Making a life in a new country can be extremely hard for migrants. It is even harder for refugees who, due to the enforced nature of their circumstances, usually have to try to rebuild their existence from scratch, starting with nothing.

Parsu Sharma Luital is a shining example of what a struggling migrant, or even a refugee, can achieve with clear goals, hard work, determination and a belief in the need to make the most of opportunities on offer.

Originally from Bhutan, Parsu is of Nepalese origin. He moved to Australia in 2002 to study for a master’s degree in horticulture. Several years after his arrival, on the advice of university staff, he sought asylum to escape unrest and civil disorder in Bhutan, which had left many of Nepalese origin, including his parents, stateless.

While Parsu was never in a refugee camp himself, his parents spent many years in camps. His family lost everything they had in Bhutan, including their land, and his father was imprisoned for activism.

These experiences left Parsu with a deep-seated desire to build a better life for his young family and to win back what his family had lost. They also gave him a profound appreciation of Australian society and the opportunities it contained. This in turn prompted his interest in property. Melbourne-based Parsu became an Australian citizen in 2008. But, while he had refugee status, between 2006 and 2008 his working capability was limited. Effectively only able to work part-time, he took on casual jobs where he could, and devoted much time to volunteering.

From a financial point of view, it wasn’t the best of starts for his journey into property investment, he says. Yet, with some spectacular scrimping and saving, he managed to purchase a home for his family in 2006.

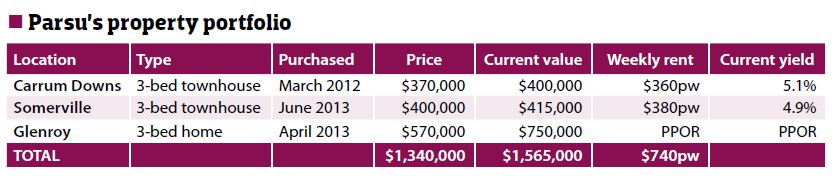

In the years since, he has purchased two investment properties and upgraded his family home. He now has a portfolio worth $1.5m, which he is looking to add to in the near future.

Building on a strong start

Parsu’s move into property investment was prompted by a cultural belief. The elders in his culture have a traditional saying that two things in life never lose their value: gold and property. “So when it came down to it – and I couldn’t afford to buy gold – property seemed like the best investment option available to me,” the father of four says.

By 2012 the family home, which he had bought with a 90% first home buyer’s loan and a saved deposit of about $30,000, had accumulated a fair bit of value. The Glenroy house originally cost $280,000 but, by the time he sold it last year, it was worth $405,000.

It was this growth in value that enabled him to take the first step on his investment journey. He drew down equity in his home to get a 20% deposit to use for purchasing his next

property.

Parsu’s first investment property, in Carrum Downs at the base of the Mornington Peninsula, cost $370,000. Just over a year later, he was able to draw on the equity in that property to make his next purchase. His second investment property was in Somerville, also on the Mornington Peninsula, and cost $400,000.

These properties are now paying their way in terms of returns, he says. “They are also experiencing rapid growth. Because their value has gone up pretty quickly, I feel I have gained an [investment] edge.”

As a result of his improved financial security, he also upgraded his family home in 2013. After selling his original home for a comfortable profit, he bought a bigger and better house in the same suburb for $570,000. It has subsequently recorded considerable growth in value.

Strategic partnership

Alongside the growth of his portfolio, Parsu has also been building his career (as a new and emerging communities liaison officer for the Victorian police) and maintaining a heavy schedule of volunteer work.

While his volunteer work with refugees and migrants led to him receiving the inaugural New Australian of the Year award this year, it means he is extremely time-poor.

For this reason partnerships are the key to his success, he says. Not only does he have the support of his wife and children, but he maintains a close working relationship with his property advisor, Grant Henschke.

When Parsu made the decision to invest in property, one of his concerns was his lack of time. He was worried that he would simply not be able to put in the necessary research and management work to successfully build a portfolio. With this in mind he approached Buy Property Direct, a company he had heard about and

liked the sound of.

The fact that the company oversaw and managed all aspects of the property process was of particular appeal to him. When he was introduced to Grant, the two realised they shared certain sensibilities.

“I see a lot of positive opportunities and a good market in Australia. And I believe it is important to take a risk and grab those opportunities rather than live in fear. Grant is much the same, which is probably why we work well together.”

