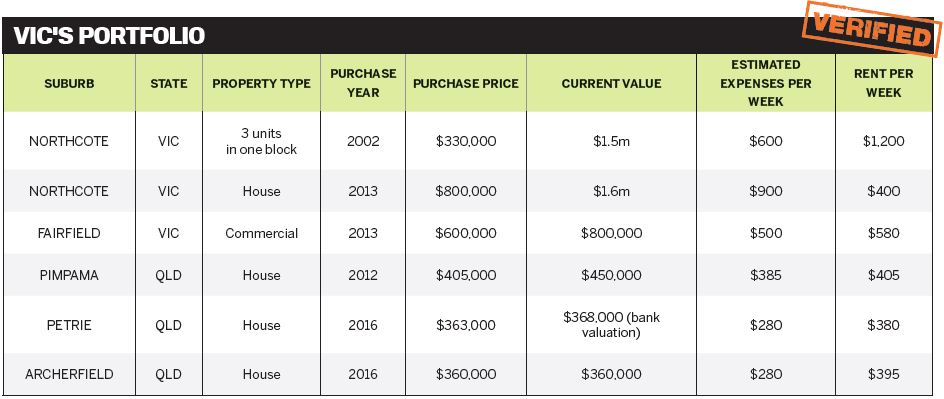

As far as property portfolios go, Vic Tang is sitting on a decent little nest egg. Vic turns 52 this year and he almost has more than enough wealth in his portfolio to comfortably retire.

His portfolio currently generates a positive cash flow of a little over $400 a week, and with around $2.5m in real estate wealth he could release enough equity to cover his lifestyle costs for many years if he desired.

“I sold … and used the proceeds to buy the Northcote home. I’ve sold and bought, when really, I should have bought and bought!”

However, Vic is not looking to leave the workforce in the near future. As the owner and operator of two gyms in Melbourne, Victor’s Gym and Fitnessland Gym, Vic is an experienced physical fitness trainer with more than 30 years in the game.

Health and fitness is as much of a passion as property, so Vic has no plans to stop working in his businesses any time soon. Rather, he invests in property with an eye on the future, and on the legacy that he and his wife want to pass on to their children.

“My kids are in their 20s. My daughter is a carer for disabled people and my son is a philosopher; he studies anthropology and knows all about politics and philosophy,” Vic says.

“When I pass away, they will get my properties. What they want to do with them is up to them!”

In the meantime, Vic has plenty of plans to continue making strides ahead with his real estate goals. His journey began almost three decades ago when he moved to Australia from Singapore in his early 20s.

“It was 1989 and I found a house in Clifton Hill, Victoria, on the market for $110,000,” he says.

“I bought it to live in, so it wasn’t an investment. But it should have been – I sold that many years ago, and I wish I’d held on to it!”

This, Vic admits, is the biggest lesson about property investing that he wished he had learnt earlier on.

After migrating to Melbourne, Vic worked hard to save up $50,000 to use as a property deposit. He had been working in the Army for a few years and was able to borrow 50% of the property’s cost from the bank.

A short while later, he got married and sold that house to buy his first family home in Fairfield in 1993, for which he paid $198,000.

“I then sold that for $450,000 in 2002 and used the proceeds to buy the Northcote home,” he says.

“I’ve sold and bought, when really, I should have bought and bought!”

“I bought it for $650,000 and sold it two years later for $720,000. That was a big mistake, as the very same property sold last year for $1.4m!”

Making peace with his property regrets

Many investors have the odd regret about the decisions they have made along the way, and for Vic, selling his assets is by far his biggest regret.

“Looking at those two houses that I sold back then, if I had held on to them I would have made a lot of money. In fact, I missed out on about $2m when I calculate what they are worth today,” he says.

“I also bought another house in 2009, in East Ivanhoe. I bought it for $650,000 and sold it two years later for $720,000. That was a big mistake as the very same property sold last year for $1.4m!”

While it can be hard to look past these lost profits, Vic has adopted a positive outlook and doesn’t wallow or worry about what could have been.

“It’s a very steep learning curve,” he says. “But I haven’t failed. They’re just lessons!”

They’re costly lessons, to be sure, and perhaps they represent decisions that Vic would have made differently if he had educated himself earlier in his property journey.

Although he has been buying, owning and developing property for almost 30 years, Vic admits that he only became serious about it in around 2012.

“That was when I started to use property as a way to grow wealth. I had purchased the house that I now live in, which I bought as a house and land package,” he says.

