Getting over a relationship breakdown is challenging in itself. Starting all over again and rebuilding one’s fortune is even more difficult.

Getting over a relationship breakdown is challenging in itself. Starting all over again and rebuilding one’s fortune is even more difficult.

Yet Miriam Keen soldiered on against the odds and now her hard work is starting to pay off. Since 2012, she has managed to amass a portfolio worth

$1.33m, while earning the equivalent of an average wage in Australia. This is no small feat by any measure.

“I decided to invest in property to secure my future and future retirement. Being divorced and single and with no family to assist me, it’s crucial that I am and always will be financially self-sufficient. I’d never want to rely on a pension during retirement,” she says.

Where it all began

For Miriam, accumulating the deposit for her first investment property was perhaps the hardest part of her property investment journey.

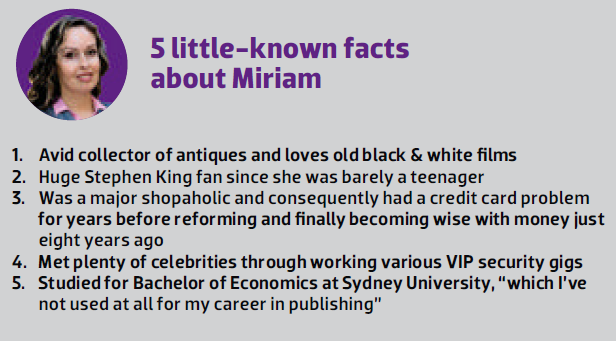

“I had to work multiple jobs to try and save enough money for my initial deposit,” she recalls. “I work full-time in publishing and also moonlighted three to four nights a week as a security guard at various bars and clubs until daylight, in order to raise the initial deposit.”

While doing this, Miriam was meticulously doing her research, studying her target area, her chosen streets and how property prices were moving.

“I wanted to buy in Rushcutters Bay in Sydney, so I studied everything about the suburb. When I was finally ready to buy, I knew my area inside out and have become quite an expert.”

It took Miriam five and a half years to save the $120,000 required for her first property purchase.

“The bank insisted on 20% deposit for my Rushcutters Bay property due to its postcode and size of only 45sqm,” she explains.

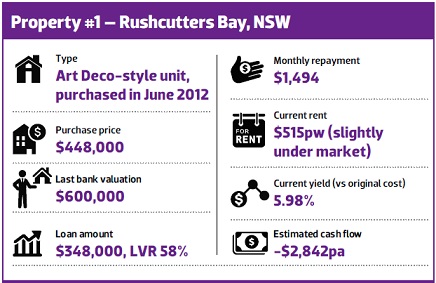

Miriam’s first purchase was an Art Deco-style unit, which she bought for $448,000 in June 2012. At that time, the Sydney market was still relatively subdued. Since the purchase, the property has gone up in value by $152,000 – a hefty 34% capital growth in less than three years.

“My Rushcutters Bay unit was a good buy. I have managed to gain a fair amount of capital growth, because I got in at the perfect time in the market. As a result, I’ve managed to draw on this equity twice,” she explains.

Buying property two and learning a hard lesson

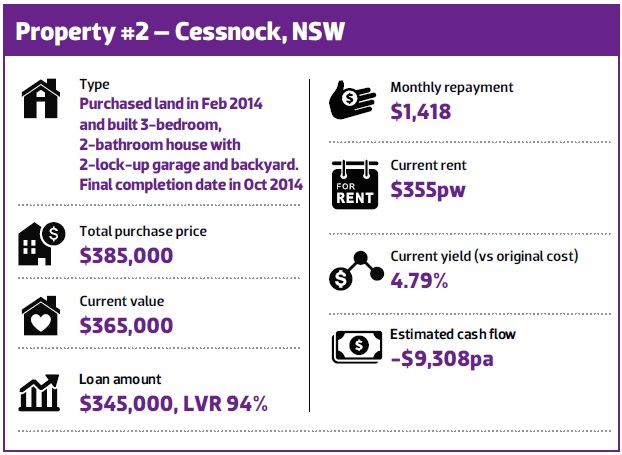

It would take Miriam another year and a half to buy her second property. Buoyed by her earlier success, she decided to enlist a property investment coach to help with her portfolio strategy.

Unfortunately, this turned out to be one of the worst decisions she’s ever made. Not only did she spend money on coaching fees and seminars but the property she was advised to buy ended up performing poorly.

“My biggest mistake was being ‘suckered in’ by a slick property spruiker,” she recalls. “Both my first and third properties – made purely from my own research – have so far proven a major success. However, with my second purchase – a recommended house and land package in Cessnock, NSW – I stupidly trusted the wrong person and their so-called ‘research’, instead of thoroughly conducting my own due diligence.

“I also paid $3,000 for an apparent ‘lifetime mentoring program’, which merely amounted to some very amateur DVDs and absolutely zero support upon actual purchase! A rookie mistake that I’m still paying for!”

The consequence of this mistake was a loss of $65,000 in value two years later.

Moving on to property three

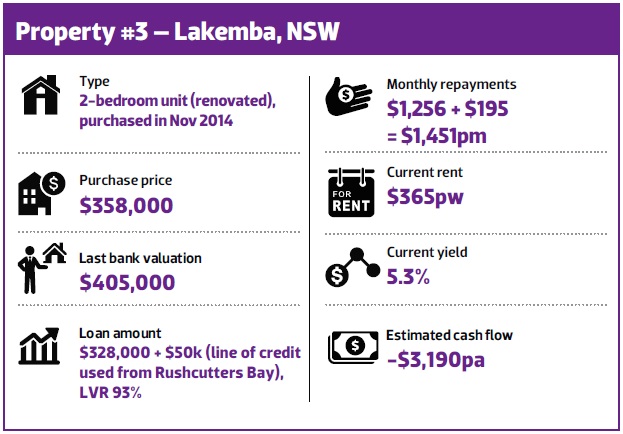

Miriam bought her third investment in Lakemba, NSW, barely a month after buying her Cessnock property.

