JAI BANSAL’S approach to wealth creation through property might be a little different to that of some investors, as he doesn’t plan to hold on to any of the properties he buys, his ultimate goal is the same as the dream of millions around Australia – to live off his property income and enjoy retirement financially free.

When Jai and his wife and young son moved to Australia eight years ago, he admits he knew very little about buying real estate for profit. Undeterred, he began a small-scale computer business of his own that would allow him the flexibility to focus on self-education and market research.

Jai’s success to date has allowed him to semi-retire in his 40s and spend more of his time focusing on his next property transaction.

“I spend at least two hours each day calling up agents and researching properties in the market,” Jai explains. “Now property has become a full-time job with the added advantage of flexible working hours.”

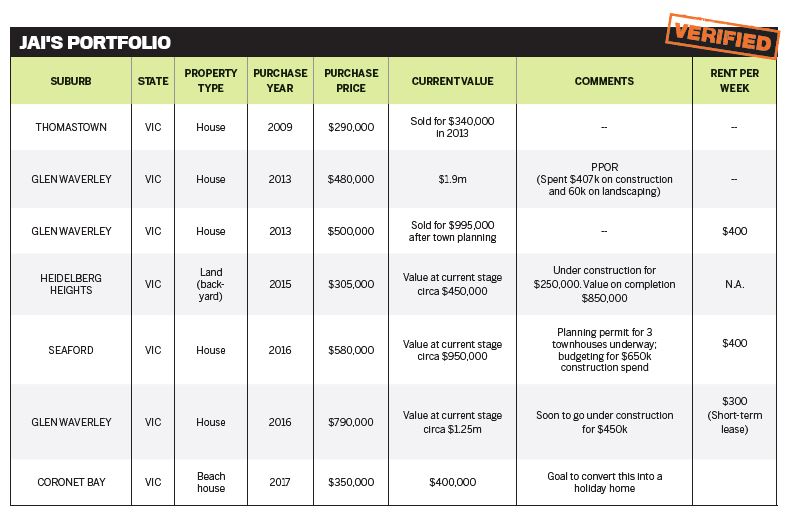

To date, Jai has purchased six properties as assets. He has sold two and holds one principal place of residence. Pinpointing a total portfolio value is tricky, however, since several of Jai’s properties are at various stages of development – which is what his entire strategy is based on.

Rather than the traditional buy-and-hold strategy, Jai has adopted a buy-develop-sell approach.

“I don’t plan to hold on to any properties. I buy with an eye on development potential only,” Jai says. “It helps me to free up my cash, with added profit.”

It’s a strategy Jai has perfected, keeping momentum going by putting approvals in place before settlement.

“The potential buyer didn’t have to do anything except sign the papers with the builder, because the prices and inclusions were already negotiated. All he had to do was sign and build!”

“I also work out my numbers to decide if I should sell it with just the planning permit in place, or go ahead with building. If my realisation gap is not very big in both circumstances, I’ll sell it with just the planning permit.”

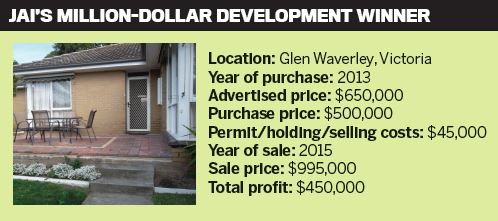

Jai used this tactic with his very first investment property in 2013, negotiating the list price of $650,000 down to $500,000. The block in Glen Waverley, Victoria, was large enough for him to gain approval for a townhouse development.

Six months later, Jai refinanced the property using the available equity he had gained by purchasing it under market value, and recouped his cash deposit.

After weighing up the numbers, he decided to sell the property a year later, with all the development plans in place, for a whopping $995,000 – without having to break ground on the new dwellings.

“I got approval for the townhouses, knocked down the existing building and even finalised everything with the builder,” Jai says.

“The potential buyer didn’t have to do anything except sign the papers with the builder, because the prices and inclusions were already negotiated. All he had to do was sign and build!”

Not only did the sale recoup the $45,000 Jai spent on planning permit expenses, holding costs and selling fees, but the profits provided more than enough leverage for him to purchase more properties.

“I got a taste of property, and I was hooked,” Jai says.

“I had just doubled my money after six months’ investment. That gave me a lot of confidence.”

A triplex strategy

Jai is always updating his strategy, depending on how he can best maximise his profits through development.

