Champion sprinters limber up, while intensively analysing exactly what lies ahead of them, well before they run their race. That concentrated preparation lasts longer than the eventual race. But when they finally explode off the blocks, there is no stopping them as they speed towards their goal.

Busy working mum Linda Lieu is much the same. She spent considerable time mulling over embarking on a property investment journey. But since she took that first step off the blocks into that journey, there has been no stopping her as she hurtles towards her goal.

Just over two years ago, Linda and her husband Loi owned their

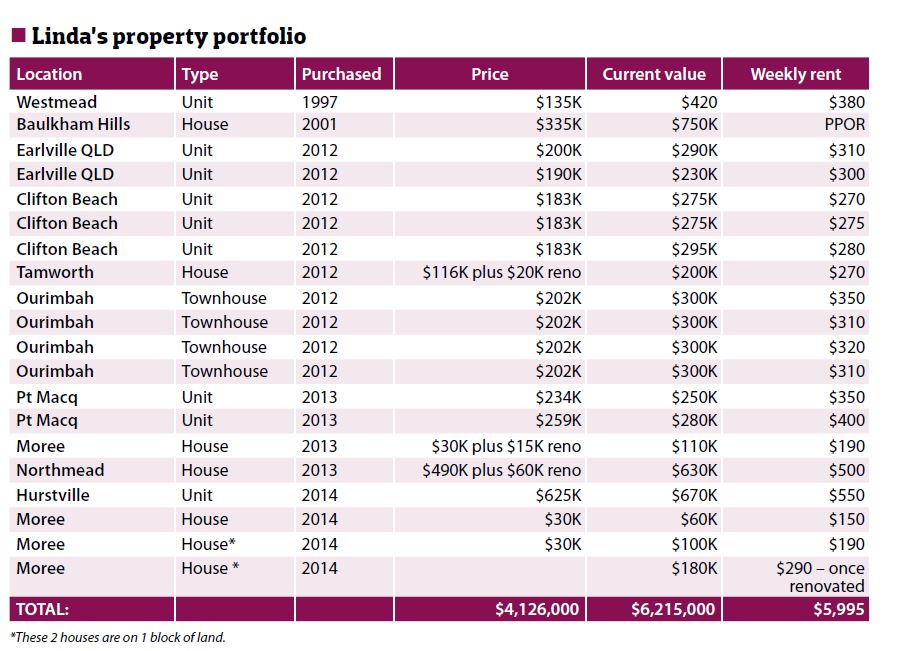

own home and just one investment property, which they bought 16 years ago. Now they own 16 properties – with another four purchases currently in the pipeline – and a property portfolio worth millions. And they have no plans to stop building that\ portfolio anytime soon.

With a BA in commerce and marketing, and a career spent working in banking and brokerage, Linda was always interested in property investment. She believed it would be the best way for her and her husband to accumulate a decent nest egg for their retirement.

However, after buying their own home when they were quite young, “life got in the way”, she says. Rather than settling down to invest, they travelled and started their family. It was only when Linda’s parents got older, and her father became unwell, that they started to think about how they could use property to build a better future for their family.

Missed-appointment revelation

Initially, the couple planned to carry out some major extensions to their existing property to benefit the wider family. They were going to get a construction loan and had an appointment to talk to an architect.

But the architect didn’t turn up for their appointment, Linda says. “That made us think that maybe it wasn’t the right time to do those renovations, that maybe it was the time to look at investing and building up a portfolio instead. It felt as though the universe was telling us to do that – it was a revelation.”

Instead of continuing down the home extension route, Linda and Loi began a period of serious research into property investment. They focused their research on investment strategies and the stories of other investors. This led to them to a change in beliefs.

Linda says society had taught them that the best way to invest in property was to do so with negatively geared property. They did this with their first property purchase. While the tactic worked out well for the couple with that initial investment, they started to think there was a better alternative. “After doing our research, our mindset had changed. We decided that positive gearing for investment purposes was a better option for us. It seemed to us that positive geared, or neutral, properties with good rental yields and good growth potential were the way to go.”

The couple were keen to pursue this strategy, but were thrown off course by the lure of an attractive-sounding off-the-plan property. Linda says that, while the proposal sounded like a great opportunity, something about it was just not right.

“We wanted to feel confident about where we were investing our money. So we attended a B Invested seminar – in order to be able to make a more informed decision – and decided they had the sort of investment strategies that we liked.”

The team at B Invested talked about buying properties under market value, which were neutral or positively geared and had good rental yields and the potential for good growth. It was listening to that strategy being expanded upon that triggered her light-bulb moment, Linda says. “As I listened, I just knew that, yes, that was the way we wanted to go.”

Kicking off from the blocks

Once the couple decided on their strategy and made the decision to get on board with B Invested, the pace of their journey picked up considerably. Their original investment property had tripled in value in the years since they bought it. This enabled them to draw down a decent amount of equity from the property.

