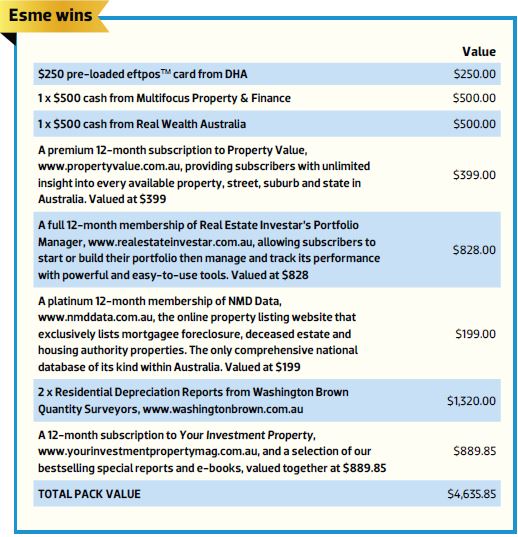

No money, no job and severely depressed, Esme Chin somehow managed to pull herself out of despair to build a property portfolio worth over $4m. Her journey is truly an inspiration to all investors and has earned her the Second Runner-up award.

No money, no job and severely depressed, Esme Chin somehow managed to pull herself out of despair to build a property portfolio worth over $4m. Her journey is truly an inspiration to all investors and has earned her the Second Runner-up award.What the judges say

“A strategy of buying and holding properties with positive or neutral cash flows has enabled Esme Chin to build a portfolio worth more than $4m. She has focused on purchasing houses with good-size land blocks that enable her to improve the value of the investment through either renovation or the addition of a granny flat. Esme has benefited strongly from the strong capital growth in the Sydney market.”

– Madeline Dermatossian, DHA

It’s been said that pain is often the biggest catalyst for change. The bigger the pain, the greater the breakthrough.

In Esme’s case, it’s as big as it gets. She lost her business, her marriage broke down, and she was rapidly running out of money. As is often the case, her misfortunes came in rapid succession as well. The year was 2008.

“I had a flourishing cafe business which I thought would be my retirement nest egg,” she recalls. “The shopping centre owner frequented my cafe on a daily basis. But he passed away suddenly. I found myself at the mercy of his unreasonable wife, who took over the reins of landlord. She refused to renew my lease and after a lot of begging would only give me 30 days to vacate the premises. I was left with no option but to fire-sale the business. I was devastated as my life savings was in that business.”

As if this wasn’t enough, the universe threw another curve ball in Esme’s way. Her husband of 20 years decided to leave her.

“I spiralled into depression. I was over 40 years old, unemployed, with half my life gone and little to show in assets. My future looked bleak. This series of events left me lost and broken. Prior to this, I was an ambitious entrepreneur,” she says.

In her despondent state, Esme found herself drifting from one seminar

to the next, desperate to rebuild her life and finances. Then she stumbled upon a property seminar at which the presenter introduced his student who had bought 18 properties in four months. Esme had an epiphany.

“I was gobsmacked. That was just the wake-up call that I needed. I realised that to be rich in this world you need one solid cash cow, a steady income stream. I realised the rich either made their money in real estate or made it elsewhere and parked it there. I decided I wanted to invest in property.”

Investing on a low income

But breaking into the property market when you are unemployed, single and almost broke is not an easy feat.

“I was not a professional earning a six-figure income and neither was I married to a Rupert Murdoch, and I had just got burned in business. So I had to ask myself, how can I get into properties? As soon as I asked, the answer came. Unlike other girls, who spent all they earned on designer clothes and bags, I spent mine on antiques, fine art such as Pro Hart, and French glass – René Lalique. I spent the next few months in auction houses selling the lot to come up with $60,000 that I used to kick-start my property portfolio.”

Being a single mother earning below $45k and working two jobs, Esme was understandably cautious when she was just starting out.

Judge's comment

“Wow! What can you say about Esme? ... from zero to hero in one fell swoop. Esme shows that sometimes when your back is up against the wall, you can come out fighting. Esme applied this to property and has gone from a $60k start to a $4m portfolio in less than 10 years. What’s not to love about this story?”

– Tyron Hyde, Washington Brown Quantity Surveyors

“I did not have a lot of money. As a single mother I could not risk my money doing anything risky. So I started buying positive cash flow properties in regional areas,” she explains.

