An investment history spanning three countries and two continents has given Sue and Anthony Hardwick a unique perspective of the property world. After 30 years of hard work, determination and a leap of faith, this property-mad couple can finally sit back, relax and reap the fruits of their labour.

Been travelling recently? Well, how does this sound for a globetrotting experience? Eight weeks wandering listlessly around the USA, Mexico and Canada. Three weeks visiting friends and family in the UK. And a month exploring South Africa and Zimbabwe, all topped off with attending a son’s marriage on a game farm in Namibia.

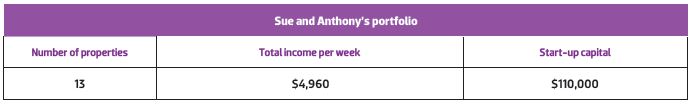

This is how Sue and Anthony Hardwick have been spending their time of late. Anthony has no plans of going back to his stressful job as CFO of a listed company, and Sue is doingwhat she loves. Financial freedom is a very real thing for the Hardwicks. To be honest, it’s difficult to imagine how life could possibly get any better for the hard-working and dedicated couple. Well, perhaps owning a portfolio of 13 properties generating a yearly income of over $257,900 also helps.

IN THE BEGINNING

Sue and Anthony are the kind of people who really understand the value of property. Living throughout southern Africa during a time of immense social upheaval, they have witnessed the dire results of losing property first-hand.

“For years we were thinking we should move, move, move, but we’re very close to our family,” Sue says.

“[The government] had been taking the farms away from the farmers in Zimbabwe for quite a while. Finally, my dad and my two brothers had their farms taken. This wasn’t just their farms and equipment; they actually had to pay severance packages to people. So they were literally left with nothing.”

Seeking a brighter future for their children, Sue and Anthony made the decision to take the plunge into Australia’s calmer waters.

“We really didn’t see a future for our children there,” Anthony says. “We wanted to be in a place where we might keep our children near us, whereas in Africa they would probably get an education, then be off. We did it for our children really, but in hindsight it was just an amazing decision for ourselves as well.”

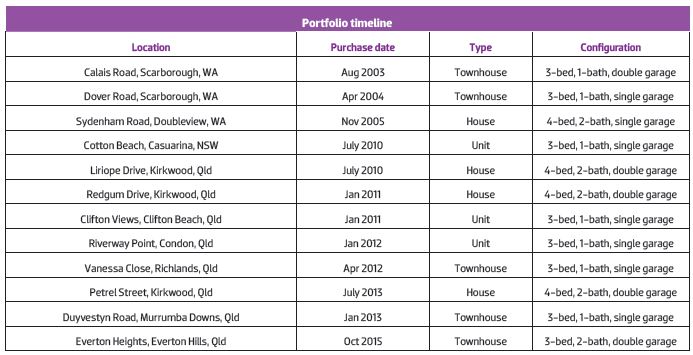

With one eye on Perth and another on a prosperous future, Sue and Anthony left Africa in 2003 with investment plans on their mind. The Hardwicks’ property-hungry ambitions, along with opportunities that arose through Anthony’s career as a CFO, had already provided the couple with a flourishing portfolio.

“We had been successful in all our previous property transactions, so it wasn’t a new game for us,” Anthony says.

Three houses in Namibia and South Africa had provided Sue and Anthony with some vital background knowledge on how to negotiate the property market. However, translating this success to a different continent was not to be an easy process.

“When we left Africa we decided that the forecast for the rand didn’t look that good,” Anthony says.

“We took a decision to liquidate all of our assets and bring the money over to Australia. It sounds like it should have been a lot of money, but it wasn’t. Basically at that stage you would get one Australian dollar for every seven rand, so in 2003 that didn’t get you a whole lot.”

Renting in Perth and with four children to look after, Sue and Anthony wanted to get back into property investment. They couldn’t afford a house in the area they wanted, so an investment property was the ideal solution. The market at the time was just beginning to heat up, and with$110,000 available for a deposit it should have been easy. It wasn’t.

Anthony was unemployed at the time and the banks simply wouldn’t have anything to do with them.

“We didn’t have a credit rating,” Sue says. “We couldn’t get a cheque book; we couldn’t get a credit card, even though we had some money in the bank.”

Things were still difficult even when Anthony began a six-month contract as a CFO.

“I’m a professional, I’m a chartered accountant, I’ve got a CV working for international corporations, we had some cash behind us, and literally I couldn’t get a credit card,” he says.

“I was doing a bit of international travel for the company and eventually I had to get the CEO to write a letter to the bank saying I needed one for work purposes. It was crazy.”

Eventually the Hardwicks came across a broker who was able to sort out a loan through the Home Building Society. They were finally able to get a foot in the door with their first property at Scarborough Beach. Six months later a second property was purchased just down the road. Finally, the banks began to wake up, and two years later came the family home in which the Hardwicks are still living today.

