When Craig Merrett was in his early 20s his property investment journey transpired out of both obligation and an ambitious personal choice. When Craig’s father and stepmother got married, Craig was informed that he had just 12 months before he had to move out. At the time he had next to zero savings and was a full-time student who wasn’t working anywhere close to full-time hours.

It was then that Craig set himself a monumental goal. Not content with just being able to afford to leave home, Craig went a step further and decided to buy a property. But in order to do this, he was forced to sacrifice the short term for the long term.

“I was at an age where my peers were quite frivolous with money and would go out on the town every Saturday night,” says Craig.

“There is a lot of peer pressure to have immediate gratification, so it took a fair bit of willpower to distance myself from that.”

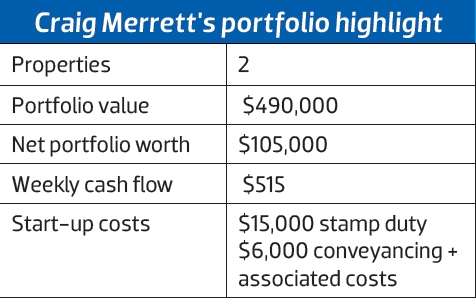

Craig was earning just $35,000, of which a very large chunk went straight into his savings. Within a year he had saved $20,000 for the necessary deposit by putting $400 aside every week.

Not only was he able to buy a unit, but he has since done so well that he aspires to own 10 properties and have an early retirement.

Research

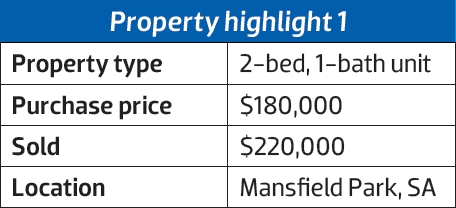

Craig says the biggest mistake of his investing journey so far was not doing enough research into buying his first property at Mansfield Park.

Despite purchasing in an area that was affordable and about 8km from the Adelaide CBD, the suburb turned out to have socio-economic problems, including prostitution and drug use.

“There was a main strip literally around the corner from my house which was very popular for prostitution, and there’s that in itself but also all the characters that activity attracts.”

Although he checked the area out thoroughly during the daytime, it was at night and on the weekend when the problems were really evident. Looking back, Craig wishes he had investigated the area when the sun was down and chatted to locals to discover that information which was not available online.

Finance

As Craig was self-employed and not earning much money, he went for a low-doc loan. However, one problem he encountered was in arranging his finances, as there was a time delay after he put an offer in.

He had pre-approval, but in the process of getting full approval it was taking a long time to get the required data.

“It almost came down to the hour and my broker at one point actually had to drive into the city to drop off some documents to save eight days’ postage time. That was how fine we cut it,” he says.

For Craig’s first purchase, he paid a $20,000 deposit (10%).

Performance

In addition to the socio-economic problems of the area, the Mansfield Park property was also not seeing capital growth.

“And this was the time when I was really getting interested in property so I was keeping a very close eye on what similar properties were doing in the area. There was no growth; it was actually going backwards a bit,” he says.

Therefore Craig decided to sell and upsize in 2012. When he attended the final strata meeting he was surprised to find that, in a complex of 14, there were only three people at the meeting: himself, the body corporate representative, and another gentleman.

When Craig asked where everyone was the response he got was, “Everybody’s here!” It was then that Craig realised the other guy owned the other 13 properties and had even made some of those purchases in the past year.

How Craig made $40,000 in two minutes

One day when he saw the other owner in the car park, Craig took a punt that if the gentleman had the other 13 units he would definitely be interested in the final piece of puzzle. Indeed, this would mean he would have sole ownership of the complex and the flexibility to change the title if he so desired.

“I’m not one to go and approach people, and it actually took me a bit of gathering myself emotionally to do that,” says Craig.

