Money and time – or more specifically a lack of them – are common excuses for not building a property portfolio. But people like Karen Van Maanen are proof that you can be very short on both, yet the only thing that matters is you’re high on determination.

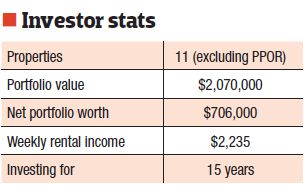

Not only does Karen own a portfolio of 11 properties and counting, but she also works tremendously hard. In fact, for almost seven years Karen has worked a full-time job and a second permanent part-time job four nights a week to achieve what others told her she could never do alone.

These days, Karen has one crucial piece of advice for investors: even though it’s important to invest as soon as possible, it is also critical to educate yourself first.

“I winged it through the first few purchases with my ex, and we did OK, but the power of education and knowing upfront what can be achieved and having a firm plan in place is crucial,” says Karen.

In 2010, after doing a property investment course, she learnt how following a renovation/development strategy that was specific to her situation and goals would result in more profit.

“None of the properties that I have purchased since the course would be anything that my ex and I would have purchased, but these have all turned out to be profitable deals for me,” she says.

Property highlight: My most challenging purchase

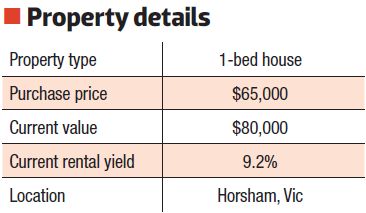

Proper planning was especially important for Karen in 2011, when she bought a one-bedroom house in Horsham in Victoria’s west. It was on a subdivided block of around 450sqm, but it was no beauty.

“This house is the ugliest on the street but was built with a plan in mind,” says Karen.

Ultimately, she was looking for a property in a desirable regional area that was highly affordable but with opportunities to add value in the future. The look of the property was not a priority for Karen, just its potential.

Horsham is the largest city by population (14,285) in the Wimmera region and has a large commercial centre on Firebrace Street.

Sometime in the next few years she hopes to completely remove the property and build a three-bedroom home, providing demand is still there for that type of house.

Finance

Despite the loan being just $52,000 for a $65,000 purchase, Karen ran into some roadblocks with the finance.

This was the first time she had used a broker, and after she sent lots of paperwork to them, the person handling the file went on holiday and didn’t forward the information to anyone.

To make matters worse, once the finance process was underway Horsham was flooded as a result of summer downpours, and nobody would approve her finance, despite the water not being near her property.

“When the finance was finally approved, after a couple of extensions, I didn’t tell the agent for a few days as I couldn’t get any insurance on the property until the fl ood waters had gone down,” says Karen.

“It was the most difficult purchase I had done for a long time and all on a property worth $65,000.”

Performance

Originally it was renting for $100 a week, but the Horsham property has now increased to $115 a week, which equates to a fantastic rental yield of 9.2%. It also has a current value of $80,000, which is a healthy 23% increase in less than four years.

Furthermore, Karen keeps her fingers crossed that her future knockdown-rebuild strategy will also add substantial value.

Challenges and rewards

Both the hardest moment and the happiest moment of Karen’s property investing journey have come from the same property.

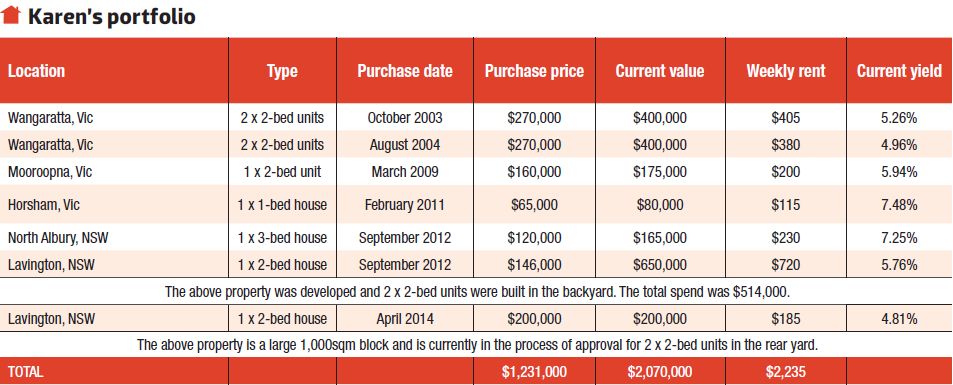

In 2012, she purchased a 1950s two-bedroom house on a corner block in Lavington, NSW. Her plan was to build two units in the backyard of this property.

In order to do this she needed to put a lot of money on the line, not to mention take a leap of faith on what she hoped was the right builder, the right design, the right colours and the right fixtures. “After engaging a builder, who realised that this single woman was not mucking around but serious about building her property portfolio, he took me under his wing and taught me so much,” she says.

