Michelle Lewis’ instinct and passion for renovation saw her making high five-figure profits in just two months.

It was a long ago current affairs show that prompted Michelle Lewis’s fascination with property. Aged just 18, a lightbulb burst into life as she watched a story on property investment.

From that point on, she knew that was the path she wanted to follow. And, thanks to an inheritance of $18,000 which kick-started her journey 11 years ago, she has just done that.

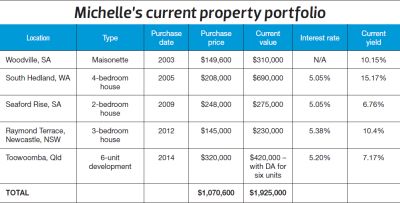

Perth-based Michelle (40) and her husband Travis currently have a solid five property portfolio worth over $1.9m. One of those properties is a development site. Once the six units planned are completed later this year the property will increase in value significantly.

Along the way, the couple has bought, renovated and sold several other properties. They have also renovated some of the properties they hold.

For Michelle, who was Property Women’s Property Woman of the Year 2014 runner up, it is the renovation work that she has found most enjoyable and fulfilling.

Instinctive renovator

Instinctive renovator

The inheritance she received in 2003 allowed her to jump into the property market. But she did so prior to getting educated.

“I didn’t have a strategy when we started out,” she says. “It was instinct to buy something with good bones that could be renovated back to life by adding value ourselves. I didn't realise it was a strategy at the time!”

Her first purchase was a one-bedroom duplex (half of a 1930s bungalow) which she bought for $149,600 at auction. While it was bought for the couple to live in, it was in desperate need of renovation.

The mother of three says it was awful. “The lady who lived there had 21 cats and it smelt like it too.”

But she realised other people would be put off by the smell and cat hair, which would decrease the number of potential buyers, and give her a better chance of securing it.

After the purchase, the couple added a laundry, a second bedroom and a family room to the house. They still own the South Australia property – which is now valued at $290,000, an increase of $140,400.

Embracing reno strategy

Although Michelle adopted an add-value reno strategy almost by accident, she subsequently decided it was the best approach for the couple to take.

“Once I got educated I became very clear and focused on strategy. Renovation was a no brainer for us to begin with as we had done some already. From there we built on this strategy – with the help of my mentor Rachel Barnes – to move forward with property investing.”

Her strategy now is to buy something that no one else wants but in which she can see potential. Therefore she targets properties that are ugly and/or dilapidated. She sources such properties by reviewing RP Data figures, using websites like realestate.com.au and council information, and by talking to people.

Once she has bought, Michelle renovates the property cost-effectively but attractively. While the couple has held some of their renovated properties and rent them out, they have also sold some.

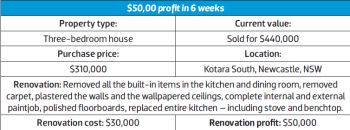

However, she considers her first buy-renovate-and-flip project to be their most successful transaction. In that particular case, the Newcastle property was bought for $310,000. Several months later postreno, it sold for $440,000.

Planning reno work

When going into a reno, Michelle plans the scope of the work around a roomby- room cost analysis. This involves establishing what basics have to be done and then isolating a couple of focal points for bigger spends.

For example, with a bathroom she might paint over the top of old tiles but then splurge on a good, new shower screen. The repainted tiles will make the room look clean and crisp, while the new screen will modernise it, she says.

“It is about choosing focal points to put your cash into effectively to create a wow factor. So your bathroom, kitchen and main bedroom should have a big wow factor and then you budget around that because people just need the basics at the end of the day.”

She works with a rough overall budget in mind and aims to do everything as cheaply as possible. This means that, after coming up with an estimate of what it will cost to renovate each room well, she halves the amount and then tries to work to that.

It can be challenging, but Michelle emphasises it is possible to achieve a great deal with not much money. For example – with the help of a painter, mistinted or unwanted paint can be retinted or mixed for use on a reno.

