As a tower crane operator in his day job, Ryan Hayes is accustomed to working with a little risk. However, the 32-year-old doesn’t take any risks when it comes to securing his financial future, a journey that began when he was just 24.

Funnily enough, his success in property has come about completely by accident.

“I never envisioned owning a whole heap of properties. Originally, I bought a two-bedroom unit in my mid-20s in an area that I was familiar with, five minutes from home, as my first place to move out to and become independent,” he explains.

“I was paying principal and interest off the loan, plus making extra payments with a view to paying the property off, and I didn’t have too much more of a grand plan at the time.”

It was only when he met his now-fiancée Michelle Romero, who had also already bought her first property – a one-bedroom apartment in Ultimo, Sydney – that the pair sat down together and looked at what could be achieved by using real estate to create wealth.

“We discussed what owning a debt-free property would actually deliver, as opposed to expanding our portfolio aggressively and trying to generate some wealth creation through property,” Ryan says.

So it was that in 2011 Ryan and Michelle, a software engineer and business manager, decided to pool their resources and begin their journey, building their portfolio together.

“A few books turned into a dozen and then two dozen, along with many seminars, buyers’ club meetings, podcasts and webinars. We built our knowledge base to reach the point where we were comfortable going into the millions of dollars worth of bank debt that property investing requires,” Ryan says.

Employing an aggressive strategy

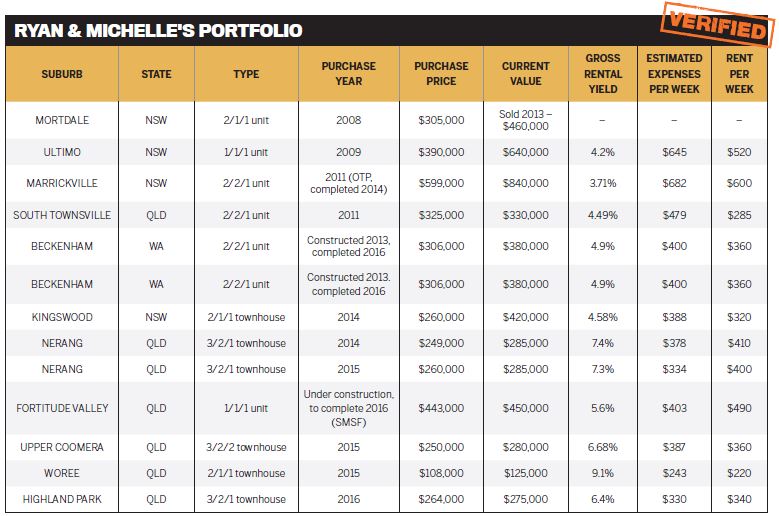

Just five short years after beginning their investing crusade in earnest, the pair have amassed a diverse and bold property portfolio valued at around $4.7m.

They own 12 units and townhouses, which are spread out across various areas, including Brisbane, Sydney, Townsville, WA and the Gold Coast.

Replacing income through real estate

“Property investment has now become our primary wealth creation strategy, with everything else geared around supporting the portfolio,” Ryan says.

“While our professions are important and fulfilling, there is no escaping the mathematical reality that without a sizeable chunk of assets held through many market cycles, or an active equity-generation method like development or sweat equity, retirement is a distant horizon.”

Therefore building and maintaining a robust property portfolio has become Ryan and Michelle’s retirement strategy.

Their relatively high combined annual income of around $250k–$300k has allowed them to build property deposits relatively quickly, facilitating their more aggressive buying strategy.

They currently have net equity of a little over $1m in their portfolio, but with time this will grow, as their overall strategy is to build and hold a significant property portfolio.

In other words, they’re in this for the long haul, rather than trying to flip properties for a fast profit along the way.

“We will use any investment method, advantage or tool at our disposal if it will, over time, provide us with the options and flexibility required to live a life that really gets us excited, rather than just living within our means through necessity,” Ryan says.

The ‘too good to be true’ deal

With so many property transactions under their belts, Ryan and Michelle have made a few decisions that, in hindsight, they would have handled differently.

“A mistake that I would take back was falling in love with ‘the deal’ even though the fundamentals of the area were questionable,” Ryan admits.

“We all try to operate with as way it was structured we effectively made a equity gain of $70,000 over the duration of settlement.”

It all sounds amazing, especially when you consider that the rental returns were also strong, initially at least.

“The problem was that the actual area it is located in, South Townsville, has had several hard years of flat returns and increasing vacancies. It was a lesson that you should always treat the area dynamics with respect, no matter how good the deal is.”

While that was a learning curve, Ryan also shares one of their most successful property transactions to date – one that was secured with the help of a buyer’s agent.

“Two years ago, through a buyer’s agency, we bought in Kingswood, Western Sydney. It was a two-bedroom, one-bathroom, one-car-garage townhouse of average quality, and we paid $260,000,” he says.

“It required a few thousand dollars worth of paint and a tidy-up and then it was off and running!”

From their research, they knew that there had been previous sales within the same block at $300,000 just a few little emotion as possible in this game, but it’s not always achievable.

“Property investment has now become our primary wealth creation strategy, with everything else geared around supporting the portfolio”

When a ‘no cash down’ opportunity came our way due to the distressed circumstances of the owner/developer, it led to a deal where we ended up acquiring a two-bedroom, near-new, neutrally geared property for a $1,000 expression of interest payment. The remainder of the deal was capitalised into the loan structure, and due to the way it was structured we effectively made a equity gain of $70,000 over the duration of settlement.”

It all sounds amazing, especially when you consider that the rental returns were also strong, initially at least.

“The problem was that the actual area it is located in, South Townsville, has had several hard years of flat returns and increasing vacancies. It was a lesson that you should always treat the area dynamics with respect, no matter how good the deal is.”

While that was a learning curve, Ryan also shares one of their most successful property transactions to date – one that was secured with the help of a buyer’s agent.

“It required a few thousand dollars worth of paint and a tidy-up and then it was off and running!”

From their research, they knew that there had been previous sales within the same block at $300,000 just a few months earlier, so it had “an inherent equity buffer already in place”.

“Just six months later, it was bank valued at $320,000 for refinance, and less than 12 months after that it was valued at $400,000!” he says.

“While the rent has not moved at anywhere near that stellar growth rate, it has been a little capital growth supercharger to help purchase in other markets more recently.”