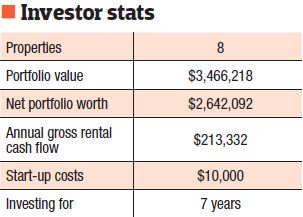

Successful full-time property investors? Check. Involved parents? Check. Active property investing networkers and bloggers? Check. Sponsor to three children in the developing world? Check.

Juggling all these hats means Anna and Melvyn Correia are a busy couple. But driven by their desire to succeed, they have made an

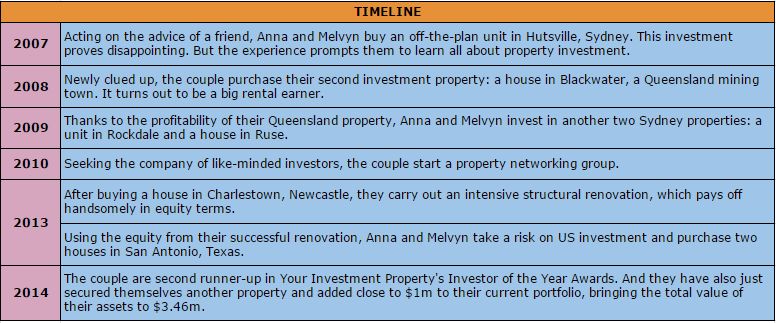

And now they have won the second runner-up prize in the 2014 Investor of the Year Awards.

Growing up in Kenya, Anna and Melvyn always dreamed of succeeding in the Western world. But after migrating to Abu Dhabi and then Australia, it took some time to get their property journey on track.

In fact, an initial misstep almost threw a spanner in the works. But undeterred, the couple learnt from the experience and persevered to make it to where they are today.

Taking the first steps

Originally accountants, Anna and Melvyn both have a background in the corporate world. But when they made the move to Australia in 2006, Anna decided she wanted the independence that comes with working for oneself.

This led her to establish a wedding business. Unfortunately, her business didn’t provide her with the returns she wanted. So she explored other ventures and attended a property seminar featuring some big-name property gurus.

Before rushing in, Anna and Melvyn decided to make sure they had a real understanding of the property investment field. To this end, they embarked on an intensive nine-month self-education program.

Early misstep

Their first property investment was prior to their learning program. A “friend” convinced them to buy a one-bedroom, off-the-plan apartment in NSW in 2007. They used their First Home Owner Grant of $7,000 to do so.

However, the property featured a massive swimming pool, gym, lifts, an underground car space, landscaped gardens and a private terrace. This resulted in high strata fees of close to $1,500 per quarter.

They initially saw the investment as a mistake, Anna says. “But it ended up as a blessing in disguise. The high negative gearing ended up giving us good tax benefits and put money back into our pocket.”

Balancing the portfolio

The experience left the couple feeling wary. Fortunately, their self-education program gave them the confidence to have another go.

With $10,000 in savings as a deposit, they purchased their second property in 2008. This time they chose a house in Queensland. “It was positively geared and grew exceptionally well in value, which allowed us to extract equity from it to put into our next deal.”

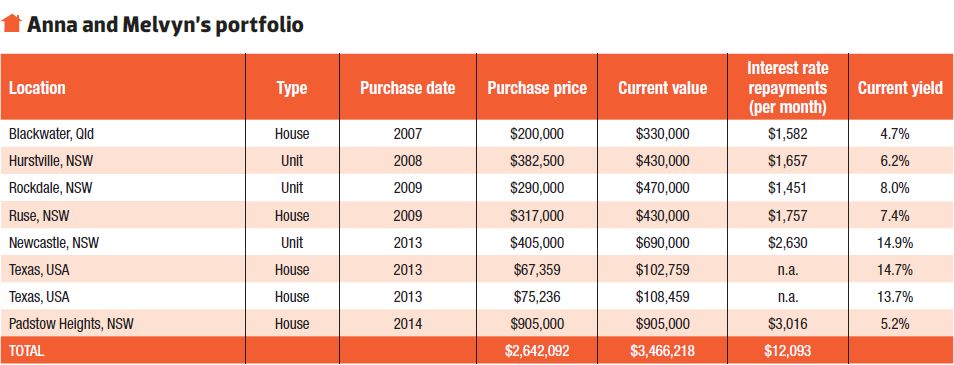

Since then, there has been a snowball effect, which has resulted in the couple’s portfolio of eight properties. Most of these properties are close to neutrally geared, while one is “extremely positive”.