It can be challenging, but Michelle emphasises it is possible to achieve a great deal with not much money. For example – with the help of a painter, mistinted or unwanted paint can be retinted or mixed for use on a reno.

“I am keen on reusing and recycling quality, second hand items that you get from places like Gumtree,” she continues. “There are plenty of things around that aren’t that old and that, with vision, you can reuse easily. I got a kitchen for our Kotara property for $1,200 on Gumtree!”

While Michelle creates, and updates daily lists of work that needs to be done in each room of each project for both herself and her tradies, she doesn’t have a template for a budget checklist.

“You go on instinct a lot. I try to keep each project as cheap as possible. With experience, you learn what things cost so you become a more business orientated renovator as you go along."

How to choose tradies

After an attempt at doing the reno work on a project themselves, Michelle and her husband decided it was best to use professionals. Being hands-on slows down the process and time equals money, she says.

“If you want to get a reno project done efficiently get in the professionals – even if it means multiple tradies on site at the same time. I think my time is better utilised as a project manager – and then I can still be mum too.”

However, that means she spends a considerable amount of time finding likely tradies, getting quotes and comparing quotes. To do this she looks for tradies on Gumtree and in the back of the local papers and then makes multiple phone calls.

“Sometimes I will make as many as 10 calls per trade to find the right person for the job. I just keep going till I get a price in the right area. This can save you thousands of dollars because the difference in quotes you receive is often massive.”

She recommends looking for semiretired tradies. In her experience, they are reliable, highly skilled, helpful, and know how to get things done on, or under, budget.

“Always try to meet with tradies face to face if you can manage it. It allows you to get a feeling for them and how they communicate. If they don’t fit, just move on to the next option."

Successfully working with tradies

Managing lots of tradies can be challenging, but Michelle says she is lucky enough to have had great experiences with the tradies they have employed.

As a result, their “worst” experience came with the respray of a clawfoot bathtub. The bath taps they had were gold-trimmed, but the tradie doing the respray put in a silver sinkhole. “Due to the nature of the mistake, it was Raymond Terrace pre-reno Raymond Terrace post-reno something we just had to live with.”

It was a minor problem, but it provides a good example of why it is necessary to keep a close eye on the work taking place – especially when undertaking a high-speed reno job.

Raymond Terrace, pre-reno

Raymond Terrace, post-reno

Michelle recommends the following to ensure good experiences with tradies:-

- Watch what your tradies are doing carefully. Make sure you are on site daily – or even several times a day if a critical piece of work is taking place or if you have a new tradie on site.

- Provide each of your tradies with a clear and specific list of what you want them to do and keep tabs on it. A chart with a checklist can also be useful.

- Treat your tradies well – buy them lunch, bring in homemade treats, have music for them to listen to while they work, create a positive and happy environment for them.

- Communicate with your tradies and make sure they know you are there and can help. For example: let them know you can go and get things offsite for them so that they don’t need to leave the job.

Lessons learned

One of the biggest lessons Michelle has learned is that, when it comes to speedy reno projects, you have to accept that you will have to give up something else in your life to get the project done.

“If you are working fast, you simply can’t continue to live your normal life. Something has to give. And it will push you to your limits – even if you enjoy the experience. So you have to be ready for the challenge.”

Reno property #1

Michelle describes this particular property as a true renovator's delight. It was a severely neglected house – which had been eaten away by the termites that were still living in a huge nest in the living room wall.

Finance

When buying this property, the couple didn’t follow their standard practice. They bought at auction – but without having their finances pre-approved. “It was an ex-housing trust property and had to sell, so we snapped it up.”

This meant that after the purchase, they had to quickly hunt around to secure the finance. Fortunately, they were able to get a business banking loan through Melbourne Business Banking Unit using leverage from other properties for the 10% fall of the hammer deposit.

Research

Michelle says they were looking for an affordable property which they could add significant value to and which would provide them with a positive cash flow rental return.

“I try to spend as little as possible on purchases so that I can have money to move onto the next project. Doing this means investing in your future can be affordable.”

