“I knew I needed to do something with it!” he says of the small sum he had accrued.

“I was referred to a property group by a close friend, and they were doing development projects on the Sunshine Coast. I decided it was time to put that money to use.”

His first investment was a townhouse in a suburb on the Sunshine Coast, around 60 to 90 minutes’ drive north of Brisbane.

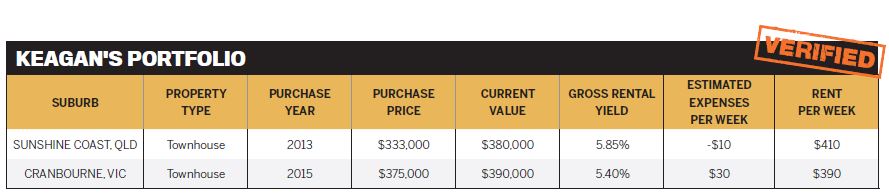

Keagan researched the deal and was impressed by the returns on offer, which saw the property become neutrally geared fairly much from day one. He paid $333,000 for the property in 2013, and today it returns $410 per week.

“After I bought that first property, I realised I had done the right thing – I wanted to invest and learn more,” he says.

“I took advantage of my time spent away with the army to save as much money as possible. In the beginning, it was hard not to purchase nice things with my money, but I knew if I held off it would be better in the long run.”

“People love immediate gratification and will often sacrifice the dream of getting out of the rat race for the good feeling you get when you buy something new. This unfortunately ties them down to a day job”

Five strategies for success

Keagan’s property investing journey commenced back in 2013 and he admits that at the time “I had no idea what I was doing and was very naive”.

As a result, his property strategy has changed many times in the past few years.

“I was first told that my properties would grow fast enough to be able to consistently draw equity out

and purchase more properties. Unfortunately, it’s not that easy, and serviceability becomes a problem. I was quick to learn that there were a few key elements I had missed,” he says.

His next purchase was a townhouse in Cranbourne, Victoria, for which he paid $375,000 in 2015. It presently returns $390 per week, and after all of his ownership expenses are added up, he says his shortfall is very manageable at around $30 per week.

Keagan did a lot of due diligence before buying into his property deals, during which time he leveraged the help of Real Estate Investar’s research tools. He has plans to expand his portfolio over the coming years as a means of generating income and setting himself up for retirement later in life.

While he is happy with the properties in his portfolio so far, his experiences have led him towards five key learnings, which he says are the foundation of his investing strategy going forward:

There is nothing good about the word ‘negative’ (gearing).

• Do your due diligence.

• Purchasing under market value

is crucial.

• Manufacturing growth can be a great option to move you forward.

• Cash flow is the key to success.

“I will continue to self-educate

myself whilst implementing the things I have learnt over the last few years. My progressive self-education has made me realise that it’s not about the amount of money that you are making but the type,” he explains.

“To be honest, I don’t look at people with nice cars or houses or clothes and think, ‘I want to be like them’. You will find that people love immediate gratification and will often sacrifice the dream of getting out of the rat race for the good feeling you get when you buy something new. This unfortunately ties them down to a day job, and people will stay there forever, because it’s where they feel comfortable.”

Regrets and refreshed strategies

When Keagan looks back on his investment journey to date, he is humble enough to admit that he’s made a few mistakes.

“I have regretted not purchasing a few properties when I had the chance to, and I would really recommend to others how important it is to know how to conduct a thorough due diligence check,” he says. “That said, I don’t think I would change anything, simply for the fact that I have learnt a lot from the small mistakes I have made.”

Through Keagan’s commitment to self-education he’s become firmer in his own ideas of what constitutes a smart buying strategy.

“I will no longer purchase off-the-plan properties as I personally think it’s not the best investment option,” he says.

“I am now looking to purchase property in the South Brisbane area, but I am finding it challenging, with it being such a hot market. That’s why my goal is to become an area expert in a select few suburbs, and make friends with the agents locally.”

Retirement through real estate

Others may turn to shares or stocks to grow their retirement wealth, but Keagan is committed to growing his property portfolio with an eventual goal of retiring from the workforce and living off his rental income.

Keagan says property investing is the vehicle he has chosen to pursue over all other asset classes because it is an area of wealth creation that “interests me the most”.

“I knew if I was committed to my goals that I could create enough recurring income [through property investing] to leave my traditional job,” he says.

“I’ve learnt that it is extremely important to surround yourself with positive, like-minded people, because the attitude is contagious. I have also learnt to cut away most distractions that would heavily slow my progress, such as Facebook and drinking at social events. Instead, I now read, watch webinars and attend courses and seminars. I honestly never thought I could convince myself to like reading, but it happened!”