06/12/2018

The golden rule of property is clear: only ever invest in blue-chip property. That means inner Sydney and inner Melbourne, and disregard everything else, right? Please, no!

Here’s the thing: there is no such thing as a ‘blue chip’ location to invest in. It’s utter BS! Australia is a massive country with hundreds of towns and cities. Each location has its own unique economic profile, diverse lifestyle attractions, and wide-ranging housing affordability price points. Those of us who have taken the time to thoroughly study historical evidence know that all markets have previously experienced boom times, every single market has has seen periods of price decline, and they will all have good and bad times in the future.

Truth be known though, those who invested in Narrabri 20 years ago will have made more money dollar for dollar than those who invested in Bondi. Similarly, South Gippsland outperformed South Yarra. We’ll dissect the evidence of these and other examples shortly.

Within Australia’s eight states and territories, there are 550 city councils, 139 of which are in capital cities and 411 in regional Australia.

Australia-wide there are thousands and thousands of suburbs, and the property investment business is littered with old wives’ tales and myths that aren’t at all substantiated by historical evidence. Make no mistake: every location has had good years, bad years, and normal years in between.

Blue-chip bias

If you ask me, while they may mean well, those who claim that certain locations are ‘blue-chip investments’ are heavily influenced by an emotional bias towards a specific location, usually based on where they personally live (or aspire to live), where they love going on holidays, or plain old ego.

Some businesses that preach the blue-chip myth do so because of their own vested interest in promoting a specific location. Often their business model depends entirely on the public always being attracted to buying property in location X.

According to these businesses, no matter what the near-term outlook is for their favoured location, all roads always lead back to that location. Even when the property market of the subject city is underwhelming, you’ll find them pretending that their blue-chip patch has immunity – just keep an ear out for the old ‘there are markets within markets’ chestnut.

According to these businesses, no matter what the near-term outlook is for their favoured location, all roads always lead back to that location. Even when the property market of the subject city is underwhelming, you’ll find them pretending that their blue-chip patch has immunity – just keep an ear out for the old ‘there are markets within markets’ chestnut.

The blue-chip brainwash typically implies that one should only ever invest in pockets of affluence within one of Australia’s five biggest capital cities. Apparently, everywhere else in Australia is full of plebs – so how could one possibly expect those property prices to outperform silvertail city?

Some seem convinced that one should only ever invest in inner Sydney or Melbourne where a typical property costs north of $1m. They’ll tell you that $30,000 to $50,000 in annual holding costs is a justifiable expense for blue-chip, and if you don’t have that sort of coin you shouldn’t invest at all. Now if that’s not snobbery, it’s certainly reckless.

Most humans have a desire for nice things, so no one should begrudge those who can afford to live in silvertail city. Plenty of people also love lobster, but most can’t afford to eat it. Meat and potatoes on the other hand… A person’s home is their castle, whether that’s in Snobville or Sh!tsville. But if their primary objective for buying a property is the potential financial return, they’ll be wise to understand that the biggest pool of future buyers (demand) is where our middle class live (95% of Australia’s society).

What goes up…

Narrow-mindedness has played a big role in this blue-chip bias. I don’t encourage anyone to invest in something they don’t understand. It’s impossible for an investor to give themselves a chance of making the best decision if they don’t first properly consider 100% of their options. Doing that requires an open mind and a preparedness to learn.

Media horror stories that draw attention to a small portion of lower-profile property markets declining by, say, 20–40% over a period of time hardly encourage people to broaden their horizons. But understand this: every market has downturns. While prices in high-profile markets are less likely to drop by large percentage values, smaller drops in much bigger values can equate to a similar dollar value.

For example, we are only about a year into Sydney’s downturn and, even in desirable locations like Northern Beaches, values have already declined by up to 8%, according to CoreLogic. Who knows, but let’s say prices fall another 5% before reaching the bottom. That’s a $150,000 capital loss, plus there is the average annual holding cost of $20,000. I ask you: is that not risky?

“Blue-chip brainwash typically implies that one should only ever invest in pockets of affluence within one of Australia’s five biggest capital cities”

If an investor purchased a property in silvertail city 20 years ago they would certainly have made lots of money. They would have experienced two major boom periods, a few years of price declines, and a couple of stretches of normal growth. The same could be said about a very large number of locations all over Australia where middle-class Australians live, including noncapital city locations.

Over the past 20 years, the so-called Sydney blue-chip suburb of Lane Cove (median house price $2,232,000 – March 2018) produced an average annual increase in median house prices of 8.4%. The identical rate of growth was seen in the Sydney outer suburb of St Helens Park (median $590,000), the regional NSW municipality of Yass Valley (median $607,000), Geelong in regional Victoria (median $520,000), and the Hobart suburb of New Town (median $592,000). Lots of other capital city and regional locations had higher growth rates.