In preparation for their move into property investing, Linda and Loi had already drawn down those funds and had them sitting in their account ready to go. This meant that when B Invested told them about a block of units that had gone into receivership, they were able to act quickly. They bought two units well below market value. Each was worth between $230,000 and $240,000, and they purchased them for around $200,000 each.

“We bought those first two properties on my husband’s birthday two years ago,” Linda says. “It seemed serendipitous. That first purchase really opened our eyes to the opportunities that are out there. The whole transaction, and what it showed us, was just so exciting!” Their next purchase, soon after, was a neutral acquisition and they were able to acquire it without tapping into

much more of their existing funds.

They then quickly bought three more properties. The sixth property was in need of some renovation, and as it was the first time they had to attempt a do-up, it slowed their property

journey down briefly. But, in the time since, the couple have kept on constant alert for properties that fit their criteria. Once they identify such a property, they release equity from their existing properties in order to buy their latest discovery and continue building their portfolio. They now have 16 properties – a mix of houses, units and townhouses – plus another four pending purchase.

Linda describes those years of building their portfolio as incredibly busy. They have been set on aggressively investing in and acquiring property, she says. “It is because we want to set ourselves up while we are still relatively young. But we have also got totally caught up in the whole process.”

Stringent research tactics

Over the course of their property investment sprint, the value of comprehensive research has been proven to the couple, time and time again. They research everything to do with the area a potential property is in, as well as the property itself. This includes price, value, cash flow prospects, and the growth potential of both the area and the property, Linda says.

“It is necessary to take all these things into account and analyse them before making a purchase. Always look at the numbers: analyse them and make sure that they work. Also, remember that sometimes properties can look great on paper, but are not so great in actuality. It’s worth checking them out.”

She believes it is crucial for investors to take the emotion out of any purchasing decision. “It is a business decision, and you have to treat it that way – just as you would any other business decision from which you hope to get growth. That is why you have to stringently analyse all these factors if you want to achieve your goals.” One of her top tips for other investors is to talk to local real estate agents who are actively buying, selling and renting in the area that a potential property investment is located in. Most of the agents are helpful, she says. “Knowledge is power: you can use good information and local knowledge to really understand the area and how the property itself might

perform.”

Rapid learning curve

Perhaps not surprisingly, their rapid acquisition and investment journey has made for a steep learning curve for Linda and Loi. They have been lucky enough not to have suffered any major setbacks at all. As they embarked on their journey after the worst of the GFC, they were untouched by the fallout from it. None of their investments have hit shaky ground. They haven’t had any problems with tradespeople or tenants.

In fact, Linda says, just a little nervously, that they have had such a smooth ride, she is wary of focusing on it for fear of jinxing it. However, despite their lack of problems, the couple have still learnt a vast amount. As an example, Linda cites their first big renovation job, which was a fire-damaged property in a regional area. Not only was the property firedamaged, but it had previously been badly converted from a three-bedder into a two-bedder, and the couple wanted to convert it back.

As relative reno novices, the couple were apprehensive. Fortunately, they found and used a local builder, who turned out to be worth his weight in gold, and a property manager who went beyond the call of duty. The whole experience taught them a lot about renovation. But, even more importantly, it taught them about the value of forging – and maintaining – strong, trusting, reciprocal relationships with people involved in your properties, Linda says.

“You have to make sure that the people you work with understand what you are trying to do, and will work with and for you. So, for example, you want your financier to understand that you are trying to grow a portfolio, what you are trying to achieve and what strategies you are employing.” The couple has also learnt that it is essential to take action and buy when the time is right, rather than continuing to analyse a prospect until the opportunity slips away. “Also, we have found that setting specific goals, staying focused on those goals and working towards achieving them is a key to success.”

Life changes

Another offshoot of the couple’s learning-filled journey has been a job change for Linda. Since early 2013, she has worked at B Invested, assisting people in building their investment portfolios.

She had been looking at a job change, so when the B Invested team told her they were creating a new role focused on helping out new investors, she jumped at the chance. “That is what I have always liked doing anyway. It’s just now I get paid

to do what I enjoy doing.”

The only regret Linda has is that she and Loi didn’t get involved in property investing earlier. However, given what they have achieved in just a couple of years, she can deal with that, she says. “We have not just achieved our expectations; we have achieved over and beyond them.”

Looking to the future, the couple plan to keep acquiring properties and building their portfolio further. They initially hoped their portfolio would enable them to work less as they got older, as well as build them a nest egg for their retirement. But now the journey is also about their two kids, Linda says. “They have got involved in this whole property investment journey and process.

“Even though they are young, they are excited by it, too. We are hoping to teach them some of what we have learnt to help them with their future.”