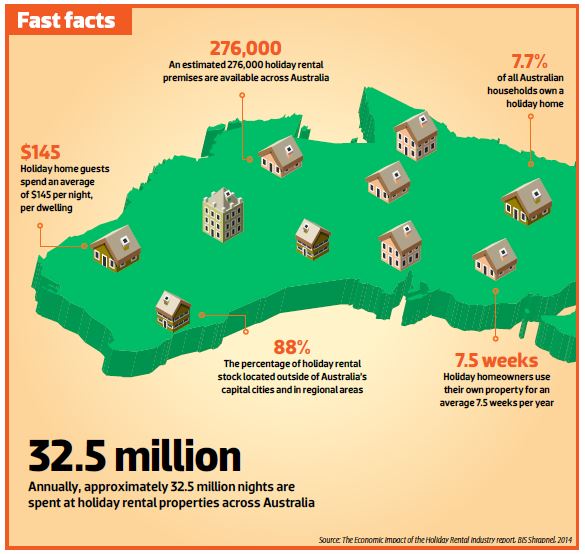

But post-GFC, many of these strategies appeared to carry too much risk for the average investor – particularly after property values in regional holiday home locations slumped further than their city-based counterparts.

Today, some of that risk appears to be abating, thanks in some part to a new wave of disruptive ‘share economy’ business models – such as Stayz.com, FlatMates.com.au, HomeExchange.com and Airbnb – which allow homeowners to leverage their spare space for extra money.

“Airbnb hosts all over the world are sharing stories of how hosting has changed their lives,” explains Bec Faye, share economy enthusiast and founder of The Wholesome Dollar.

“According to a recent Airbnb study, the average Sydney-based host earns $4,505 per annum. That’s enough to cover the cost of a holiday, or at least take some of the pressure off living and mortgage expenses.”

But the benefits of hosting with Airbnb extend “well beyond the earning potential," Faye says.

“Many people sign up as a host simply to earn a little extra cash, but once they start they find the whole experience truly rewarding. They’re meeting interesting people from all over the world, have the opportunity to share their own way of life, and some hosts even find new life-long friends,” Faye explains.

But just how profitable is it to share your own home, or your holiday home, with strangers?

And can you genuinely, significantly boost your investment property’s rental income by leveraging the share economy?

Traditional tenants vs short-term rentals

The primary upshot of renting your home to holiday makers instead of full-time tenants is clear: the potential for higher rental returns to be generated, says Justin Butterworth, director of government and industry relations at Stayz.

“You also have the flexibility to owner-occupy from time to time, and there’s a lower likelihood of unpaid rental, as guests pay upfront when booking short stays,” Butterworth explains.

Contrary to popular belief, holiday rentals often experience less wear and tear than long-term rentals, he adds, as “heavy goods are not moved in and out at the end of each tenancy”. But the benefits of renting your property as a holiday home come at a cost. Rental returns are higher but so are operating costs, with management fees typically accounting for 15–30% of your rental income.

Furthermore, this type of strategy is generally not as ‘set and forget’ as a traditional tenancy.

“You need to invest in your guest experience to drive satisfaction and great guest reviews. A special feature or being generous with the basics such as crockery can go a long way to ensuring you have happy guests,” Butterworth says.

You also need to be aware of the distinct risks that holiday homes attract, he explains. These can include:

Income

The risks of cyclical income exist with holiday home rentals, but they can be offset by cash flow planning through the year.

Damage

Guest screening, security deposits and solid terms and conditions can mitigate damage to the property. Insurance is even more important.

Neighbourly disputes

These can arise with any property investment, but specific risks apply to holiday homes. Adopting the Holiday and Short Term Rental Code of Conduct can help to minimise any disruption to residential amenity, Butterworth advises.

Regulatory risks

You need to ensure that you have the appropriate permission and meet the local regulations of holiday rentals to avoid compliance action by councils.

Traveller cancellations

This can impact your cash flow. “They can be mitigated via Terms and Conditions and an appropriate deposit or prepayment,” Butterworth says.

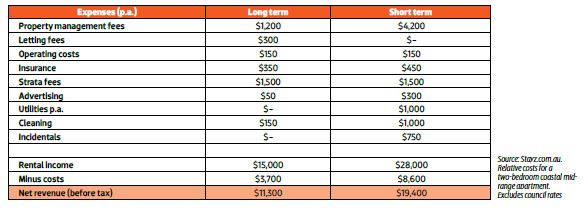

If you have the right risk profile, and the type of keen budgeting and money management skills to ensure your cash flow is sufficient year-round, a holiday rental could help you generate thousands of extra dollars in rental returns. This general income comparison of a holiday rental versus traditional rental paints a picture of what could be:

Double the profit with an executive lease

Short-term rentals don’t just refer to holiday lettings; they also include corporate or executive rentals, which can add a serious premium to your weekly asking price.

“It can be very lucrative, depending on where your property is located,” says Heather Turpin, director of G&H Property Group, a boutique property management company located in Melbourne.