When it comes to strategy, the couple adopt a mixed approach, Anna explains. This means they have houses and units, plus US properties. To ensure a balanced portfolio, they have a mix of negatively geared and positive cash flow properties. They also like to use renovation strategies.

Anna says these days they have the tools, experience and network to do this successfully. “But when you are starting out, I don’t think you have a strategy per se. Also, you aren’t 90% certain you are choosing the right property – it’s more like 5%.”

Finding their own way

In her view, everybody needs to formulate their own investment strategy and criteria to suit their goals, but based on solid education. “Also, always thoroughly research the relevant markets. Keeping abreast of topical information allows you to make informed decisions.”

While the couple advocate buying and holding, they emphasise that people need to think about all the costs involved when making investment decisions. “Think about the ongoing costs, the selling costs, and the holding costs, and how they impact on profits.”

Renovation is a strategy the couple love. However, Anna says it is necessary to have a solid range of skills that cover negotiation, budgeting, marketing and project management.

“Many people attempt renovation projects without proper planning and budgeting. But I have my ways of managing them ... thanks to 13 years of corporate experience and the many different industries I have worked in.”

As an example, she cites their most successful renovation project.

The structural renovation took 12 weeks, cost $160,000, and required a major investment of time and energy. But the equity gained on the project was $285,000. “We then drew out all the equity, recovered the renovation costs, and reinvested the money in another project.”

Finance and risk management strategy

When it comes to loan arrangements, accessing maximum funds is a prime objective for the couple, who are not put off by having to pay Lenders Mortgage Insurance (LMI).

“It’s just another cost of doing business,” Anna says.

However, she warns that it’s possible to get caught out with LMI when refinancing, meaning you end up having to pay it again.

To avoid this, she says: “If you can manage an 80% lend, do it, and then refinance at 90%. Then you don’t have to pay LMI twice. Lenders can hold you to ransom over such things.”

Investing in the current market

Ideally, the couple would like to buy three properties a year. However, this is not always possible, particularly in the current market. Anna says they have been actively looking for a new property, but with no luck.

“There are lots of novice investors buying on emotion and being swayed by agents and auctions. Plus there are cashed-up foreign investors. This makes it harder to find good deals without eating into your equity.”

More positively, she adds that the current market is a good one for sellers and for holding existing properties. “We have received lots of equity from this market. That allows us to refinance for further investments.”

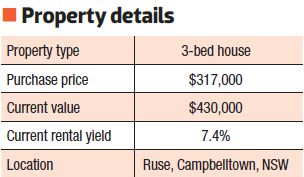

Property highlight 1: Adding value

Anna and Melvyn bought this Campbelltown property in 2009 when they were relatively new to the property investment game. They are now adding a granny flat to generate additional cash flow and value.

Finance

They used a trust structure to purchase the property for $330,000. It was bought using a 10% deposit of $33,000, which was generated from their savings and a 90% loan. The interest rate is now about 5%. For the granny flat addition, they wanted to switch to another lender to get better value. However, due to an early financing mistake, the property was cross-collateralised. This meant it was more cost-effective to stay put.

Research

Anna says they decided to buy because they had heard there was new infrastructure going into the area. “The lesson we learned was that, while infrastructure going in might boost an area, you need to look for the right house on the right street and in the right suburb.”

She adds that they were correct in identifying Campbelltown as a good area. This property itself is next to schools, public transport, and shops. While the couple was able to significantly increase the equity in the house via renovation, they decided to add further value with a granny flat. To research the viability of the project, they analysed relevant data from sources like RP Data and APM and talked to local real estate agents plus their property manager.

“This was essential because you can’t just put a granny flat anywhere. It all depends on what the demand is. You have to know the area, do the research and ask the right questions.”

Their research has left them confident that they will have no problem renting out both the house and the granny flat for a good sum.

Performance

As a result of renovations and the hot Sydney market, the property is currently worth $430,000. It returns yields of 7.4% as it is rented out at a relatively high rate.

Once the granny flat is completed – at a cost of $130,000 – the property will be about $5,000–$6,000 cash flow positive per year. “On completion, it will be worth the equivalent of a six-bedroom, three-bathroom house in that area. The rental yield will also be increased.” This means the couple is largely happy with the property’s performance.

