From a young age Karin Mackay has been driven by her passion for property. Despite some ups and downs, her love of property has served her well: she currently has a portfolio of 10 properties worth a total of $7.1m

From a young age Karin Mackay has been driven by her passion for property. Despite some ups and downs, her love of property has served her well: she currently has a portfolio of 10 properties worth a total of $7.1m

Not many young stay-at-home mums with small children have the inclination or energy to spend time on any personal interest or hobby. But, nearly 40 years ago, that is just what Karin Mackay did.

By the age of 19, she was married with two young sons - and needed to keep her mind occupied, she says. "So I used to read about, and follow, properties selling in different areas. I could see then that you could make money out of property."

This pastime inspired her to use an inheritance of $2,500 as the deposit to buy her first property, in Yarra Junction, at the age of 20. Located 72km away from Melbourne, the house cost $17,000.

Just 18 months later, after tiling the shower cubicle, carpeting two rooms and doing some painting, she sold it for $30,000 in order to buy closer to Melbourne. The whole process inspired her lifelong devotion to property investment.

These days, Karin lives and breathes property. It is her passion, she says. And for some years she has been lucky enough to have been able to pursue that passion in her career as a buyer's agent, too.

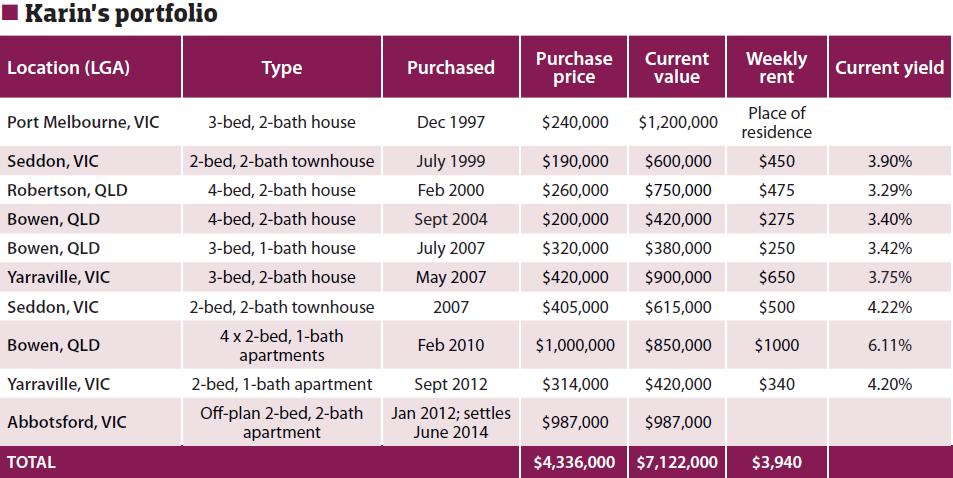

The 58-year-old grandmother of nine currently owns nine investment properties, along with her family home in Port Melbourne. Her portfolio is worth $7.1m.

"I have been very fortunate in everything I have invested in," she says. "And so, for that reason, it's all been a very simple process really."

Evolving strategy

Despite actively investing all her life, Karin stepped up her game when she married her second husband in the late 1990s. The couple decided that property was the way to ensure they would be able to enjoy the sort of retirement they wanted.

Their objective has always been to have nine properties, with good capital growh, by the time of their retirement, she explains. “Then we can sell off four or five of them, pay off the loans on the rest and we will have the returns on those properties as our income - which should equate to about $150k per annum."

In turn, this end goal has informed her investment strategy and selection criteria. She has always aimed for a diversified, residential portfolio and she has focused on relatively new properties in order to gain the tax benefits that come with them.

Initially, she stuck to a buy-and-hold strategy. But, over time, that has evolved and she has tried a number of of different approaches - from townhouses to housing infill areas to major renovation jobs to a development project of her own.

"Now I love buying older properties to renovate and add value," she says. "I prefer not to buy houses as I believe they take too long to recoup the funds. And holding costs are a killer."

When selecting her properties, which are all in Victoria or Queensland, she looks in areas that are less than 12km from the CBD. She then chooses properties that will either give her close to a 5% return or that she can makeover in three weeks or less on and on-sell.

Property focus: FIRST SUCCESS

Property type: 3-bed, 2-bath townhouse

Purchase price: $190,000

Current value: $600,000

Rental yield on purchase: 12.32%

Location: Seddon, VIC

Not long after Karin and her husband started looking for their first investment property in 1999, they found a new-city townhouse which ticked all their boxes.

Te three-bed,two-bath property, which cost $190,000 was in the right location to meet all their requirements. It is close to public transport and to the city, so it has attractive lifestyle factors - which is one of the key elements she looks for.

- Research, research, research!

- Don’t assume that if you are buying in a “growth” corridor it automatically means you will achieve capital growth. It is generally the exact opposite

- Don’t buy a price: Just because a property is cheap it doesn’t necessarily mean it is a good investment

- The way to grow wealth is through capital growth. So it is better to buy something that has scarcity value. I believe it is better to buy an apartment/ unit/townhouse in inner city where there is a scarcity of land than buy a house on 500m2 20km out of Melbourne (for example)

- Don’t get emotional!

It is in a great western suburb with good capital growth and decent rental returns, she says. "And those are the two reasons we invest in a property. I don't think we could have got the same sort of [total] returns anywhere else."

