Under labor's policy to limit negative gearing to new housing from 1 January 2020 if it had won the election in May, taxpayers would only have been able to deduct rental losses against their other income if the losses were from newly constructed housing.

We could debate the merits or otherwise of Labor’s proposed changes endlessly, but the polldefying re-election of the Coalition Government means that Labor’s proposed changes to negative gearing are off the table – at least for the time being.

But that doesn’t mean the benefits of negative gearing necessarily remain in play.

What is negative gearing?

Most people who buy an investment property need to borrow the majority of the purchase price from a bank or other lender. And naturally, the lender expects the investor to pay interest on the debt.

If the total of the mortgage repayments, plus the costs of managing and maintaining the property, is more than the rent being paid by your tenant, then you’ll make a cash flow loss from the property. In other words, it costs you money to hold the property, and you must come up with the shortfall between the rent and the ongoing costs out of your own pocket.

The process of borrowing is called ‘gearing’, and because the outcome in this case is negative cash flow, the term ‘negative gearing’ is used to describe this approach.

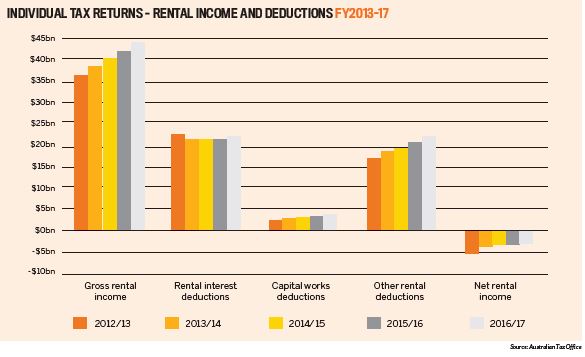

The average investor makes a loss of almost $9,000 per year on their property, according to ATO figures (see boxout, p42). Making a nine grand loss each year doesn’t sound like a great investment strategy, so why do so many people do this?

The reason 1.3 million people are willing to make a loss when holding an investment property is that they can claim this loss against other income and reduce their overall tax bill.

Now, it’s important to recognise that the deduction for the loss will only reduce an investor’s tax bill by a portion of the loss amount, equivalent to the marginal tax rate – at most 47% of the loss, including Medicare Levy, and possibly much less. So, if your property is negatively geared, chances are you’ll still be out of pocket even after any tax refund.

An investor taking a long-term approach may be willing to accept a cash flow loss today, in anticipation of a larger capital gain in the future. Ultimately, they hope to make more in capital growth than they will lose in out-of-pocket costs.

However, this carries a degree of risk, as the immediate cash flow loss is a certainty, while the future capital gain is only a possibility.

In spite of the election result, it could be argued that the death of negative gearing had already occurred … thanks instead to APRA and the banks

Careful selection of the property and location are therefore very important if they are to maximise the likelihood that capital growth over time will not only exceed the net holding costs but also deliver a decent profit.

Lenders and negative gearing

Lenders focus on your ability to actually repay your debt, and will become increasingly nervous as more and more of your income is committed to servicing debt on investment properties.

A negatively geared property is generally a financial burden while you own it, and the bank certainly won’t lend against the potential capital gain that you say you’re going to make 20 years from now!

The rental income from the property helps with the loan repayments to a point. But lenders will only consider a portion of the rental income from an investment property when assessing your ability to meet your loan obligations – usually around 70–80% of the gross annual rent. This is fair enough, as they are taking into account potential vacancies and the other overhead costs of holding a property.

Keep adding one negatively geared property after another to your portfolio and with each subsequent property the lender will consider more and more of your personal income to be committed to servicing debt. This makes it increasingly difficult to get finance approval, and an inability to obtain finance can stop your investing dead.

Over the past couple of years, some lenders have quietly reintroduced negative gearing tax deductions into their servicing calculators

The ‘death’ of negative gearing

In spite of the election result, it could be argued that the death of negative gearing had already occurred without any direct action by the political left wing. Thanks instead go to the actions of the finance industry regulator – the Australian Prudential Regulation Authority – and the banks.

Over the last five years, investors have experienced significant changes to the Australian lending environment, which have made building an investment property portfolio through negative gearing even more difficult.

Chief among these changes were stricter loan servicing tests forced on the banks by the regulators, along with the tightening of loan qualification criteria by the banks themselves.

These changes directly affected how much you could borrow to invest – and they directly impacted on the effectiveness of long-term negative gearing as an investment strategy.

For instance, from 2014, lenders were required to test your ability to afford a loan as if you were going to be paying at least 7% interest (most lenders in fact test at 7.25% plus), regardless of the actual interest rate you might have been paying.

