12/10/2015

12/10/2015But when she began investing in property in her early ’20s, she admits that like many people who are just starting out, “I didn’t know why I was investing or what my plan or goals were”.

“My goals today are to further increase my passive income from my property investments by purchasing in areas that have strong fundamentals. I have been able to achieve this by having a clear plan, but this wasn’t the case in the beginning!” she says.

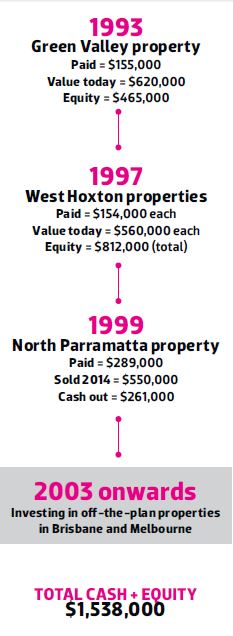

Her first property, which was originally her owner-occupied home, was purchased in 1993. Today, that four-bedroom home is one of her star investments, having quadrupled in value in 20 years.

But it was a rough start to property ownership, after she and her husband ran into finance issues at the outset.

“When buying our first property, our bank rejected our loan after telling us everything was good – they even told us no one else would ever give us a loan!” Ash explains.

“We went to another bank, and this other lender was happy to lend to us and even explained how we could utilise a 55-day interest-free credit card to help pay our loan off faster. This definitely allowed us to do this, so it was a blessing in disguise.”

She didn’t consider buying any further properties until 1997, when her dad encouraged her to consider investing.

“It’s a funny story actually; my father just turned up at my door one day with a real estate agent,” she says.

“Back in those days, the agent would drive you around and show you properties. My only research was going around in the agent’s car and inspecting some properties.”

Diving in head first

Driving around to get a sense of a neighbourhood’s good and bad areas is a far cry from the detailed analysis and research that investors can do today when reviewing the property market. But Ash believes the lack of resources available actually worked in her favour, as she was prompted to make proactive decisions without being overwhelmed by too much information.

“I was young and not aware of any risks, and looking back I believe that was probably a good thing,” she says.

“These days, a lot of investors overanalyse everything when they’re looking for the perfect investment property, and so they end up searching for months and even years without purchasing anything.”

That wasn’t the case for Ash. She drove around several suburbs of Western Sydney and eventually settled on a duplex pair in West Hoxton, around 40km from the CBD. She paid $154,000 for each three-bedroom duplex, a total of $308,000.

“I wasn’t even aware that people such as building inspectors and buyers’ agents existed, so I bought these properties without any checks or guidance,” Ash explains.

She did, however, use a property manager. Early on, she realised the value of having a property professional on her team so she could “take advantage of their expertise” and help manage her tenants day-to-day.

But over the years she’s experienced a number of challenging situations while renting out the duplex pair, including an incident with a gun.

“For some reason, one side of our duplex constantly had bad tenants. At one stage, the agent took them to the tribunal, but they did a runner. The next tenant actually found a gun in the roof! When they contacted me I told them to call the police,” Ash explains.

“We also had a situation where our property manager paid our rental income to someone else’s account, two months in a row. The important thing, though, is that we didn’t give up and sell when problems arose; we kept holding on to the properties despite the challenges. This is one of the reasons why most investors fail – they give up and sell – but you’ve got to work past the negativity and look at the bigger picture.”

Two years after acquiring the duplex pair, Ash bought a two-bedroom unit in North Parramatta for $289,000 – again purchased after driving around the area looking for investment opportunities. She sold that property in 2014 for $550,000, almost doubling her money.

Managing road bumps along the way

This was partly driven by her life stage – she and her husband were preoccupied with starting and raising their family – but it was also due to the financial challenges involved in managing their property portfolio.

“After our fourth property, we received a $7,000 land tax bill from the taxation office. Purchasing under joint names meant we only had one land tax threshold; if we could go back and do it differently, we would have bought properties in individual names rather than joint names, to try and avoid this,” she says.