Sue and Anthony had finally gained the traction they needed to develop a portfolio. However, this was not to be the last obstacle they faced.

JUMPING THE HURDLES

After purchasing their home the Hardwicks hit a wall.

“That’s when the whole investment practice stalled,” Anthony says.

“While the two that we bought were doing well from a capital view, they were older ones and the rents weren’t so good. From a cash flow point of view they weren’t that flash, but from a capital gains view they were great.”

The strain of owning two negatively geared properties plus a house that required significant maintenance severely dampened the couple’s efforts.

“It was quite tight, but we were on the same page and we went very hard on property. But we sort of stalled because of the non-deductibility on our house. You want to fix things up and of course you want to spend a bit more money because it’s your own home and not a rental.”

This was how the situation remained for several years until a chance meeting with Rocket Property Group founder Ian Hosking Richards. After attending a conference in Sydney where Richards was a side speaker, the couple arranged a meeting at the airport before jetting off home to Perth.

“We met him at the airport and we had a chat. Basically, on the spot we bought two properties,” Anthony says.

With some useful insight and guidance, the Hardwicks developed an entirely different view of the property market.

“We really got stuck in at that stage, and as soon as one sale closed we got into the next one. We bought about nine properties in five years. We got our final investments in place in 2013 and then said, ‘Right. We’re stopping now; we’ve got enough. It’s time to enter our consolidation stage’.”

HOW THEY DID IT

A key factor that allowed Sue and Anthony to develop such an aggressive acquisition approach was the application of a low-risk, set-and-forget strategy. “We would buy new, either off-the-plan or house and land packages, and intend to hold those properties in the very long term, ie never sell them even in retirement.

“You buy new in areas that are going to give good capital growth and are going to have a good tenant base. It’s set and forget. So, basically, you buy it and forget about it, then 30 years later it’s worth a fortune.”

This strategy worked so well because buying new allowed the Hardwicks to save on unexpected costs.

“If you’re going to hold a property for 30 years, you wouldn’t want to buy one that’s 10 years old. At some stage there’s going to be a need for maintenance,” Anthony says.

“If you’re going hard for investments, cash flow is very, very important, and you don’t want any surprises. With an old house you could move in there, work out the cash flows, and the first thing that happens is the geyser blows, then the electrics go, and then suddenly you’ve got surprise expenditure.”

Sue says buying new houses over old is also a much better option in regard to finding stable tenants.

“You’re getting a premium because tenants are wanting to be in a new property and will pay more,” she says.

“It took us eight years for our first two properties to become cash flow positive that we bought in Perth. Whereas the others we bought were cash flow positive from day one. It wasn’t draining our funds, so we could get into the next property as soon as we had the serviceability.”

Another important part of the Hardwicks strategy was to diversify their banks. Acquiring loans from different banks made it much easier to free up some of the equity in their investments. This in turn allowed a more liquid approach to financing.

“Basically, what the philosophy is when you go for a new property is you go to another bank and get the best you can get out of them,” Anthony says.

“You use the equity in your existing property to get the deposit, so you broaden your line of credit from your existing property. You get a fresh loan from a fresh bank and because it’s a fresh loan it’s self-standing. The banks don’t ask for a guarantee from another property because they don’t know you have them. So you can start buying all these properties stand-alone, whereas if you’re with one bank they know about all the other properties.”

WHERE TO NOW?

In 2013 the Hardwicks got their final investments in place and entered their “consolidation phase”. However, looking back on their property investment history, Sue and Anthony admit that in some cases they should have done things differently. While they are still living in their family home to this day, perhaps buying their own home so early on was not the best option.

“We have actually done well capital growth wise from this and used the equity to buy further investment properties,” Anthony says. “However, it really stalled our investment strategy because we had a lot of capital tied up in a non-income-producing asset.”

Anthony also believes that in the beginning they focused too much on investing locally when they should have been looking outwards.

“We probably had a lucky escape from this lesson, though, as our first two investment properties in Perth have done well from a capital growth point of view as WA was booming. Also, rental returns in Perth have been traditionally very poor compared to other parts of Australia. A national perspective is imperative when you buy investment properties.”

While previous mistakes may have made property investment difficult, Sue and Anthony are now using their expertise to help others. In 2011 Sue became a property advisor for WA, working under the Rocket Property Group umbrella. As Anthony has no intentions of going back to work, he focuses on supporting Sue as the main business driver.

“We want to help people,” Sue says. “When we came into the country our money literally got divided, and starting all over again was a real challenge. Coming from Africa we’ve never had a welfare system, so for us we had to get somewhere so we could have something to live on for retirement. I just love showing people that there is a way to become financially independent after making that big move.”

Having significantly more spare time on their hands, the Hardwicks have been opened up to the opportunity to do what they love.

“We have been looking forward to helping people in the property area become successful while our investments grow and we really enjoy the fruits of our hard labour to get to this point,” Anthony says.

“Our time will involve family primarily, but also international travel; we’ve got the travel bug, I think."