While working as a labourer, Jakab Golding made the decision to invest in property. Just a few shrewd investments enabled him to give up his day job to pursue his interest in music. He recounts his rags-to-riches story to Miriam Bell.

Property advisors tend to emphasise that investing in property is not a ‘get rich quick’ tactic. Yet Jakab Golding’s story is one that illustrates how several clever investments can be of financial benefit in a short space of time.

Originally from Perth, Jakab moved to South Hedland in 2005 after an intense period of self-development. A preliminary visit to South Hedland had showed him the area was booming, and he wanted to get involved. Prior to the move, he had worked at St Vincent de Paul and then as a door-to-door salesman. But on arriving in South Hedland he got a job at Job Futures. Although it was not a highly paid job, it was a salary sacrifice job and also provided job security.

Jakab says it was exactly what he wanted because it provided him with the means to save in order to invest in property. “I had always thought that property might be a good way to get rich. Then I started reading Robert Kiyosaki books and learning about people like Donald Trump, which inspired me to take the step and get into property investment.”

Inspiring move

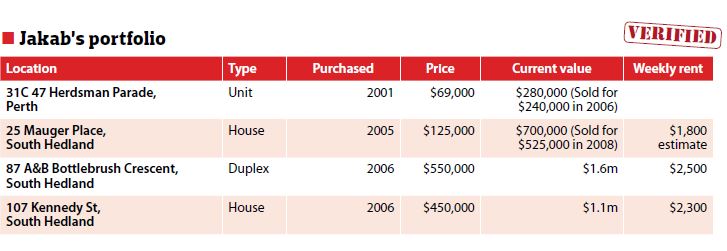

While Jakab already owned a unit in Perth, he had not seriously considered further investment until he moved to South Hedland.

“I brought that first property for $70,000, with a $5,000 deposit, in 2001,” he says. “I was only 21 and I wasn’t into investment then. I just sat on it, and I didn’t buy another property for some time.”

After his move to South Hedland, he decided he wanted to buy more property. The security of his job allowed him to get a bank loan in order to buy his first property in South Hedland. He purchased a house for $125,000, which he rented out.

It was a successful transaction, yet he was still wary of making the leap into further investment. A year later, he saw the light. His light-bulb moment came while he was on a bike ride one day.

There were construction signs all over the place, he says. “Money was pumping into the area. And it was full of old houses. I just suddenly realised that the whole place was on the brink of change. It was like a huge shot of adrenalin. I realised that I had to buy more property right away.”

Taking the plunge

Jakab immediately contacted a property investment company and an accountant for advice. Within a week, he had worked out his borrowing capacity. The very next day he saw a $550,000 duplex that he wanted to buy.

He signed up to purchase the duplex but, two days later, he saw another property that tickled his fancy. It was a five-bedroom, three-bathroom house on the market for $450,000. He knew it was an excellent opportunity, he says. “So I signed up for that too, even though I didn’t know how I was going to finance it all.”

Working with his property advisor, Jakab figured out how he could manage the double purchase. First up, he managed to sell his unit in Perth in less than a month. He also used equity from the first house he bought in South Hedland, and he got three loans from two different banks.

Looking back, he didn’t know about the potential risks, nor did he think about protection, he says. “Everything happened so quickly. It was all very last minute, and very intense. It was such a massive relief when it all went through without a hitch.”

Life transformation

Despite the stress of the purchase, the combined deal was easily his most successful transaction. When he made the deal, he knew it was his gateway to retirement, if it went well. And so it did. Jakab says the deal turned out to be the one big move that enabled him to retire from his day job.

“When I first bought the duplex, the rents were $300 per week at 87A Bottlebrush and $300 at 87B. Over the years, they have gone up – thanks to renovations and demand – and, despite a recent drop, they now sit at $1,400 per week for 87A and $1,100 for 87B.

“When I first bought the 107 Kennedy house it rented for $950 per week, but with renovations it now stands at $2,300 and has never suffered a rental drop.”

This means that from these two properties alone he earns nearly $5,000 a week in rent. At one point in the past, that amount was closer to $6,000.

“Investing in these properties has totally transformed my life,” he emphasises.

“Before I bought these properties, I was living from week to week and unable to really enjoy life. Today, I am effectively retired and live on the passive income from my properties.”

Learning on the journey

In 2008, Jakab sold his first South Hedland property for $700,000 – a very healthy return on his initial $125,000 purchase. The sale was beneficial to his savings, but he now regrets the move. He thinks it was the worst thing he has done in his property investment journey.

“Instead of selling it, I could have subdivided that property. I could have borrowed on the equity. It would be worth a great deal more these days. It had a few weak points, but they could have been fixed up.” Another lesson he has learnt is that renovations are often best done by professionals.

“I did what I could myself. But now I wouldn’t do that at all. Anyone can paint a room, true. But a professional painter can do it better in a tenth of the time – and they don’t charge that much. It is worth it to get experts to do the work for you.”

Jakab was fortunate enough to sail through the GFC relatively unscathed. The GFC didn’t hit South Hedland very hard, he says. “There was always lots of industry and construction going on, so it didn’t impact on me.”

Stock experiment shows property benefits

However, around the time the GFC hit, he had made a tentative move into stocks. He pulled $170,000 out of equity for stocks.

Despite having a strategy and doing his research, he soon lost $70,000 in just one day. “It wasn’t the best time to start with stocks, so I jumped out of it pretty quickly.”

The experience reinforced for him the benefits of property investment. Although he has taken a break from building his portfolio in recent years, his hiatus is now over, he says. He will return to what has proved a winning strategy for him to date.

“I like to pinpoint and capitalise on the opportunities present in mining town properties. Such properties are dipping a little, but I think the demand is still growing. You just need to pick the right time and the right property – one that is near an attractive feature like the water or a school. These days I’m looking at property in South Australia, Queensland, and maybe the US.”

Taking early retirement

Jakab’s decision to retire from his last day job was prompted by exhaustion. He had been working hard and it was affecting his health, he says.

“I wanted to get out of the rat race and rest. And I wanted to have lots of breathing space.”

So he assessed his property portfolio to see if it was possible to take some time out. He calculated that he could depend on getting around $100,000p.a. in passive income. That was enough to allow him to retire.

In fact, the income generated from these properties has allowed him to pursue his love of travelling, he says. He has now lived in the Philippines and Thailand for extended periods, and has travelled extensively around other parts of the world.

The income has also allowed him to indulge both his spiritual side and his love of music.

“I am currently working on a major music project which would not be possible to undertake if I was working in a 9–5 job on an average salary.”

Music motivated return to investing

It is this music project that has, indirectly, led him to plot a return to active property investing. He says he plans to run the enterprise like a successful company. To do so, he wants to boost his passive income to $300,000p.a. over the next two years.

While Jakab’s current net worth is currently about $1.2m, he is looking forward to adding to that with the purchase of further positively geared properties. To that end, he has established a trust for his upcoming purchases.

Reflection has led him to believe that he should have bought a lot more property already. It was the combination of exhaustion, his experience with stocks, and the onset of the GFC that stopped him in his tracks.

However, now that he is more relaxed and inspired by his music, his motivation has returned. His experience of the last few years has taught him that you get out of life what you put into it.

“To achieve a happy and fulfilling life you need to be totally motivated. That is why I invest time and money to attend motivational events addressed by successful people like Donald Trump, Arnold Schwarzenegger, and boxer Danny Green.”

The danger of early retirement is that it can lead to boredom and even depression, he adds. “I don’t want to be like that. But music is the best thing in the world to counteract that. And property investment allows me to explore my passion for my music.”