When Craig finally approached the other owner to see if he was interested in buying, the man was gobsmacked, to say the least.

“His face dropped and I knew I could basically name my price,” says Craig.

“From literally this two-minute conversation I was able to save much of the emotional hassle of the selling process, and I sold it for about $40,000 over the market value of the unit at the time.”

Additionally, Craig was able to make further savings in associates fees and the costs of selling the property.

“Not having to interview agents, keep my place super clean and presentable and worry about inspections and all the other costs involved was a huge relief,” he says.

Even though Craig acknowledges that this scenario was fortunate for him, he says it just goes to show what investors can achieve by thinking differently and being bold in asking questions or creating arrangements.

“With this $40,000 and existing savings I had built up I was able to purchase a comfortable property and avoided lenders mortgage insurance [LMI] by putting down a 20% deposit,” adds Craig.

“Forty thousand dollars for two minutes’ work wasn’t too bad.”

Research

Now that Craig had the extra cash from the Mansfield Park property, he had more money to play with for a more desirable property.

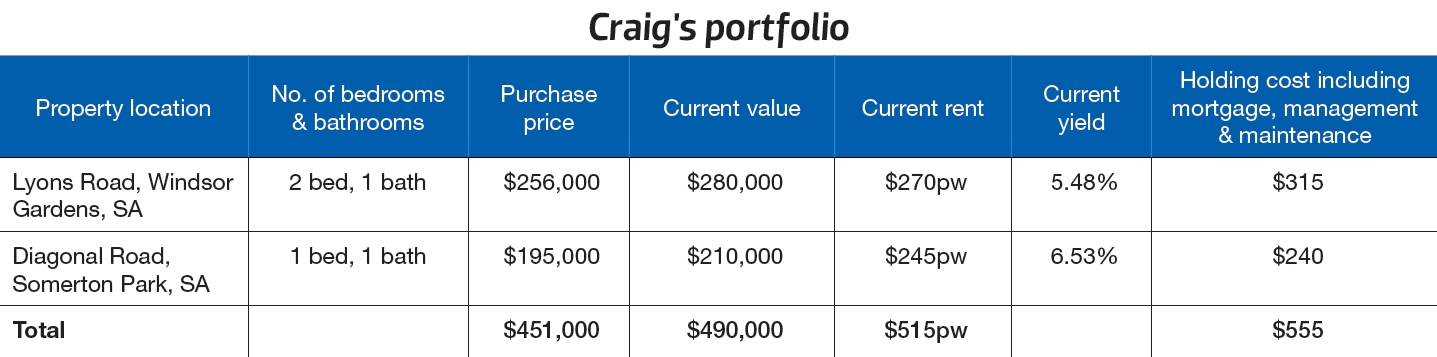

Craig turned to his father for advice, who himself had an investment property near where Craig was looking in Windsor Gardens, one of the northeastern suburbs of Adelaide.

Craig knew he wanted an area that was family-friendly, with good schools, local shops, public transport and proximity to the CBD.

“I like to consider Windsor Gardens a bit of a ‘sleeper’ suburb. It’s family-friendly, close to amenities and in general a good central suburb,” says Craig.

The features of the property that appealed to Craig included a rainwater tank, ample parking, solar panels, a shed, outdoor entertaining, built-in wardrobes, a storage room and an unusually large backyard. These were the kinds of features Craig believed would attract a young family.

Finance

Thanks to the profit gained on Craig’s previous purchase, he was able to afford a deposit of $52,000 (approximately 20%). This enabled him to avoid paying LMI. He ended up opting for a 5.18% interest rate with ANZ Bank, at a loan-to-value ratio (LVR) of 67%.

“ANZ are accepting of self-employed applicants. Additionally, they offered the flexibility to make repayments,” says Craig.

Craig now pays $850 in interest costs per month.

Performance

Craig has found Windsor Gardens to be an area that’s benefiting from being in transition.