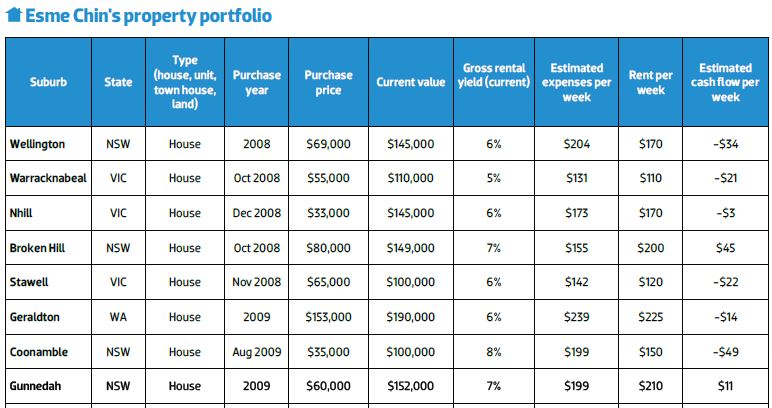

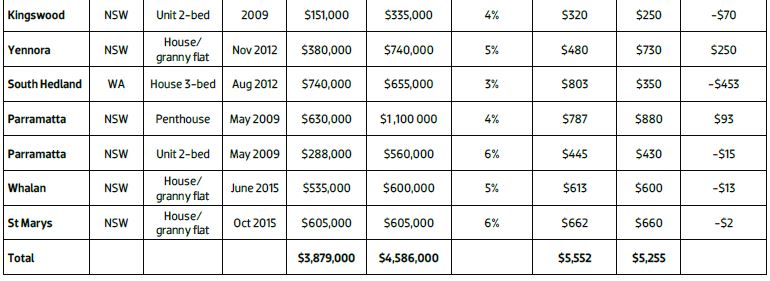

Esme’s first purchase was a house in Wellington, a rural town 360km from Sydney and 49km from Dubbo. She paid $69,000 for it in 2008 and then got it tenanted for a rent of $170, achieving a solid 6% gross rental yield.

After her successful first foray, she bought four more properties in regional Victoria and NSW in rapid succession. All those properties were priced between $33k and $80k and achieved solid rental yields of between 6% and 7%.

“When the GFC came, I saw the opportunity to buy cheap properties and grabbed it,” she says. “I thought outside the square, and when I did not have enough money I did a joint venture with my sister and we bought two properties in Tasmania. I also bought another property with a friend in Penrith, and later bought over his share. We bought it for $145,000, as a man died in there and the carpet had fleas; renovated it for $20,000 and sold it in 2014 for $280 000.”

Later on, Esme balanced out her portfolio by buying in Sydney’s west.

“I saw a lot of potential and believed in the area,” she says. “Sydney was a migrant’s first pick. I particularly liked houses with granny flats on them as it allowed me to service them easily. I believe capital growth will come in time so it was a win-win.”

As Esme became more confident about investing, she ventured out overseas and bought properties in the US.

“I bought two houses in Texas. Texas was a landlord-friendly state. At the time of buying the US dollar was low, so I saw an opportunity and jumped on it. Texas had oil, army, healthcare and one of the top three growing economies, and that was why I chose to invest there. Property management was key to buying in the US and I found a very reliable manager there,” she recalls.

Picking the right area and best property

Like many successful investors, Esme is meticulous in researching both location and properties.

“I usually spend six months looking at potential places I want to buy, and I look at Real.Estate.com.au daily until I am really familiar with the area and type of house I want to buy, just like when I was buying in Whalan andSt Mary’s in Western Sydney,” she says.

Esme identified Brisbane as a potential area to invest in, but she settled for Western Sydney instead.

“Whalan is situated in the Blacktown area and is midway between Parramatta and Penrith. It means it’s along the job nodes and also within commuting distance to the city by train. It’s also close to the just-opened Sydney Business Park, which potentially offers 20,000 jobs and is also within driving distance to Norwest Business Park. I like to buy in areas where there are local jobs without having to commute all the way to the city. It also is a light industrial area, with lots of local small factories, so there would always be potential tenants,” she explains.

Esme points out that the Badgerys Creek airport is only a 20-minute drive from these suburbs.

“I also like my properties to be near universities, and the University of Western Sydney is opening a 10,000-student campus in Parramatta and the main campus is to remain in Kingswood. These infrastructures going in are not pipe dreams; they have all received the green light, and that is why I am buying in Western Sydney,” she says.

Esme’s strategy is simply to buy and hold and she aims to buy 50 properties.

“My criteria were that each property must enable me to leapfrog into the next property and not hinder me from moving forward. I try to buy positive cash flow properties or cash flow neutral properties. I balance that with an equal proportion of capital growth properties. That way I get the cash flow that allows the lenders to keep lending to me. The spurts of capital growth give me the equity to use for deposits and keep me growing my portfolio.