Let’s imagine an investor was looking to buy a typical apartment in Balmain today, at a median price of $1.3m. They would first need to save $320,000 (cash) to cover their 20% deposit and stamp duty, and would then have to fork out $17,000 each and every year to cover the shortfall between rental income and expenses.

Acknowledging the considerable opportunity cost of sitting on the sidelines while saving a big deposit, a high proportion of investors raise their deposit and acquisition costs using equity in existing property. In Balmain’s case, the higher leveraging increases the holding cost to $34,000 each year.

A typical apartment in Sydney’s Balmain has increased in value (from $340,000) by $1m over the last 20 years (source: CoreLogic). So the price of buying blue-chip does pay off. Or does it?

That 6.9% average annual growth rate is similar to many NSW regional locations, like Dubbo (6.3%) and Orange (6.5%). Higher rates of growth were produced in lots of other NSW locations, including Kempsey (7.2%), Mudgee (7.6%), and Newcastle (8.5%).

“A higher price tag, affluence and desire actually work against [demand] … because there’s a much smaller pool of buyers who can afford these properties”

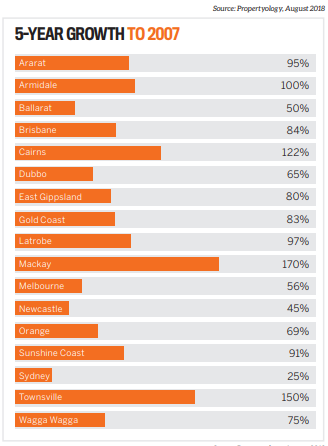

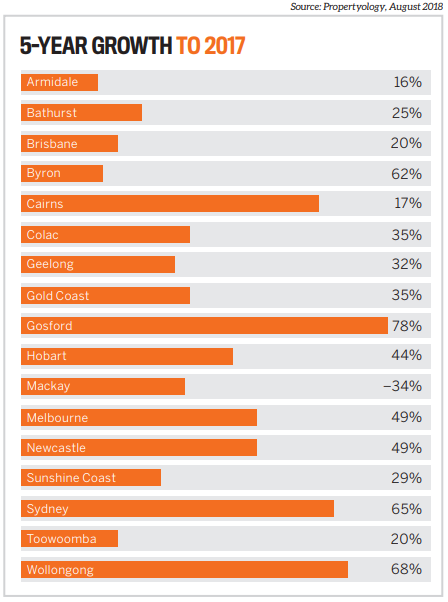

Regardless, as the tables at right illustrate, the rates of growth in many locations where Australia’s middle class live are comparable or even superior to silvertail city. When the rental yields and important annual costs of holding a property are added to the equation to produce a total return for the investor, the evidence is compelling – blue-chip is baloney, and the highest buyer demand is for meat and potatoes.

Smarts, not status

In life in general there will always be people who believe what they want to believe. There’s absolutely nothing wrong with investing in a so-called blue-chip suburb.

But please understand that a higher price tag, affluence and desire actually work against the demand side of the growth equation, because there’s a much smaller pool of buyers who can afford these properties.

The important thing is to understand the real factors that influence property markets. Investing is too big a decision to rely on mythology. No one can predict the future, but smart investors understand what is meant by the term ‘fundamentals’; they know how to analyse them, and they appreciate the importance of buying at the start (not end) of a chosen location’s growth cycle.

At the end of the day, big companies like CBA, Qantas, BHP, Telstra and Woolworths have good times and they have bad times. Smart share investors know the difference between the two.

“The aim of the game is to overcome emotion and ignore personal bias in order to genuinely consider 100% of the option”

The aim of the game is to overcome emotion and ignore personal bias in order to genuinely consider 100% of the options and give your hard-earned money a chance of working as hard for you as possible.

From an analysis of the historical performance of literally every location in Australia since before the turn of the century, the evidence shows that both higher capital growth and cash flow occur when a town or city has a combination of an affordable median house price and a sustained period of confidence, usually driven by economic development.

It’s always a good time to invest in property. The key question is where and not when. As our graphs illustrate, different markets will produce vastly different results at different times.

My advice is, don’t sit on the sidelines reading media reports. By the time you’ve read about several consecutive months of good performance you might have missed 30% of the total growth produced by that cycle in that market. And as the historical evidence has taught us, those media reports are unlikely to alert us to those many lower-profile locations that have produced higher total returns than silvertail city.

To show that I put my money where my mouth is, as recently as February this year I personally invested in another exciting non-capital city location. I purchased a low-maintenance, three-bedroom house close to the CBD for only $375,000. It costs nothing to hold each year and prices are now starting to move at a double-digit pace.

Job growth in this location is already occurring, community confidence is high, and several major job-creation projects are due to commence shortly. I believe it’s at the very early stage of this location’s growth cycle. Remember: the biggest risk to take is to never invest at all.

is the managing director of

Propertyology and three-time

Australian (REIA) Buyer’s Agent of the Year