“The main thing investors need to keep in mind is that they have to be realistic and understand what their average rental income will be over the year, because you may not attract a tenant year-round.”

Generally, executive or corporate leases range from three months up to 12 months, depending on the location and size of the property. An executive with a family may stay for a longer period, whereas an inner-city apartment suitable for one or two occupants is more likely to attract shorter leases.

That latter category is usually the more sought-after property type for executive leases, Turpin explains, and they often need to be fully furnished.

“They also need to have good facilities, like a gym, and be modern and appealing,” she says.

“If you’re renting through a short-term leasing company, they may want you to include furniture or they may put their own furniture in there; it’s up to you to negotiate that with them directly.”

Which brings about Turpin’s next point: for landlords who wish to pursue an executive rental strategy, there are two options available. You can manage the listing yourself in an effort to reap the full weight of the financial rewards, or you can engage the services of a short-term leasing company.

In the latter situation, the leasing company then becomes your tenant, and they manage the incoming and outgoing guests – and all of the risks and rewards that go with it.

“Using a leasing company is a much safer way for the landlord to go about it, as you’re just responsible for one main tenant,” Turpin says.

“Of course, they’re going to charge for their services so you may not make as much as you would by letting it yourself, but you can try charging a higher rent to the company, and you’ll minimise your vacancies this way as well.”

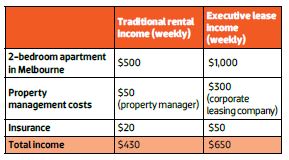

Landlords stand to make “up to double the regular rent” through a corporate leasing, she adds, although you will need to share those profits with your leasing company:

“At the end of the day, you’ve got to get the right person with the right risk profile, with a house in the right spot with the right furniture,” Turpin says.

“You have to keep in mind that you’ve got more people coming and going into the property, so there’s a higher risk of damage, but you can make around 20–30% above your regular rent. Knowledge is power, so do your research, speak to property managers, and make sure you target your property towards that market you’re aiming for.”

Insurance risks: What short-term landlords need to know

There are certain traps for the unwary investor when using non-traditional property strategies, and insurance has the potential to be one of them according to Sharon Fox-Slater, executive general manager of EBM's RentCover.

“Standard landlord insurance doesn’t cover by-the-night accommodation rentals. Specialist short-term landlord insurance is available, but it costs more than the standard product because risks tend to be higher,” she explains.

“In a holiday rental setting, people are more likely to let their hair down and perhaps behave in a more cavalier way, which can increase the chances of property damage or petty theft. Also, properties are often more attractive break-in targets when they are vacant. An unoccupied, comfortably furnished short-term let, complete with flat screen TV, can be a prime target for thieves.”

Regular landlord insurance policies also don’t generally cover property investors who rent by the room, an important consideration for those contemplating an Airbnb strategy.

“They would need a different type of cover tailored to the situation, although in some cases, single-room rentals let out to more than a certain number of tenants are illegal under council and state rules – unless a property is appropriately licensed,” she says.

“Often, the regulations for boarding houses can apply, which can require a significant investment in fire equipment, a minimum number of bathrooms, and so on.”

Lastly, Fox-Slater says investors need to be aware of some of the “non-insurable risks” of embracing a less traditional rental strategy.

“This could include the possibility of local councils stepping in to stop renting by the night, which has led to several lawsuits in recent years,” she says.

Boost your income by renting by the room

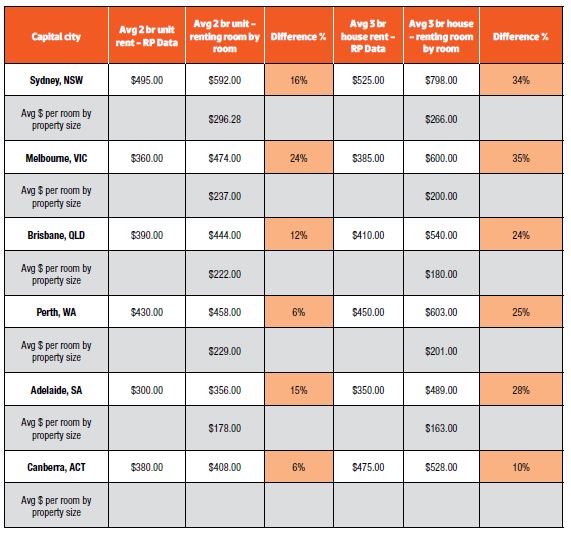

Landlords could increase their rental yields by up to 34% by letting out their property individually by the room, according to new research from Flatmates.

“Renting an investment property out by the room may not be practical for everyone, but in many cases the higher yields could outweigh the extra effort,” says Thomas Clement, managing director of Flatmates.

“Based on the averages, a three-bedroom home rented by rooms in Sydney could bring in around $14,000 extra per annum than a traditional home rental.”