In the time since they bought the property, they have spent $40,000 on some cosmetic renovations. Ot was just a lick and spit type of renovation involving repainting, polishing the floors, and carpeting, she says.

Overall, the property has been a highly successful investment with no problems at all, Karin says. "It has always been easily tenanted and our tenants have been great. Although one group of tenants were three girls, and apparently, the hot water service wasn't good enough. So we bought a new one. That has probably been our biggest problem!"

Further, the property has provided the couple with significant tax benefits. That's one of the reasons she is all for buying new in the right location, she adds. “I think it really minimises your risks. And I’m all about that.”

Property focus: DEVELOPMENT FORAY

Property type: Development: two townhouses

Purchase price: $560,000

Development cost: $770,000

Sold for: $1,400,000

Location: Yarraville, VIC

After spending some years buying and renovating, Karin and her husband decided to have a go at a development project of their own. They chose to build two townhouses on a section they subdivided in Yarraville.

It turned out to be their most difficult investment project of all. While the approval and build process was straightforward and easy, they ran into problems due to tight market competition and finances.

When you invest in a ready-built property, the time that you buy is when you make your money, she explains. “But with development projects you need to make sure that you are selling in a good market to make your money.”

The main problem was financial overextension: she borrowed a lot of money which meant the house cost was high but, unfortunately, the market wasn’t great at the time. This left the couple with some problems.

To resolve the issue, Karin thought that they could sell one of the properties [in the subdivision], rent out their family home for about $1,000 a week and live in the other property [on the subdivision] for a year. That would have sorted out the situation, but her husband was not keen on her solution.

Eventually, they sold the properties but it was a highly stressful time, she says. “We’ll never do that again, unless we can put down 50% up front. But you need lots of energy for development and we’re a bit too old for that now.”

However, she says she learnt the following valuable lessons:

- Always have at least 50% of the total cost of the development in the bank. The holding interest is a killer.

- Unless you are "the" builder, it is hard to make money. This is because a builder builds at cost and then adds the profit at the end when he sells. But when using a builder you have to recoup the stamp duty, holding costs, the builder's 18-20% profit, and then you have to make a profit.

Property focus: OFF-THE-PLAN PRESTIGE

Property type: 2-bed, 2-bath apartment

Purchase price: $987,000

Current value: $987,000

Location: Abbotsford, VIC

Karin’s latest investment is a two-bed, two-bath apartment in Abbotsford, which she bought off the plan. While she usually avoids buying off the plan, she says the deal on this property was just too good for her to resist.

Also, she loves the developer responsible’s work because of his beautiful workmanship and finish. Plus it is in a unique location, she adds. “It is right on the Yarra River, the 109 tram runs right by [to the city], Victoria Garden shopping centre is just down the road. So the development had those crucial lifestyle factors.”

Karin's Portfolio (Click to enlarge)

Her intention is to flip the property, which she is confident she can do. This is because it is a unique, owner-occupier block. When she is buying she looks at where people want to live and what type of people they are, she says. “I prefer professionals and tradies. I don’t buy in lower socio-economic areas because they are fraught with danger, particularly the high possibility of problem tenants.”

At $987,000 the apartment was expensive. She concedes this is a bit scary, especially given her plans to flip the property. “But, as I am an agent, I got the commission for it so I made some money from the start. Still, putting aside the commission that I earned, I think that in a resale I could make $20,000 profit on it - for doing nothing."

Property focus: FUTURE POTENTIAL

Property type: 4-bed, 2-bath house, 2024m2 block

Purchase price: $200,000

Current value: $420,000

Rental yield on purchase: 7.15%

Location: Bowen, QLD

One set of Karin’s properties has not yet performed as well as she had hoped. However, she believes they will see capital growth in the future, so she is happy holding them for the time being.

These properties are in Bowen, Queensland, an area she fell in love with when she first went there. At that time, there was a lot of hype about the area, with mining concerns setting up in close proximity, a massive expansion planned for the nearby crushing facility at Abbots Point, and plans for a marina.

To date, none of this has happened. And, not long after she and her husband bought their properties in Bowen, the bottom fell out of its market. This means they have had to hold on to most of their properties in this area.

“Having said that, with everything that we have bought there, even if we were to sell today, we would make money on it,” she notes. For example, they have a four-bed, two-bath house which they paid $200,000 for. If they were to sell it now, it is worth $420,000. Adding to its value is the fact it sits on a big 2024m2 block.

Further, Karin says that, while the marina is unlikely to happen, the mines have now been approved as has the crushing facility expansion, so Bowen is set to boom in future.

“I’m not generally keen on mining towns, but Bowen has other things going on too. It is big in agriculture and it also has beautiful, as yet undiscovered, beaches which will one day pull in tourists. I'm confident that growth will come.”

Equity end goal

While Karin’s long-term goal has always been to ensure she and her husband are set up for retirement, a more immediate goal is to pay off their equity loan. Doing so will enable her to retire if, or when, she wants to, she explains. “That time is not now. I am not ready yet! But I do want to have the choice.”

In the meantime, she plans to focus on buying older style one- and two-bedroom apartments and units, giving them a makeover and then flipping them.

“If you get a good team in there, you can finish such a project in around three weeks and earn $20,000 to $30,000 profit...Well, how else can you earn that in three weeks? It just adds to the passion for property that I think I must have been born with.”

This feature is from the October issue of Your Investment Property Magazine. Download the issue to read more!