“As I was building it, I was thinking about the potential rental income it could generate, so when I built that house I made sure we included several extra bedrooms to rent out to students. The house was built purposefully to hold extra people, with five bedrooms and four bathrooms.”

When the home was complete, Vic and Jane advertised the spare bedrooms for rent to students, and they were able to attract tenants immediately.

At present they receive around $400 per week in rent, which they sink into the mortgage each week.

The situation has worked out perfectly, Vic says, as they’ve been able to generate a profit from their own home, which is usually a ‘dead’ debt.

“It’s my forever house,” he adds. “I’m not looking at buying a home in Toorak or anything like that! We’re happy here, especially while we can make a profit by renting out the extra space.”

Developing profits

Vic’s property journey to date has involved many different strategies, including a spell as a property developer back in 2002.

He hadn’t exactly bought the property with a view to developing it. But when he realised the potential of the project to positively impact his financial situation, it “just made sense”.

“At the time, I spent over $250,000 to subdivide the existing house and to rebuild it into three units,” he says.

“It wasn’t a big, heavy job; it wasn’t a huge demolish with big alterations. But it’s now three separate properties, and by spending $250,000 I added $35,000 per year to the rental income – not to mention the increase in capital value.”

Clearly, the positive experience gave Vic the confidence to tackle another development project, as soon afterwards he decided to develop his commercial property at Fairfield.

The property was the site of one of his gyms, which he wished to expand. He doubled its size by building up one level, growing the footprint from 140sqm to 240sqm.

“I spent around $100,000, but I almost doubled the floor area. Sometimes you don’t have to buy new property to make a profit; by adding value to your existing properties you can get a great return on your investment.”

From here, Vic may buy more properties, though he’s aware that his age means he’ll need to get his skates on if he wants to borrow any more funds from banks in the near future.

“My view is that if the bank wants to lend you money, you take it!” he laughs.

“They’re going to look at you and look at the house and say yes or no, and they’re taking a risk from their perspective. They wouldn’t just lend someone $1m without being pretty sure that the money was going to good use. I think the bank is cleverer than me, and if the bank has faith in you, then that’s a good sign! So if they look at the house I want to buy and they say, ‘Yes, it’s a goer’, then I better say yes, too.”

VIC’S CRITERIA FOR A SOLID INVESTMENT

• Suburb with a low vacancy rate (below 4% – ideally between 1% and 2%)

• Solid historical growth statistics for the area

• Suitable housing for target tenants. Remember, you don’t have to fall in love with the house

• Potential to add value (if you have the ability to renovate), OR

• Buy new to access good depreciation benefits

“By spending $250,000 I added $35,000 per year to the rental income – not to mention the increase in capital value”

While Vic has made some strong profits out of his Melbourne-based properties, he recognised that

in order to continue investing and to diversify his portfolio, he would need to look into more affordable markets.

This led to him investigating Southeast Queensland, where he has bought three properties since 2012.

“With the three properties I bought in Queensland, I’ve never seen them myself!” he says.

“There’s nothing emotional about investing in real estate, so I let the facts and figures lead me. I employ people to inspect the house to check for termites and faults. In terms of research, I look at the rental history, make sure the vacancy rates are below 4% – I usually aim for 1.5–2% – and that the property is near schools, transport and the CBD.”

“I bought the Queensland properties with subdivision plans in place,” he says.

“I always make my decisions based on the numbers. I don’t care if the house is green! It’s not my house.

“As a landlord I take the responsibility of upkeeping it, but my renters help me to pay the mortgage. I’m taking a risk that they didn’t want to take, and they get a roof over their head in return.”

Vic hopes to buy a couple more properties in the next few years, depending on how much access to equity he can leverage from his existing portfolio.

“I’ll stop buying when the bank refuses to lend me any more,” he jokes.

Advice for new investors

Do you have a goal of creating millions of dollars worth of property wealth for yourself, but you have no idea where to start? You’re not alone, Vic says.

“I think many young people have the opinion that ‘I can’t afford to buy property’ – but they can. They just have to know where to buy, and they have to understand that you don’t have to buy where you live,” he says.

“The most important thing to do is to learn about property investing and to then do something about it. I now look for things like low vacancy rates, and locations close to schools, shops and employment, but I didn’t know to look for all of this even five years ago.”

To get into the market, look for affordable opportunities in suburbs and cities outside of your immediate area. Just make sure you don’t fudge the numbers on your loan application in order to get a bigger home loan, Vic warns.

“Some people borrow money and they lie about their income so they can borrow more, but that can make sure you stretch yourself financially. Creative applications can get you into trouble!”