This meant that even though the bank might have offered an interest rate of as low as 3.5%, they would still have assessed your ability to afford the loan as if you were paying 7% or more (ie double the rate).

Under pressure from the regulators to reduce the growth in their investment loan books, and to tighten up loan assessment criteria, back in 2016/17 many lenders also abolished negative gearing tax breaks from the calculations they were using to assess how much you could borrow. Any tax refund you might have received from negative gearing therefore wouldn’t necessarily have helped your borrowing capacity.

For those attempting to build a property portfolio through negative gearing, these changes meant they would run out of borrowing capacity – and run into a financial brick wall – even faster than they might done have previously.

The upshot was that if you wanted to build a multi-property portfolio, negative gearing for long-term growth simply wouldn’t get you there. Most people were more likely to run out of borrowing capacity before they could accumulate enough property, because of the combined effect of the negative gearing drain and tighter lending criteria.

Add in the fall in property values experienced across much of the country in 2018, plus the uncertainties that were present in the lead-up to this year’s federal election, and negative gearing had begun to look like one of the least effective and potentially riskier strategies you could employ in your property investing today!

The resurrection of negative gearing?

Does the outcome of the election, with changes to negative gearing off the table for now, breathe new life into negative gearing as an investment strategy?

As noted above, building a property portfolio through negative gearing had become substantially more difficult due to the implementation of tighter loan servicing tests. On its own, the election outcome didn’t change much in this respect.

But on the Tuesday immediately following election day, APRA announced its intention to relax a key lending restriction. The regulator proposed that the 7% minimum interest rate test should be scrapped in favour of banks simply adding a buffer of 2.5% to the actual interest rate of the loan when assessing an individual’s borrowing capacity.

For instance, if you were about to borrow at a 4% interest rate, then your ability to service the loan would be tested at a 6.5% interest rate (4% plus 2.5%) instead of 7% plus.

Sophisticated property investors need to be mindful of the risk of change, and prepare themselves by proactively adapting their strategies

This is a significant change – one that is likely to make it easier for more homebuyers and investors to access finance, and increase the amount of money they can qualify to borrow.

A by-product of this change is also that the eroding effect on an investor’s overall borrowing capacity of negative gearing may be slightly less, especially when combined with falling interest rates.

It’s also worth noting that over the past couple of years some lenders have quietly reintroduced negative gearing tax deductions into their servicing calculators, so shopping around can make quite a difference to a negatively geared investor’s borrowing ability.

The future of negative gearing

Ironically, the downward trend in interest rates means that most investment properties will become less negatively geared as the interest deduction gets smaller. This will have the effect of reducing any tax deduction, further weakening the effectiveness of negative gearing as a tax minimisation strategy.

Furthermore, the recent federal election result doesn’t mean that negative gearing is off the chopping block forever. It's still very much a live issue, and likely to be contested again at a future election.

The Coalition itself has indicated a willingness to consider some reform of negative gearing (just not right now), with Scott Morrison reportedly expressing an interest in broader tax reform during his tenure as federal treasurer.

For instance, in February 2016, Morrison suggested potential policies targeted at what he termed the “excesses” of negative gearing, floating ideas such as a limit on the number of investment properties that could be negatively geared, or a cap on the maximum total deduction that could be claimed.

Change is probably inevitable at some point in the future, whether it's in the next term of government or a subsequent one. Sophisticated property investors therefore need to be mindful of the risk of change and prepare themselves by proactively adapting their strategies and managing their portfolios to reduce reliance on negative gearing over time, rather than reacting after the fact.

What’s the alternative?

It’s important to keep in mind that the purpose of investing is to create a profit. If your primary motivation for investing is to save tax by making a negative gearing loss, then you may have missed the point.

Fortunately, there are other property investing strategies that are well suited to current financial and market conditions, and which offer investors opportunities to profit and build their wealth.

Strategies better suited to today’s market include investing for positive cash flow (the exact opposite of negative gearing); adding value through renovation, subdivision or property development to effectively create your own capital growth; or simply being smart about selecting areas that are primed for growth in the near term, rather than investing randomly and hoping the value of your property will go up faster than what it costs to hold over the uncertain longer term.

It’s time to take a close look at the balance of your own portfolio, and to ask how you may need to alter your strategies to better fit the market today and in the future.

Simon Buckingham is a professional investor with over 15 years’ experience. He writes frequently on the property market and is a director of the awardwinning Results Mentoring Program for property investors

Simon Buckingham is a professional investor with over 15 years’ experience. He writes frequently on the property market and is a director of the awardwinning Results Mentoring Program for property investors