“New houses and subdivisions are popping up almost by the day,” says Craig. “People are realising it’s a great area just 15 minutes from the city.”

His strategy for this property is to hold it for the coming years, as he believes it will experience a good rate of growth.

The property also has good renovation potential, and Craig believes there’s opportunity to add further value through landscaping and work on the kitchen.

- Be frugal for future gain. In what I call my “year of sacrifice”, there was no hitting the town on Saturday nights and no fast cars. I was just putting every dollar possible aside for the first purchase.

- Set up a contract or arrangement with your parents that says that if you put every cent away for your property they will waive board; alternatively, have them collect board and put all or part aside as a ‘first home fund’.

- Think differently and be bold in asking questions or creating arrangements. Thirty seconds of being uncomfortable could be worth three months of income.

- I would strongly recommend personally visiting areas of prospective purchases and spending time there at night and on the weekend, as well as having a good talk with the neighbours and local residents about the good and bad features of the area.

- They say it’s never too late to start, and I also believe you can’t start too early. Who’s to say the school years are too early to have a part-time job and look into guarantor loans or joint ventures with trusted family members?

- I think it can be useful to separate personal emotion from property and look at it as a business transaction. A house I would personally choose not to live in is not necessarily unattractive to the majority or not a great investment.

Research

In South Australia there are areas known as the “between city and sea” suburbs that range from Semaphore to Brighton and Adelaide.

Since these suburbs are generally between five and 20 minutes from the city and beach, they are commonly viewed as very sound investment areas, says Craig.

One such suburb is Somerton Park, which suited Craig’s borrowing capacity and was in an area that was ripe for continued growth and high rental demand.

“I asked some friends in the eastern states, and they are always astonished at the prices you can get for almost-seaside property over here. I mean, the beaches are really nice,” says Craig.

The one-bedroom, one-bathroom unit that Craig found was everything he had hoped for in terms of price, location and amenities.

“I was pleased that it was close to public transport, with direct access to the city, and a stroll away from the popular Jetty Road shopping precinct and Glenelg foreshore,” adds Craig.

“Most research was conducted through general knowledge of years of researching South Australian property and using online data to research minimum prices, etc. I took a long look at what similar properties were doing in the area and felt it was a great buy.”

Finance

At this point Craig wanted to put in the least amount of money possible, which turned out to be a $5,000 deposit. The LVR was 100% and he again elected to stick with ANZ, this time at a 5.18% interest rate. He currently pays $880 interest each month.

“Being with ANZ for other loans, it was a simple process to go with them again,” says Craig.

Performance

Craig has been very happy with this property so far, particularly with the low maintenance required for a location attractive to singles or couples who enjoy the beach lifestyle.

“Somerton Park has a great reputation as a suburb. I felt the property was undervalued and it gained instant equity,” says Craig.

“Additionally, I feel entry-level properties are only going to increase in demand,” he says.

He believes he will hold on to this suburb for a long time, particularly due to the great location, the future demand for affordable accommodation, and potential for a great rental return down the track. The rental yield is already a healthy 6.53%.

The next steps

Aside from investing, Craig is also passionate about entrepreneurialism. He has been self-employed since he was out of high school and is involved in a few business ventures at the moment.

“I see entrepreneurialism as something that allows me to create and let out my abilities, and in some ways it kind of ties in with property as well,” says Craig.

“What I am passionate about is actually leveraging my property as well as my business to not be trading dollars for hours but to actually have my assets working for me.”

Over the next 20 years Craig hopes to accumulate a portfolio with 10 properties by buying one every 12 to 18 months.

He also hopes to retire early so he will be able to have time to spend with family.

For now, Craig hopes he can encourage other people on low incomes to start preserving their hard-earned money.

“Make those sacrifices and just remember that from small things big things grow – $20 a week is $1,000 a year,” adds Craig.

“It’s funny how those little things can really add up. And then from that place you can leverage yourself into great things.”