Coronavirus (or COVID-19) has had a devastating impact on Australian society. Small businesses are on their knees, companies have slashed jobs, a battle between renters and landlords looms large and essential grocery items have been in short supply.

In the fragility, many people have come to a stark realisation that it doesn’t take much to unravel business and lose a job. It now seems a daily occurrence to see thousands of people queueing for hours outside of Centrelink to register for unemployment.

This situation is heartbreaking and dire. And it won’t end anytime soon.

According to the Grattan Institute, up to 26% of Australian workers could be out of work due to COVID-19 and the crisis will have an enduring impact on jobs and the economy for years to come.

The Australian Government Labour Market Information Portal indicates there were approximately 13 million Australians employed in February 2020.

If unemployment rates reach 26% based on that figure, an extra three million people will be looking for work.

While it might seem insensitive, this circumstance has highlighted that individual financial security needs to be diversified. The age-old concept of ‘not placing all your eggs in one basket’ now has renewed importance.

Having multiple revenue streams is the only way to ride-out situations like COVID-19.

That’s why I believe you must turn your attention to bricks and mortar, but not in Australia.

The U.S. property market offers Australian investors a strong opportunity to diversify their revenue streams and build wealth and it can be done without a significant cost-outlay.

Investing in U.S. property

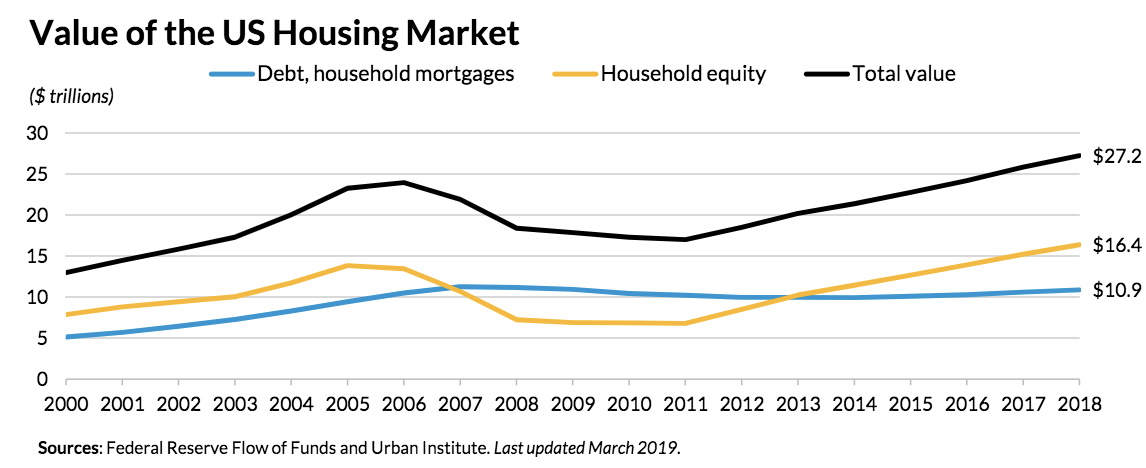

As evidenced by the graph below, the U.S. residential housing market was worth more than $27 trillion dollars last year and is expected to grow to over $33 trillion within the next 24 months.

While these figures may be affected by COVID-19, it highlights that the U.S. residential property market in the next two years alone is worth more than the entire property market in Australia.

I’m not suggesting there’s anything wrong with our property market and if you have the resources to invest, it might be your best option. But most people don’t.

The average cost of a two-bedroom apartment in Melbourne, Sydney and now Brisbane has skyrocketed in recent years and it’s not uncommon to see prices hit more than $600,000.

That would mean Australians trying to get into the property market would need a deposit in excess of $100,000 not including stamp duty and other associated costs. Investing in our domestic property market adds-up quickly and it would seem for many owning ‘the Australian dream’ is a reality out of reach.

However, US property prices are much lower than what we experience here and represent a significant opportunity. For example, a three-bedroom family home can be purchased with tenants from a meagre $50,000 US outright. That’s less than a deposit for Australian property and it’s done without the loan and no interest.

While many outside of the U.S. might view the country as still rebuilding from the aftermath of the Global Financial Crisis, nothing could be further from the truth.

One of the hardest hit areas, Detroit, now offers enormous potential for growth, has a high domestic rental market and affordability of accommodation. This is supplemented by increased levels of government investment and flourishing local industries.

