From the beginning

Since the day Karan Sharma turned 18, he read an abundance of real estate investment books as he had a great aspiration to be a millionaire. After reading a steady stream of success stories, he decided to wander down the path of property to achieve his dream.

In 2008, Karan purchased his first property in Australia and has been actively buying and selling since.

“Real estate is, in my opinion, a safe investment as everyone works to earn food and shelter,” he says.

“Therefore, investing in property was an ideal way for me to achieve both cash flow and capital growth.”

Karan’s current portfolio is roughly worth $4m ($4.8m including overseas) and, if he was to go and sell tomorrow, his bank loans would be $2.7m. However, at present, the net cash flow a year is positive at $6,000 ($11,000 including overseas).

Raised in a middle class family, and with a father who worked as a banker, Karan was always told about the real estate opportunities his father had missed out on.

With his father’s regrets in mind, Karan went on to do well in school and obtained a bachelor's degree in business, majoring in accounting and finance, from the University of Western Sydney.

“To learn more about the real estate market, I studied for the full real estate licence,” he says.

“My childhood was really basic, and this always motivated me to be rich so my kids can enjoy a lavish lifestyle when they grow up. While I don’t have any children yet, I am confident in my strategy of setting up a successful portfolio before settling down and getting married.”

Looking abroad

Living in Australia, Karan decided to kick-start his portfolio in a market close to home, but once he began to accumulate decent equity in India he decided to invest in Australia and India both and take advantage of the rapid growth both the markets were experiencing.

“I believe in the numbers game – the more you buy, the more growth you can make per investment,” he says.

“These opportunities came up via a network of Indian investors I knew

here in Sydney so I decided to give it a crack. Networking has definitely been a positive influence on my decisions.”

With experience in both markets, Karan has deemed Australia as the much safer country to invest in due to the highly regulated legal system.

“Builders, developers and real estate agents are monitored constantly, so I definitely feel safer buying in Australia,” he says.

“But that doesn’t stop me from investing small and short-term in overseas markets. The builders in India often take longer than promised to finish a project, but in my case it worked as a blessing in disguise, as it gave me more time to pay off the property without borrowing from the banks.”

“Networking has definitely been a positive influence on my decisions”

TOP 5 PROPERTY NEGOTIATION TIPS

1 I always try to network with the local listing agents in areas where I wish to invest. This way, I can get listings in my inbox before the homes open. I always try to give listing agents a heads up on what kinds of properties suit my needs so when they get something, it can be qualified to my needs.

2 I always try to order a full bank valuation so that I know where I stand from the bank approval point of view as well. It gives me a good guide to negotiate harder with the vendors or agents. Bank valuations are detailed and also include planned infrastructure, past sales and risks, etc.

3 I look to buy properties from vendors upsizing, downsizing or moving overseas, as generally, they tend to be in a rush to sell the properties and one can negotiate a better price.

4 I always keep my pre-approvals and deposits ready so I can offer quick settlement timeframes to vendors. I have built up a good team of fellow investors. When I find something good in a high growth area we can negotiate good deals as bulk buys. This applies more to newly built properties.

5 I always order full building and pest inspections. I also take tradies to the properties at open homes so I can get a good idea of how much work is needed to rent out at the market rent rate. I can then make a checklist of what can be taken off the purchase price.

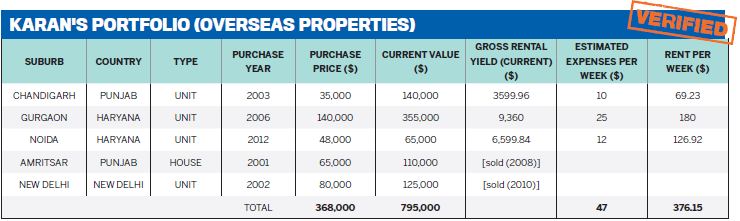

Karan currently holds three properties in India after selling two to invest back in Australia.

“The Indian real estate market always has high demand due to an increasing population and increasing infrastructure.

“I invested there as off-the-plan properties were cheap to get a hold of and because predictions of capital growth and yield were high upon completion due to market forces.”

The buying price was often cheaper for Karan than any other market – being as low as $35,000–$85,000, provided he invested in the right areas.

“My plan now is to start investing in the USA, UK, New Zealand and maybe other international markets.”

Defining the strategy

In terms of an overall strategy, Karan explains that he would like to continue to buy properties in cash-flow positive areas with good potential capital growth.

“Further to this, I look to negotiate deals under market value so I can instantly capitalise on the growth to buy more properties, all while securing good rental yields to service my loans,” he says.

“I never had a real estate coach or any mentoring to assist me as, in the end, they all charged huge amounts of money. Luckily, and so far, this hasn’t tripped me up yet.

“The only regrets are that I wish I had sought advice on how to grow my portfolio at a faster rate and that I had started the process earlier in my life.”

Karan says if he was given the chance to start over, he would seek areas where not many other people invest as this keeps the purchase price down. Additionally, by ensuring there are large plans for infrastructure projects, you can take advantage of better capital growth.

“I might also look to team up with other investors instead of going solo,” he says.

“Buying and educating as a group is far more beneficial than buying solo.”

Fostering relationships

Karan warns that investing overseas can be challenging without a wellstructured network.

“Many agents overseas will often try and sell you either stock that is hard to offload to the local market or something that earns more commission for them,” he says.

“But, I do my research really well and usually buy directly from reputable builders or developers instead of through agents. I use the reputation of my investment group as a means to show the developers overseas that if they recommend or sell bad stock, then they could potentially lose long-term business. Once I have scouted good opportunities I share them with the investors in my group.”

Karan also recently made the trip to the US and Canadian markets to build strong relationships with local builders and developers.

“I have come back with some exciting deals that I shall be buying over the next few months and I will definitely be passing them on to my group,” he says.

Karan advises any investor interested in an overseas market to buy from blue chip reputable builders or developers directly. “Stock might be slightly more expensive, but it will definitely be safer,” he says.

Karan also reveals he prefers to buy stock that has high yield at a low entrylevel price.

“It’s purely a numbers game. I invest around $30,000-$40,000 on cashbased products and aim to sell them at $65,000-$75,000 in three years’ time.”

He also recommends dealing with an investment group that has experience buying in overseas markets and to ensure you have local contacts in Australia who can be the point of contact if things go wrong.

“Take good tax and legal advice so the structure is set up to cover any risk,” he says.

TOP 5 PROPERTY MANAGEMENT TIPS

1 I use the best property management companies, such as Raine & Horne, around the area my properties are based in. I also prefer to give them the bulk of my properties to manage, so I can negotiate cheaper management rates and no hidden fees and charges.

2 I communicate closely with my property managers twice a month.

3 I always check my bank accounts and tally up if I am receiving my rents correctly from the property management companies.

4 I request my property managers to collect rents fortnightly in the middle and end of every month, so I can audit them twice a month.

5 I request my property managers to always keep my rents appraised to the market value so I can maximise my yields.

TOP 5 PROPERTY MANAGEMENT TIPS

1 I use the best property management companies, such as Raine & Horne, around the area my properties are based in. I also prefer to give them the bulk of my properties to manage, so I can negotiate cheaper management rates and no hidden fees and charges.

2 I communicate closely with my property managers twice a month.

3 I always check my bank accounts and tally up if I am receiving my rents correctly from the property management companies.

4 I request my property managers to collect rents fortnightly in the middle and end of every month, so I can audit them twice a month.

5 I request my property managers to always keep my rents appraised to the market value so I can maximise my yields.

KARAN’S BEST PIECE OF ADVICE

-Start earlier in life

-Team up with other investors

.JPG)