“It was also challenging not selling or giving up, and not letting media hype get to us. If we were out there worrying every time the media reported that they expected property prices to come down, we might have sold everything five times over. Ultimately, investing does come with its challenges, but success is about not

giving up, and persevering.”

Unexpected land tax bills, negative naysayers, and the various issues they encountered with dodgy tenants and unprofessional property managers over the years put a lid on further investments in the interim.

It wasn’t until 2013 that Ash began realising how much she had achieved with property without really

planning it – which made her consider what could be possible if she took a more strategic approach.

“The one thing most investors get wrong, ourselves included, is not understanding why they are investing or what are they trying to achieve. Most people just buy a property, thinking ‘I need to buy something because everyone else is’, so they go out and buy a property that may not help them reach their goals,” she explains.

Despite all of its challenges, she adds, property investing has helped her create a lifestyle she’d never dreamed of.

“We purchased our first four properties while I was working at Centrelink as a customer service officer and my husband was working in a factory as a machine operator,” she says.

“Property has allowed him to buy into a business partnership. It allowed me to take two years off from Centrelink without pay, before I requested a voluntary redundancy after 20 years of service. If I didn’t have the passive income from my investment properties, I would never have been able to ask for a redundancy.”

Where to from here?

After taking an extended break frominvesting, Ash felt ready to invest again in 2013. However, by this time she had a brand-new strategy in mind.

“Now I am taking advantage of a buying off-the-plan strategy, which is getting in early and holding with only 10% deposit, and waiting while the property is being constructed. I am mitigating the risk with this strategy by making sure that all the key ingredients of a successful investment are in place,” Ash says.

“I’m also investing in areas where I believe the market is on the way up, based on the property cycle and where it is affordable, and where a yield of about 5% is making it much easier to hold.”

It was only two years ago that Ash found out about buyers’ agents and property groups, and she says the benefits of using these professional services “has been paramount in growing my portfolio”.

“It has allowed me to leverage their research, contacts and negotiation power to obtain great deals, and I’ve used them to help me acquire my next properties off the plan. They also gave me the confidence to invest interstate – without them I would not have gone interstate and would have missed out on great opportunities as a result,” she says.

Today, Ash has a robust property portfolio of established homes and new off-the-plan properties in the mix, and big plans for the future.

Vital Stats

“Hindsight is a wonderful thing; if I could go back in time, I would have identified a goal and put a plan in place to purchase properties regularly over the years. I would have purchased more properties, in areas closer to CBDs,” Ash explains.

“But you can’t go back in time, so now I am buying off-the-plan properties within 5km of the CBD in Brisbane and Melbourne, as I believe these locations have greater affordability and opportunities right now than Sydney.

I believe these states are on the way up in the property cycle and I know there will be a lot of infrastructure spending in these areas within the next five years.”

Ash has also written an e-book, The Six Figure Property Formula, which outlines the investing strategies she used to replace her income through property and retire.

“We are now able to do things like taking our children out of school for three months, and travel to Turkey regularly to see my husband’s family. If it weren’t for property investing, I believe I would still be sitting in my cubicle at my desk today.”

Top 5 tips for investors

If it works, stick with it.

My only strategy has been buying and holding. I like to compare this to the tortoise and the hare story, which proves that ‘slow and steady wins the race’.

Don’t listen to the naysayers.

Family and friends may try to help and provide advice and guidance; however, they are not experts. Sometimes, although well-meaning, they are the very people who stop us from achieving our dreams.

Follow the lead of other successful investors.

Seeking help from property investment experts can be invaluable. You can’t do it all on your own, so take advantage of their resources.

Save selling for your ‘last resort’.

Don’t ever sell unless it is your last resort or your exit strategy. You often hear the stories of ‘if only I had kept that one’. It doesn’t matter what or where you used to own; it is what you still own in 10 to 20 years’ time that counts.

Take action!

Don’t spend months or years researching the perfect investment property.

It’s called ‘analysis paralysis’ when people do so much research that they talk themselves out of great opportunities. By the time they realise what was possible, time has passed and the opportunities are gone.