Buying a property in a location other than your own neighbourhood is a strategy investors have used for decades to build wealth in their portfolios. In fact, today more than ever, with the advantage of video chats, live online mapping, and a raft of service providers who can review and analyse properties on your behalf, buying interstate is a popular investment move.

But it’s not a strategy without risk. There are many potential downsides to sinking your hard-earned cash into a property on the other side of the state (or country).

Whether you’re already a successful investor, you’re looking to diversify your portfolio on a national scale, or you’re a newbie rentvester hoping that an interstate property will be the fi rst step on your journey to becoming a real estate mogul, there are a few things to be aware of before taking that interstate plunge. Let’s start with the positives.

The pros

Lower property prices: There are plenty of positives to interstate investing, especially if you live in one of the major mainland cities where prices have skyrocketed.

Maximise your potential capital growth by looking at interstate options where the market is at a more favourable stage of the cycle

Investing in Melbourne or Sydney in 2019 probably won’t give you the rental yield you were hoping for, and you’ll be whacked with a scarily large investment loan. Over in Adelaide or Brisbane, however, you could grab yourself an investment property for half the price – that’s half the deposit required, half the mortgage, and half the stress!

The thinking behind this is that the more markets you’re exposed to, the more balanced your risk. If you own properties in Sydney, Melbourne, Perth and Brisbane, and the market in Melbourne comes to a standstill, you’ll be glad you own investment properties in other cities that may be experiencing stronger growth.

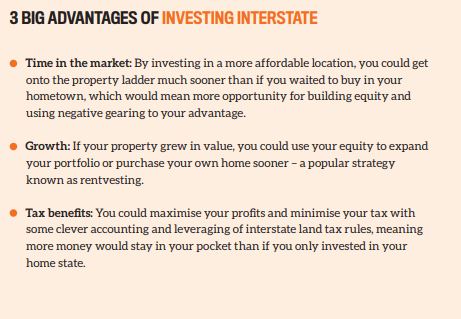

Capital growth: You could also maximise your potential capital growth by looking at interstate options where the market is at a more favourable stage of the cycle.

For example, in the last couple of years you might have struggled to get the funds together to buy an investment property in Sydney, and with the market teetering ominously at the top of the boom, growth hasn’t been guaranteed. However, if you’d snapped up a rental property in Tassie at the same time, you’d have been pleasantly surprised by how much it would have grown in value.

In 2019, Tasmania’s property market could reach the peak of its profit cycle, while the markets in Sydney and Melbourne are becoming more affordable. Depending on your investment timeline, these cities could be at a better stage of the cycle for you to consider investing.

Tax concessions: Another factor to consider when planning where to invest next is the tax concessions available.

If you live in NSW and own a few investment properties within the state, you’ll be hit with a land tax bill for the cumulative value of the land component of your portfolio. But if you have just one property in NSW and others in Queensland, WA or Victoria, you’re less likely to reach the land tax thresholds in each of these states. By diversifying your assets across the country, you can avoid paying land tax, even with a multimillion-dollar portfolio, potentially saving a load of cash.

The rate of stamp duty payable also varies across the country, as do the concessions for properties under a certain value. While changes to negative gearing could transform the property investing game if Labor win the next election, at present it still offers excellent tax incentives to investors. Speak to your accountant or financial planner if you need help figuring out how to weave the various tax breaks into your strategy.

The cons

What are the demographic stats, and are there adequate employment opportunities to attract tenants? Are local renters generally families, young couples, university students, or city workers? These things are assumed knowledge when you’re looking at investment properties just down the road, but when you’re buying in an unfamiliar location you have to do extra due diligence.

Tenancy laws: Another thing to be mindful of is the differences in tenancy laws that may apply from state to state. You’ll need to know how the legislation differs from what you’re used to, and what processes and tribunals are involved when it comes to settling disputes or evicting troublesome tenants. This is where a buyer’s advocate or local property manager who is familiar with the location can really come in handy.

Differences in property regulations: Things like contract cooling-off periods, auction procedures and conditions of sale vary considerably from state to state, and buyers ignore this at their peril!

Again, a professional buyer’s advocate can help you navigate the process, potentially sparing you a legal and financial nightmare.

Insurance issues: Buying interstate and being unfamiliar with the local area can cause headaches when it comes to taking out building or landlord insurance. You don’t have the insider knowledge that residents do, so it’s important to do your research to avoid being stung with outrageous insurance premiums.

Is the property on a flood plain? Are theft and drug use on the rise? Call your insurer before you make an offer on the property – if they think it’s a risky asset, you should potentially take that as a warning sign.