Questions about where to buy, what type of property is best, what is an appropriate purchase price, and will the bank lend me the money will rage through the mind of every investor.

A major question you’ll need to answer is whether you are in a position to borrow the required funds from a bank. Understanding the bank’s lending criteria is critical to your success. As a mortgage broker I am frequently asked to help people understand the banks’ lending criteria. This is key to your success in obtaining the right loan.

Banks have four major criteria they consider when assessing your investment property loan application.

Reliability – Are you a reliable, low-risk applicant?

Serviceability – Can you repay the loan over the next 30 years?

Deposit funds – How risky are your deposit funds?

Suitable security – Is the investment property you wish to purchase acceptable to the bank?

Reliability

Lenders are interested in how reliable you are. They want to know – do you pay your bills on time? Is your employment and residential history stable? Lenders are interested in this as they need to be confident that you are likely to continue to earn an income, make repayments and be contactable after they lend you hundreds of thousands of dollars. To check this, banks will collect information from you about your residential and employment history and search your credit history for defaults, non-payments and bankruptcies. If you have any issues you will need to resolve them before applying for a loan.

Serviceability

A major point of interest for banks is your ability to ‘service’ the loan. Essentially, can you afford to repay the loan?

Low-income earners will get a boost to their income as investors’ income will come from two sources: their personal income and their new rental income. The tricky thing here is that not all banks accept 100% of all types of income. They may discount some types of income such as overtime and allowances. Rental income is certainly discounted by all banks by 75–80%. PAYG applicants prove their income by providing their current payslips. Self-employed applicants will need to supply their personal and business income tax returns and financials to prove their income. It is best to have these documents up to date to ensure a smooth income assessment process.

A living expenses budget is also vitally important for all prospective investors. Banks assess your total income to ensure it is enough to cover all of your living expenses, such as rent, food, utility bills, childcare, child maintenance, entertainment, existing home loans, car leases, personal loans and credit cards, as well as your new investment property loan repayments. Making a realistic budget of your living expenses is essential as lenders will ask you for this as part of the application process.

Once it is established that you can repay the loan at current interest rates your banks will also consider whether you can service the loan repayments when interest rates are 2.5–3.5% higher. This is done to ensure you will be able to continue making repayments when interest rates rise – because one day they will!

Deposit funds

The big question, particularly for low-income earners, is ‘do I have enough deposit?’ Deposit funds can come from cash savings, gifted funds, equity in another property you own, or even from the sale of other assets such as shares.

What we all need to know is whether the deposit funds we have available make the risk associated with the loan an acceptable risk to our lender. This question is answered by calculating the loan-to-value ratio (LVR).

In the simplest terms, the LVR is calculated by first subtracting your deposit funds from the total purchase cost of the investment property to determine the required loan. This loan amount is then divided by the value of the property to calculate the LVR. Lower LVRs equate to low-risk deposit funds and low-risk loans. An LVR of 80% or lower is considered low-risk and therefor your deposit is considered good. If your LVR is higher than 80% your deposit is considered to be risky. A high LVR does not mean the bank will not approve your loan, but you may incur an additional fee of several thousand dollars for lenders mortgage insurance.

Low-income earners may have a low deposit but should not be discouraged. Seek assistance to determine which purchase price is best for your deposit

funds and to ensure you are comfortable with the situation.

If you find your deposit is too low for the investment property you are considering, then you have the choice of either spending time improving your deposit funds or finding a less expensive investment property. The best time to sort this out is before you make an offer on a property.

Suitable security

Banks will check that your proposed investment property is suitable security for the loan before they make a formal loan offer. Some properties that may not be suitable security include properties of less than 40sqm, display homes, properties in one-industry towns, student accommodation, and retirement village accommodation, to name a few. Some banks even have blacklisted suburbs.

Seeking advice about acceptable investment properties will assist you in purchasing the right investment property. It is essential to check this

with your bank before exchanging contracts unconditionally, as otherwise you may end up with a contract to purchase a property and no loan.

How much can I borrow on my low income?

Now that we know the major areas of concern for banks we can start to actually see where we fit in and how much we can borrow. Low-income earners may feel challenged by all of this but should be encouraged to seek advice from trustworthy professionals who can support you through the maze.

