It’s a powerful strategy that is paying dividends for many young landlords, but Sydney couple Rhianna Lombe and Jason Burke decided to go down a different path when they started building their property portfolio.

While they’ve only really just begun their property journey, the pair believe they have taken their first steps on what will prove to be a successful path to a comfortable retirement, fuelled by their real estate portfolio.

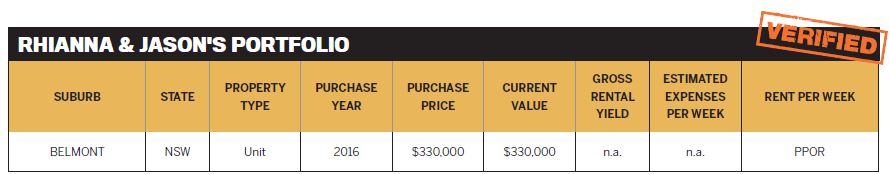

The couple, aged in their mid-20s, have recently made their first play in the property market, this year purchasing a one-bedroom unit in Belmont, around 20km south of the Newcastle CBD.

While that purchase may make for a relatively modest portfolio at present, Rhianna believes the fact that they’ve taken action while still being relatively young is what really counts.

“We chose to start our investing now at 24 and 25 so we can start earning a significant passive income from our properties in the next 10 years. Our goal is to start off with roughly one new investment each year and then increase that number once we have more equity growing,” Rhianna says.

“We don’t want to spend our whole lives working and then retire once we are 60 or 70; we want the freedom to enjoy the prime of our lives throughout our 30s and 40s, without having to worry about financial stresses.”

Education is key

For all successful investors, education is key, and Rhianna made sure they weren’t behind the pack in that respect.

“We got started with a whole lot of reading. I read every magazine I could get my hands on and I was so inspired – I love that property can be used to create such amazing wealth,” she says.

“We plan to diversify our portfolio with our next purchases in different states and different property types”

“We don’t want to spendour whole lives working and then retire once we are 60 or 70; we want the freedom to enjoy the prime of our lives throughout our 30s and 40s”

During that education process, Rhianna had an epiphany of sorts that kicked the couple into action.

“While reading so much I realised that we needed to finally take action, and so I booked us into a property seminar/information night with Positive Real Estate. That got us started on our path to being property investors,” she explains.

With their support, she and Jason devised a strategy to leverage stamp duty discounts to get into their first property. Their plan is to live in their home for the short term, before converting it into an investment property.

To make this purchase, they ramped up their savings strategy to amass a property deposit, and in June this year they took the plunge and purchased their apartment for $330,000.

While many other young people are spending their money on sky-high rents, Rhianna says they are pleased to be in the market and putting their money towards mortgage payments that will form the building blocks of their future retirement fund.

“We currently own just the one property, which is our principal place of residence, but we are planning to eventually turn it into an investment property down the track,” Rhianna confirms.

Looking back and moving forward

Having one property to their name at present, Rhianna said the couple’s plans for the near future revolve around growing and diversifying their portfolio.

“Our overall property strategy is to grow our portfolio so it can provide us with a passive income that will be enough to retire during the years that we are raising a family, so we don’t miss out on important milestones,” she says.

“We want to enjoy the best years of our lives to the fullest! We plan to diversify our portfolio with our next purchases in different states and different property types.”

While they’ve only made the one purchase to date, Rhianna says they have already learnt a key lesson that will form part of their plans going forward.

“Action, action, action! I had read so much about investing and it wasn’t until I booked us into an information night and subsequently surrounded myself with a great team that things started to happen,” she adds.

“If we had tried to do it by ourselves we still wouldn’t have bought our first property – nor would we already be planning for the next one.”

Taking the next step

While growing their portfolio is a key aim over the next few years, Rhianna says an important part of that process will be continuing their education journey.

“We have only purchased Belmont so far but have loved learning during the process and learning what everyone’s roles are,” she says.

The pair won’t be making any rash decisions when it comes to their next move, she advises, as they’ve devised a strategy that will ensure they do not jeopardise their plans for a comfortable retirement.

“We’ve learnt a number of things that will help us on our way. For instance, that it’s always important to have a buffer in place, and that you should never stretch yourself beyond your financial capacity, as interest rates and unexpected expenses can always increase,” she says.

“[If we had to start again] we would have surrounded ourselves with a great team sooner – and we would have started taking action a lot sooner.”