Although he makes his own investment decisions, Parsu takes Grant’s advice to heart. Grant knows his requirements, he says. “For example, he is well aware that I am interested in low-risk, low-cost investments which maximise my returns – and that, due to my lack of time, I only want hands-off properties in my portfolio.”

Maximising options

Together, Parsu and Grant have established a set of investment tactics and criteria to work from when looking at property.

To date, he has bought off the plan in developments, rather than buying build-complete properties. There are two reasons for this. One is that it has enabled him to save on stamp duty, which means there is a significantly lower entry cost. The other is that it allows him to maximise the tax deductions and rebates available to him, which also helps with his hold costs.

Then they look for a property that fits a “sweet spot” between price point, rental yield and growth, Parsu explains. So, rather than buying an existing property in Port Melbourne for $800,000, paying a further $43,000 in stamp duty, and earning just $500 a week in rent with growth of 3–4% p.a., he will buy a property for half that price which delivers better yield, rate of return and deprecation benefits.

His Carrum Downs property is a good example of this. It cost $370,000, earns $360 per week in rent, has a yield of 5.1% and a history of growth of 7.7%. “So half the risk, twice the return,” he says. Buying his properties at a lower price point meant Parsu was able to buy two lower-priced townhouses in different areas rather than just one property in the city. This allowed him to spread the risk somewhat. For example, if a tenant vacancy means he has to cover a mortgage for a month, it is not such a big deal because the price point is much lower.

Overall, his aim is to maximise his money, keeping in mind his attitude to risk and his goals of what he wants to achieve. He wants to buy as much property as possible and take some risk but not unnecessary risk, so that in 10 to 15 years he will be well placed, he says.

In terms of property selection, Parsu relies on Grant and the comprehensive suburb homework done by the team at Buy Property Direct. They look at an area’s history of growth, at current and future growth stimulus points (like new infrastructure), at the area’s amenities, and at other stock in the area.

He feels comfortable with their model, as they take a large commercial risk by purchasing the land and then building the properties themselves. “The fact they underwrite the projects means they are putting their money where their mouth is,” he says. In this sense, both Carrum Downs and Somerville – where Parsu’s properties are located – tick all the right boxes. They both have a history of almost 8% growth over 10 years, new infrastructure which provides current stimulus, and upcoming development which provides future stimulus. There are good amenities in both areas.

These are all good drivers for growth, Parsu says. “They are also good rental triggers. Also, the fact that much of the existing stock in the area is older means tenants are happy to pay more for new stock in a better location.”

Understanding risk

Parsu’s personal history means he has developed a particularly pragmatic approach to taking risks. In Bhutan, his family originally owned a substantial amount of property, which they leased out for share cropping. They lost it all and ended up as refugees with nothing to their name. This experience showed him that, in life, it is not possible to know what is going to happen next, he says. “So you have to seize the opportunities that come your way. What is the worst that can happen?

In this country, probably the worst scenario is bankruptcy. But in other countries much worse things can happen to you. It is this which gives me the courage to take risks and invest.” Parsu has taken risks in buying the properties he has bought, and those risks have paid off, in terms of rental appreciation and growth. However, he adopts a vigorous approach to risk management on the properties he now holds.

For example, his exit strategy is two-pronged. Both his investment properties are in areas that appeal to a range of potential buyers rather than just fellow investors, which should make them easier to sell quickly if he needs to do so. He also has a plan in place whereby he could borrow six months’ worth of mortgage instalments by borrowing one month’s worth from six different friends. This would cover him until he was able to sell his property and recoup any losses.

Some of Parsu’s other risk management strategies include using two lenders, maintaining all necessary insurance, including landlord’s insurance, and remaining in an

ongoing dialogue with his brokers on the subject of interest rates.

Future directions

Realising the incentives and opportunities that are on offer to all those wanting to achieve the great Australian dream was a light-bulb moment for Parsu. It is a very different system to where he comes from and has enabled him to set about building a better life for himself and his family. The same would apply to many migrants if they were given the chance, he says. “Migrants don’t want charity or handouts. They want opportunities, especially employment opportunities.”

In the future, Parsu hopes to invest in more properties. His investments already help him to pay the bills and maintain a good standard of living. He hopes that further investments will support his goal to move into political work. “Political and community work is a way of helping people less fortunate than me. I want to contribute to Australian society and help people who are vulnerable and suffering.”