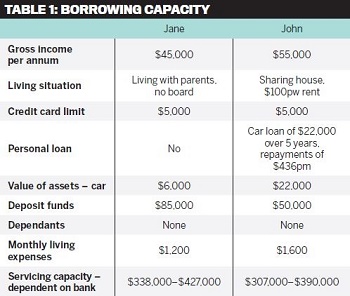

You may be pleasantly surprised to learn that banks treat every applicant as an individual, and one client earning $45,000 per year may actually be able to borrow more than another applicant earning $55,000 per year.

The answer lies in your own individual circumstances.

Let’s explore this a bit further by looking at two applicants.

What we can see from Table 1 is that while Jane earns less than John, her personal circumstances allow her to service a larger loan – up to $427,000. What we can also see from this table is that different banks assess the same applicant differently and, as a result, will approve different amounts of loan funds.

John’s servicing capacity with different lenders is anywhere between $307,000 and $390,000. If John has found his ideal investment property and needs a loan of $370,000, then he really wants his loan application to be with the lender likely to approve the loan rather than the bank that will decline to lend that level of funds. It would be a great shame for him to miss out on his ideal first investment because he applies to the wrong bank for his personal situation. This is where the support of a trustworthy professional like a mortgage broker will greatly assist John.

Which loan is best for you?

Many of my clients come to me because there are so many loan options available in the market and it is really hard to know the real difference between them all. Determining which will be right for your circumstances can be confusing.

Essentially there are two types of loans available: basic loans and packaged/professional loans.

A basic loan is the simplest form of lending. The bank lends you the funds and you repay them over a set time, usually 30 years. Repayments consist of either principal and interest repayments or interest-only repayments. These loans have basic features such as permitting unlimited additional repayments if the loan is a standard variable rate loan, permitting redraw of funds paid in advance, and a fixed-rate option which locks in an interest rate for a period of time, usually one to five years. These loans are often low- or no-fee loans and their interest rates are often a bit higher than those of packaged/professional loans.

A packaged or professional loan has many more features. Often the loan package will include the loan(s), an offset account and a credit card for one set fee. Repayments can be either principal and interest or interest only. Your loan can be a variable-rate loan a fixed-rate loan, a line-of-credit loan, or any combination of these options. You will have redraw available on your variable-rate loans, interest-in-advance options, and the ability to add new loans at a later date for no extra account-keeping fees. These loans are often keenly priced and the most flexible.

So, which one is right for you?

The choice comes down to your current situation, your future plans, whether you have enough income to utilise an offset account, or even if you have plans to purchase a further investment property down the track. What makes the difference in this decision is looking at your overall plan and picking the lender with the right loan for your personal situation and ensuring you are comfortable with the outcome.

10-STEP GAME PLAN: PLANNING TO SUCCEED!

1. Become educated about investment loans and property investing – surround yourself with trustworthy professionals to assist you.

2. Apply for a pre-approved loan – this lets you know the bank supports you before you make an offer on your first investment property.

3. Check your credit file to ensure you have a clean credit history. Fix any late payments and defaults before applying for your investment loan.

4. Self-employed applicants should have their personal and business tax returns and financials up to date.

5. Have a realistic living expense budget – know your cash flow.

6. Reduce your living expenses – if possible, live with mum and dad or house-sit or rent in a low-rent property while you save your deposit.

7. Grow your deposit funds by not spending frivolously. Buying lunch at the shops every work day will cost you over $3,000 per year.

8. Reduce your liabilities – avoid expensive personal loans if at all possible. Ask yourself: “Do I really need to borrow $$ for a brand-new car or an overseas holiday at the moment?"

9. Reduce the limit on your credit card or cancel it altogether. A debit card will still allow you to live in the online world and your serviceability will increase.

10. Find the best loan for your personal circumstances. You have the choice of researching the lender options yourself or engaging the services of a quality mortgage broker. Mortgage brokers will work for you and access the right loan for you. This is a very costeffective option as you will not be charged for your broker's assistance as the banks pay mortgage brokers out of their profits.

Also see:

Cash Is King: What you need to know about investing in cash flow properties

Building a Nest Egg Through Capital Growth