow out your retirement by over a decade and lose this opportunity. Done well, this is the time to set yourself up for an additional $2m to enjoy in your 60s and beyond,” Evans says.

It’s crucial at this point that you invest based on clear facts and figures, not on your intuition and ideas, he adds.

“If your plan involves any kind of projection like, ‘In seven years it’ll be worth…’, then that’s not a plan, it’s a hope – and if you’re wrong you could stand to lose nearly a decade on an incorrect guess. Do you want to spend the best part of a decade in a property to find out if you were right?” Evans says.

“You have probably learnt by now that the markets are too slow and unreliable to waste this decade hoping a property performs. These are potentially your best years as an investor, so don’t blow them sitting on your hands and waiting. By your 40s, your portfolio should be self-sustaining and accelerating in value.”

“One of the biggest surprises I have when talking to people in their 30s and 40s is their understanding of risk,” Slack-Smith says.

“If your borrowing capacity or buying power are going to go backwards because of a deal, then it’s setting you back”

“For instance, they would rather use their savings than equity in their home, chewing up their buffer of cash that they might need in case of emergencies. They would prefer principal and interest repayments rather than paying interest only and saving $1,000 a year in interest repayments instead of concentrating instead on paying their home off first.

“They would rather put in a 20% deposit, and wait five years or longer to save for another deposit, than pay $15,000, for instance, in mortgage insurance, and then they miss out on having an investment property that could have made them another $50,000 in the same time. Risk is about perception, and this age group needs to work with someone who can walk them through these options.”

Award-winning investor: Keshav Jha

Your Investment Property’s 2016 Investor of the Year winner Keshav Jha has built an impressive portfolio of properties and enjoyed enormous success over the years. Now aged 42, Keshav says his investment decisions are “very different today in my 40s, compared to when I was younger”.

“Firstly, my investment strategies now include taking adequate steps to lower my investment risks,” he explains.

“I carefully implement low-risk strategies, such as buying investment properties in good locations with amenities, schools, shopping centres, access to freeways, and within 40km of the CBD. Furthermore, I buy into suburbs with reasonable to high demand for rental properties, where there is less than 2% vacancy rate, with at least 7% average annual capital growth spread across a 10- to 20-year time frame. And I stay away from high-volatility areas, including mining towns.”

Keshav says this low-risk strategy will allow him to invest without dramatically impacting his finances now, while building wealth for the future.

“It I invest well now, I can expect to sell few properties, pay off my property debts when I am nearing retirement at the age of 65, and draw a passive rental income to support my retirement from my remaining unencumbered investment properties,” he says. Here, he explains the top three issues he believes investors in their 30s and 40s need to consider:

- Exit strategy: “You need to evaluate the impact of retirement on your property portfolio so there are no surprises – and so you can optimise your property income and minimise taxes when you retire.”

- Consolidation: “Develop a clear portfolio consolidation strategy. For example, if you have purchased three investment properties in your 40s, one consolidation strategy could be to hold all properties for the next 20 years, then sell one property and use the after-tax profits to pay off the other two mortgages. You can then use the rental income generated by the remaining two debt-free properties to support your retirement and lifestyle.”

- Insurance: “Have adequate life insurance to cover all your property debt, in case something unforeseen happens to you. Also, having landlord insurance is a must to compensate you for any damage caused to your rental property, or for rental loss at times when tenants default on their rent payments.”

Keshav Jha says

it’s crucial to consider

your retirement goals

Positive cash flow strategy success: MJ Anthony

Positive cash flow strategy success: MJ Anthony

MJ Anthony kicked off his investment journey at the age of 24, and since then he’s amassed an impressive portfolio. The 38-year-old IT engineer, who lives in Bella Vista in NSW, says he’s changed strategies over time to make the most of market conditions.

“My original flawed strategy was to buy capital growth properties, never pay the loans off, and redraw on them to buy more. But capital growth is lumpy, and if you don’t buy in the right areas it is a completely unsustainable strategy,” he says.

“Also, finance overrides any property strategy, so if the banks aren’t willing to lend on the increased equity, it completely changes your strategy.”

He’s since shifted to investing in high-yielding cash flow positive properties in regional NSW, where the cost to get in is low. He aims to buy below market value, and below or around the median price, and only buys in good streets where tenants want to live with minimal problems.

“I always keep my properties well maintained, to reduce headaches and surprise expenses in the future. I have systems in place for all aspects of the property so owning multiple properties doesn’t become a chore – like alerts to let me know when landlord insurance is due, when leases are up for renewal, or when prospective value-adding can be done in the future.”

His overall goal is to pay down each property loan one at a time so he can eventually live off the cash flow.

“Paying off one loan [at a time] via my salary is too slow – it’s easier to have multiple properties generating a surplus, which is all put towards a single loan. There are so many strategies out there, and they all have merits, so the idea is to find the strategy that works for you. This works for me – I only wish I had started my current strategy when I was 24, rather than at 34!” he says.

“I’m grinding away now to build my property portfolio as quickly as possible, safely – so that by the time I hit my 40s I don’t need to rely on a salary. At this age I have a lot more experience than I did in my 20s, and there’s so much more information online now than there was when I started out in the 2000s.”

MJ aims to pay off

one mortgage at a time

using positive cash flow

Related stories:

How to invest in property at any age

Investing in your teens or 20s

Investing in your 50s and beyond