Other аrеаѕ like Florida, uрѕtаtе Nеw York, Ohio, Tennessee and еvеn Texas and Alаѕkа are primed for investment too.

While this type of approach doesn’t necessarily address an immediate need of finding an Australian home to live in right now, it does present a viable solution to building financial security.

Ways to invest in U.S. property

There are many ways Australians can invest in the U.S. property market but, as with everything, the results achieved depend on how you go about it.

Three of the most commons ways to invest in U.S. property are:

Buy property and hold rentals - this is considered a long term investment strategy with minimal risk. An investor will purchase a house or apartment and hold on to it long term and open up the property for rent. This strategy can earn more than a 10% return in NET passive income.

Fix and flip - I’m sure you’ve seen this on TV and what happens there (minus the smoke and mirror) can happen for investors. Fix and flip means buying a rundown property, renovating and then on-selling it for a much higher price to make a profit. This gives an investor great returns and strong equity.

Buy, Renovate, Rent, Refinance and Repeat (BRRRR) - this is a strategy an investor will go through in order of the investment cycle. First buying, then dong up the property, then renting it out, refinancing for a better deal and doing it all again. This allows investors to get a cash flowing investment and refinance out most of their capital and repeat, leaving a strong cash flow even after finance costs of 4-6% ROI. Even foreign investors have access to this strategy.

Going beyond the mechanism with which to purchase property, investors need to know how they are going to do it. This is where the process can become more complicated.

Typically, there are two types of people investing in U.S. property. The first one will be gung-ho and want to do everything from start-to-finish by themselves.

They think that hard work is all it takes and spend day after day researching growth areas and property evaluations and then jump right in. No system. No strategy. No idea.

This approach can work but it doesn’t give the best return of investment (ROI) and after time in the game this investor gets burnt out and doesn’t achieve the passive income results wanted.

The other investor takes a more measured approach and plans what they want to achieve, puts the correct strategy in place to achieve it and is prepared to undergo the ‘training’ required to fully understand U.S. investment and the opportunities it presents.

It’s no secret who gets more out of their investment.

Minimising U.S. property investment risk

Nobody should go into U.S. property investment blind.

As with Australian property investment, it presents potential risks that need to be mitigated.

Currency shifts - can be a boon as much as a risk to your investment. The key to avoid running into strife is to have flexibility when converting funds. Owning a bank account, or trust account (called Escrow account in the U.S.) can help allow funds to be kept in the U.S., until needed, or you are comfortable with the exchange rate.

When the AUD is low, this can mean the price of the properties is higher, but of course, also means your rental returns are greater. Alternatively, the reverse allows for cheaper entry rates on purchase but reduces the equivalent AUD of your rental yield.

It is always pertinent to look at the yield as a percentage of the value, rather than actual dollar value, which even during large currency shifts, will remain constant. Specialised Foreign Exchange companies often have much better rates when exchanging money than banks generally do and can save thousands on transfers if done right.

Insurances - like in Australia, insurances are critical for your investment. Ensuring your investment property is covered for damage, flood, theft, fire and storm is a minimum, but going further is also an option. Tenant and rental insurance are also available to cover damage caused by tenants, even loss of rent if the tenant leaves, or does not pay.

Property management - is a vital part of your investment strategy. Choosing the wrong one, can cause a significant heartache especially when they’re based overseas. It’s not uncommon for an investor to spend hours on due diligence of a property, only to hand over the keys to the first property manager they meet.

You should always seek out the services of more than one property manager and subject all to a rigorous interview process. Chances are you won’t get the option to meet face-to-face but online video programs can be used to conduct interviews.

Spend as much time developing your property manager, as you do researching your property, and you will certainly massively increase your success rate, and mitigate risks.

COVID-19 has delivered us a new reality and what many thought was secure is now not.

Australians are fighters by nature and we will bounce back but it will take time and won’t be without a few more battle scars along the way.

But as unemployment lines continue to grow - up to as much as 600,000 - and as more companies go the way of Virgin Airlines, now more than ever is the time to start looking at ways to diversify your revenue streams to financially safeguard your future as much as possible.

There’s safety in bricks and mortar and ROI opportunities in the U.S. property market.

- Lindsay Stewart, Founder & CEO, Star Dynamic Property Investments