“Many investors see the current market as the opportunity of a lifetime: the chance to put a lot of properties into their portfolios very quickly with minimal risk. Adding properties at a profit and with positive cash flow is incredibly easy right now.”

You could be forgiven for thinking this was a description of the Sydney property market in 2014, just as the big boom was happening – but it’s actually referring to the market today. It is the view expressed by Drew Evans, director of Caifu Property, who is keenly aware that there are opportunities for profit in any market conditions.

“We love the current market. The typical retail ‘buy, hope and pray’ investor is the only person worrying right now,” Evans says. “They’re worried because they know that for the next five years or more their portfolio will be stuck – it’s not going to grow much at all or even go backwards. But for investors who know how to create equity in a deal, the next five years are going to be a fantastic opportunity. We’re very excited about it because the profit available in each deal is getting better and better.”

Investors who make the mistake of waiting for the market to turn before building will have significantly less exposure during the next surge. Establishing a portfolio with profitable properties will not only create equity right now – even in flat or even shrinking market conditions – but will also generate substantial wealth when the market turns again.

“All investors understand the process of creating equity from market growth; in principle, it takes no special skills or knowledge to buy a property and wait,” says Evans. “Over the last few years, you could throw a dart at a map of Sydney and that would have worked.”

Calm in the face of adversity

Evans believes that many of the problems facing investors now are due to a lack of back-up investment techniques. The typical retail approach has been so easy for so long that investors have not pushed themselves to develop a broader palette of skills. The result is that, in a falling market, many investors simply don’t know what to do and are therefore worried. Nonetheless, Evans remains confident.

“In 2018, we’re making money, not losing it,” he says. “We predicted 14.96% as the average return on our clients’ properties this year, but we were off by 12.49% and actually made our clients an average of 27.45%.”

“In 2018, we’re making money, not losing it,” he says. “We predicted 14.96% as the average return on our clients’ properties this year, but we were off by 12.49% and actually made our clients an average of 27.45%.”

Given that this figure is nearly double what was initially predicted, this amounts to an equity gain of $227,222 per property for Caifu’s clients.

Evans concedes that the Caifu team do use very conservative estimates when putting deals together for clients, as they like to plan for the worst while still hoping for the best. This means returns are regularly much higher than their benchmark minimum of a 10% return.

“Obviously, none of our clients are calling our office and complaining about us making these kinds of ‘miscalculations’ with their money,” he says.

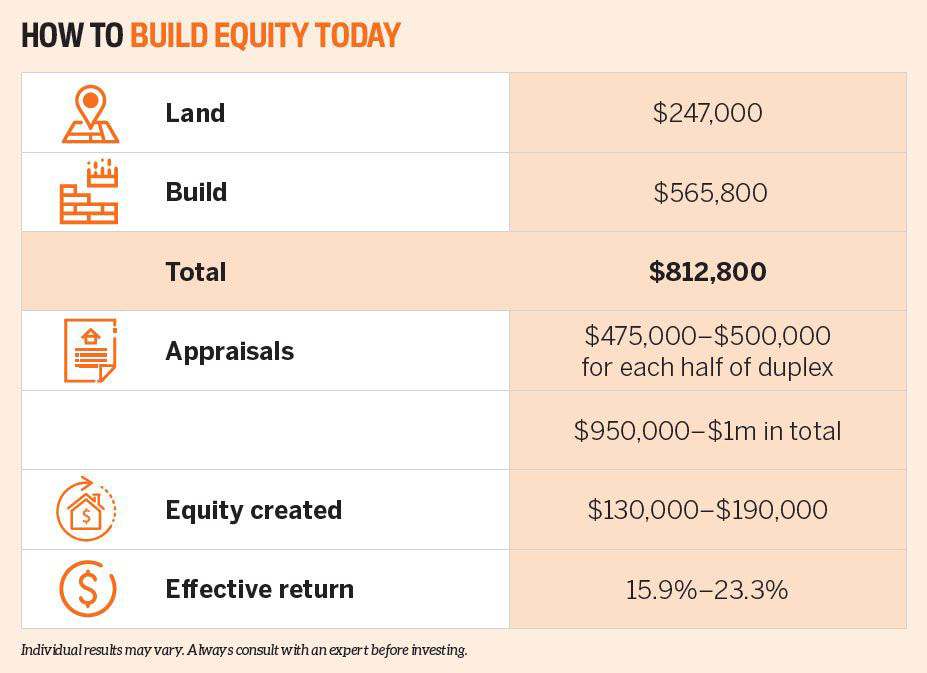

Still, Evans has strong views about investors being excessively cautious and potentially missing out on opportunities as a result. For example, building a duplex allows you to add your own value and control the equity creation process – in contrast to waiting for the market to move, which involves factors well beyond any investor’s control.

“If you told someone there was a hotspot suburb where next year they’d get market growth of 27%, they’d be begging you for the information,” Evans says. “But when it comes to creating their own equity by building a duplex that’s worth 27% more than they paid for it, they’re afraid. And that makes no sense because, whichever way you cut it, that’s still a 27% equity uplift worth hundreds of thousands in equity gains.”

To provide some broader perspective on the issue, Evans notes that the market wasn’t growing at that rate even in the best years of the Sydney boom.

“This opportunity to add properties to your portfolio so easily doesn’t exist in really hot markets – it’s only now that this is easy,” he says. “

That’s why we see this as the opportunity of a lifetime to build an amazing portfolio.”

What about the downturn in housing prices?

Evans is also of the opinion that creating your own equity in a falling market can act as a shield against price drops.

“Have housing prices ever fallen by 20%? They didn’t even do half that in the GFC,” he says. “But even if we were to have recordbreaking falls and they did drop 20%, our clients would still be up by 7%. There’s no doubt in my mind that this is the safest way for anyone to invest, because you have that inbuilt buffer of equity in your property.“If you are using conservative bank valuations to do your due diligence, not only is finance available to you but the safety margin you have is enormous. That’s why we’ve seen nearly double our expected results even in a falling market.”

To learn how Caifu Property is generating equity in a falling market, visit: www.automaticequity.com.au