Currently working as a real estate agent in Sydney, 23-year-old Nikita has much more than just a nine-to-five interest in property. Now three years into his investment journey, he aims to use this asset class to achieve his goal of an early retirement.

But this is not something that Nikita just fell into, as he says his father’s words of advice were what helped him settle on property as a wealth creation strategy.

“I think my dad inspired me the most to get into property. From a young age I remember him drilling into my head to put my money in the right place,” he says. “Growing up we would often have discussions around the dinner table about money and investments, and he explained to me the pros and cons of each investment strategy.

“It became clear to me that property investing was the best thing to do and one of the safest investment options available.”

Viewing property as a long-term play, Nikita wasted little time in taking his father’s advice on board and getting the ball rolling on his investment path.

During his time at school, pocket money wasn’t spent on toys or other attractions, and there were no big, celebratory purchases when he found his first full-time job.

“Even though it takes longer to invest in property, I found it to be one of the safest places to invest my money. So basically, whilst I was at school any money I received from birthdays, Christmas and things like that I put into a savings account,” Nikita says.

“When I left school and got my first job as a real estate agent I saved 90% of my wage for that 10% deposit. Once I had enough, I bought my first property.”

The portfolio begins

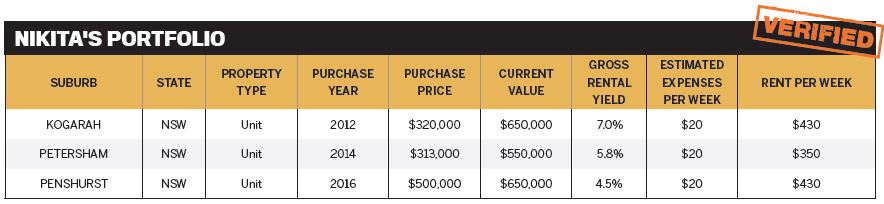

Nikita got the actual process of investing underway at the age of 20, settling on a two-bedroom unit in the southern Sydney suburb of Kogarah as his first purchase.

The unit carried a price tag of $320,000, which was one of the reasons it attracted Nikita, as he believed it was really worth closer to $410,000.

Although it was only his first purchase, he rates it as his best, as the apartment is now valued at $650,000 just four years after purchase.

While it might take some effort to find a similar under-market deal, Nikita would recommend that all investors spend some time bargain hunting if they want to replicate this result.

“Buying a property for under the market value is key – yes, they do exist if you look hard enough, and if you do find one it should allow you to have equity to move on to the next property,” he says.

“It’s not that hard to do. There are always people out there that are desperate to sell; it’s just a matter of finding them. I was searching for about three months before I found [the Kogarah unit]. It was in a desolate state and I knew I wanted to buy it. If you’re patient, you can find bargains.”

Banking equity to move on

As a qualified real estate agent, Nikita may have a deeper understanding of the property market and what makes it tick than those outside the industry, and he’s not afraid to make use of that advantage.

“I guess I have the edge on most people that aren’t in the industry as I know what areas are good or not and am able to tell a bargain from one that is not. When I look at a property I am able to immediately see the benefits and negatives of it,” he says.

“For example, for a lot of people, an original unit may be a negative; however, the way I see it, I can buy the property for a lesser price than if it was renovated, and renovate it myself, which adds equity.”

That added equity then becomes the rungs in Nikita’s property ladder, as he holds on to his renovated properties and draws out the increase in value to fund his next purchase.

The equity from Kogarah allowed Nikita to make his next move in 2014, when he invested in another unit, this time in Petersham in Sydney’s inner west. He paid $313,000 and spruced up the apartment with a cosmetic renovation.

Then it was on to Penshurst, where Nikita found another unit, which he purchased in 2016 for $500,000.

So far, one theme flows through Nikita’s investment portfolio: his properties are all apartments and are all located in Sydney.

While he admits that his portfolio currently lacks diversification, he also believes that sticking to what he knows is paying off well right now.

His Kogarah unit has more than doubled in value in the four years since he bought it, while the Petersham and Penshurst units have both seen impressive growth, bringing the current value of his portfolio to $1.85m.

Acting now to benefit later

For many people in their early 20s, retirement may be the last thing on their minds, but Nikita has a constant reminder of why it’s important to put the work in early to reap the rewards down the track.

“Both my parents did exactly the strategy that I am doing now. They worked hard, saved their money, bought assets that gave great returns, and now that they’re in their mid-40s they’re able to enjoy and reap the rewards of their smart investment options,” he says.

“My parents had a huge influence on me to buy property, as they invested themselves – and it worked.”

In a similar vein, he also came to an early realisation that while some sacrifice may be necessary, building his portfolio didn’t have to come at the expense of all other aspects of his life.