To ensure a tenant pool, they wanted a property within a reasonable distance of the Newcastle CBD and near some employment hubs. This property was within 20km of the CBD and near the airport and RAAF base.

The fact that the three-bedroom house was in such poor condition meant that it was going for a low price and that it would be easy to add value.

Further, the property is on an 1190m2 block which meant they could develop it in the future. They are considering building four units on it or, alternatively, adding a granny flat at the rear in the years to come.

All of these factors meant the numbers added up, but Michelle says gut instinct also came into play when they made the decision to buy then.

Performance

After spending $20,000 on a whole house renovation, the end result was a neat, clean and appealing home. They secured a good tenant quickly and the property returns a good income.

In Michelle’s view, the project was a rewarding and successful one. It was a great learning curve, but the trick was not to over-capitalise on the property, she says.

“I love that we have provided a nice home.”

Challenges

Their biggest challenge came because they tried to do as much as possible themselves to cut costs. But it took longer and ended up costing them more, Michelle says.

“Doing it in the way we did also took a toll on us as a family. So we learnt to use tradies to sustain energy and save money.”

1. Be frugal. Never buy retail. Always buy wholesale, check out sales, and don’t be ashamed to pick up things on the side of the road. “I once found a perfect modern couch which was unwanted!”

2. Don’t replace what you can reuse. For example, instead of tossing an old sink away, polish it up and change the taps.

3. Always get a minimum of three quotes from tradesmen. Ask for itemised pricing so that you can ensure the bill is worth the work put in.

4. Be organised and communicate well with tradesmen.

5. Be on site on a regular basis to check on progress.

6. Build a team environment and always thank your tradesmen for good work. Also, send your tradies a message updating them on the sale of your property and emphasising that the work they did contributed to the successful transaction.

7. Styling can be key to attracting a large group to your open home. Large numbers create a sense of urgency and healthy competition in buyers. This can lead to a higher sale price. So make the styling appeal to as many people as possible by keeping colours neutral, light and bright.

Reno property #2

This severely rundown house “with a falling down porch and possums in the roof” tickled Michelle’s fancy as soon as she saw it. It was the perfect property for her next goal.

Finance

Michelle says they purchased this property at auction as it was a deceased estate which had to sell. On this occasion, they had their finances firmly in order prior to the auction.

Leveraging a line of credit from their other properties as a 10% fall of the hammer deposit, they had secured a loan with National Australia Bank. To minimise capital gains tax, it was bought using a trust structure.

The loan was paid out when the property sold and achieved the profit they wanted.

Research

Several months' search to find the right property in the right location was behind this purchase.

This property ticked all Michelle’s boxes when she discovered it. It is just 11km from the Newcastle CBD and there is a major hospital, a Hunter TAFE campus and one of Newcastle’s largest shopping areas in neighbouring suburbs.

It had the added bonus of being located close to her home at the time – which was a positive when it came to carrying out the planned project.

The property’s bad condition also meant they were able to buy it under value at $310,000. She says it fit all their criteria for a reno-and-flip project. “So our decision was based largely on hard numbers as the goal was to make a decent profit via reno and flipping or on-selling right away.”

Performance

After purchasing the property, Michelle oversaw a six week intensive internal and external renovation. Two additional weeks were devoted to finishing and styling, which she believes was key to its success. It sold after its first open home.

They had set out to buy a house under value, renovate it and sell it within a short space of time, thus maximising their profits. She says that achieving this, along with a $50,000 profit, was a wonderful experience.

However, she adds that seeing the property’s transformation and the speed in which the project was completed was very satisfying.

Challenges

The main challenge posed by this property was its steep driveway. It had the potential to put buyers off and it also made things logistically problematic. Another challenge was the short timeframe of the project and managing multiple tradies all working at the same time.

But Michelle says it is a great example of how property investment is, ultimately, about working with people. “Communication and organisation is a massive part of the job – and, luckily, it’s something I love.”