“Lakemba was also a clever purchase based on quality and uniqueness for the area. I also bought it at the perfect time, and slightly under market value, when everyone in the media was claiming that the Sydney boom was officially over.

“My due diligence told me Sydney still had yet another 12–18 months’ growth in certain previously forgotten pockets – the poorer cousins of successful growth pockets. This told me that the ‘ripple effect’ was due to come into play shortly.”

Miriam bought the renovated two-bedroom unit for $358,000, and it has already grown in value by $42,000, or 11.7%, in just seven months. Her property is currently achieving a 5.4% gross rental yield, which is rare in the current Sydney market.

Challenges along the way

Challenges along the way

Miriam soon realised that in order to succeed as an investor, you need to keep learning. “It’s a continual ‘work in progress’ in order to succeed and not fall into various traps,” she says.

“It’s been challenging to work out who to trust and what information is actually valuable, timely and reliable, as opposed to random media opinion which is often misguided, mere speculation reported as facts, or just ‘no longer current’. Trying to formulate a strategy and never giving up regardless of certain hurdles which are guaranteed to crop up in any property investment journey is something that would truly test your resolve.

“I also have to balance what I know to be ‘fact’ and what the bank believes is my serviceability level, and whether or not a property is viable in my portfolio at this time or not. It’s about learning value, and also the limitation of a bank valuation.”

Managing cash flow

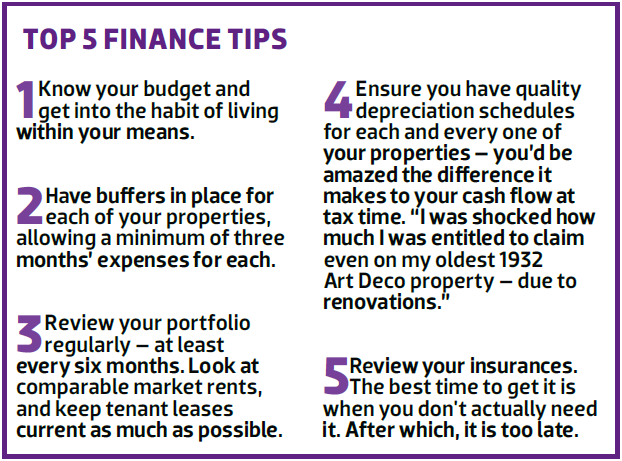

Managing cash flowTo ensure that she’s able to hold on to her portfolio over the long term, Miriam insists on setting aside a hefty buffer to deal with any unforeseen event.

“I have been able to build a substantial buffer over the last two years, in preparation for impending interest rate rises, which has already occurred for investors due to APRA’s new strict regulations, and to also safeguard against any other unexpected circumstances,” she says.

To do this, Miriam puts any short-term spare savings into a relatively high-interest account such as the eSaver from Westpac or ING Direct accounts.

“I also asked my accountant to help me lodge a tax variation form. This allowed me to get my tax refund(s) in  proportion with my pay throughout the tax year, rather than having to wait until my next tax return. This is very helpful for your cash flow and could mean the difference between easily managing your finances and even saving faster for another deposit, especially if banks are proving slow to release your equity.”

proportion with my pay throughout the tax year, rather than having to wait until my next tax return. This is very helpful for your cash flow and could mean the difference between easily managing your finances and even saving faster for another deposit, especially if banks are proving slow to release your equity.”

Strategies in the current market

Due to the fast-changing market and lending practices, Miriam has become even more selective with her investment choices.

“You need to buy smart and be cautious with buying, particularly within the Sydney market as we’ve had it great for the last three years and it won’t last forever,” she says.

“I am now focusing on Southeast Queensland and targeting townhouses and properties which are unique or scarce in some way so will always be in demand long term.

I am also considering central Adelaide – in the  already-established blue-chip suburbs.

already-established blue-chip suburbs.

“If money was no object, I would have purchased on the lower North Shore of Sydney, around Waverton, where it is a beautiful quiet area with its own little cafes and shopping village. Waverton defies the fact that it is so close to the city, yet has none of the usual city traps of traffic, pollution, noise, or after-effects of nearby late nightlife – whilst still remaining just five to 10 minutes from all the action. It really is a bit of a sanctuary, with so many trees and clean, crisp air, evident the second you get off the train! The views from Waverton are also spectacular and varied.

“I believe this area still has growth in it due to its superior location and scarcity factor. Although it’s already quite expensive, it’s unlikely to ever be affected by any downturn as it attracts an older and wealthier demographic.”

Learning from her mistakes

Like many successful investors, Miriam made sure that she learned from the mistakes she made earlier in her journey.

“I would never blindly trust any so-called ‘expert’ again without first examining the facts and conducting my own thorough due diligence,” she says. “I now always try to get an official bank valuation and building and pest inspection, as well as a strata report on a property I’m interested in. This gives me confidence in making a plausible offer in a timely manner that is likely to be accepted.

“I’m no longer frightened to increase rents when tenant leases expire – after conducting market comparisons, of course. Consistent small rent increases are manageable, and acceptable, whilst huge $50pw increases to try to play catch-up are counterproductive.

“I now take action when action is required and right for me at the time. When there is no sensible action to take, I sit back and continue my education to prime myself when the time is right again. Sometimes, when you are too ambitious and impatient, it is tempting to act for the sake of momentum.

Sometimes however, it proves beneficial to temporarily gather your reserves, consolidate, and simply wait for better circumstances.

“There is as much to gain from preventing a substandard purchase as there is from making a clever one.”