One of his creative value-adding tactics is to hunt down sites that agents and town planners assumed would only gain a permit for two dwellings, but then seek permission for three.

“I take a bit of a risk here, and I speak to town planners, local council and architects and try to get approval for three instead of two,” he says.

“If I’m able to build a triplex, my profit jumps. So I do this often.”

“I had doubled my money after just six months on my first property. That gave me a lot of confidence”

As well as generating far more capital in his properties, this buying strategy allows Jai to purchase properties at a market value based on a two-dwelling development.As a word of advice for investors considering their own property purchases, Jai advises thinking a little outside the box.

“Don’t leave it entirely to the architect; come out with your own ideas and discuss them,” he suggests. “Sitting on your investment may not be the best option. Be creative and bold to develop it.”

Jai’s creativity and attention to his research were instrumental in the success of his first development.

“I had applied for subdivision, and the town planner told me the house numbers would be 73a and 73b,” he says.

“But I did my own research and found that the council could give me separate numbers, since it was a corner block.”

Giving each dwelling its own independent street address removed any negative townhouse perceptions, which Jai believes further bumped up the property’s value.

He used his first two investment purchases – bought virtually back to back in Glen Waverley in 2013 – to cut his teeth on, and spent almost two years on development.

More recently, he has fast-tracked his purchasing, buying three more properties in less than a year.

Choosing sites

Initially, Jai bought in Glen Waverley because of its excellent schools, where he wanted to enrol his son. Since then, he has bought several properties in the same area or its surrounding suburbs, and also diversified into a coastal Victoria location.

MAXIMISING DEVELOPMENT PROFIT

• Find properties that aren’t generating a lot of interest, and buy at below market value.

• Look for areas with appealing infrastructure and popular school zones; make sure you research the suburb and build dwellings that suit the market.

• Start getting planning permissions in place before settlement.

• Be creative in your development proposal, and look for ways to value-add, such as adding an extra unit.

• Negotiate the purchase price as well as agreements with builders.

With his primary goal being a quick turnover, Jai says his key indicator for a sought-after suburb with development potential is the existing infrastructure.

“Rather than focusing on future potential, I look at what current facilities they have,” he explains.

“For instance, Glen Waverley has good schools, basketball courts, cafes, shops, shopping malls; it’s a multicultural neighbourhood and it ticked all my boxes.”

In addition, Jai aims to buy property with equity built into it from day one, by purchasing below market value. He then runs each potential purchase through a profit filter.

“I ask myself, how can I add value to this investment and achieve at least 20% profit above purchase price, after deducting all expenses? If I don’t see this profit, I don’t buy.”

Today, Jai’s portfolio consists of five properties, which are worth $3m at their current stages of development. Once the projects are completed, he expects that figure to rise to $7m.

He’s working on three development projects simultaneously – two with new houses and one with a permit for three townhouses.

Not all of Jai’s developments have been smooth sailing, he admits. His build in Heidelberg Heights stalled for seven months when issues related to water supply and the neighbour’s sewer lines cropped up.

However, other than wishing he had bought more properties, Jai has no regrets about the path he is paving and where it’s leading.

Bigger plans

From this point on, Jai expects to buy and develop a property each year.

His plans extend beyond traditional development, though – his goal is to eventually purchase large regional blocks to subdivide and sell.

“My idea is to buy acreage and hectares and subdivide them into 50, 60 or 100 blocks, for example, and then sell them,” Jai says. “I want to start doing that from next year.”

After four years as an investor, Jai believes that the property market provides better returns than any other investment.

“The beauty of a long-term strategy is that you have gained additional equity each year but you don’t actually get access to it; it’s kind of a simpler version of superannuation, with way more flexibility,” he explains.

“I would always bet my money on property investment rather than putting it into mysuperannuation fund.”

While Jai gets immense satisfaction from the course that his life has taken and the financial gains he has found in property, he says the best part of this is the positive impact it has had on his family.

“My beautiful wife is my partner in this business, and I love that we can work together,” he says.

“I actively discuss property options with my 15-year-old son, and at times he surprises me with his insight!”

Jai also appreciates the time he has each day to invest in his son’s ambition to become a professional cricketer and earn his light plane pilot’s licence.

“My time is flexible, so I can train with him, take him to practice and lessons, and to different coaches,” Jai says.

“This property investment business is giving me the gift of the most important kind: hours of my day.”