“I try mainly to buy properties with a house on it and properties with a twist, the ones that I can renovate and take equity out of instantly. Houses with land content allow me to land bank. When I retire, I can go back to each property and see if I can do a development, such as build a granny flat, or townhouses or units. I do not believe in a flip strategy and will only sell if the property had a problem tenant or it was a bad property. I am at the accumulation phase, so I am content to buy and hold and ride the wave, and like my Sydney properties see it double in value within 10 years.”

In order to protect her assets, Esme adopts a rigorous strategy, including:

- Insuring all her properties

She takes out both building and landlord insurance to cover any unforeseen events.

- Diversification

She spreads her risks by buying across markets and states. “I believe in diversifying my investment portfolio,” she explains. “I have properties in five states in Australia: NSW, South Australia, Western Australia, Victoria and Tasmania. This gives me peace of mind that if one market is down, like the resource state in WA, another like the Sydney market is going up. I also bought in the US market when the US dollar was low. I currently have two properties there to take advantage of when the US dollar rises,” she notes.

- Using company structure

A company structure limits her personal liability as well as protecting her assets.

- Fixing her mortgage

She recently fixed the rates of nearly half the properties in her portfolio to take advantage of the low interest rates and to mitigate the risk of interest rate rises. The ones that she wants to continue taking equity out of were left at a variable rate.

- Never cross collateralising

- Keeping her borrowing to a healthy level Esme maintains a healthy LVR of no more than 80%.

Judge's comment

“Esme Chin is a success story. Her determination, discipline and self-control has undoubtedly played a significant role in achieving her extraordinary property acquisitions. Her portfolio has been very carefully managed by a mixture of diversified investments, innovative finance, capital growth, yield, cash flow and a very high level of her own management skills. Awesome achievement!”

– John Kovacs, NMD Data

“I’m constantly overseeing my property managers, making sure that rents are not in arrears, and if a place is not tenanted, I ring every week to suggest ways to have it tenanted. I have more than one property manager in certain areas, like Sydney, and never put all my properties with just the one agency in case the manager becomes inefficient,” Esme explains.

- Keeping a healthy buffer

Esme also puts aside a buffer in case of emergencies such as repairs or certain properties becoming vacant.

- Selling a property in case of emergency

“I have set aside a property earmarked for selling in case things turn pear-shaped.”

- Rigorous due diligence before buying

“I always carry out a pest and building insurance before purchasing, so I don’t get nasty surprises. I always use a solicitor rather than a conveyancer in case things get complicated. I don’t want to get embroiled in any litigation,” she explains

- Promptly dealing with maintenance issues

When a tenant asks for things to be repaired, I see to it that the property manager attends to it immediately and all correspondence is filed, in case of any legal disputes down the line.

My biggest mistakes and lessons learned

While Esme was rigorous in her research and due diligence, she admits to making the wrong call by buying in South Hedland.

“One of my biggest mistakes was to buy in South Hedland amidst all the hype at the height of the boom in 2013,” she recalls. “Spruikers were predicting a population boom and the port extension. But not only did prices fall but the rents went from $1,600 to $350, if you were lucky to get it rented. I learned the hard way that in mining areas you need to beware of mining companies building dongas, and greedy developers can flatten a boom market by overbuilding.”

Esme also found that insurance premiums in cyclone, flood, and bushfire-prone areas were extortionate.

“Lenders have certain postcodes they do not like to lend to, and if the place is too dilapidated they won’t give you the finance. Community-titled properties are also hard to get finance for. When it comes to renovating in mining areas, it’s hard to find tradies and extremely costly when you do find them. Another thing to watch out for in regional areas is that ice is on the rise, tenants are taking drugs and smashing your house, and even vacant properties are vandalised. Just something you should bear in mind when buying in the current market,” Esme warns.

Patience pays

Towards the end of 2013 when Esme put her Parramatta penthouse up for sale, she was hard-pressed to even get $680k. Eventually a Chinese couple offered $710k. Although it was the highest offer and she knew she should be happy with the price, somehow she wasn’t feeling it. In fact it made her feel queasy. So, despite having paid for styling and advertising, she thought better of it and did not sell. Then in 2014 the same buyer offered her $790k and she still did not sell. Today that same property is now worth $1.1m.

“Sometimes the best strategy is to buy and never sell,” she muses. “Patience really is gold. Selling is an antiquated way of doing things. If you want money just extract the equity; that way you have both the cash and still hold the property. Why would you kill the golden goose?” Why indeed?