“While I had massive support from those around me, at the end of the day the buck stopped with me.” Karen’s happiest moment came when this development was almost completed and her parents, who live about 2.5 hours from the property, came to inspect the almost-finished product.

“I gave them the guided tour, and as they were leaving they both hugged me goodbye and told me they were so proud of me and what I achieved. This special moment is what makes it all worthwhile,” says Karen.

Approximately 12 months after settling on the property, Karen had two beautiful new units in the backyard. These rented out at $275 per week each, and the old house is rented out at $170 per week. This is a yield of 8.32% on borrowings, and after subdivision, valuations and end-of-financial-year figures were calculated, the equity build in this project was $105,000.

Protecting her investments

Karen’s strategy has evolved over the years as she has become more ambitious and fiercely protective of her investments. To reduce her risks, she says her strategies are as follows:

- I now deal with four lenders, and once the next development is done I may again look at changing lenders for diversification.

- Working with a good mortgage broker is essential for a property investor. I have been told by some banking staff and other brokers that what I wanted to achieve was impossible, but having the right broker guiding my way through the maze of finance has been crucial to my success.

- Make sure you have insurance for the building, and public liability, as well as landlord insurance.

- I have also insured myself for income protection and TPD [total permanent disability]. Recently, two of my friends have found themselves sick with major illnesses, and this has brought home to me the absolute necessity to insure yourself. There is no point in working hard to build a property portfolio, only to lose it due to illness.

- I have identified properties that I wish to hold long term, and have fixed some of the interest rates. When you are able to fix at 4.99%, you have the security of knowing exactly what your repayments are going to be over a certain period of time. Being able to budget with confidence for one to two years in advance gives me the advantage, when planning a development, of knowing the exact payments over the time we are building.

Karen has a friend, a single mum, who initially thought she could not follow the same property investing path that Karen took, because it sounded too difficult and stressful.

However, she ended up buying an investment property in a regional centre, which was chosen due to the healthy rental return and affordable buy-in cost.

Fast-forward another two and a half years and Karen’s friend decided to emulate another part of Karen’s strategy – adding a development. A year further on and she has a neat older home with two two-bedroom units in the backyard, and is cash flow positive.

“To make such a positive effect on another person’s life is what motivates me,” Karen says.

Just warming up

Karen’s original goal was to achieve something that many investors could only dream of. She aspired to own 10 properties by the time she was 50. Karen is now 48 and owns 12 properties, including her principal place of residence.

At this point in time the focus is not so much on the number of properties but what the properties are. “Some of the older properties will eventually be sold to reduce debt, and newer stock kept for the long-term income stream,” says Karen.

She also hopes to be in a position where she has the choice to retire in mid-2021 when she turns 55. Other long-term goals include travelling around Australia and sharing her experiences with family and friends.

“Also, being able to afford to help my nieces and nephews get into the property market, and to help homelessness and cancer charities, are high on the agenda as well,” she says.

Top tips

- Purchase in large regional centres that are cheaper than capital cities. An additional benefit of buying in regional areas is the higher yield, which has meant most of my properties have been cash flow positive from day one.

- Look for properties that are undervalued or have renovation or development potential.

- Target corner blocks or large blocks close to shops and services.

- Use a range of lenders. I initially used just one bank, but now I deal with four lenders, and once the next development is done I may look to change lenders for further diversification.

- Educate yourself early.

“With a significant number of properties under her belt, Karen’s property investment journey is certainly noteworthy. In addition to a clearly entrepreneurial mindset, the importance she has placed on seeking assistance from professional experts, as well as advice from experienced industry operators, gives her strategy a very sound foundation. Her willingness to explore different opportunities, i.e. renovation or development, is commendable.”

– Tyron Hyde, director, Washington Brown

“Karen had a change in life circumstances and took it upon herself to build wealth for the future. Looking for investment-grade property at a discount, where value can be added, is a great strategy to accelerate a property portfolio. I like that she looks far and wide for the right investment that matches her strategy. Her life lesson of education first was something that also appealed to me, as I know that understanding first is critical to having successful outcomes.”

– Justin Davey, head of partnerships, Real Estate Investar

Karen wins

For winning a Highly Commended ranking in Your Investment Property’s 2014 Investor of the Year Awards, Karen receives a prize pack worth $1,956,including:

- A 3-month Real Estate Investar ‘Portfolio Builder’ membership, valued at $747

- A 12-month NMD Data ‘Platinum’ membership, valued at $199

- A 12-month subscription to Your Investment Propertymagazine, including an exclusive report pack compiled by Your Investment Property and RP Data, valuedat $1,010