By the time she was in her mid-20s, Jie Chen looked like she had her life fairly well sorted out.

Living in her native China, Jie was married and had completed her studies in mechanical engineering before stepping out and starting a successful logistics company.

In 1998, with those achievements under her belt at the age of 25, Jie and her then-husband decided to make

the move to Australia in search of a better life.

At the time it seemed like a smart decision for the pair, but ultimately Jie was left in perilous state, as she ended up almost broke and alone in a far-flung country.

“The first few years in Australia were difficult ones. I worked two jobs and studied IT while my first husband studied accounting full-time. All the while, my husband insisted on investing our life savings in the Chinese share market via a friend,” Jie says.

“Three years later, our life savings were gone, despite several vain attempts at recovery. I gave birth to a baby girl and suffered a marriage breakdown. My first husband took what money was left – leaving me nothing.”

Starting again after divorce

The breakdown in her marriage meant that at 28 Jie was left with just a few dollars to her name and a young child to look after on her own.

Despite the circumstances, she tried to stick with her plan of making a life for herself in Australia, but she was forced to make a tough decision.

“At 28, I was a divorced single mum with $20. I sent my baby to day care and worked full-time. Then I decided to go back to China in 2003,” she says.

Jie’s decision to move back to China proved to be a smart one, especially from a timing standpoint, as she found herself in Shanghai just as property prices in the Asian superpower began to take off.

Not wanting to see prices move out of her reach, Jie acted quickly and bought in the city, which ultimately led to her returning to Australia and embarking on her property investment journey.

“The lesson I learned is that long-term investment should be your goal”

Jie’s first purchase was a two-bedroom apartment in Shanghai for the equivalent of A$140,000.In 2005 Jie made the decision to try her luck in Australia again and sold the apartment for $200,000 to fund her move. With some funds left over after the sale, Jie looked replace her Shanghai apartment with one in her adopted home country.

“I purchased a two-bedroom flat in Kogarah, Sydney, for $265,000. The property, which was built in the 1970s, was in bad need of renovation,” she says.

“I worked hard to pay the monthly mortgage, and renovated, including installing a new timber floor, painting and redoing the bathroom.”

Making her own luck in the lucky country

Jie’s decision to buy in Kogarah, as well as putting in the hard yards to improve the property’s condition, has paid off; it is now valued at $685,000 and is being rented for $410 per week.

Despite already overcoming financial heartache after her first husband’s dalliances with the Chinese share market proved disastrous, Jie was not put off the idea of investing but opted for a bricks-and-mortar approach to wealth creation.

“After losing my life savings, I see property as a more reliable investment. I have seen family friends lose money in shares too,” she says.

“I believe property investment can bring better returns with easier entry points compared with alternative investment options. I am a logical person and I believe that property is a steady investment, one that brings long-term wealth.”

Committed to making her second venture to Australia work, Jie returned to a full-time job in the logistics sector and began working her way up the chain of command to help fund her new-found desire to build wealth through property.

Again, the lessons learned from her first husband’s financial misadventures stuck with her, and she made sure she was equipped with the necessary knowledge to forge a successful investment path.

“I was working for a large company as a planning analyst, and the skill required of an analyst is somewhat similar to that needed for analysing property investment. While working full-time, I spent what little leisure time I had reading self-education books about property and tax,” she says.

“In the years that followed, I used the equity of the Kogarah apartment to buy a house in Castle Hill. Then I used the equity of the house to buy an apartment together with my current husband. Then we purchased a duplex house in Queensland.”

• Stay poker-faced.

Never show that you’re too eager to bid on a property. Let real estate agents call you. Know the property’s problems and point them out to the agent so you have negotiation power.

• Renovation is not necessary to improve property value.

Buying and selling at the right time and in the right location improves value. If you are not a good DIY renovator, don’t attempt it. If you buy a newer property at the right time instead, you can benefit from capital gain, negative gearing and good rental returns.

• Don't set and forget your mortgage.

Actively check your mortgage and look to refinance so you can use equity to create more wealth.

• Stick to your budget.

If you are young and just starting out, buy a property that you can afford and rent it out. When the property value increases, you will be able to afford a better lifestyle.

• Above all, location is the key.

Do your research or have an investment consultant help you find the right location.

The plan pays off

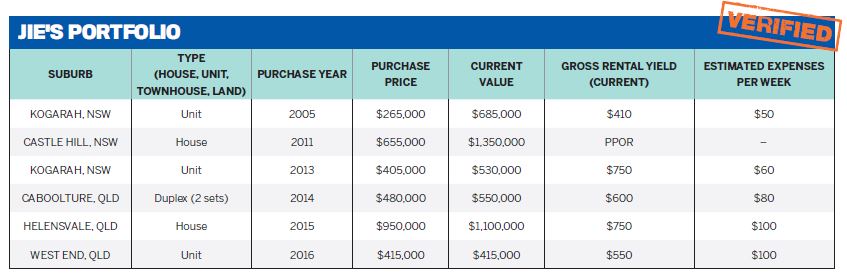

Using that buy-and-hold strategy, Jie has now amassed a portfolio consisting of six properties with a combined value of $3.4m.

As part of her strategy, Jie has also targeted properties at the lower end of the price spectrum in the hopes of seeing decent cash flow along with strong capital growth, and the plan has worked in large part, especially in the case of her Castle Hill purchase.

“The Castle Hill property which was purchased at $650,000 is now worth $1.3m,” Jie says.

“Thanks to the M2 upgrade and North West Rail Link, the Hills area in Sydney’s northwest has seen big demands and big increases. In just five years the property value doubled. I know that holding a property where upgrades to infrastructure are taking place will pay off in the long run.”

Despite the fact that she can look back with pride at the journey she has taken to overcome her early setbacks, Jie still has some regrets about her investment career.

“Selling a property that increased in value by 600% was my biggest mistake – the Shanghai apartment that I bought for an amount equivalent to $140,000 and sold for $200,000 two years later. Today, this apartment is worth over $900,000,” she explains.

“The lesson I learned is that long-term investment should be your goal.”

While she may be in a comfortable position currently thanks to her investment decisions, Jie is far from finished with investing.

She remains committed to continuing to build her portfolio and also has plans to venture into the world of property development.

Jie also hopes she can use her experience to help other investors make successful decisions and has recently founded her own property consulting business, EolutionInvest.com.

For new investors, Jie’s most important piece of advice would be to “just do it”.

“I recommend looking for high-yield properties. While Sydney and Melbourne have priced out many would-be investors, there are many other options, even for those earning a normal salary. In many other areas, you can invest in high-yield properties for better cash flow,” she says.

“Look for areas with investments to infrastructure and buy now for good long-term returns. Don’t be afraid of buying unseen properties – hire a property inspector for this purpose.”