Challenges

However, there have been challenges with the property. It has kept them up and going, Anna says. For example, they had a bad agent who said there was rental money coming in when there was no one in the property. “We had to take them on to get our money back.”

The addition of the granny flat has taken longer than expected as the builder has been focused on bigger projects. This has slowed down the work. Also, as the property is in a flood and bushfire zone, it has been necessary to spend lots of time and money to get the reports required for council approval.

“It hasn’t been like most of our other properties which have had no issues,” she says. “But we can create a positive cash flow from it, so it is a good property to have in our portfolio.”

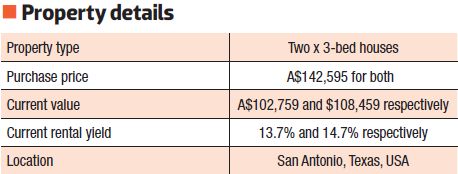

Property highlight 2: American foray

After finishing a profitable renovation project, the couple decided to make a foray into investing in the USA.

Finance

Thanks to the equity from their renovation success, they were able to buy the houses outright, with no loans at all.

They used a vendor finance strategy, Anna explains. “Essentially, we act as the bank. A person is found to buy the house from us, and they become the new owner. As a ‘bank’, we get principal and interest paid to us monthly, while they are now the owners of the property and responsible for all expenses.”

This has left the properties, which are in a trust structure, generating cash-on-cash returns of 22%. They paid $4,000 to be introduced to the company that arranged the deal. However, that company does everything from finalising settlement of the property, to finding buyers for the deal, to organising the renovations.

Research

To facilitate the deal, Anna travelled to the US for a five-day property conference late in 2013.

“I love taking risks,” she explains. “If you don’t, how will you learn? Opportunities only come once, so I took the leap and tried a brand-new strategy.”

In the US, the group viewed multiple properties, which they won numbers to bid on. For each property they got a full cost breakdown of how much they would pay – including the company’s fees, renovation costs, legal costs – and of the gross income for the investor.

Personal selection criteria didn’t really come into it, Anna says. But it was possible to make an informed decision based on the data provided, along with viewing of the property.

Performance

Overall, Anna and Melvyn are happy with their investment, although it took time to get a buyer. “It’s a nice little investment. We bought them outright, so they are positive cash flow and purely profit.”

Challenges

Vendor financing in different country is a risky strategy, Anna concedes. This is because it comes with unfamiliar laws, regulations, demographics and trends.

For this reason, it is necessary to be sure that the agent, the accountant, and any other people involved in the transaction are reputable and trustworthy.

“It’s risky and there are challenges. But some people I know have done well out of it. We are still trying it out, so it’s still early days.”

Lessons learned

Looking back, Anna says the biggest lesson they have learned is to be careful of who you trust.

After being burnt on the advice of a “friend”, who turned out to be an agent, the couple realised that property attracts people who will take advantage of others for profit. So, if they were to start over, they wouldn’t be as trusting and they would do their own due diligence.

“But we don’t like to look back at the past and say, ‘Oh no’. Instead we prefer to learn from our mistakes, and then move forward.”

Finance tips

- Try to avoid cross-collateralisation.

- Use a broker to fi nd the best lender, but always go for the broker that a) meets your loan criteria and b) off ers the best deal.

- Use a trust structure when suitable, but think about the numbers. Sometimes it makes sense to put a property in your own name to take advantage of tax breaks. Also, remember that trust structures have extra costs and high accountant’s fees.

“Anna and Melvyn are the classic property investor success story. They are a hard-working couple who are prepared to change their lives and take calculated risks. Education is the theme of their present and future success. Their mixed strategy of diversified property investments has helped them achieve impressive results. Along the way they have broadened their knowledge and experience in many levels of property investing.”

– John Kovacs, managing director, NMD Data

Anna and Melvyn win

As second runner-up in Your Investment Property’s 2014 Investor of the Year Awards, Anna and Melvyn win a prize pack worth $4,126. It includes:

$500 cash from Trilogy

- A preloaded $250 eftpos® card from DHA Australia

- A 6-month Real Estate Investar ‘Portfolio Builder’ membership, valued at $1,494

- Two residential depreciation reports from Washington Brown, valued at $1,320

- A 12-month NMD Data ‘Platinum’ membership, valued at $199

- A 12-month subscription to Your Investment Property magazine, including an exclusive report pack compiled by Your Investment Property and RP Data, valued at $1,010