Ben Handler has always seen property investing as a strategy for creating wealth. As the CEO of property buyer’s agency group Cohen Handler, he’s in the market every day and believes the tangibility of property over other asset classes makes it the ideal investment option.

Ben Handler has always seen property investing as a strategy for creating wealth. As the CEO of property buyer’s agency group Cohen Handler, he’s in the market every day and believes the tangibility of property over other asset classes makes it the ideal investment option. Make no mistakes about it: Ben is fully ready to play the real estate game with a long-term strategy in mind.

“Property investment is a very long-term strategy; it’s an area that requires patience – if you want the best return, you shouldn’t just buy and flip. My overall strategy is to hold. What this means is I intend to hold on to my investment properties for at least 15 years or more,” he explains.

“One of my investment strategies is to find properties that can be renovated to add value. Following that, I will revalue the property after three months. If the equity has increased, then I will use that to purchase again. But overall, when I look to invest I make sure I

Ben has been investing for seven years, but it’s the properties he has bought in the last two years that he’s most excited about. These are the blue-chip assets that will lay the foundation for his future retirement fund.

“Some people may be content with putting their money into saving accounts and waiting for it to grow, but I always had an objective to accumulate wealth through property. I’ve previously invested in shares and funds, but the most successful investments by far have been in property,” he says.

So where is he investing and why is he parking his investment dollars in these locations?

Starting in Sydney

Before purchasing anything, Ben carefully analyses the contributing factors in each location that he feels could indicate its future level of demand and market performance.

“Some people may be content with putting their money into saving accounts and waiting for it to grow, but I always had an objective to accumulate wealth through property”

In the case of his property in Summer Hill, in the inner west of Sydney, he settled on the suitability of the suburb as a rental hotspot based on demand for surrounding schools, among other things.

“It is an awesome suburb based on the surrounding schools that have serious waiting lists. It’s also close to transportation and is an area that has no pending developments and will never be overdeveloped,” he says.

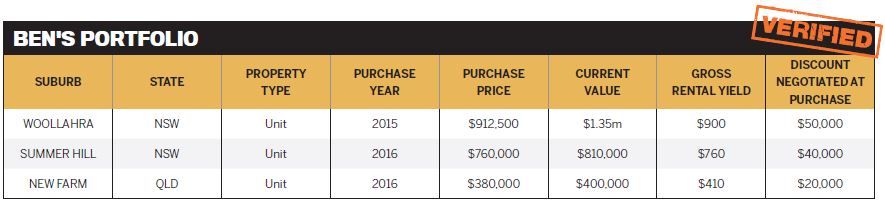

He paid $760,000 for his Summer Hill investment property earlier this year, which quickly found a tenant paying $760 per week.

Similarly, he looked into possible out-of-the-box game changers before investing in Woollahra.

“Woollahra is a beautiful sought-out area with no developments going on, and is close to good public transportation,” Ben says.

Here, he paid just over $900,000 for a home that is renting for $900 per week, and which has enjoyed immediate capital growth.

Further afield in Sydney’s west, Ben investigated the commercial market a few years ago in consultation with a family member, who was seeking a long-term place to park their business.

“I made a commercial retail investment for someone in my family who I knew would be a long-term tenant,” he says.

“I saw the potential of Mt Druitt as an area – we are currently seeing a lot of development of residential apartments, which will soon be in high demand due to its proximity to Parramatta. As you can see, my current property portfolio is quite diversified.”

Leveraging local expertise

With quite a few Sydney investments in his portfolio, Ben’s next move was to look to the Sunshine State for investing opportunities.

While experience has taught him a few trusted moves to make before committing to a property, Ben also doesn’t shy away from working with the experts to get the best possible result.

He is careful to only buy properties with the aforementioned features, as he believes these “good bones and foundations” will earn him the greatest future profits.

But even though he’s a successful buyer’s agent with plenty of access to information at his fingertips, Ben was more than happy to use a buyer’s agent himself when investing in the Brisbane market, as it was an area that was unfamiliar to him.

He has only recently turned his attention to Brisbane, following the advice and expertise of his employee Jordan Navybox, head of Cohen Handler’s Brisbane office. Jordan guided him on his purchase of an apartment in New Farm, Brisbane’s equivalent of Potts Point.

“Based on his research, the area was great for renting and there would be no problems finding a tenant. This advice was extremely accurate as I managed to rent out the apartment three days after I purchased it. The apartment was purchased off-market, and we managed to get a great deal due to Jordan’s strong relationship with the agent looking after the property,” Ben says.

It turns out that the costs of marketing and advertising dissuaded the vendor from officially putting the apartment on the market, which allowed Ben to capitalise on timing.

“I ended up paying the same price that the vendor paid three to four years ago,” he says.

“Without Jordan, I would not have been able to find and purchase my Brisbane investment at such a good price. Many of Cohen Handler’s employees engage with each other, especially when looking interstate, when they’re looking to invest or purchase a place to settle down in.”

This particular property was on the market for $400,000, but Ben and Jordan were able to negotiate a discount down to $380,000. It instantly rented for $410 per week.

“The key to successfully buying and investing in property is all about the right timing, but it’s not always possible to watch every single market in Australia. That’s where buyers’ agents come in: they are the local experts in that area or state and will be able to provide the necessary insights,” Ben adds.

Following this experience, Ben says he sees huge potential for Brisbane’s property market in the near future.

“It’s very favourable, with a lot of room to grow,” Ben says of the broader Brisbane property market.

“There is a lot of opportunity for capital growth and there’s very good yield to be earned, with apartments returning 5% and more. For investors that want to diversify and branch away from the overpriced Sydney, Brisbane is the place to look to.”

3 LITTLE-KNOWN FACTS ABOUT BEN

• I am a certified yoga teacher.

• I start every morning with a freezing cold shower.

• I do a 30-second headstand in the morning before I kick off the day.