“Buying property does not impede on your lifestyle. I think most people think that buying an investment property affects their lifestyle, but in reality in doesn’t have to. Buy property whilst you’re young so you can reap the rewards later on.”

With that in mind, the young investor is currently in the process of expanding his portfolio; however, it won’t be a rushed move as he doesn’t want to do anything that will jeopardise his ultimate goal.

“My plan is to just continue investing. I am currently in the process of researching the next property. I make sure all my moves are calculated, because I understand that one wrong purchase or overcommitting can ruin it all,” he says.

“Basically, I plan to have enough passive income to take over my income from work. Once I have enough to live off my investment properties, then I’ll retire. My goal is to retire before 50.”

If he keeps making decisions like he has, this may very well be an attainable goal, as all three of his purchases are currently providing rental returns that would be the envy of most unit owners in Sydney.

NIKITA’S TOP 5 INVESTING TIPS

• Become best friends with the real estate agents.

• Never act too keen; you’ll show your hand.

• Do your research – then do it again.

• There are always bargains out there; you just need to find them.

• Save every single dollar you can.

TIPS FOR BUILDING YOUR PROPERTY DEPOSIT

Whether you are ready to buy your debut investment property to establish the first building block of your retirement fund, or you’re an experienced investor preparing to add another property

to your portfolio, one challenge is universal: the finance hurdle.

In the current market, investors can find it difficult to obtain a loan, as many banks and lenders are setting their servicing criteria to ‘high’.

Interest rates may be in the sub-4% bracket, but banks will often assess the serviceability of your borrowing at 7% plus – which can make what looks like an on-paper straightforward purchase seem risky to your potential lender.

If your ability to access finance is one of the things that is holding you back on your journey towards building your property portfolio, then one of the best things you can do to improve your position is to reduce your LVR.

Those investors who can build a 20% deposit will be able to cut out the middleman – otherwise known as the lenders mortgage insurance provider – whose lending criteria they would also need to satisfy. This means the investor will only have to pass through the gauntlet of one servicing panel.

Here are a few tips for getting your deposit together.

1. Refinance

One of the most effective ways to access money and minimise your outgoing expenses is to refinance an existing loan over a fresh 30-year loan term.

Let’s say you paid $450,000 for an investment property seven years ago. The first five years of the loan were interest only, so the principal and interest repayments on your loan balance were structured over 25 years instead of 30 years. As a result, your monthly repayments are now higher.

You’re now paying $2,700 per month principal and interest on that loan, at an interest rate of 4.25%.

However, you speak to your mortgage broker and discover that you can refinance the loan over a brand-new 30-year term with a new lender, at an interest rate of 3.99%. Better still, your first five years on this new loan product can revert to interest only.

And as the icing on the cake, thanks to property price growth you can borrow up to $480,000 with no LMI payable.

This gives you:

• access to $30,000 in equity to put towards your next property deposit

• a new lower interest rate

• a reduced monthly repayment of $1,600

You’re now paying $1,600 per month instead of $2,700, so you can put your savings of $1,100 each month into a property savings account. This will see your bank balance grow by $13,000 in just 12 months.

Of course, this strategy does involve restructuring your loan term over a new, longer period of time, so you should consider your age and long-term financial goals. Therefore it’s advisable that you speak to a financial planner to discuss the impact of refinancing over a new loan term before embarking on this strategy.

2. Move home to save cash

Move back in with your parents or in-laws for a short period of time to save money. Yes, it may seem drastic, but this is becoming a popular move, with a recent survey from Homeloans.com.au showing that more than three quarters of respondents had moved in with their parents or in-laws in a bid to save money.

“The most popular reason for moving in with parents or in-laws was to save for a house deposit,” says Will Keall, national marketing manager of Homeloans.com.au.

“Interestingly, we’re apparently never too old to go home, with 45- to 64-year-olds most likely to return to their parents while renovating or building.”

3. Makeover your budget

Can’t move in with your parents? Then consider restructuring your own lifestyle expenses to save money. By paying your biggest bill, your accommodation, fortnightly instead of monthly, you’ll create some financial breathing space.

It means that twice a year you’ll be able to skip a mortgage or rent payment, and those funds can top up your deposit savings account.

How does this work? Let’s say your monthly rent or mortgage payment is $3,500. Instead of paying that amount per month, you pay $1,750 per fortnight.

When you do the maths on this, you can see that:

$3,500 x 12 months = $42,000

$1,750 x 26 fortnights = $45,500

Difference = $3,500

By following this payment strategy, you’ll eventually build up enough ‘advance equity’ in your mortgage or rental ledger to be able to ‘skip’ two payments per year.

In our example, you would have an extra $3,500 to add to your deposit savings account. It may not sound like a huge amount on its own, but if you structure your repayments like this across two or three properties, you may be able to save an extra $10,000 in 12 months, without much extra effort or sacrifice.