Could your property suit a room-by-room strategy? Check out the potential profits:

CASE STUDY 1

For four years, Roger Weeks and his wife Angie travelled around Australia in a caravan, an adventure they’ll not soon forget. Throughout that time they also ran their business – renting out their pet-friendly holiday home, Angie’s Garden, in Hervey Bay.

“All you really need to run a holiday home is a good phone and internet connection, as it’s a really low-input business that generates great returns,” Roger says.

Angie’s Garden, their regional retreat in Hervey Bay (around threeand-a-half hours north of Brisbane), includes two separate dwellings: the original three-bedroom ‘Retreat’, built under a massive Balinese pavilion six years ago, and the ‘Beachhouse’, a new addition that comes complete with an office and wifi.

“We own both of these properties, and we also manage a third property, the ‘Poolhouse’, on behalf of another investor,” Roger explains.

They oversee all of the bookings and make 10% commission from the Poolhouse property rentals, while pocketing 100% of the rental returns from their own properties after booking commission fees, such as Stayz fees, are accounted for.

In an average year they gross around $65,000 from the Retreat alone. For the 2015 financial year, they projected a “conservative” income of $110,000 in income across both properties and commissions from the third, a financial goal that they were on track to surpass at the time of interview.

The entire business is systemised, Roger explains, which is why he believes a holiday home strategy can be highly profitable in exchange for minimal input.

They use booking agencies like Stayz to help drive business – which comes from as far as the United Kingdom – and have cleaners and gardeners who have access to their booking website, and can therefore plan their maintenance and cleaning around the dates of people checking in and out.

“All three houses have a key safe at the front door so that guests can put in the code at any time of day or night when they arrive, to access the keys to the house. Our cleaners use the key safe as well to clean the property between bookings,” Roger says.

CASE STUDY 2

Twenty-nine-year-old Sydney investor Steven Ryan bought his first home in 2010. He’s purchased two investment properties in the five years since, but it’s his own home – a one-bedroom apartment in Marrickville – that is proving most profitable, thanks to a clever Airbnb strategy that sees his couch occupied for months of the year.

“At my absolute peak, I probably spent half of an entire year with a guest in my home at some point,” explains Steven, who works as a qualified mortgage broker.

“There was a period around Christmas where it was booked pretty much non-stop. Either my guest will sleep in the lounge room, or sometimes I let them have my bed and I stay on my couch, and I charge from $35 per night.”

While both of his investment properties operate under traditional rental agreements with full-time, long-term tenants, Steven has found that hosting via Airbnb has enabled “a nice way of meeting interesting people from around the world, while also generating some cash flow.”

“I actually have a friend in Marrickville who has two properties that are exclusively listed via Airbnb. He offers a minimum booking period of a month or so, rather than one- or two-night bookings,” Steven says.

“Because he takes long bookings, tenants are usually staying up to two months, and so they look after the place themselves, with just a quick clean and changeover when someone new checks in.

“It’s a little bit more hands-on than a long-term tenancy, but he achieves a yield that is 1–2% higher.”

Before you decide to rent out an entire property using this method, Steven suggests that you build up some experience by offering a room in your own home first. It’s a great way to build up your reputation on the site, and gain an understanding of what your potential guests are looking for, in terms of property features, amenities, location and overall experience.

“It’s important to make sure there will be demand for your property,” Steven adds.

“If you’re somewhere like Darlinghurst or Potts Point in Sydney, you’ll have demand year-round. In Homebush, demand will be very dependent on events, whereas at Bondi Beach, you’ll have peak season in summer and tumbleweeds in winter. My bookings really come down to the quality of reviews left by my guests; my location isn’t perfect. It’s the value and the experience that appeals to people.”

“And if you do decide to embrace an Airbnb strategy for your rental property year-round, you’ll need to be aware of the financial implications,” he says.

There is a distinction from the ATO’s perspective between sharing your home with a boarder (and providing them with food, shampoo and other amenities), and renting your property out to a ‘tenant’ in your absence.

Whilst the first scenario represents a lodger, which in some circumstances may not attract traditional income tax, in the second situation you may be considered to be offering hotel accommodation, on which income tax and/or GST may be applicable. Your accountant can best advise you about your situation.

Furthermore, banks are “not interested in considering Airbnb income in your loan application” Steven says. The only way to get around that is if you treat your Airbnb enterprise as a legitimate business and you charge GST on your accommodation prices, Steven advises.

“I’m not going down that path myself, even though I could make more money, because for me, it’s not about the money – it’s about the enriching experiences,” he says.

“When I first did this in 2013, I thought, ‘Maybe I can offer my room or couch and make a bit of extra cash’, and then I had person after person coming through. The extra dollars didn’t hurt, but for me it’s really about the experience and the opportunity to meet a diverse range of truly wonderful people. I’ve hosted 70-odd guests and met some really, really amazing folks – I’ve even become friends with and helped some of them on their investment journeys in various ways. It’s rewarding on so many levels.”

.JPG)